Refinancing Your Automobile Mortgage with Dangerous Credit score: A Information to Decrease Funds and Higher Charges

Associated Articles

- Secured Vs. Unsecured Auto Loans: Professionals And Cons

- Auto Mortgage Amortization Defined: What You Want To Know

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

- Greatest Auto Loans With Low Credit score: A Complete Information To Discovering The Excellent Trip

- Transferring Your Auto Mortgage: A Information To Clean Transitions

Introduction

Welcome to our in-depth take a look at Refinancing Your Automobile Mortgage with Dangerous Credit score: A Information to Decrease Funds and Higher Charges

Video about

Refinancing Your Automobile Mortgage with Dangerous Credit score: A Information to Decrease Funds and Higher Charges

Are you caught with a high-interest automotive mortgage that is consuming into your price range? Do you’re feeling such as you’re drowning in debt and struggling to maintain up with funds? You are not alone. Many individuals discover themselves on this scenario, particularly these with less-than-perfect credit score. However do not despair! Refinancing your automotive mortgage could possibly be the reply you’ve got been on the lookout for.

This complete information will equip you with the data and techniques to efficiently refinance your automotive mortgage even with below-average credit. We’ll cowl every little thing from understanding your credit score rating to discovering the suitable lender and negotiating the very best phrases. Let’s dive in!

Understanding Your Credit score Rating and Its Impression on Refinancing

Your credit score rating is an important consider figuring out your eligibility for refinancing and the rate of interest you may obtain. It is a numerical illustration of your creditworthiness, reflecting your skill to handle debt responsibly. Scores vary from 300 to 850, with larger scores indicating higher credit score.

Here is a breakdown of how your credit score rating impacts refinancing:

- Glorious Credit score (740-850): You will possible qualify for the bottom rates of interest and have essentially the most choices.

- Good Credit score (670-739): You will nonetheless have good probabilities of securing a good charge, however might have fewer choices in comparison with these with wonderful credit score.

- Honest Credit score (580-669): You might need extra problem discovering lenders keen to refinance, and rates of interest will possible be larger.

- Poor Credit score (300-579): Refinancing turns into considerably more difficult, and you could face very excessive rates of interest and even be denied altogether.

Earlier than you even think about refinancing, it is important to grasp your present credit score rating. You’ll be able to get hold of your credit score report totally free from the three main credit score bureaus: Experian, Equifax, and TransUnion. Evaluation your report fastidiously for any errors that could possibly be impacting your rating.

Ideas for Enhancing Your Credit score Rating Earlier than Refinancing

When you might not be capable of magically increase your rating in a single day, there are a number of steps you possibly can take to enhance it over time:

- Pay your payments on time: That is the one most vital consider constructing credit score rating. Set reminders and automate funds to make sure you by no means miss a deadline.

- Hold your credit score utilization low: This refers back to the quantity of credit score you are utilizing in comparison with your whole out there credit score. Intention to maintain your utilization beneath 30%.

- Do not shut previous accounts: Whereas it might sound tempting to shut unused accounts, doing so can really harm your credit score rating. Older accounts contribute to your credit score historical past size, which is a constructive issue.

- Contemplate a secured bank card: When you’ve got restricted credit score historical past, a secured bank card might help construct your rating. You will must put down a safety deposit, which will likely be returned once you shut the account.

- Dispute any errors in your credit score report: For those who discover inaccuracies in your report, contact the credit score bureau and dispute them. This will considerably enhance your rating.

Exploring Your Refinancing Choices

After you have a greater understanding of your credit score rating and have taken steps to enhance it, it is time to begin exploring your refinancing choices.

Listed here are some frequent refinancing choices:

- Refinancing along with your present lender: This may be the only choice, as you are already conversant in their course of and phrases. Nevertheless, they might not provide essentially the most aggressive charges, particularly in case your credit score has improved because you took out the unique mortgage.

- Refinancing with a brand new lender: This offers you entry to a wider vary of lenders and probably higher charges. Nevertheless, it requires extra analysis and paperwork.

- Credit score union refinancing: Credit score unions usually provide aggressive charges and extra versatile phrases in comparison with conventional banks. They’re sometimes member-owned, in order that they prioritize their members’ monetary well-being.

- On-line lenders: On-line lenders have turn out to be more and more common for refinancing automotive loans, providing fast approvals and streamlined processes. Nevertheless, it is essential to analysis their repute and evaluate charges fastidiously.

Components to Contemplate When Selecting a Lender

When deciding on a lender on your automotive mortgage refinance, think about the next elements:

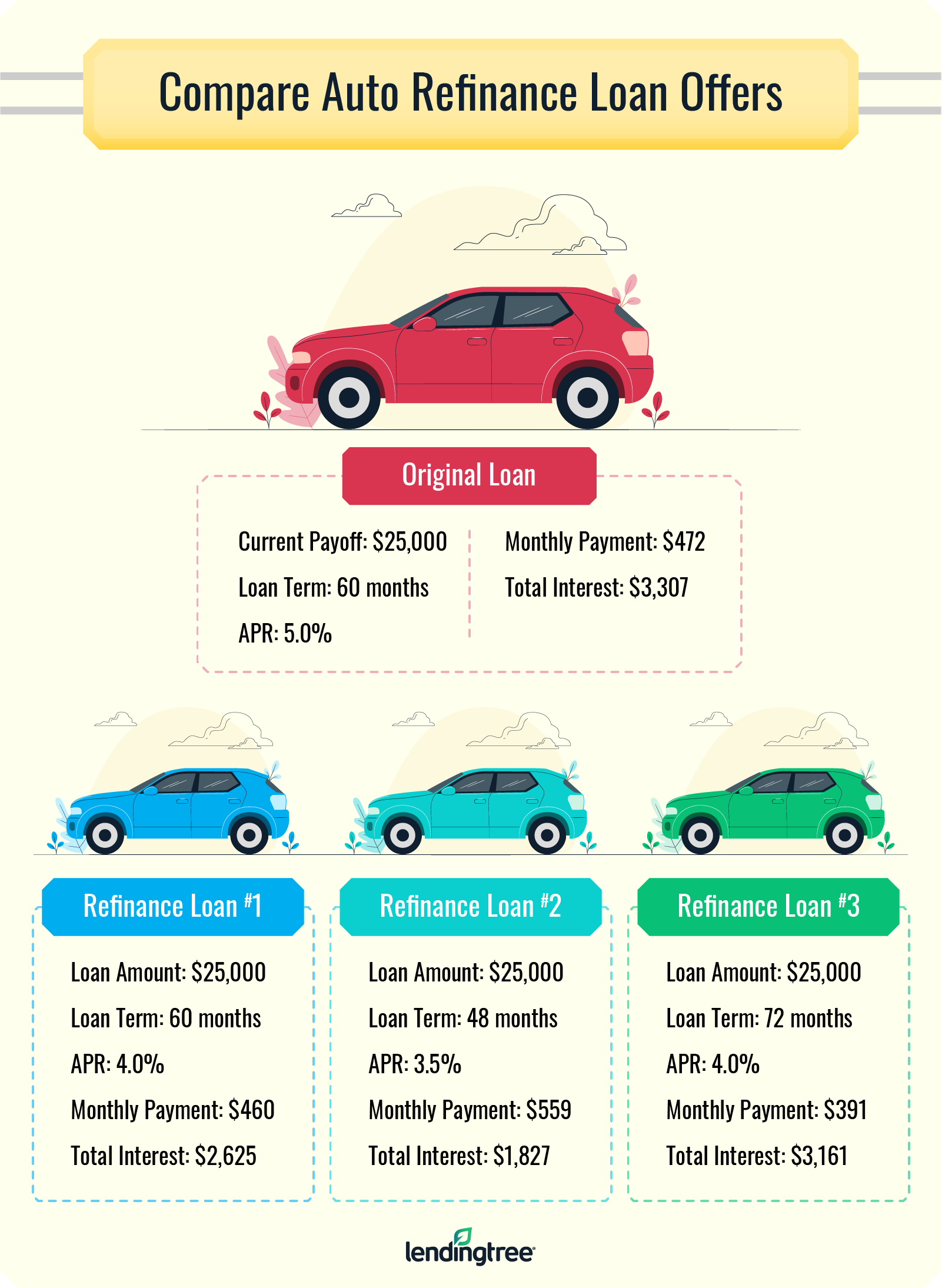

- Rates of interest: That is a very powerful issue, because it immediately impacts your month-to-month funds and total mortgage value.

- Mortgage phrases: The mortgage time period (the size of time you may should repay the mortgage) can considerably influence your month-to-month funds. Shorter phrases end in larger funds however decrease total curiosity prices.

- Charges: Lenders usually cost charges for processing your utility, closing the mortgage, or different companies. You’ll want to inquire about all charges upfront.

- Customer support: Select a lender with a repute for wonderful customer support, as you may be coping with them all through the mortgage course of.

- Repute and evaluations: Learn evaluations from different debtors to gauge the lender’s reliability and trustworthiness.

Negotiating the Greatest Phrases for Your Refinanced Mortgage

As soon as you’ve got discovered a lender you are snug with, it is time to negotiate the very best phrases attainable.

Listed here are some ideas for getting the very best deal:

- Store round for charges: Do not accept the primary give you obtain. Get quotes from a number of lenders to check charges and phrases.

- Use your credit score rating as leverage: For those who’ve not too long ago improved your credit score rating, spotlight this to the lender as a motive for a decrease charge.

- Negotiate charges: Lenders are sometimes keen to barter charges, particularly if you happen to’re borrower with a stable fee historical past.

- Be ready to stroll away: For those who’re not pleased with the phrases supplied, do not be afraid to stroll away and search for a greater deal elsewhere.

Understanding the Potential Prices and Advantages of Refinancing

Refinancing your automotive mortgage can have each prices and advantages.

Here is a breakdown of the potential prices:

- Origination charges: These are charged by the lender to course of your mortgage utility.

- Closing prices: These cowl varied bills related to closing the mortgage, equivalent to appraisal charges, title charges, and recording charges.

- Prepayment penalties: Some lenders cost a penalty if you happen to repay your mortgage early.

Listed here are the potential advantages:

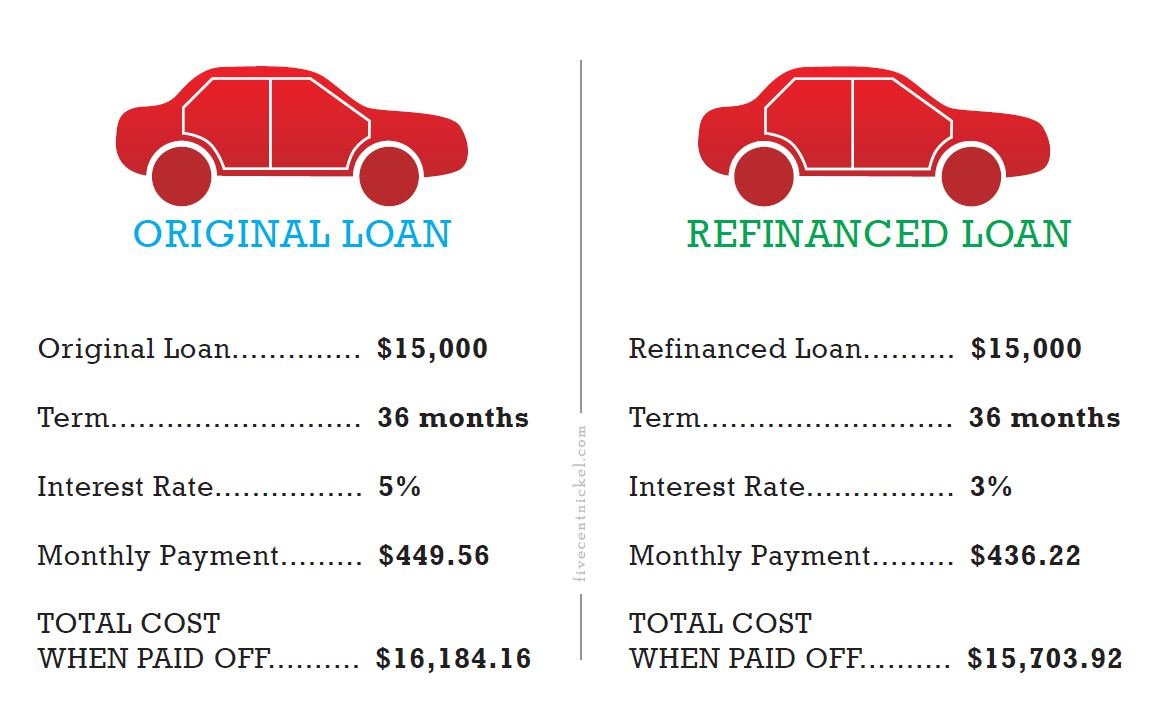

- Decrease month-to-month funds: Refinancing to a decrease rate of interest can considerably cut back your month-to-month funds, liberating up money circulation for different bills.

- Shorter mortgage time period: You’ll be able to refinance to a shorter mortgage time period, which can end in larger funds however decrease total curiosity prices.

- Decreased whole curiosity paid: Over the lifetime of the mortgage, refinancing to a decrease rate of interest can prevent 1000’s of {dollars} in curiosity fees.

Vital Concerns Earlier than Refinancing

Earlier than you bounce into refinancing, it is essential to think about the next:

- Your present mortgage phrases: Evaluation your present mortgage settlement to grasp the prepayment penalties and different phrases.

- Your credit score rating: In case your credit score rating has considerably improved because you took out the unique mortgage, refinancing could possibly be choice.

- Your monetary scenario: Guarantee you possibly can comfortably afford the brand new month-to-month funds earlier than committing to refinancing.

- The price of refinancing: Weigh the potential financial savings towards the prices of refinancing, equivalent to origination charges and shutting prices.

Alternate options to Refinancing

If refinancing is not the suitable choice for you, there are different methods to handle your automotive mortgage debt:

- Debt consolidation: This includes combining a number of money owed right into a single mortgage with a decrease rate of interest.

- Debt administration plan: A debt administration plan includes working with a credit score counseling company to barter decrease rates of interest and month-to-month funds.

- Stability switch: When you’ve got a bank card with a excessive steadiness, you possibly can switch the steadiness to a card with a decrease rate of interest.

Conclusion: Taking Management of Your Automobile Mortgage Debt

Refinancing your automotive mortgage with below-average credit generally is a difficult course of, however it’s not not possible. By understanding your credit score rating, exploring your choices, and negotiating successfully, you possibly can probably safe a decrease rate of interest and cut back your month-to-month funds. Keep in mind to fastidiously think about the prices and advantages earlier than making a call. Take management of your automotive mortgage debt and regain monetary freedom!

Closure

Thanks for studying! Stick with us for extra insights on Refinancing Your Automobile Mortgage with Dangerous Credit score: A Information to Decrease Funds and Higher Charges.

Don’t neglect to examine again for the newest information and updates on Refinancing Your Automobile Mortgage with Dangerous Credit score: A Information to Decrease Funds and Higher Charges!

Be at liberty to share your expertise with Refinancing Your Automobile Mortgage with Dangerous Credit score: A Information to Decrease Funds and Higher Charges within the remark part.

Keep knowledgeable with our subsequent updates on Refinancing Your Automobile Mortgage with Dangerous Credit score: A Information to Decrease Funds and Higher Charges and different thrilling matters.