Unlocking the Secrets and techniques to Your Auto Mortgage Cost: A Complete Information to Correct Calculation

Associated Articles

- Secured Vs. Unsecured Auto Loans: Professionals And Cons

- Can You Get An Auto Mortgage With out A Down Fee? Navigating The World Of No-Down Fee Automotive Loans

- Navigating The Street To Auto Possession: Avoiding Widespread Auto Mortgage Scams

- What Occurs If You Miss An Auto Mortgage Fee? A Information To Avoiding Late Charges And Defending Your Credit score

- Greatest Auto Loans With Low Credit score: A Complete Information To Discovering The Excellent Trip

Introduction

Welcome to our in-depth take a look at Unlocking the Secrets and techniques to Your Auto Mortgage Cost: A Complete Information to Correct Calculation

Video about

Unlocking the Secrets and techniques to Your Auto Mortgage Cost: A Complete Information to Correct Calculation

Shopping for a automobile is a big monetary determination, and understanding your auto mortgage fee is essential. Figuring out precisely how a lot you may be paying every month might help you funds successfully, keep away from surprises, and make knowledgeable decisions about your automobile buy. This complete information will stroll you thru the intricacies of auto mortgage fee calculations, empowering you to find out your month-to-month bills with confidence.

Understanding the Fundamentals: Decoding the Auto Mortgage Equation

The muse of any auto mortgage fee calculation lies in understanding the important thing elements:

- Principal: That is the whole amount of cash you borrow to buy the automobile.

- Curiosity Charge: That is the proportion charged by the lender for borrowing the cash, expressed as an annual proportion price (APR).

- Mortgage Time period: That is the length of your mortgage, sometimes expressed in months or years.

The Magic Components: Unveiling the Auto Mortgage Cost Calculation

The commonest methodology for calculating auto mortgage funds is utilizing the amortization formulation. This formulation takes into consideration the principal, rate of interest, and mortgage time period to find out your month-to-month fee.

The Amortization Components:

Month-to-month Cost = (P * r) / (1 - (1 + r)^-n)The place:

- P: Principal mortgage quantity

- r: Month-to-month rate of interest (annual rate of interest divided by 12)

- n: Whole variety of funds (mortgage time period in months)

Step-by-Step Information: Calculating Your Auto Mortgage Cost

-

Collect Your Mortgage Particulars:

- Principal (P): The quantity you are borrowing.

- Annual Curiosity Charge (APR): The proportion charged by the lender.

- Mortgage Time period: The size of the mortgage in months or years.

-

Convert the Annual Curiosity Charge to a Month-to-month Charge:

- Divide the annual rate of interest by 12. For instance, in case your APR is 5%, your month-to-month rate of interest can be 0.05 / 12 = 0.0041667.

-

Calculate the Whole Variety of Funds (n):

- Multiply the mortgage time period in years by 12 to get the whole variety of months. For instance, a 5-year mortgage would have 5 * 12 = 60 months.

-

Plug the Values into the Amortization Components:

-

Utilizing the values you gathered in steps 1-3, substitute them into the formulation:

Month-to-month Cost = (P * r) / (1 - (1 + r)^-n)

-

-

Calculate the End result:

- Use a calculator or spreadsheet software program to resolve the equation and decide your month-to-month fee.

Instance: Calculating an Auto Mortgage Cost

Let’s assume you are borrowing $20,000 with a 5% APR for a 5-year mortgage:

- P: $20,000

- APR: 5%

- Mortgage Time period: 5 years (60 months)

- Month-to-month Curiosity Charge: 0.05 / 12 = 0.0041667

- Whole Variety of Funds: 5 * 12 = 60

- Month-to-month Cost:

(20000 * 0.0041667) / (1 - (1 + 0.0041667)^-60) = $377.42

Subsequently, your estimated month-to-month fee for this mortgage can be $377.42.

Past the Fundamentals: Components Influencing Your Auto Mortgage Cost

Whereas the amortization formulation supplies a foundational understanding of auto mortgage funds, a number of different elements can affect your month-to-month bills:

- Mortgage Charges: Lenders usually cost origination charges, processing charges, or different charges related to the mortgage. These charges can improve your general price and have an effect on your month-to-month funds.

- Down Cost: A bigger down fee reduces the principal quantity you borrow, resulting in decrease month-to-month funds.

- Credit score Rating: Your credit score rating performs a big position in figuring out your rate of interest. A better credit score rating sometimes leads to decrease rates of interest and decrease month-to-month funds.

- Mortgage Time period: An extended mortgage time period typically interprets to decrease month-to-month funds however leads to paying extra curiosity over the lifetime of the mortgage.

- Curiosity Charge Sort: Auto loans can have mounted or variable rates of interest. Fastened charges keep the identical for the whole mortgage time period, whereas variable charges fluctuate based mostly on market situations.

- Mortgage Sort: Various kinds of auto loans, resembling new automobile loans, used automobile loans, or lease financing, include various rates of interest and phrases.

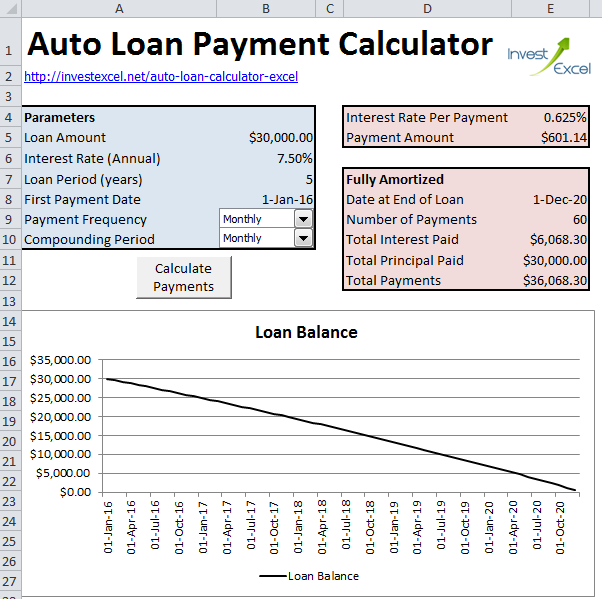

Using On-line Calculators: Making the Calculation Easy

Calculating auto mortgage funds manually might be tedious, particularly when contemplating a number of mortgage choices. Luckily, quite a few on-line auto mortgage calculators can be found to simplify the method. These calculators mean you can enter your mortgage particulars and immediately generate an estimated month-to-month fee.

Advantages of Utilizing On-line Calculators:

- Comfort: Calculators remove the necessity for handbook calculations, saving you effort and time.

- Flexibility: You’ll be able to simply modify mortgage parameters to see how totally different eventualities have an effect on your funds.

- Accuracy: Calculators use correct formulation and guarantee exact calculations.

- Comparability: You’ll be able to evaluate mortgage presents from totally different lenders side-by-side, making knowledgeable selections.

Discovering the Proper Calculator:

A number of respected web sites provide dependable auto mortgage calculators. Some well-liked choices embrace:

- Bankrate: https://www.bankrate.com/loans/auto-loans/

- NerdWallet: https://www.nerdwallet.com/loans/auto-loans/calculator

- Experian: https://www.experian.com/blogs/ask-experian/auto-loan-calculator/

Past the Cost: Understanding the Mortgage’s Whole Value

Whereas your month-to-month fee is an important facet of your auto mortgage, it is important to think about the whole price of the mortgage. This consists of the principal, curiosity, and any related charges. Understanding the whole price helps you make knowledgeable selections in regards to the general affordability of the mortgage.

Calculating the Whole Value:

- Multiply your month-to-month fee by the whole variety of funds: This provides you the whole quantity you may pay over the mortgage time period.

- Add any upfront charges: Embody origination charges, processing charges, or different expenses related to the mortgage.

Instance: Calculating the Whole Value of an Auto Mortgage

Persevering with our earlier instance, with a month-to-month fee of $377.42 and a 60-month mortgage time period, the whole price can be:

- Whole Cost: $377.42 * 60 = $22,645.20

- Whole Value (together with charges): $22,645.20 + (any upfront charges)

Optimizing Your Mortgage: Methods for Reducing Your Cost

When you perceive the elements influencing your auto mortgage fee, you’ll be able to discover methods to cut back your month-to-month bills:

- Enhance Your Credit score Rating: A better credit score rating qualifies you for decrease rates of interest, considerably impacting your month-to-month funds.

- Negotiate the Curiosity Charge: Store round for loans from totally different lenders and negotiate the rate of interest.

- Improve Your Down Cost: A bigger down fee reduces the principal quantity, leading to decrease month-to-month funds.

- Take into account a Shorter Mortgage Time period: Whereas a shorter mortgage time period results in greater month-to-month funds, you may pay much less curiosity general.

- Discover Mortgage Refinancing: If rates of interest have dropped because you took out your mortgage, think about refinancing to safe a decrease price and cut back your month-to-month funds.

Taking Cost of Your Funds: A Last Phrase

Calculating your auto mortgage fee precisely is essential for managing your funds successfully. By understanding the important thing elements of the mortgage and using the amortization formulation or on-line calculators, you’ll be able to decide your month-to-month bills with confidence. Keep in mind to consider further charges and discover methods to optimize your mortgage for decrease month-to-month funds. Armed with this information, you’ll be able to confidently navigate the automobile shopping for course of and make knowledgeable monetary selections that align along with your funds and monetary targets.

Closure

We hope this text has helped you perceive all the pieces about Unlocking the Secrets and techniques to Your Auto Mortgage Cost: A Complete Information to Correct Calculation. Keep tuned for extra updates!

Don’t overlook to examine again for the newest information and updates on Unlocking the Secrets and techniques to Your Auto Mortgage Cost: A Complete Information to Correct Calculation!

Be at liberty to share your expertise with Unlocking the Secrets and techniques to Your Auto Mortgage Cost: A Complete Information to Correct Calculation within the remark part.

Hold visiting our web site for the newest developments and opinions.