Do You Want Legal responsibility Insurance coverage for Your Dwelling-Based mostly Enterprise? Navigating the Dangers and Defending Your Future

Associated Articles

- Slash Your Legal responsibility Insurance coverage Premiums: A Complete Information To Saving Cash

- How to Choose the Right Insurance for Your Home-Based Craft Business

- The Position of Insurance coverage in Defending Your Digital Advertising and marketing Enterprise

- Understanding The Fundamentals Of Common Legal responsibility Insurance coverage: Your Protect In opposition to The Sudden

- High 5 Components That Have an effect on Your Legal responsibility Insurance coverage Charges: A Information To Saving Cash

Introduction

Uncover every thing that you must learn about Do You Want Legal responsibility Insurance coverage for Your Dwelling-Based mostly Enterprise? Navigating the Dangers and Defending Your Future

Video about Do You Want Legal responsibility Insurance coverage for Your Dwelling-Based mostly Enterprise? Navigating the Dangers and Defending Your Future

Do You Want Legal responsibility Insurance coverage for Your Dwelling-Based mostly Enterprise? Navigating the Dangers and Defending Your Future

The attract of a home-based enterprise is simple: flexibility, management, and the flexibility to work within the consolation of your individual house. However beneath this attractive facade lies a vital query: do you want legal responsibility insurance coverage to your home-based enterprise? The reply, briefly, is a powerful sure.

This text delves into the world of home-based enterprise legal responsibility insurance coverage, exploring the frequent dangers, the varied varieties of protection accessible, and make knowledgeable choices to safeguard your monetary well-being.

Understanding the Dangers: Why Legal responsibility Insurance coverage Issues

A house-based enterprise, whereas seemingly secure inside your individual partitions, exposes you to a spread of legal responsibility dangers. These dangers can manifest in varied methods, resulting in vital monetary burdens and authorized battles. Listed below are some key eventualities that spotlight the significance of legal responsibility insurance coverage:

- Consumer Accidents: Think about a consumer visiting your house workplace, tripping over a free rug and sustaining a critical damage. With out legal responsibility insurance coverage, you can be held personally liable for his or her medical bills, misplaced wages, and ache and struggling.

- Product Legal responsibility: In case you manufacture or promote merchandise from your house, a defect might result in damage or property harm. You might face lawsuits and hefty settlements in case your present owners insurance coverage would not cowl product legal responsibility claims.

- Skilled Negligence: As knowledgeable, even unintentional errors or omissions can result in lawsuits. For instance, a monetary advisor offering incorrect recommendation might face claims of negligence.

- Cybersecurity Threats: Knowledge breaches are more and more frequent, and home-based companies usually are not immune. In case you retailer delicate consumer data, a cyberattack might result in authorized motion and vital monetary losses.

- Dwelling Enterprise Tools: Your house-based enterprise tools, comparable to computer systems, printers, and furnishings, might be broken or stolen. Legal responsibility insurance coverage can present protection for these losses.

The Significance of Dwelling-Based mostly Enterprise Legal responsibility Insurance coverage

Legal responsibility insurance coverage acts as a security web, defending you from the monetary penalties of those dangers. It gives monetary protection to defend you towards lawsuits and pay for settlements or judgments. This is the way it works:

- Protection Prices: Legal responsibility insurance coverage covers the authorized charges and different bills related to defending your self towards a lawsuit. This could be a vital price, particularly in complicated authorized battles.

- Settlement or Judgment: If a declare towards you is profitable, legal responsibility insurance coverage pays for the settlement or judgment as much as the coverage limits. This may stop you from having to promote your house or belongings to repay a debt.

- Peace of Thoughts: Having legal responsibility insurance coverage gives peace of thoughts, understanding you might be protected against potential monetary wreck. It lets you concentrate on operating your small business with out the fixed fear of authorized motion.

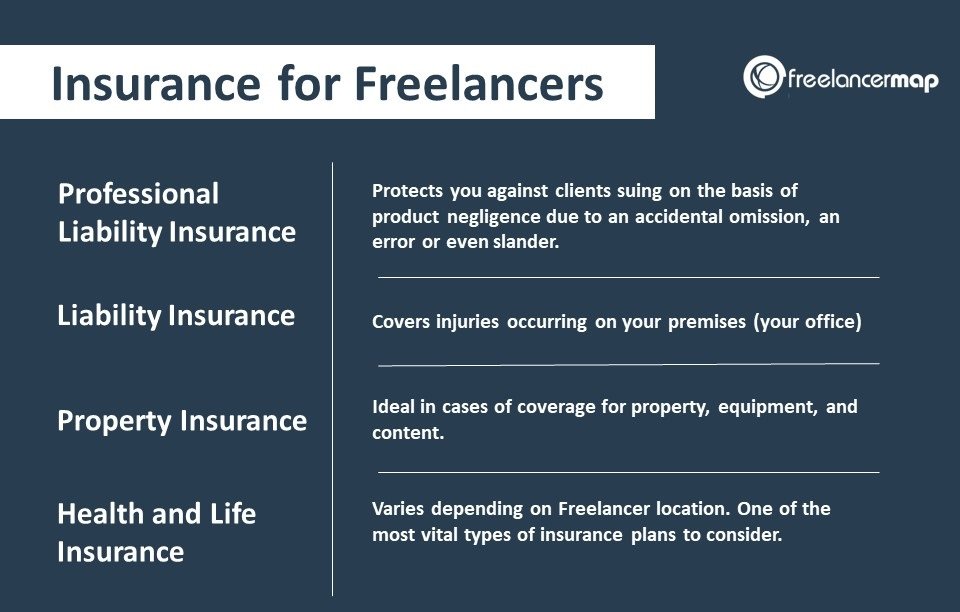

Kinds of Dwelling-Based mostly Enterprise Legal responsibility Insurance coverage

There are a number of varieties of legal responsibility insurance coverage insurance policies particularly designed for home-based companies. Understanding the completely different choices is essential to selecting the best protection to your wants:

- Basic Legal responsibility Insurance coverage: That is the commonest sort of legal responsibility insurance coverage for home-based companies. It gives protection for a variety of dangers, together with bodily damage, property harm, and private damage claims.

- Product Legal responsibility Insurance coverage: In case you manufacture or promote merchandise, any such insurance coverage protects you from claims arising from product defects or accidents brought on by your merchandise.

- Skilled Legal responsibility Insurance coverage (Errors & Omissions): Often known as E&O insurance coverage, this protection protects you from claims of negligence or skilled misconduct. It’s important for professionals like consultants, monetary advisors, and therapists.

- Cyber Legal responsibility Insurance coverage: This protection protects your small business from the monetary penalties of cyberattacks, together with information breaches, ransomware assaults, and system failures.

- Employees’ Compensation Insurance coverage: When you have staff, employees’ compensation insurance coverage is required in most states. It gives protection for medical bills and misplaced wages in case your staff are injured on the job.

Tips on how to Select the Proper Protection

Selecting the best legal responsibility insurance coverage to your home-based enterprise requires cautious consideration. This is a step-by-step information that will help you make an knowledgeable determination:

- Assess Your Dangers: Determine the precise dangers your small business faces primarily based in your business, services or products, and working procedures.

- Evaluate Your Owners Coverage: Verify in case your present owners insurance coverage gives any protection to your home-based enterprise. Some insurance policies could provide restricted protection, but it surely’s essential to grasp the restrictions.

- Seek the advice of with an Insurance coverage Dealer: An skilled dealer can assist you assess your wants and advocate the proper insurance coverage insurance policies. They’ll additionally evaluate quotes from completely different insurance coverage firms to search out the very best worth.

- Contemplate Your Finances: Legal responsibility insurance coverage premiums differ relying on components like your business, protection limits, and threat profile. Select a coverage that gives enough protection inside your finances.

- Evaluate Coverage Particulars: Fastidiously learn the coverage paperwork to grasp the protection limits, exclusions, and circumstances.

Suggestions for Decreasing Your Legal responsibility Dangers

Whereas legal responsibility insurance coverage is an important security web, it is also important to proactively cut back your threat publicity. Listed below are some suggestions:

- Safe Your Premises: Guarantee your house workplace is secure and safe, with correct lighting, non-slip surfaces, and dealing smoke detectors.

- Preserve Secure Practices: Implement security procedures for your small business operations, together with product dealing with, tools upkeep, and office security.

- Practice Your Staff: When you have staff, present them with correct coaching on security procedures, customer support, and moral conduct.

- Defend Your Knowledge: Implement sturdy cybersecurity measures to guard your small business information, together with firewalls, antivirus software program, and worker coaching.

- Evaluate Your Contracts: Fastidiously overview contracts with purchasers and distributors to grasp your obligations and limitations.

- Preserve Correct Information: Maintain correct information of your small business operations, together with buyer interactions, product data, and monetary transactions.

Conclusion: Safeguarding Your Future

Legal responsibility insurance coverage is a necessary funding for any home-based enterprise proprietor. It gives a significant security web, defending you from the monetary penalties of sudden occasions. By understanding the dangers, selecting the best protection, and implementing proactive threat administration methods, you may confidently navigate the challenges of operating a home-based enterprise and safeguard your future.

Key Takeaways:

- Dwelling-based companies are uncovered to numerous legal responsibility dangers, together with consumer accidents, product legal responsibility, skilled negligence, cybersecurity threats, and tools harm.

- Legal responsibility insurance coverage gives monetary safety towards lawsuits and settlements, masking protection prices and judgments.

- Several types of legal responsibility insurance coverage insurance policies can be found, together with common legal responsibility, product legal responsibility, skilled legal responsibility, cyber legal responsibility, and employees’ compensation.

- Selecting the best protection requires assessing your dangers, reviewing your owners coverage, consulting with an insurance coverage dealer, contemplating your finances, and reviewing coverage particulars.

- Proactive threat administration methods, comparable to securing your premises, sustaining secure practices, defending your information, and reviewing contracts, can additional cut back your legal responsibility publicity.

Keep in mind: Investing in legal responsibility insurance coverage isn’t just about defending your belongings, it is about defending your peace of thoughts and making certain the long-term success of your home-based enterprise.

Closure

Thanks for studying! Stick with us for extra insights on Do You Want Legal responsibility Insurance coverage for Your Dwelling-Based mostly Enterprise? Navigating the Dangers and Defending Your Future.

Ensure to comply with us for extra thrilling information and critiques.

We’d love to listen to your ideas about Do You Want Legal responsibility Insurance coverage for Your Dwelling-Based mostly Enterprise? Navigating the Dangers and Defending Your Future—depart your feedback under!

Maintain visiting our web site for the most recent developments and critiques.