Prime 5 Lenders for Private Loans with Truthful Credit score: Your Information to Discovering the Greatest Deal

Associated Articles

- Fueling Your Dreams: Top Personal Loans For Small Business Owners In 2023

- Paying For Faculty: When A Private Mortgage Is (and Is not) The Reply

- Unlocking Your Monetary Potential: A Complete Information To Private Mortgage Eligibility For Self-Employed People

- The Top 10 Personal Loan Apps You Need To Know About: Your Guide To Quick And Easy Cash

- Personal Loans Vs. Payday Loans: Which Should You Choose?

Introduction

Be a part of us as we discover Prime 5 Lenders for Private Loans with Truthful Credit score: Your Information to Discovering the Greatest Deal, full of thrilling updates

Video about

Prime 5 Lenders for Private Loans with Truthful Credit score: Your Information to Discovering the Greatest Deal

Life throws curveballs. Sudden bills, house repairs, medical payments – these conditions can depart you scrambling for money. When you’ve got honest credit score, securing a private mortgage might sound daunting, however it would not need to be. This information will provide help to navigate the world of non-public loans with honest credit score, highlighting the highest 5 lenders and offering helpful suggestions for securing one of the best deal.

Understanding Truthful Credit score and Private Loans

Earlier than diving into the highest lenders, let’s outline "honest credit score" and discover why private loans are a viable possibility.

What’s Truthful Credit score?

Truthful credit score, also known as "common" credit score, falls inside the credit score rating vary of 580 to 669. Whereas it isn’t thought-about glorious, it isn’t horrible both. This credit score rating vary signifies you might have a historical past of paying your payments on time, however there is likely to be some blemishes like late funds or missed funds.

Why Think about a Private Mortgage with Truthful Credit score?

Private loans supply a versatile strategy to borrow cash for varied functions, together with:

- Consolidating Debt: Mix high-interest debt like bank cards into one lower-interest mortgage, saving you cash on curiosity funds.

- Residence Enhancements: Finance obligatory repairs or upgrades to your property with out breaking the financial institution.

- Medical Bills: Cowl sudden medical payments that insurance coverage would not absolutely cowl.

- Main Purchases: Fund important purchases like a brand new automobile or home equipment.

Components Affecting Your Mortgage Eligibility with Truthful Credit score

Whereas honest credit score is not superb, you may nonetheless qualify for a private mortgage. Nevertheless, lenders will think about a number of elements:

- Credit score Rating: The next credit score rating inside the honest credit score vary will improve your possibilities of approval and decrease rates of interest.

- Debt-to-Earnings Ratio (DTI): Lenders assess your skill to repay the mortgage by your month-to-month debt funds in comparison with your revenue. A decrease DTI signifies you might have extra monetary flexibility.

- Earnings and Employment Historical past: Regular revenue and a secure job historical past reveal your skill to repay the mortgage.

- Mortgage Quantity and Time period: Bigger mortgage quantities and longer phrases usually include increased rates of interest.

Prime 5 Lenders for Private Loans with Truthful Credit score

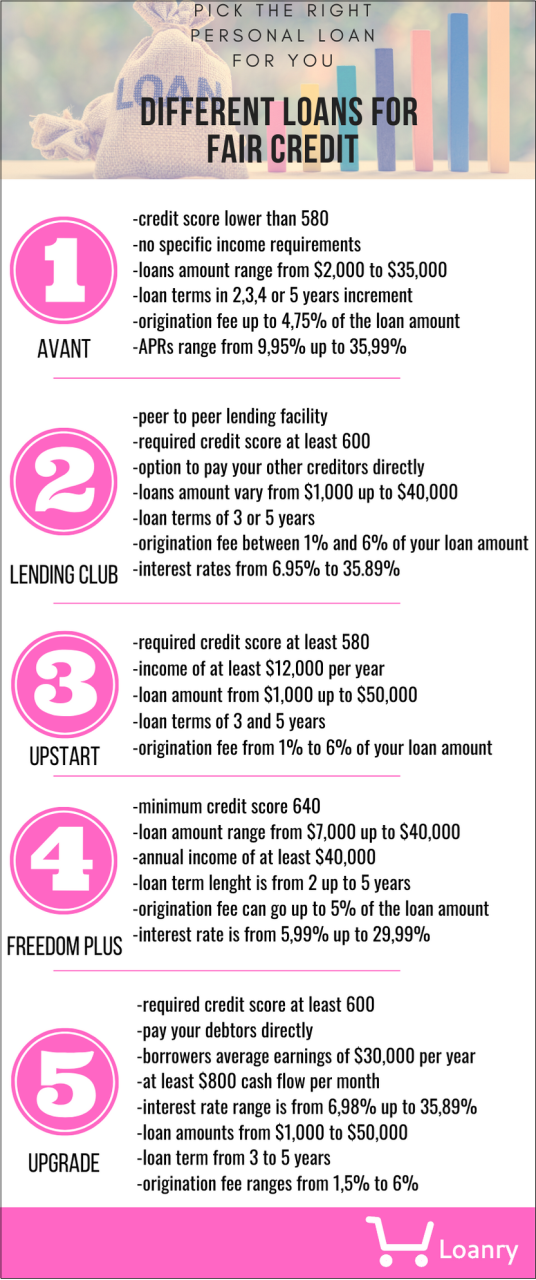

Now, let’s discover the highest 5 lenders that cater to debtors with honest credit score:

1. LendingClub:

- Execs: Big selection of mortgage quantities (as much as $40,000), aggressive rates of interest, on-line software course of, quick funding.

- Cons: Origination charges will be increased than different lenders.

- Credit score Rating Requirement: Minimal credit score rating of 600, however debtors with honest credit score can nonetheless qualify.

2. Upstart:

- Execs: Focuses on debtors with honest credit score, gives loans as much as $50,000, considers elements past credit score rating, quick funding.

- Cons: Rates of interest will be increased for debtors with decrease credit score scores.

- Credit score Rating Requirement: Minimal credit score rating of 620, however debtors with honest credit score are inspired to use.

3. Avant:

- Execs: Versatile mortgage phrases, quick funding, gives private loans as much as $35,000, on-line software course of.

- Cons: Increased rates of interest in comparison with another lenders.

- Credit score Rating Requirement: Minimal credit score rating of 580, making it possibility for debtors with honest credit score.

4. SoFi:

- Execs: Aggressive rates of interest, no origination charges, gives mortgage quantities as much as $100,000, glorious customer support.

- Cons: Extra stringent credit score rating necessities than another lenders.

- Credit score Rating Requirement: Minimal credit score rating of 680, however debtors with honest credit score can qualify with a powerful monetary profile.

5. LightStream:

- Execs: Provides aggressive rates of interest, no origination charges, quick funding, big selection of mortgage quantities (as much as $100,000).

- Cons: Increased credit score rating requirement than another lenders.

- Credit score Rating Requirement: Minimal credit score rating of 660, making it possibility for debtors with honest credit score who’ve a powerful monetary profile.

Suggestions for Getting Accredited with Truthful Credit score

Whereas having honest credit score can current challenges, following the following tips can enhance your possibilities of mortgage approval:

- Test Your Credit score Report: Assessment your credit score report for errors and dispute any inaccuracies. This may help enhance your rating.

- Pay Payments On Time: Constant on-time funds are essential for enhancing your credit score rating.

- Decrease Your Debt-to-Earnings Ratio: Scale back your month-to-month debt funds by paying down high-interest debt or consolidating debt.

- Store Round for Charges: Examine gives from a number of lenders to seek out probably the most aggressive rates of interest.

- Think about a Cosigner: In case your credit score rating is low, a cosigner with good credit score can strengthen your software.

Conclusion: Discovering the Proper Private Mortgage for You

Securing a private mortgage with honest credit score is feasible, however it requires cautious analysis and planning. By understanding the elements affecting your eligibility, exploring the highest lenders catering to honest credit score debtors, and following the information above, you may improve your possibilities of securing a mortgage with favorable phrases.

Keep in mind, your credit score rating just isn’t the one issue lenders think about. A robust monetary profile, together with your revenue, debt-to-income ratio, and employment historical past, performs a significant function within the approval course of.

With cautious planning and somewhat effort, you may navigate the world of non-public loans with honest credit score and discover the fitting monetary answer to your wants.

Closure

Thanks for studying! Stick with us for extra insights on Prime 5 Lenders for Private Loans with Truthful Credit score: Your Information to Discovering the Greatest Deal.

Be certain to comply with us for extra thrilling information and critiques.

Be at liberty to share your expertise with Prime 5 Lenders for Private Loans with Truthful Credit score: Your Information to Discovering the Greatest Deal within the remark part.

Keep knowledgeable with our subsequent updates on Prime 5 Lenders for Private Loans with Truthful Credit score: Your Information to Discovering the Greatest Deal and different thrilling matters.