Earnings-Pushed Reimbursement Plans Defined: Which One Is Proper for You?

Associated Articles

- Strategies to Get Cheap Prolonged-Time interval Care Insurance coverage protection: A Full Info

- Prime Suggestions For Refinancing Non-public Pupil Loans In 2024: Maximizing Financial savings

- How To Navigate The SAVE Plan: A Complete Information For Federal Pupil Mortgage Debtors

- Every thing You Have to Know About Flood Insurance coverage and Find out how to Get Lined

- Cyber Insurance coverage for Small Companies: Defending Your Digital Belongings

Introduction

Uncover every thing you should learn about Earnings-Pushed Reimbursement Plans Defined: Which One Is Proper for You?

Video about Earnings-Pushed Reimbursement Plans Defined: Which One Is Proper for You?

Earnings-Pushed Reimbursement Plans Defined: Which One Is Proper for You?

Navigating the Advanced World of Scholar Mortgage Reimbursement

For hundreds of thousands of Individuals, the load of scholar mortgage debt can really feel like an anchor dragging them down. The common borrower owes over $37,000, and plenty of battle to make month-to-month funds that match inside their finances. Happily, there are alternatives designed to make compensation extra manageable, and Earnings-Pushed Reimbursement (IDR) plans are some of the highly effective instruments out there.

This text will delve into the intricacies of IDR plans, explaining how they work, the completely different choices out there, and learn how to decide which plan could be best for you. We’ll additionally discover the potential advantages and disadvantages of IDR plans and deal with frequent questions on their affect in your monetary future.

Understanding the Fundamentals: What are Earnings-Pushed Reimbursement Plans?

IDR plans are a kind of federal scholar mortgage compensation program designed to make month-to-month funds extra reasonably priced primarily based in your revenue and household dimension. As a substitute of paying a hard and fast proportion of your mortgage principal every month, your funds are calculated as a proportion of your discretionary revenue. This implies your month-to-month fee is adjusted to mirror your present monetary scenario, providing much-needed flexibility and reduction.

Why Ought to You Think about an IDR Plan?

- Decrease Month-to-month Funds: Essentially the most vital benefit of IDR plans is the potential for considerably decrease month-to-month funds in comparison with normal compensation plans. This could release money movement for different necessary monetary targets, reminiscent of saving for a down fee on a home, paying off different money owed, or constructing an emergency fund.

- Potential for Mortgage Forgiveness: IDR plans can result in mortgage forgiveness after a selected time frame, usually 20 or 25 years, relying on the plan. Because of this a portion and even your whole mortgage steadiness may very well be forgiven, eliminating the burden of scholar debt solely.

- Flexibility and Stability: IDR plans supply flexibility in compensation. As your revenue fluctuates, your month-to-month fee adjusts accordingly. This stability may be essential for debtors going through monetary uncertainties, reminiscent of job adjustments or sudden bills.

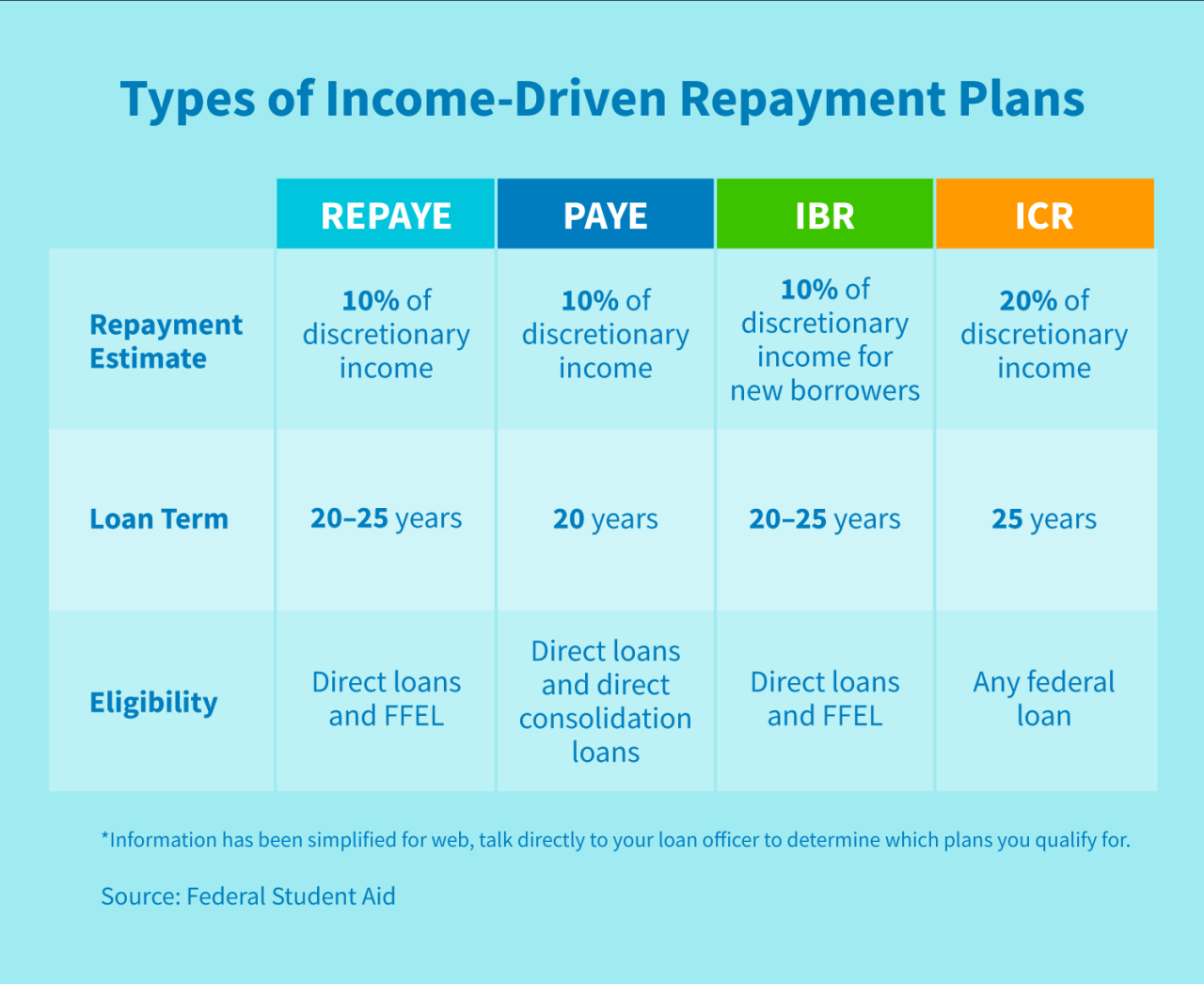

The Completely different Forms of IDR Plans: Navigating Your Choices

There are a number of completely different IDR plans out there, every with its personal set of eligibility necessities and fee calculations. Let’s discover the commonest choices:

1. Earnings-Contingent Reimbursement (ICR):

- Eligibility: Out there to debtors with Federal Direct Loans.

- Cost Calculation: Your month-to-month fee is capped at 20% of your discretionary revenue.

- Forgiveness: After 25 years of funds, any remaining steadiness is forgiven.

- Key Concerns: ICR provides the bottom potential month-to-month fee, making it superb for debtors with low incomes. Nevertheless, it additionally has the longest forgiveness interval, doubtlessly extending your compensation timeline considerably.

2. Earnings-Based mostly Reimbursement (IBR):

- Eligibility: Out there to debtors with Federal Direct Loans.

- Cost Calculation: Your month-to-month fee is capped at 10% of your discretionary revenue.

- Forgiveness: After 20 years of funds, any remaining steadiness is forgiven for undergraduate loans. For graduate loans, forgiveness happens after 25 years.

- Key Concerns: IBR provides a decrease fee than the Commonplace Reimbursement Plan however a better fee than ICR. It additionally has a shorter forgiveness interval than ICR, making it engaging for debtors looking for a quicker path to forgiveness.

3. Pay As You Earn (PAYE):

- Eligibility: Out there to debtors with Federal Direct Loans who originated their loans on or after October 1, 2007.

- Cost Calculation: Your month-to-month fee is capped at 10% of your discretionary revenue.

- Forgiveness: After 20 years of funds, any remaining steadiness is forgiven.

- Key Concerns: PAYE shares many similarities with IBR, together with the fee calculation and forgiveness interval. Nevertheless, it has stricter eligibility necessities, making it much less accessible to all debtors.

4. Revised Pay As You Earn (REPAYE):

- Eligibility: Out there to debtors with Federal Direct Loans, together with those that originated their loans earlier than October 1, 2007.

- Cost Calculation: Your month-to-month fee is capped at 10% of your discretionary revenue.

- Forgiveness: After 20 years of funds, any remaining steadiness is forgiven for undergraduate loans. For graduate loans, forgiveness happens after 25 years.

- Key Concerns: REPAYE is the newest IDR plan and provides a wider vary of eligibility, making it accessible to a bigger group of debtors. It additionally contains a beneficiant forgiveness interval, making it a robust choice for long-term debt reduction.

Selecting the Proper IDR Plan for Your Wants

Choosing the proper IDR plan entails contemplating your distinctive monetary scenario and long-term targets. This is a step-by-step information that can assist you make the most effective choice:

1. Assess Your Earnings and Bills:

- Decide your discretionary revenue: That is your revenue after taxes and important bills, reminiscent of housing, meals, and transportation.

- Calculate your present month-to-month scholar mortgage fee: Examine this quantity to your discretionary revenue. In case your present fee is considerably impacting your finances, an IDR plan might present much-needed reduction.

2. Consider Your Eligibility:

- Examine your mortgage sorts: Guarantee your loans are eligible for IDR plans. Most federal scholar loans qualify, however personal loans usually don’t.

- Assessment the eligibility necessities for every plan: Every IDR plan has its personal set of necessities, reminiscent of mortgage origination date and revenue degree.

3. Examine Cost Calculations and Forgiveness Durations:

- Think about your long-term targets: When you prioritize the bottom month-to-month fee, ICR could be your best option. Nevertheless, in the event you choose a shorter forgiveness interval, IBR or PAYE could be extra appropriate.

- Consider potential adjustments in your revenue: When you anticipate your revenue rising sooner or later, a plan with a shorter forgiveness interval, reminiscent of IBR, could be extra advantageous.

4. Seek the advice of with a Monetary Advisor:

- Search skilled steering: A monetary advisor may also help you navigate the complexities of IDR plans and decide the most suitable choice on your particular person circumstances. They’ll additionally present insights into the potential long-term monetary implications of selecting an IDR plan.

Frequent Questions About IDR Plans

1. How Do IDR Plans Influence My Credit score Rating?

Whereas IDR plans may also help handle your debt, they will additionally affect your credit score rating. Since your month-to-month fee relies in your revenue, it might be decrease than the minimal fee required for the standard compensation plan. This could result in a decrease credit score utilization ratio, which may negatively affect your credit score rating. Nevertheless, making well timed funds in your IDR plan will nonetheless show accountable borrowing habits and contribute positively to your credit score rating.

2. Can I Change Between IDR Plans?

Sure, you may change between IDR plans at any time. This may be useful in case your monetary scenario adjustments or if a special plan turns into extra appropriate. Nevertheless, switching plans could have an effect on your forgiveness timeline and fee quantity.

3. What Occurs if My Earnings Modifications?

Your IDR fee is recalculated yearly primarily based in your revenue and household dimension. In case your revenue will increase, your fee will probably enhance as properly. Nevertheless, in case your revenue decreases, your fee might be adjusted downward, guaranteeing that your funds stay manageable.

4. Are IDR Plans Proper for Everybody?

IDR plans should not a one-size-fits-all resolution. They are often extremely useful for debtors struggling to make funds below normal compensation plans. Nevertheless, they may not be the most suitable choice for debtors with excessive incomes or those that choose to repay their loans rapidly.

5. What are the Potential Drawbacks of IDR Plans?

- Longer Reimbursement Timeline: IDR plans can prolong your compensation interval considerably, doubtlessly delaying your monetary targets.

- Greater Curiosity Accrual: Whereas your month-to-month fee is decrease, curiosity continues to accrue in your mortgage steadiness, doubtlessly rising your whole debt over time.

- Restricted Eligibility for Personal Loans: IDR plans are primarily designed for federal scholar loans. Personal loans usually don’t qualify.

Navigating the Future: The Lengthy-Time period Influence of IDR Plans

IDR plans are a strong software for managing scholar mortgage debt, but it surely’s important to grasp their potential long-term affect. Whereas they provide decrease funds and the potential for mortgage forgiveness, they will additionally prolong your compensation interval and enhance your whole curiosity paid.

- Plan for the Lengthy Haul: Be ready for the opportunity of making funds for an extended interval than a regular compensation plan.

- Monitor Curiosity Accrual: Regulate your rate of interest and take into account methods for minimizing curiosity accrual, reminiscent of making further funds or refinancing your loans.

- Put together for Potential Modifications: Bear in mind that IDR plans are topic to adjustments in coverage and laws. Keep knowledgeable about updates and regulate your compensation technique as wanted.

Conclusion: Empowering Your Monetary Future

Earnings-Pushed Reimbursement plans supply a worthwhile lifeline for debtors combating scholar mortgage debt. By aligning your funds together with your revenue, IDR plans could make compensation extra manageable, permitting you to deal with different monetary targets. Nevertheless, it is essential to fastidiously consider your choices, perceive the potential advantages and disadvantages, and select the plan that greatest aligns together with your particular person circumstances and long-term aspirations.

By embracing the facility of IDR plans and making knowledgeable choices about your scholar mortgage compensation, you may take management of your monetary future and obtain better monetary freedom.

Closure

Thanks for studying! Stick with us for extra insights on Earnings-Pushed Reimbursement Plans Defined: Which One Is Proper for You?.

Don’t overlook to verify again for the most recent information and updates on Earnings-Pushed Reimbursement Plans Defined: Which One Is Proper for You?!

Be at liberty to share your expertise with Earnings-Pushed Reimbursement Plans Defined: Which One Is Proper for You? within the remark part.

Maintain visiting our web site for the most recent traits and critiques.