Auto Mortgage Amortization Defined: What You Must Know

Associated Articles

- Cruising In direction of Independence: Auto Mortgage Choices For College students

- Unlocking The Greatest Curiosity Charges On Your Auto Mortgage: A Complete Information

- Auto Loans For First-Time Consumers: Your Information To Getting On The Street

- Navigating The Highway To Auto Possession: Getting Authorised For A Automobile Mortgage With Unhealthy Credit score In 2024

- All the things You Want To Know About Auto Mortgage Reimbursement Phrases: A Complete Information

Introduction

Uncover the most recent particulars about Auto Mortgage Amortization Defined: What You Must Know on this complete information.

Video about

Auto Mortgage Amortization Defined: What You Must Know

Shopping for a automotive is a big monetary resolution, and understanding auto mortgage amortization is essential to creating knowledgeable decisions. This complete information will demystify the idea of amortization, explaining the way it works, its affect in your funds, and tips on how to navigate the method successfully.

What’s Auto Mortgage Amortization?

Think about you borrow $20,000 to purchase a automotive. As an alternative of paying the complete quantity upfront, you conform to pay it again in month-to-month installments over a set interval, say, 5 years. That is the place auto mortgage amortization comes into play.

Amortization is the method of step by step paying off a mortgage over time via common funds. With every cost, you pay a portion of the principal (the unique mortgage quantity) and curiosity accrued on the remaining stability.

The Mechanics of Amortization

Let’s break down the important thing components of auto mortgage amortization:

- Principal: The unique sum of money you borrowed.

- Curiosity: The price of borrowing cash, usually expressed as an annual share charge (APR).

- Mortgage Time period: The size of time it’s important to repay the mortgage, often in months or years.

- Month-to-month Cost: The fastened quantity you pay every month to cowl principal and curiosity.

How Amortization Works in Observe

- Preliminary Cost: Your first cost will include a small quantity of principal and a bigger portion of curiosity. It is because you might be paying curiosity on the complete mortgage quantity initially.

- Subsequent Funds: As you make subsequent funds, the principal stability decreases, resulting in decrease curiosity fees. With every cost, the proportion of principal repaid will increase, whereas the curiosity portion decreases.

- Last Cost: By the ultimate cost, you should have paid off the complete principal quantity, together with all accrued curiosity.

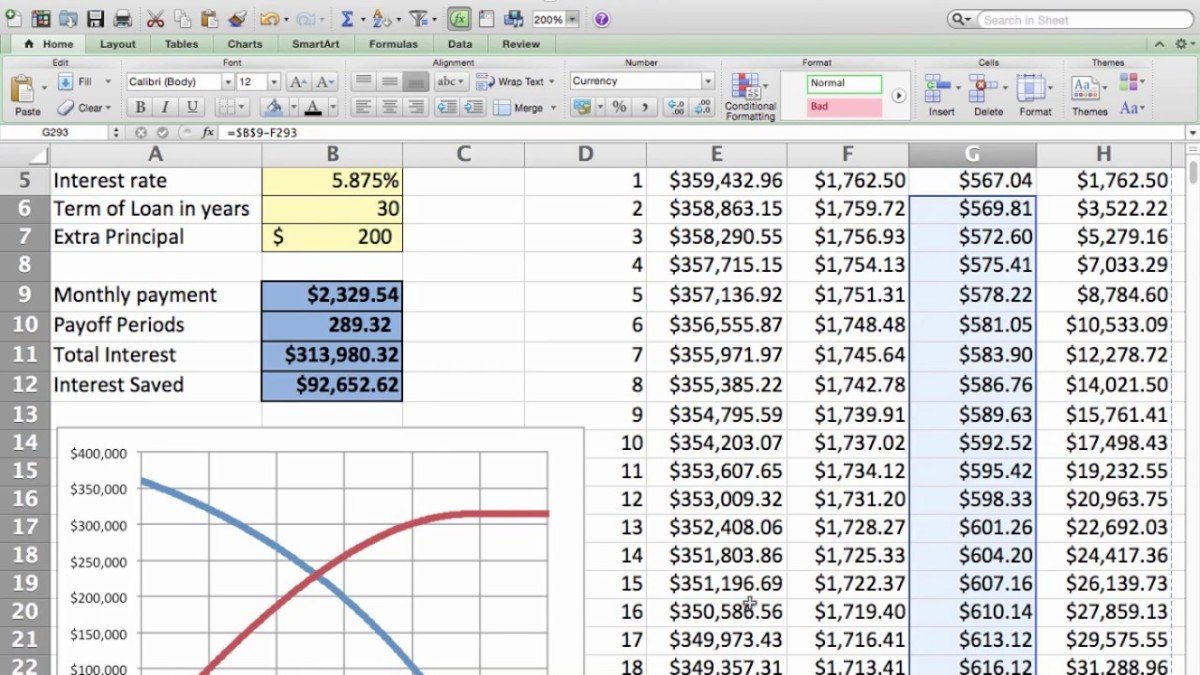

Understanding Amortization Schedules

An amortization schedule is an in depth breakdown of your mortgage funds, exhibiting how a lot of every cost goes in the direction of principal and curiosity over the lifetime of the mortgage. It supplies precious insights into your mortgage’s reimbursement progress and helps you monitor your monetary obligations.

Components Affecting Amortization

A number of components affect your auto mortgage amortization:

- Mortgage Quantity: The bigger the mortgage quantity, the upper your month-to-month funds and the longer it is going to take to repay the mortgage.

- Curiosity Charge: A better rate of interest ends in larger curiosity fees and a larger general mortgage price.

- Mortgage Time period: An extended mortgage time period will result in decrease month-to-month funds however larger general curiosity prices. A shorter mortgage time period will end in larger month-to-month funds however decrease general curiosity prices.

Selecting the Proper Mortgage Time period

The selection of mortgage time period depends upon your monetary scenario and priorities.

- Shorter Time period: A shorter mortgage time period may be appropriate should you prioritize decrease general curiosity prices and wish to repay your mortgage sooner. Nevertheless, it is going to require larger month-to-month funds.

- Longer Time period: An extended mortgage time period provides decrease month-to-month funds, making it simpler to handle your price range. Nevertheless, it is going to end in larger general curiosity prices.

Calculating Your Month-to-month Cost

You should use a web-based auto mortgage calculator to estimate your month-to-month cost. These calculators usually require you to enter the mortgage quantity, rate of interest, and mortgage time period.

Ideas for Managing Your Auto Mortgage Amortization

- Make Additional Funds: Making further funds in your mortgage will help you repay the mortgage sooner and save on curiosity prices.

- Refinance Your Mortgage: If rates of interest fall after you are taking out your mortgage, you may take into account refinancing to safe a decrease rate of interest and cut back your month-to-month funds.

- Monitor Your Progress: Often overview your amortization schedule to observe your mortgage reimbursement progress and guarantee you might be on monitor.

The Significance of Understanding Amortization

Understanding auto mortgage amortization is essential for a number of causes:

- Making Knowledgeable Choices: It empowers you to check mortgage choices and select the most effective match in your monetary scenario.

- Budgeting Successfully: Realizing your month-to-month funds helps you create a sensible price range and guarantee you may afford your mortgage.

- Avoiding Debt Traps: Amortization helps you keep away from getting caught in a cycle of debt by offering a transparent path to repay your mortgage.

Conclusion

Auto mortgage amortization is a basic idea in private finance. By understanding the way it works, you can also make knowledgeable choices about your automotive mortgage, handle your funds successfully, and obtain your monetary objectives. Keep in mind, the important thing to profitable mortgage administration is to decide on a mortgage that aligns together with your monetary scenario and to make knowledgeable choices primarily based in your particular person wants and priorities.

Closure

We hope this text has helped you perceive every part about Auto Mortgage Amortization Defined: What You Must Know. Keep tuned for extra updates!

Don’t neglect to test again for the most recent information and updates on Auto Mortgage Amortization Defined: What You Must Know!

We’d love to listen to your ideas about Auto Mortgage Amortization Defined: What You Must Know—go away your feedback beneath!

Hold visiting our web site for the most recent developments and opinions.