Auto Mortgage Vs. Lease: Which Is Higher For You?

Auto Mortgage vs. Lease: Which is Higher for You?

Associated Articles

- Cruising In direction of Independence: Auto Mortgage Choices For College students

- Unlocking The Secrets and techniques To Your Auto Mortgage Cost: A Complete Information To Correct Calculation

- Slash Your Automotive Fee: A Information To Decreasing Your Auto Mortgage Prices

- Auto Loan Mistakes That Can Cost You Thousands: Avoid These Pitfalls And Drive Away With Savings

- Auto Mortgage Vs. Private Mortgage: Which Is Finest For Automotive Financing?

Introduction

Uncover every part it’s good to find out about Auto Mortgage vs. Lease: Which is Higher for You?

Video about

Auto Mortgage vs. Lease: Which is Higher for You?

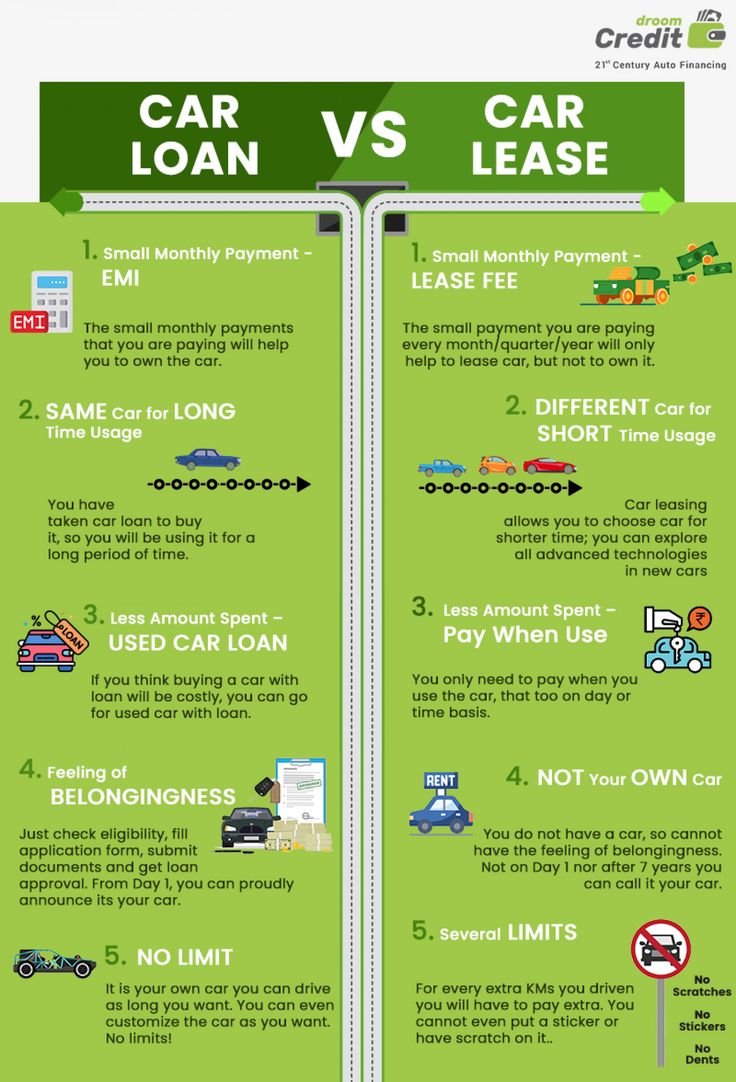

Selecting your subsequent automobile is an thrilling expertise, however the monetary facet might be daunting. You will probably be confronted with two main choices: shopping for with a mortgage or leasing. Every choice comes with its personal set of benefits and downsides, and the only option depends upon your particular person wants and monetary scenario. This complete information will break down the intricacies of auto loans and leases, serving to you make an knowledgeable resolution that matches your life-style.

Understanding Auto Loans

An auto mortgage is a conventional option to finance a automobile buy. You borrow cash from a lender, usually a financial institution or credit score union, to purchase the car. You then repay the mortgage over a predetermined interval, normally 3 to 7 years, with curiosity.

Key Options of Auto Loans:

- Possession: You personal the automobile outright as soon as the mortgage is paid off.

- Flexibility: You possibly can customise the mortgage time period, select your individual insurance coverage, and make modifications to the automobile.

- Fairness: You construct fairness within the automobile as you make funds, which is the distinction between the automobile’s worth and the quantity you owe.

- Longer-term dedication: You are dedicated to the automobile throughout the mortgage, which might be a number of years.

- Potential for depreciation: The automobile’s worth will depreciate over time, and it’s possible you’ll find yourself owing greater than the automobile is price.

Understanding Leases

A lease is an settlement the place you pay a month-to-month charge to make use of a automobile for a predetermined interval, usually 2 to 4 years. You do not personal the automobile; you are primarily renting it.

Key Options of Leases:

- Decrease month-to-month funds: Leases usually have decrease month-to-month funds than loans, as you are solely paying for the depreciation of the automobile in the course of the lease time period.

- New automobile each few years: You possibly can drive a brand new automobile each few years by leasing, which appeals to those that need the newest options and expertise.

- Restricted mileage: Most leases have mileage limits, and exceeding them can lead to penalties.

- No fairness: You do not construct fairness within the automobile; you are primarily paying for the appropriate to make use of it.

- Restricted customization: You could not be capable to make vital modifications to the automobile with out permission from the leasing firm.

Components to Think about When Selecting Between a Mortgage and a Lease:

1. Your Driving Wants and Habits:

- Mileage: In case you drive lots, a lease may not be the best choice as a result of mileage limits. An auto mortgage permits for limitless mileage.

- Driving fashion: In case you’re vulnerable to accidents or are inclined to drive aggressively, a lease may not be best, as you will be liable for any injury past regular put on and tear.

2. Monetary State of affairs and Objectives:

- Credit score rating: A superb credit score rating is essential for securing favorable mortgage phrases or a lease.

- Down fee: Loans usually require a bigger down fee than leases.

- Price range: Leases usually have decrease month-to-month funds, however they won’t be the best choice in case you’re in search of a long-term funding.

- Lengthy-term vs. short-term targets: If you wish to personal the automobile outright, a mortgage is a better option. In case you want a brand new automobile each few years, a lease is perhaps extra interesting.

3. The Automobile You Need:

- New vs. used: Leases are usually for brand new vehicles, whereas loans can be utilized for each new and used vehicles.

- Luxurious vs. sensible: Luxurious vehicles usually depreciate quicker, making a lease extra interesting. Sensible vehicles with good resale worth is perhaps higher suited to a mortgage.

4. The Lease vs. Mortgage Settlement:

- Lease phrases: Fastidiously evaluation the lease phrases, together with mileage limits, put on and tear provisions, and early termination charges.

- Mortgage phrases: Examine rates of interest, mortgage phrases, and different charges from totally different lenders.

- Residual worth: That is the estimated worth of the automobile on the finish of the lease time period. The next residual worth means decrease lease funds.

Execs and Cons of Auto Loans:

Execs:

- Possession: You personal the automobile outright after the mortgage is paid off.

- Flexibility: You possibly can customise the mortgage time period, select your individual insurance coverage, and make modifications to the automobile.

- Fairness: You construct fairness within the automobile as you make funds.

- Potential for resale worth: You possibly can promote the automobile at any time and doubtlessly recoup a few of your funding.

- No mileage limits: You possibly can drive as a lot as you need with out worrying about penalties.

Cons:

- Greater month-to-month funds: Mortgage funds are usually increased than lease funds.

- Longer-term dedication: You are dedicated to the automobile throughout the mortgage.

- Depreciation: The automobile’s worth will depreciate over time.

- Potential for adverse fairness: You could owe extra on the mortgage than the automobile is price if it depreciates quickly.

Execs and Cons of Leases:

Execs:

- Decrease month-to-month funds: Leases usually have decrease month-to-month funds than loans.

- New automobile each few years: You possibly can drive a brand new automobile each few years by leasing.

- Predictable prices: precisely how a lot you will be paying every month throughout the lease.

- Decrease upfront prices: Leases usually require a smaller down fee than loans.

- No worries about promoting the automobile: You merely return the automobile on the finish of the lease time period.

Cons:

- No possession: You do not personal the automobile; you are primarily renting it.

- Mileage limits: Most leases have mileage limits, and exceeding them can lead to penalties.

- Restricted customization: You could not be capable to make vital modifications to the automobile with out permission from the leasing firm.

- Potential for hidden charges: Leases can have hidden charges, reminiscent of early termination charges and put on and tear prices.

- No fairness: You do not construct fairness within the automobile.

Selecting the Proper Choice for You

There isn’t any one-size-fits-all reply to the query of whether or not to lease or finance. The only option depends upon your particular person circumstances and priorities.

Listed below are some eventualities the place a lease is perhaps a greater choice:

- You drive a average quantity of miles and desire a new automobile each few years.

- You are in search of decrease month-to-month funds.

- You desire a predictable month-to-month value and do not need to fear about promoting the automobile.

- You need to drive a luxurious automobile with out the excessive upfront value of possession.

Listed below are some eventualities the place a mortgage is perhaps a greater choice:

- You drive a variety of miles and need to personal the automobile outright.

- You are in search of a long-term funding and need to construct fairness.

- You need to customise the automobile and make modifications.

- You are comfy with the potential for depreciation and adverse fairness.

Suggestions for Getting the Greatest Deal:

- Store round for financing choices. Examine rates of interest and mortgage phrases from totally different lenders.

- Negotiate the value of the automobile. Do not be afraid to haggle with the dealership.

- Learn the advantageous print. Fastidiously evaluation the lease or mortgage settlement earlier than signing.

- Think about pre-owned vehicles. Used vehicles can supply nice worth and decrease financing prices.

- Do not be afraid to stroll away. In case you’re not comfy with the phrases of the deal, do not be afraid to stroll away and search for a greater choice.

Conclusion

The choice of whether or not to lease or finance a automobile is a private one. By fastidiously contemplating your wants, monetary scenario, and the professionals and cons of every choice, you may make an knowledgeable resolution that most closely fits your life-style and targets. Bear in mind, crucial factor is to decide on a financing choice that you simply’re comfy with and that permits you to take pleasure in your new automobile with out monetary stress.

Key phrases:

- Auto mortgage

- Lease

- Automobile financing

- Possession

- Fairness

- Depreciation

- Mileage limits

- Month-to-month funds

- Down fee

- Rate of interest

- Credit score rating

- Mortgage time period

- Lease time period

- Residual worth

- Put on and tear

- Early termination charges

- New automobile

- Used automobile

- Luxurious automobile

- Sensible automobile

- Monetary targets

- Driving wants

- Budgeting

- Monetary stress

Closure

We hope this text has helped you perceive every part about Auto Mortgage vs. Lease: Which is Higher for You?. Keep tuned for extra updates!

Don’t overlook to test again for the newest information and updates on Auto Mortgage vs. Lease: Which is Higher for You?!

Be happy to share your expertise with Auto Mortgage vs. Lease: Which is Higher for You? within the remark part.

Maintain visiting our web site for the newest tendencies and critiques.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…