Unlocking Homeownership: Demystifying No-Closing Value Mortgages

Associated Articles

- Greatest Auto Loans With Low Credit score: A Complete Information To Discovering The Excellent Trip

- Refinancing Your Automobile Mortgage With Dangerous Credit score: A Information To Decrease Funds And Higher Charges

- Understanding Mortgage Factors: Are They Price It?

- What You Want To Know About FHA Mortgage Limits In 2024: Your Information To Reasonably priced Homeownership

- 5 Causes Why Lengthy-Time period Auto Loans May Be A Monetary Nightmare (And What To Do As an alternative)

Introduction

Uncover the whole lot you’ll want to learn about Unlocking Homeownership: Demystifying No-Closing Value Mortgages

Video about

Unlocking Homeownership: Demystifying No-Closing Value Mortgages

The dream of proudly owning a house is a robust motivator, however the actuality of closing prices can really feel daunting. These upfront bills, usually totaling 1000’s of {dollars}, can seem to be an insurmountable hurdle for a lot of potential consumers. Enter the no-closing value mortgage, a seemingly magical answer that guarantees to get rid of these monetary limitations and pave the best way to homeownership. However is all of it it is cracked as much as be? Let’s delve into the world of no-closing value mortgages, exploring the intricacies, potential pitfalls, and in the end, whether or not they’re the proper match to your distinctive monetary scenario.

What are No-Closing Value Mortgages?

In essence, a no-closing value mortgage is a mortgage the place the lender covers the related closing prices. This seemingly beneficiant supply comes with a catch: the prices are rolled into the mortgage’s principal stability, rising the general quantity you will repay over the lifetime of the mortgage.

Understanding the "No-Closing Value" Phantasm

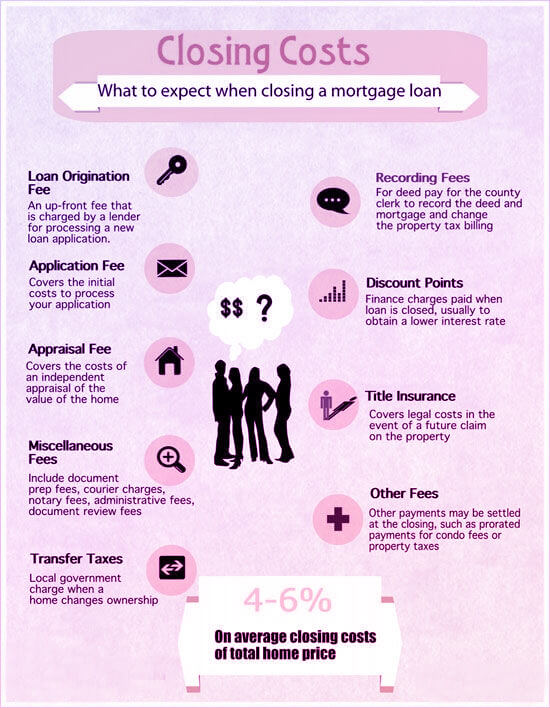

Whereas the phrase "no-closing value" evokes a way of economic reduction, it is essential to grasp that you just’re not really avoiding these bills. As an alternative, you are merely deferring them. Let’s break down the frequent closing prices and the way they’re usually dealt with in a no-closing value mortgage:

- Mortgage Origination Price: This payment, charged by the lender for processing your mortgage utility, is commonly included within the no-closing value bundle. It is often a share of the mortgage quantity.

- Appraisal Price: To find out the truthful market worth of the property, an appraisal is performed. This value is usually factored into the no-closing value association.

- **

Closure

We hope this text has helped you perceive the whole lot about Unlocking Homeownership: Demystifying No-Closing Value Mortgages. Keep tuned for extra updates!

Make sure that to observe us for extra thrilling information and opinions.

We’d love to listen to your ideas about Unlocking Homeownership: Demystifying No-Closing Value Mortgages—go away your feedback beneath!

Keep knowledgeable with our subsequent updates on Unlocking Homeownership: Demystifying No-Closing Value Mortgages and different thrilling matters.