Bridging the Hole: Understanding Bridge Loans and When They’re Your Finest Guess

Associated Articles

- Navigating The Mortgage Underwriting Course of: A Complete Information

- Is Refinancing Your Auto Mortgage Value It? Weighing The Execs And Cons

- The Federal Reserve And Your Automotive Mortgage: How Curiosity Charges Affect Your Wheels

- Mortgage Mortgage Necessities In 2024: What Has Modified? Navigating The Evolving Panorama

- Auto Loans For First-Time Consumers: Your Information To Getting On The Street

Introduction

On this article, we dive into Bridging the Hole: Understanding Bridge Loans and When They’re Your Finest Guess, providing you with a full overview of what’s to return

Video about

Bridging the Hole: Understanding Bridge Loans and When They’re Your Finest Guess

Within the ever-evolving world of finance, navigating the complexities of loans can really feel like traversing a labyrinth. One specific sort of mortgage, typically shrouded in thriller, is the bridge mortgage. Whereas it might appear to be simply one other monetary device, bridge loans supply a novel answer for particular conditions, performing as a brief lifeline throughout transitional intervals.

This complete information goals to demystify bridge loans, outlining their objective, benefits, disadvantages, and essential concerns. By the top, you will acquire a transparent understanding of when bridge loans will be your monetary saviour and after they may be greatest prevented.

What’s a Bridge Mortgage?

Think about your self standing on a bridge, connecting two distinct factors in your monetary journey. That is the essence of a bridge mortgage: it offers short-term financing to bridge the hole between two monetary occasions, typically performing as a short-term answer whereas ready for a bigger, extra everlasting supply of funds.

Consider it as a monetary slingshot, propelling you in the direction of your subsequent monetary objective.

Key Options of Bridge Loans:

- Quick-Time period Nature: Bridge loans are designed to be short-term, sometimes lasting wherever from a couple of weeks to some months.

- Excessive Curiosity Charges: As a consequence of their short-term and infrequently high-risk nature, bridge loans sometimes include larger rates of interest in comparison with conventional loans.

- Versatile Collateral: Relying on the lender, bridge loans will be secured or unsecured. Secured loans require collateral, corresponding to actual property or investments, whereas unsecured loans depend on your creditworthiness.

- Particular Objective: Bridge loans are sometimes used for particular functions, corresponding to buying a brand new dwelling whereas ready for the sale of your present property or funding a enterprise acquisition whereas ready for a bigger mortgage to be accepted.

When Ought to You Take into account a Bridge Mortgage?

Bridge loans aren’t a one-size-fits-all answer. They’re greatest suited to particular conditions the place you want short-term financing to bridge a short-term hole. Listed here are some frequent eventualities the place a bridge mortgage may be useful:

1. Actual Property Transactions:

- Shopping for a New House Earlier than Promoting Your Present One: If you happen to discover your dream dwelling however have not but bought your present property, a bridge mortgage can present the funds to buy the brand new dwelling when you wait to your present property to promote.

- Bridging the Hole Between Mortgage Approvals: Typically, securing a mortgage to your new dwelling can take longer than anticipated. A bridge mortgage can present the mandatory funds when you await the ultimate mortgage approval.

- Buying a Property at Public sale: Bridge loans will be useful for buying properties at auctions, particularly when it’s good to shut the transaction rapidly.

2. Enterprise Acquisitions and Growth:

- Funding a Enterprise Acquisition: Bridge loans can present the mandatory capital to amass a brand new enterprise when you wait for a bigger mortgage to be accepted or safe extra funding.

- Bridging the Hole Between Funding Rounds: For startups or rising companies, bridge loans may help bridge the hole between funding rounds, offering essential capital for operations and growth.

3. Refinancing and Debt Consolidation:

- Bridging the Hole Between Refinancing Loans: If you happen to’re refinancing your mortgage or different debt, a bridge mortgage can present short-term financing when you await the brand new mortgage to be accepted and the funds to be disbursed.

- Consolidating Excessive-Curiosity Debt: Bridge loans can be utilized to consolidate high-interest debt, offering a brief answer when you work on lowering your general debt burden.

4. Sudden Monetary Emergencies:

- Medical Bills: Bridge loans can present the mandatory funds to cowl sudden medical bills, particularly if you do not have enough medical insurance protection.

- House Repairs: If your private home requires pressing repairs, a bridge mortgage may help cowl the prices when you await insurance coverage claims to be processed or safe different financing choices.

The Benefits of Bridge Loans:

- Quick Entry to Funds: Bridge loans are sometimes processed rapidly, offering you with the mandatory funds in a well timed method.

- Flexibility: Bridge loans will be tailor-made to your particular wants, providing a versatile answer for varied monetary conditions.

- Non permanent Answer: Bridge loans are designed to be short-term, permitting you to bridge the hole between monetary occasions with out taking over long-term debt.

The Disadvantages of Bridge Loans:

- Excessive Curiosity Charges: Bridge loans sometimes include larger rates of interest than conventional loans, making them dearer in the long term.

- Quick-Time period Nature: The short-term nature of bridge loans can put stress on you to repay the mortgage rapidly, which can not all the time be possible.

- Potential for Threat: If you happen to’re unable to repay the bridge mortgage on time, you may face penalties and even foreclosures in your collateral.

The way to Select the Proper Bridge Mortgage:

- Store Round for Charges: Examine rates of interest and costs from a number of lenders to make sure you’re getting one of the best deal.

- Perceive the Phrases: Rigorously learn the mortgage settlement to know the phrases, together with the rate of interest, charges, and compensation schedule.

- Take into account Your Monetary State of affairs: Consider your potential to repay the mortgage on time, contemplating your present revenue, bills, and different monetary obligations.

Bridge Loans: A Highly effective Instrument in Your Monetary Arsenal

Bridge loans generally is a helpful device for navigating advanced monetary conditions. Nevertheless, it is essential to know their strengths and weaknesses earlier than utilizing them. By fastidiously weighing the professionals and cons and contemplating your particular monetary circumstances, you may decide whether or not a bridge mortgage is the proper answer for you.

Key phrases: bridge mortgage, short-term financing, actual property transactions, enterprise acquisitions, refinancing, debt consolidation, monetary emergencies, excessive rates of interest, short-term loans, monetary hole, monetary options, monetary planning, funding, dwelling shopping for, enterprise financing.

search engine optimisation Optimization:

This text is optimized for search engines like google and yahoo by incorporating related key phrases all through the textual content. The headings and subheadings are additionally keyword-rich, making it simpler for search engines like google and yahoo to know the content material. Using bullet factors and clear explanations enhances readability and improves person expertise.

Further Info:

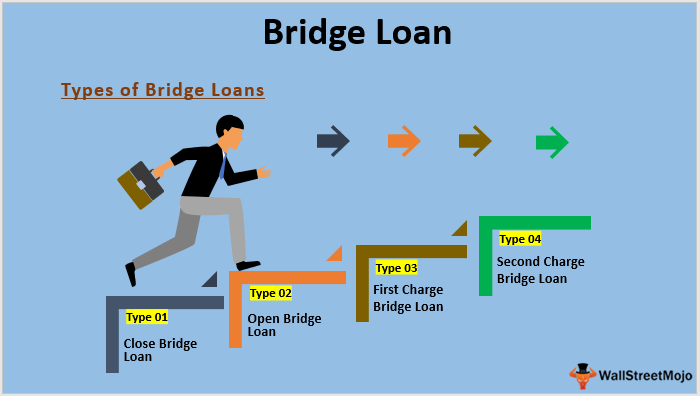

- Varieties of Bridge Loans: There are several types of bridge loans out there, together with laborious cash loans, development loans, and industrial bridge loans.

- Mortgage Necessities: The precise necessities for a bridge mortgage will range relying on the lender. Nevertheless, most lenders would require a credit score rating, revenue verification, and collateral.

- Options to Bridge Loans: If a bridge mortgage is not the proper choice for you, there are different alternate options, corresponding to private loans, dwelling fairness loans, or strains of credit score.

Conclusion:

Bridge loans generally is a helpful device for people and companies dealing with short-term monetary challenges. They supply short-term financing to bridge the hole between monetary occasions, providing flexibility and pace. Nevertheless, it is important to weigh the benefits and drawbacks fastidiously earlier than deciding if a bridge mortgage is the proper answer to your wants. By understanding the aim, options, and potential dangers of bridge loans, you can also make knowledgeable monetary choices and obtain your monetary targets.

Closure

Thanks for studying! Stick with us for extra insights on Bridging the Hole: Understanding Bridge Loans and When They’re Your Finest Guess.

Ensure that to observe us for extra thrilling information and critiques.

We’d love to listen to your ideas about Bridging the Hole: Understanding Bridge Loans and When They’re Your Finest Guess—depart your feedback under!

Keep knowledgeable with our subsequent updates on Bridging the Hole: Understanding Bridge Loans and When They’re Your Finest Guess and different thrilling subjects.