Can You Purchase a Dwelling with a Low Credit score Rating? Navigating the Mortgage Maze

Associated Articles

- Unlocking The Finest Auto Mortgage Phrases: A Complete Information To Negotiating Your Manner To Financial savings

- Unlocking The Energy Of Auto Mortgage Calculators: How To Evaluate Lenders And Get The Finest Deal

- Slash Your Automotive Fee: A Information To Decreasing Your Auto Mortgage Prices

- High 10 Ideas For Getting Permitted For An Auto Mortgage In 2024: Drive Away With Confidence

- Navigating The Highway To Auto Possession: Getting Authorised For A Automobile Mortgage With Unhealthy Credit score In 2024

Introduction

Uncover every thing you’ll want to find out about Can You Purchase a Dwelling with a Low Credit score Rating? Navigating the Mortgage Maze

Video about

Can You Purchase a Dwelling with a Low Credit score Rating? Navigating the Mortgage Maze

Proudly owning a house is the American dream, however for a lot of, the trail to homeownership can really feel like a frightening, even inconceivable, journey. One of many largest hurdles is credit score rating. A low credit score rating can really feel like a roadblock, stopping you from getting a mortgage, and even getting a very good rate of interest. However is it actually inconceivable to purchase a house with a low credit score rating?

The reply is: it is not inconceivable, nevertheless it’s positively tougher. This text will information you thru the intricacies of shopping for a house with a low credit score rating, offering sensible recommendation, methods, and sources that can assist you obtain your homeownership objectives.

Understanding the Influence of Credit score Rating

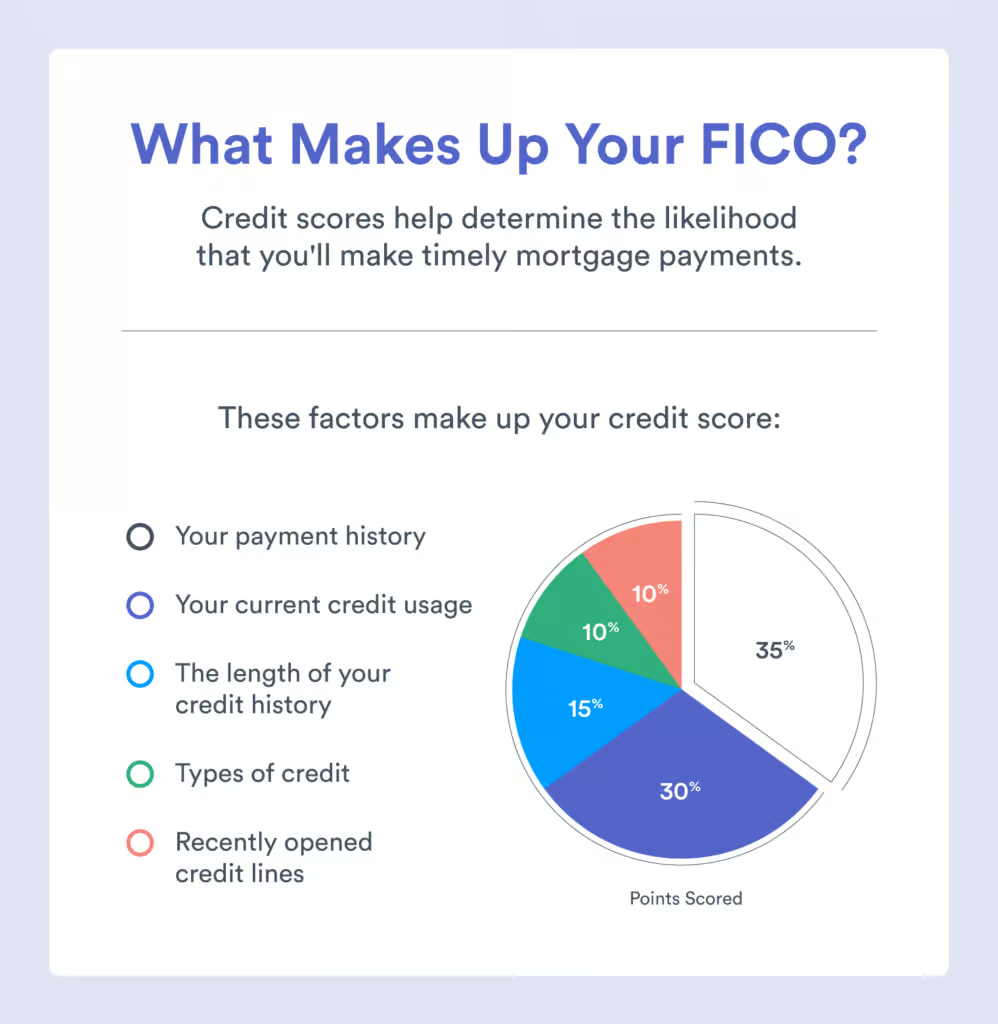

Your credit score rating is a numerical illustration of your creditworthiness, reflecting how effectively you handle debt. It is a essential issue for lenders when evaluating your mortgage utility, together with mortgages. Lenders use credit score scores to evaluate your danger – the chance of you repaying the mortgage on time.

Here is a simplified breakdown of how credit score rating impacts your mortgage journey:

- Larger Credit score Rating: A better credit score rating (usually 740 or above) interprets to a decrease danger for lenders. This implies you are prone to qualify for higher rates of interest, decrease down funds, and doubtlessly much more mortgage choices.

- Decrease Credit score Rating: A decrease credit score rating (under 620) signifies a better danger for lenders. This will result in:

- Larger rates of interest: You may possible face larger rates of interest, rising the general price of your mortgage.

- Restricted mortgage choices: You may not qualify for standard loans and will should discover different mortgage packages with stricter necessities.

- Larger down fee: You is likely to be required to place down a bigger down fee to compensate for the perceived danger.

- Mortgage denial: In some circumstances, lenders may fully deny your mortgage utility.

Navigating the Mortgage Maze with a Low Credit score Rating

Whereas a low credit score rating may look like a serious impediment, it is not an insurmountable barrier. Here is a roadmap that can assist you navigate the mortgage maze:

1. Assess Your Credit score Rating and Monetary Scenario

Step one is to grasp your present monetary standing.

- Verify Your Credit score Report: Order a free credit score report from every of the three main credit score bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Evaluate the report for any errors or inaccuracies that may very well be negatively impacting your rating.

- Determine Credit score Rating Challenges: Analyze your credit score report back to pinpoint areas the place you’ll be able to enhance your rating. Frequent points embrace:

- Late funds: Even a single late fee can considerably harm your credit score rating.

- Excessive credit score utilization: Utilizing a big portion of your obtainable credit score can decrease your rating.

- Adverse accounts: Assortment accounts, charge-offs, or bankruptcies can have a serious impression.

- Consider Your Monetary Well being: Assess your revenue, bills, and debt-to-income ratio (DTI). A decrease DTI (usually below 43%) is extra favorable for mortgage lenders.

2. Enhance Your Credit score Rating

When you perceive your credit score rating challenges, you can begin taking steps to enhance it.

- Pay Payments on Time: That is essentially the most essential step. Make all of your funds on time, even when it is simply the minimal quantity due.

- Cut back Credit score Utilization: Decrease your credit score utilization ratio by paying down your bank card balances and avoiding opening new credit score accounts. Goal to maintain your utilization under 30%.

- Dispute Errors: For those who discover any inaccuracies in your credit score report, contact the credit score bureau and dispute them.

- Take into account a Secured Credit score Card: A secured bank card requires a safety deposit, which will help construct your credit score historical past and enhance your rating.

- Develop into an Approved Person: Ask a trusted buddy or member of the family with good credit score so as to add you as a licensed person on their bank card account. This will help you profit from their optimistic credit score historical past.

- Keep away from Opening New Credit score Accounts: Opening too many new credit score accounts can negatively impression your rating.

- Be Affected person: Constructing credit score takes time. Do not anticipate in a single day outcomes.

3. Discover Mortgage Choices for Low Credit score Scores

Whereas standard mortgages are usually essentially the most inexpensive, they usually require a better credit score rating. When you’ve got a decrease credit score rating, you may have to discover different choices:

- FHA Loans: The Federal Housing Administration (FHA) provides loans with decrease credit score rating necessities and down fee choices. Nevertheless, FHA loans sometimes include larger mortgage insurance coverage premiums.

- VA Loans: For eligible veterans, the Division of Veterans Affairs (VA) provides loans with no down fee requirement and extra lenient credit score rating requirements.

- USDA Loans: The U.S. Division of Agriculture (USDA) provides loans to eligible debtors in rural areas with low credit score rating necessities and inexpensive rates of interest.

- Non-QM Loans: Non-qualified mortgages (Non-QM) are loans that do not meet the strict underwriting tips of standard loans. They usually have larger rates of interest however will be an possibility for debtors with decrease credit score scores or unconventional revenue.

4. Discover a Lender Who Focuses on Low Credit score Scores

Not all lenders are created equal. Some lenders focus on working with debtors who’ve decrease credit score scores.

- Store Round: Examine charges and phrases from a number of lenders, together with credit score unions, banks, and mortgage brokers.

- Ask About Packages: Inquire about particular packages designed for debtors with low credit score scores.

- Search for Expertise: Select a lender with a confirmed monitor report of working with debtors with credit score challenges.

5. Construct a Sturdy Mortgage Software

As soon as you have discovered a lender, put together a powerful mortgage utility:

- Present Correct Info: Be sincere and clear about your monetary state of affairs.

- Doc Your Earnings: Present documentation of your revenue, similar to pay stubs, tax returns, and financial institution statements.

- Clarify Credit score Points: When you’ve got any destructive credit score historical past, be ready to clarify the circumstances and display that you have taken steps to enhance your credit score.

- Present Stability: Spotlight your job stability and constant revenue.

6. Take into account a Co-Borrower or Co-Signer

For those who’re struggling to qualify for a mortgage by yourself, take into account including a co-borrower or co-signer with good credit score. This will considerably enhance your probabilities of approval.

7. Be Ready for Larger Curiosity Charges

You may possible face larger rates of interest with a decrease credit score rating. Be ready to pay extra to your mortgage over the lifetime of the mortgage.

8. Be Reasonable About Your Expectations

Do not anticipate to get the identical phrases as somebody with a better credit score rating. Be reasonable about your expectations and perceive that you just may have to make some compromises.

9. Get Pre-Authorized for a Mortgage

Getting pre-approved for a mortgage can provide you a greater understanding of how a lot you’ll be able to afford to borrow and make the home-buying course of smoother.

10. Be Affected person and Persistent

Shopping for a house with a low credit score rating can take effort and time. Be affected person, persistent, and do not hand over in your dream of homeownership.

Past the Mortgage: Constructing a Basis for Monetary Success

Whereas enhancing your credit score rating and securing a mortgage are essential steps, it is necessary to construct a basis for long-term monetary success.

- Budgeting: Create a sensible price range to trace your revenue and bills.

- Saving: Develop a financial savings plan to construct an emergency fund and put together for future monetary objectives.

- Debt Administration: Create a plan to pay down current debt and keep away from accumulating new debt.

- Monetary Literacy: Educate your self about private finance, credit score administration, and investing.

Conclusion: Unlocking the Door to Homeownership

Shopping for a house with a low credit score rating is difficult, nevertheless it’s not inconceivable. By understanding the components that affect credit score scores, taking steps to enhance your credit score, exploring different mortgage choices, and dealing with the suitable lender, you’ll be able to enhance your probabilities of reaching your homeownership objectives. Bear in mind, persistence, persistence, and a dedication to monetary duty are key to constructing a strong monetary basis and securing your dream residence.

Closure

Thanks for studying! Stick with us for extra insights on Can You Purchase a Dwelling with a Low Credit score Rating? Navigating the Mortgage Maze.

Be certain that to comply with us for extra thrilling information and evaluations.

Be at liberty to share your expertise with Can You Purchase a Dwelling with a Low Credit score Rating? Navigating the Mortgage Maze within the remark part.

Keep knowledgeable with our subsequent updates on Can You Purchase a Dwelling with a Low Credit score Rating? Navigating the Mortgage Maze and different thrilling matters.