2024 Mortgage Traits: What Homebuyers Have to Know

Associated Articles

- Navigating The Shifting Tides: Understanding Adjustable-Charge Mortgages In 2024

- Interest-Only Mortgages: A Detailed Look At The Pros And Cons

- Auto Mortgage Vs. Lease: Which Is Higher For You?

- How Does Leasing A Automotive Have an effect on Your Auto Mortgage Eligibility?

- How Lengthy Ought to Your Auto Mortgage Time period Be? Navigating The Maze Of Months

Introduction

Uncover the whole lot it’s essential to find out about 2024 Mortgage Traits: What Homebuyers Have to Know

Video about

2024 Mortgage Traits: What Homebuyers Have to Know

The housing market is a dynamic beast, continually shifting with financial winds and evolving client wants. As we navigate the unsure waters of 2024, it is extra necessary than ever for potential homebuyers to know the newest mortgage tendencies and the way they may influence their dream of homeownership.

This complete information will delve into the important thing components shaping the mortgage panorama in 2024, providing insights into rates of interest, mortgage choices, affordability, and the general market outlook. Armed with this data, you can also make knowledgeable choices, navigate the complexities of the mortgage course of, and safe the absolute best financing to your future house.

Curiosity Charges: The Rollercoaster Journey Continues

The Federal Reserve’s ongoing battle towards inflation has had a profound influence on mortgage charges. Whereas charges have retreated from their peak in 2022, they continue to be considerably greater than pre-pandemic ranges. This volatility makes it essential for patrons to know the components influencing rates of interest and their potential trajectory in 2024.

Components Influencing Curiosity Charges:

- Inflation: So long as inflation stays a priority, the Fed is prone to proceed elevating rates of interest, probably placing upward strain on mortgage charges.

- Financial Progress: A sturdy financial system can assist greater rates of interest, whereas a slowdown would possibly immediate the Fed to ease financial coverage, probably reducing charges.

- Authorities Insurance policies: Adjustments in authorities insurance policies, similar to tax incentives or rules affecting the housing market, may also affect rates of interest.

- International Financial Circumstances: International financial occasions, similar to geopolitical tensions or worldwide commerce disputes, can influence rate of interest actions.

Predicting Curiosity Charge Traits:

Forecasting rate of interest actions is a fancy activity, and specialists supply a spread of views. Some predict a continued rise in charges, whereas others anticipate a stabilization or perhaps a slight decline.

Methods for Navigating Curiosity Charge Volatility:

- Lock in a Charge: Should you’re assured about your timeline and cozy with present charges, think about locking in a charge to keep away from future fluctuations.

- Store Round: Evaluate charges from a number of lenders to safe the perfect deal.

- Contemplate Adjustable-Charge Mortgages (ARMs): ARMs supply decrease preliminary charges however can modify over time. They could be choice for these planning to remain of their house for a shorter interval.

- Discover Different Mortgage Choices: Contemplate government-backed loans like FHA or VA loans, which can supply decrease charges and extra versatile eligibility necessities.

Affordability: The Balancing Act of Rising Charges and Stock

The mix of upper rates of interest and restricted stock presents a singular problem for homebuyers in 2024. Whereas costs might not see the identical dramatic will increase as in earlier years, affordability stays a key concern.

Components Affecting Affordability:

- Curiosity Charges: Larger rates of interest enhance month-to-month mortgage funds, making houses much less reasonably priced for a lot of patrons.

- Stock Ranges: Restricted stock offers sellers extra leverage, probably pushing costs greater.

- Competitors: Sturdy demand, particularly from money patrons, can gasoline bidding wars and additional pressure affordability.

- Financial Circumstances: Rising inflation and potential financial uncertainty can influence affordability by decreasing buying energy and making patrons extra cautious.

Methods for Bettering Affordability:

- Save for a Bigger Down Cost: A bigger down cost reduces the mortgage quantity and curiosity prices, making the mortgage extra reasonably priced.

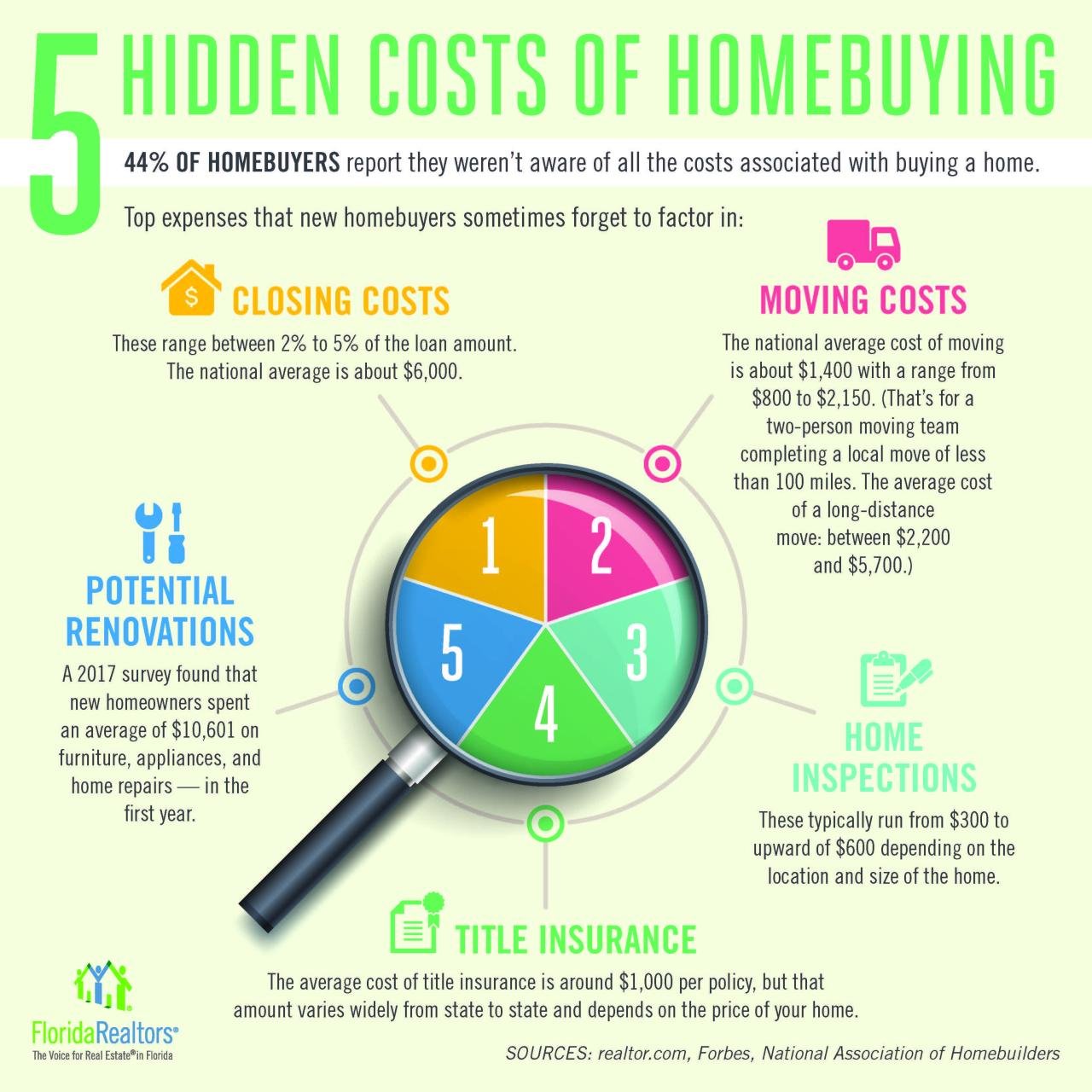

- Store for Decrease Closing Prices: Negotiate with lenders and repair suppliers to reduce closing prices.

- Contemplate a Shorter Mortgage Time period: A 15-year mortgage sometimes has a decrease rate of interest than a 30-year mortgage, leading to decrease total curiosity funds.

- Discover Authorities-Backed Mortgage Applications: FHA and VA loans usually require decrease down funds and have extra versatile eligibility necessities, making homeownership extra accessible.

- Search for Properties in Much less Aggressive Markets: Discover areas with decrease housing costs and fewer competitors to discover a extra reasonably priced house.

Mortgage Mortgage Choices: A Diversified Panorama

The mortgage market gives a various vary of mortgage choices to go well with totally different monetary conditions and wishes. Understanding these choices is essential for selecting the perfect financing to your particular person circumstances.

Typical Loans:

- Mounted-Charge Mortgages: Supply a secure rate of interest for the whole mortgage time period, offering predictable month-to-month funds.

- Adjustable-Charge Mortgages (ARMs): Characteristic an preliminary fixed-rate interval adopted by an adjustable charge that may fluctuate based mostly on market circumstances. ARMs may be advantageous for short-term homeownership or when anticipating decrease rates of interest sooner or later.

Authorities-Backed Loans:

- FHA Loans: Supply decrease down cost necessities and extra versatile credit score rating tips, making homeownership extra accessible for first-time patrons and people with less-than-perfect credit score.

- VA Loans: Accessible to eligible veterans, active-duty army personnel, and surviving spouses, VA loans usually require no down cost and have aggressive rates of interest.

- USDA Loans: Designed for rural properties, USDA loans supply low rates of interest and versatile phrases, selling homeownership in much less populated areas.

Different Mortgage Choices:

- Jumbo Loans: Appropriate for high-value properties exceeding conforming mortgage limits, jumbo loans usually require greater down funds and credit score scores.

- Bridge Loans: Present short-term financing to bridge the hole between promoting your present house and buying a brand new one.

Selecting the Proper Mortgage Possibility:

- Contemplate your monetary scenario: Consider your earnings, credit score rating, down cost, and anticipated homeownership length.

- Evaluate charges and phrases: Store round for the perfect charges and mortgage options from totally different lenders.

- Search skilled recommendation: Seek the advice of with a mortgage lender or monetary advisor to debate your choices and decide the perfect match to your wants.

The Market Outlook: Navigating Uncertainties

Predicting the way forward for the housing market is inherently difficult, however a number of components counsel potential tendencies in 2024:

- Curiosity Charges: Continued volatility in rates of interest is probably going, making it essential to remain knowledgeable and adapt to altering market circumstances.

- Stock Ranges: Stock is anticipated to stay tight, probably preserving costs elevated and competitors fierce.

- Financial Circumstances: The general financial outlook will affect purchaser sentiment and affordability, with potential influence on market exercise.

- Authorities Insurance policies: Adjustments in authorities insurance policies, similar to tax incentives or rules, can affect the housing market and mortgage availability.

Methods for Success in 2024:

- Be Ready: Save for a down cost, enhance your credit score rating, and collect crucial documentation.

- Keep Knowledgeable: Maintain abreast of present market circumstances, rates of interest, and mortgage choices.

- Be Affected person: The housing market may be unpredictable, so be affected person and do not rush into a call.

- Search Skilled Steering: Seek the advice of with an actual property agent, mortgage lender, and monetary advisor to navigate the complexities of the market.

Conclusion: Embracing the Journey to Homeownership

2024 presents a singular set of challenges and alternatives for homebuyers. By understanding the newest mortgage tendencies, navigating rate of interest fluctuations, and making knowledgeable choices, you’ll be able to enhance your probabilities of attaining your homeownership objectives.

Keep in mind, the journey to homeownership is a marathon, not a dash. Embrace the method, keep knowledgeable, and search skilled steering to benefit from your journey to a future stuffed with the enjoyment and luxury of your personal house.

Key phrases: mortgage tendencies, 2024 mortgage, rates of interest, house shopping for, affordability, mortgage choices, typical loans, government-backed loans, FHA loans, VA loans, USDA loans, jumbo loans, bridge loans, market outlook, housing market, financial circumstances, methods for achievement, homeownership.

Closure

We hope this text has helped you perceive the whole lot about 2024 Mortgage Traits: What Homebuyers Have to Know. Keep tuned for extra updates!

Don’t neglect to examine again for the newest information and updates on 2024 Mortgage Traits: What Homebuyers Have to Know!

We’d love to listen to your ideas about 2024 Mortgage Traits: What Homebuyers Have to Know—go away your feedback beneath!

Maintain visiting our web site for the newest tendencies and critiques.