What Occurs if You Default on a Private Mortgage? A Information to Avoiding the Fallout

Associated Articles

- Unlock Your Financial Freedom: How To Get Preapproved For A Personal Loan

- Unleashing The Power Of Personal Loans: Your Guide To Debt Consolidation And Financial Freedom

- Navigating The Street To Private Loans With Dangerous Credit score: A Complete Information

- Unlocking Your Financial Potential: How To Get A Personal Loan With No Credit History

- Prime 5 Private Mortgage Suppliers In The U.S. For 2024

Introduction

On this article, we dive into What Occurs if You Default on a Private Mortgage? A Information to Avoiding the Fallout, supplying you with a full overview of what’s to come back

Video about

What Occurs if You Default on a Private Mortgage? A Information to Avoiding the Fallout

Taking out a private mortgage could be a lifesaver in a pinch, providing fast entry to funds for surprising bills, debt consolidation, and even dwelling renovations. However what occurs when you possibly can’t sustain with the funds? Defaulting on a private mortgage can have extreme penalties, impacting your monetary well-being and even your credit score rating. Understanding the potential fallout is essential to creating knowledgeable selections about your funds.

What’s a Private Mortgage Default?

In easy phrases, defaulting on a private mortgage means failing to make your scheduled funds in response to the phrases of your mortgage settlement. This will embody lacking a single fee or falling behind on a number of funds.

The Domino Impact of Defaulting

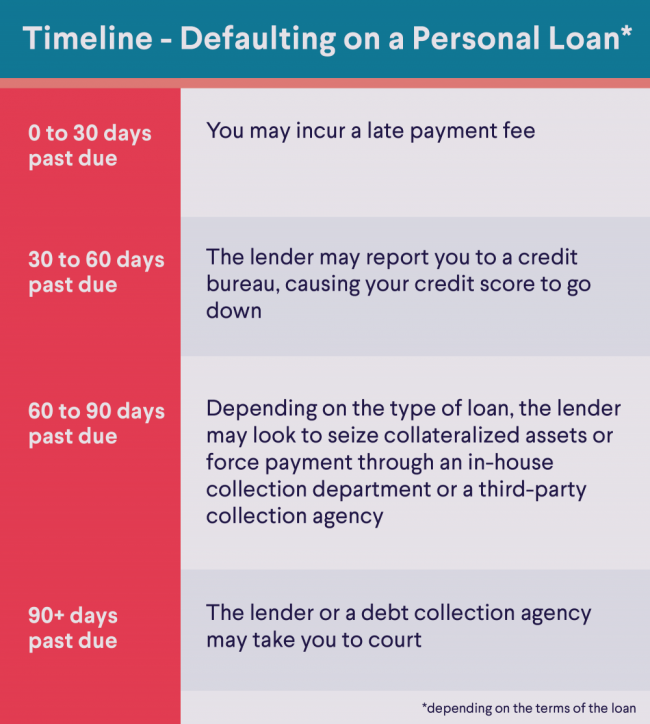

Defaulting on a private mortgage units off a sequence response with probably devastating penalties:

1. Late Charges and Penalties: Probably the most quick consequence of lacking a fee is the buildup of late charges and penalties. These prices can rapidly add up, making your debt even bigger.

2. Broken Credit score Rating: Late funds are reported to credit score bureaus, considerably impacting your credit score rating. A low credit score rating could make it difficult to safe future loans, bank cards, and even hire an condominium.

3. Elevated Curiosity Charges: Lenders might enhance your rate of interest as a result of your missed funds, making your debt much more costly to repay.

4. Assortment Companies: In case you proceed to overlook funds, your lender might promote your debt to a group company. These businesses are aggressive in pursuing fee, typically resorting to telephone calls, letters, and even authorized motion.

5. Authorized Motion: Lenders can take authorized motion to get better the excellent debt, probably leading to:

- Wage garnishment: A portion of your wages may be seized to repay the debt.

- Checking account levies: Funds in your checking account may be frozen and used to repay the mortgage.

- Liens on property: Your property may be topic to a lien, which may make it troublesome to promote or refinance.

- Lawsuit: It’s possible you’ll be sued in court docket for the excellent debt.

6. Unfavorable Impression on Future Borrowing: A default in your mortgage could make it troublesome to safe future loans, bank cards, and even mortgages. Lenders view a default as an indication of economic irresponsibility, making them hesitant to increase credit score.

7. Potential for Chapter: In excessive instances, defaulting on a private mortgage can result in chapter. This can be a severe step that ought to solely be thought-about as a final resort.

Understanding the Phrases of Your Mortgage

Earlier than taking out a private mortgage, it is important to totally perceive the phrases and circumstances of the mortgage settlement. Pay shut consideration to:

- Rate of interest: The rate of interest determines the price of borrowing. A better rate of interest means you may pay extra in curiosity over the lifetime of the mortgage.

- Mortgage time period: The mortgage time period is the size of time it’s a must to repay the mortgage. An extended mortgage time period may end up in decrease month-to-month funds, however you may pay extra in curiosity general.

- Charges: Mortgage agreements typically embody charges, resembling origination charges, late fee charges, and prepayment penalties.

- Grace interval: That is the time period it’s a must to make a fee after the due date with out incurring a late payment.

Avoiding Default: A Proactive Strategy

One of the simplest ways to keep away from defaulting on a private mortgage is to take a proactive method to managing your funds:

1. Finances and Monitor Bills: Create a practical funds that accounts for all of your revenue and bills. Monitor your spending to make sure you’re staying inside your funds.

2. Prioritize Funds: Make sure that to prioritize your mortgage funds, particularly if in case you have a number of money owed.

3. Set Up Automated Funds: Arrange computerized funds to keep away from lacking funds as a result of forgetfulness.

4. Talk with Your Lender: In case you anticipate problem making your funds, contact your lender as quickly as potential. They could be keen to work with you to create a fee plan or modify the phrases of your mortgage.

5. Contemplate Debt Consolidation: When you’ve got a number of money owed, consolidating them right into a single mortgage with a decrease rate of interest could make it simpler to handle your funds.

6. Search Monetary Counseling: In case you’re struggling to handle your debt, take into account searching for skilled monetary counseling. They’ll present customized steering and aid you develop a plan to get again on observe.

What to Do if You have Already Defaulted

In case you’ve already defaulted on a private mortgage, do not panic. There are nonetheless steps you possibly can take to mitigate the injury:

1. Contact Your Lender: Attain out to your lender and clarify your state of affairs. They could be keen to work with you to create a fee plan or negotiate a settlement.

2. Negotiate with Assortment Companies: In case your debt has been offered to a group company, attempt to negotiate a decrease fee quantity or a fee plan.

3. Search Authorized Help: In case you’re dealing with authorized motion, search authorized help from a certified legal professional. They might help you perceive your rights and choices.

4. Contemplate Debt Administration Applications: Debt administration packages might help you consolidate your debt, negotiate decrease rates of interest, and create a funds to get your funds again on observe.

5. Discover Chapter: In excessive instances, chapter could also be an possibility to alleviate your debt burden. Nonetheless, it ought to solely be thought-about as a final resort.

Conclusion: Navigating the Path to Monetary Stability

Defaulting on a private mortgage can have extreme penalties, impacting your credit score rating, monetary well-being, and future borrowing alternatives. Nonetheless, by understanding the dangers and taking proactive steps to handle your funds, you possibly can keep away from this example and preserve your monetary stability.

Keep in mind, communication is vital. In case you’re dealing with monetary challenges, attain out to your lender or a monetary advisor for steering. By taking motion and searching for assist, you possibly can navigate the trail to monetary stability and shield your future.

Closure

We hope this text has helped you perceive every little thing about What Occurs if You Default on a Private Mortgage? A Information to Avoiding the Fallout. Keep tuned for extra updates!

Don’t overlook to examine again for the most recent information and updates on What Occurs if You Default on a Private Mortgage? A Information to Avoiding the Fallout!

We’d love to listen to your ideas about What Occurs if You Default on a Private Mortgage? A Information to Avoiding the Fallout—go away your feedback under!

Keep knowledgeable with our subsequent updates on What Occurs if You Default on a Private Mortgage? A Information to Avoiding the Fallout and different thrilling matters.