Can You Get An Auto Mortgage With out A Down Fee? Navigating The World Of No-Down Fee Automotive Loans

Can You Get an Auto Mortgage And not using a Down Fee? Navigating the World of No-Down Fee Automotive Loans

Associated Articles

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

- What Occurs If You Miss An Auto Mortgage Fee? A Information To Avoiding Late Charges And Defending Your Credit score

- High 10 Ideas For Getting Permitted For An Auto Mortgage In 2024: Drive Away With Confidence

- Secured Vs. Unsecured Auto Loans: Professionals And Cons

- High 5 On-line Auto Mortgage Lenders To Take into account This Yr: Your Information To Inexpensive Financing

Introduction

Be a part of us as we discover Can You Get an Auto Mortgage And not using a Down Fee? Navigating the World of No-Down Fee Automotive Loans, full of thrilling updates

Video about

Can You Get an Auto Mortgage And not using a Down Fee? Navigating the World of No-Down Fee Automotive Loans

Shopping for a automotive is an enormous determination, and securing financing is usually a major hurdle. Many individuals surprise if they will get an auto mortgage with out a down cost, particularly in the event that they’re on a good funds. The reply, whereas not all the time a easy sure, could be achievable with the suitable method and understanding of the automotive mortgage panorama.

Understanding the Fundamentals: Down Funds and Auto Loans

Earlier than diving into the specifics of no-down cost loans, let’s make clear the function of a down cost within the auto financing course of.

-

Down Fee: That is the preliminary sum of money you pay upfront when buying a automotive. It reduces the whole mortgage quantity you must borrow, impacting your month-to-month funds and general curiosity prices.

-

Auto Mortgage: This can be a mortgage particularly designed to finance the acquisition of a automobile. It is sometimes provided by banks, credit score unions, and automotive dealerships.

Why Down Funds Matter

Down funds are usually helpful for each debtors and lenders:

-

Debtors:

- Decrease Mortgage Quantity: A bigger down cost reduces the whole quantity you must borrow, resulting in decrease month-to-month funds and probably a shorter mortgage time period.

- Decrease Curiosity Charges: Lenders typically provide decrease rates of interest to debtors with bigger down funds, because it demonstrates monetary duty and reduces their threat.

- Improved Mortgage Approval Odds: A down cost can enhance your probabilities of mortgage approval, particularly when you’ve got a decrease credit score rating.

-

Lenders:

- Decreased Danger: A down cost acts as collateral, offering some safety for the lender in case the borrower defaults on the mortgage.

- Increased Revenue Potential: Decrease mortgage quantities typically imply greater rates of interest, producing extra income for the lender.

Can You Get an Auto Mortgage And not using a Down Fee?

The brief reply is sure, however it’s not all the time straightforward. Whereas some lenders provide no-down cost auto loans, they typically include particular necessities and potential drawbacks:

1. No-Down Fee Auto Loans: The Good, the Dangerous, and the Ugly

The Good:

- Accessibility: No-down cost loans provide a path to automotive possession for these with restricted upfront capital. That is notably useful for people with decrease credit score scores or these going through monetary constraints.

- Flexibility: The flexibility to keep away from a down cost can unlock funds for different important bills or financial savings objectives.

- Potential for Decrease Month-to-month Funds: Whereas the whole curiosity value is perhaps greater, the absence of a down cost can lead to decrease month-to-month funds, making automotive possession extra manageable.

The Dangerous:

- Increased Curiosity Charges: No-down cost loans sometimes include greater rates of interest in comparison with loans with a down cost. It is because lenders understand a better threat related to these loans.

- Bigger Complete Mortgage Quantity: Because you’re borrowing the complete buy value, you may find yourself paying extra in curiosity over the lifetime of the mortgage.

- Adverse Impression on Credit score Rating: Taking up a bigger mortgage quantity can probably negatively impression your credit score rating, particularly should you’re already carrying different debt.

The Ugly:

- Restricted Availability: Not all lenders provide no-down cost auto loans, and those who do may need stricter eligibility standards.

- Increased Danger of Default: The absence of a down cost will increase the chance for the lender if the borrower defaults on the mortgage.

- Doubtlessly Increased Month-to-month Funds: Whereas the preliminary month-to-month cost is perhaps decrease, the upper rate of interest can result in considerably greater funds within the later levels of the mortgage.

2. Alternate options to No-Down Fee Loans

When you’re struggling to safe a no-down cost mortgage, take into account these alternate options:

- Save for a Down Fee: Probably the most simple method is to save lots of up for a down cost earlier than making use of for a mortgage. Even a small down cost can considerably enhance your mortgage phrases.

- Negotiate with Dealerships: Whereas not all the time profitable, negotiating with dealerships can generally result in decrease costs or financing incentives that successfully cut back the necessity for a down cost.

- Take into account a Used Automotive: Used automobiles usually value lower than new automobiles, permitting you to safe a automobile with a smaller down cost and even no down cost.

- Discover Co-signers: When you’ve got a trusted good friend or member of the family with good credit score, they is perhaps prepared to co-sign your mortgage, enhancing your probabilities of approval and probably securing a decrease rate of interest.

- Search for Particular Mortgage Applications: Sure lenders provide specialised mortgage applications for people with decrease credit score scores or these going through monetary challenges.

3. Elements Affecting Mortgage Approval and Phrases

The probabilities of securing a no-down cost mortgage and the related phrases rely upon a number of components:

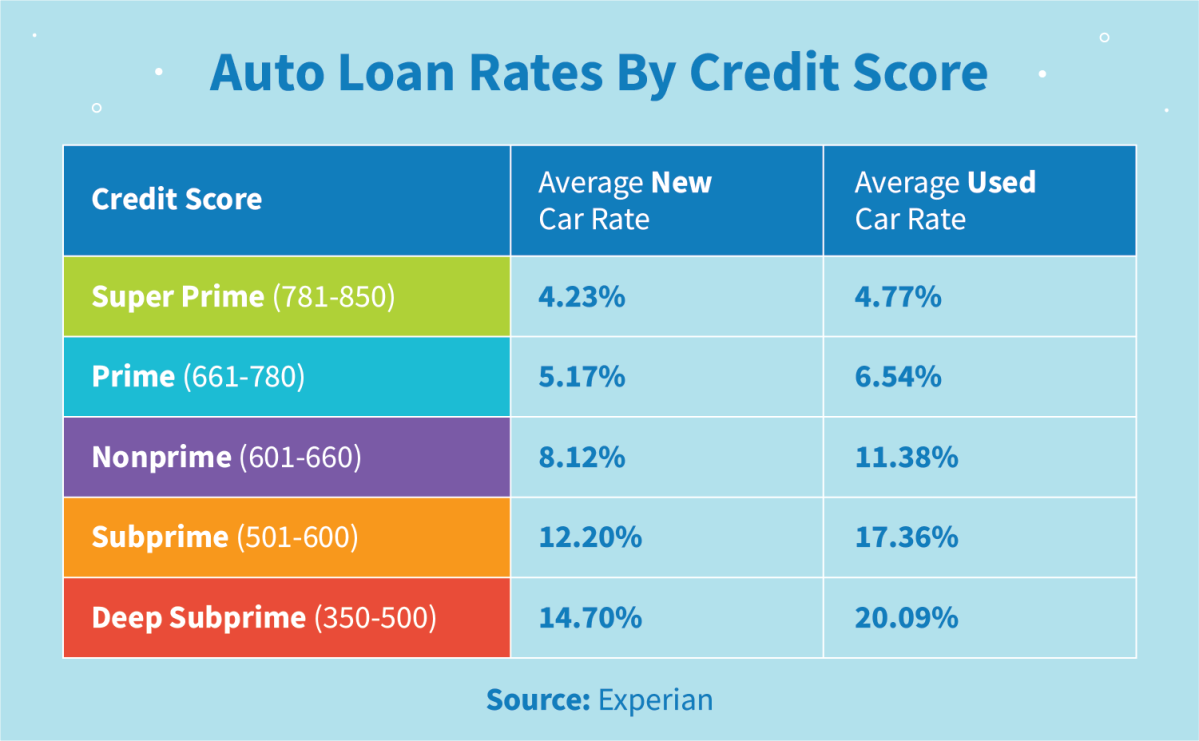

- Credit score Rating: Your credit score rating is a significant determinant of your mortgage eligibility and rate of interest. The next credit score rating usually interprets to higher mortgage phrases.

- Revenue and Debt-to-Revenue Ratio (DTI): Lenders assess your revenue and current debt obligations to find out your skill to repay the mortgage. A decrease DTI (debt-to-income ratio) will increase your probabilities of approval.

- Car Worth: The worth of the automotive you are buying performs a job in mortgage approval. Lenders is perhaps extra hesitant to offer no-down cost loans for costly automobiles.

- Mortgage Time period: An extended mortgage time period could make month-to-month funds extra manageable however will end in greater general curiosity prices.

- Lender Necessities: Completely different lenders have various necessities and insurance policies for no-down cost loans.

4. Suggestions for Securing a No-Down Fee Auto Mortgage

- Enhance Your Credit score Rating: Earlier than making use of for a mortgage, take steps to enhance your credit score rating. This consists of paying payments on time, conserving credit score utilization low, and avoiding pointless credit score purposes.

- Store Round for Lenders: Evaluate mortgage presents from completely different lenders to safe essentially the most favorable phrases.

- Take into account a Used Automotive: Used automobiles typically provide higher worth for cash and would possibly require a smaller down cost.

- Negotiate with Dealerships: Do not be afraid to barter with dealerships to probably safe a lower cost or financing incentives.

- Discover Particular Mortgage Applications: Some lenders provide specialised applications for people with decrease credit score scores or these going through monetary challenges.

5. The Significance of Monetary Accountability

Securing a no-down cost auto mortgage could be a worthwhile device for automotive possession, however it’s essential to method it with monetary duty. Bear in mind:

- Budgeting: Rigorously funds your bills to make sure you can afford the month-to-month funds.

- Sustaining Good Credit score: Proceed to take care of an excellent credit score rating by managing your debt responsibly.

- Avoiding Late Funds: Make well timed funds to keep away from late charges and damaging impacts in your credit score rating.

- Emergency Financial savings: Keep an emergency fund to cowl sudden automotive repairs or bills.

6. No-Down Fee Auto Loans: A Balanced Perspective

No-down cost auto loans could be a useful choice for people with restricted upfront capital, however they need to be approached with warning. It is important to weigh the potential advantages towards the related dangers and make a well-informed determination primarily based in your particular person monetary state of affairs.

7. Conclusion

Whereas the opportunity of securing a no-down cost auto mortgage exists, it is not a assured path to automotive possession. Thorough analysis, cautious consideration of your monetary state of affairs, and accountable borrowing practices are important for making an knowledgeable and financially sound determination. Bear in mind, the most effective method is to discover a mortgage that matches your wants and funds, even when it means saving for a down cost or exploring various financing choices.

Key phrases:

- Auto mortgage

- No down cost

- Automotive mortgage

- Down cost

- Mortgage phrases

- Credit score rating

- Rate of interest

- Debt-to-income ratio (DTI)

- Mortgage approval

- Monetary duty

- Budgeting

- Emergency financial savings

- Used automotive

- New automotive

- Co-signer

- Particular mortgage applications

- Mortgage choices

- Automotive shopping for

- Automotive financing

- Financing choices

- Mortgage eligibility

- Mortgage necessities

- Lender necessities

- Mortgage utility

- Mortgage course of

- Mortgage comparability

- Mortgage charges

- Automotive dealership

- Automotive insurance coverage

- Automotive upkeep

- Automotive repairs

- Automotive possession

- Monetary planning

- Credit score administration

- Debt administration

- Monetary literacy

- Cash administration

Closure

We hope this text has helped you perceive all the things about Can You Get an Auto Mortgage And not using a Down Fee? Navigating the World of No-Down Fee Automotive Loans. Keep tuned for extra updates!

Don’t overlook to test again for the newest information and updates on Can You Get an Auto Mortgage And not using a Down Fee? Navigating the World of No-Down Fee Automotive Loans!

Be at liberty to share your expertise with Can You Get an Auto Mortgage And not using a Down Fee? Navigating the World of No-Down Fee Automotive Loans within the remark part.

Keep knowledgeable with our subsequent updates on Can You Get an Auto Mortgage And not using a Down Fee? Navigating the World of No-Down Fee Automotive Loans and different thrilling matters.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…