Cashing Out: Utilizing a Refinance to Conquer Your Debt

Associated Articles

- Understanding Jumbo Loans: When Do You Want One?

- Refinance Your FHA Mortgage: Unlock Decrease Charges And Save Cash

- Denied! What To Do When Your House Mortgage Software Will get Rejected

- Discovering The Proper Match: Finest House Mortgage Packages For Low-Revenue Households

- Unlocking Financial savings: How Mortgage Factors Can Decrease Your Curiosity Price And Save You 1000’s

Introduction

Welcome to our in-depth take a look at Cashing Out: Utilizing a Refinance to Conquer Your Debt

Video about Cashing Out: Utilizing a Refinance to Conquer Your Debt

Cashing Out: Utilizing a Refinance to Conquer Your Debt

The American dream typically comes with a hefty price ticket. From scholar loans to bank card debt, many discover themselves burdened by monetary obligations. However what if there was a method to consolidate these money owed, probably decrease your month-to-month funds, and even unlock some money? Enter the cash-out refinance, a strong instrument that may aid you take management of your funds.

This text will delve into the intricacies of cash-out refinancing, exploring its advantages, dangers, and the way to decide if it is the appropriate transfer for you. We’ll cowl all the things from understanding the method to calculating the potential financial savings and navigating the complexities of mortgage phrases.

Understanding the Fundamentals of Money-Out Refinancing

Think about you might have a mortgage with a decrease rate of interest than your bank card debt. By refinancing your house, you’ll be able to entry a portion of its fairness, utilizing that cash to repay your higher-interest money owed. This course of, often known as a cash-out refinance, primarily replaces your present mortgage with a brand new one, permitting you to borrow extra money than your authentic mortgage quantity.

This is a simplified breakdown:

- You personal a house with fairness: This implies your house’s worth exceeds the quantity you owe in your mortgage.

- You refinance your mortgage: This entails getting a brand new mortgage with a better mortgage quantity than your present mortgage.

- You obtain money: The distinction between the brand new mortgage quantity and your present mortgage quantity, plus any closing prices, is disbursed to you as money.

- You utilize the money to consolidate debt: You utilize the money to repay high-interest money owed, like bank cards or private loans.

Why Select a Money-Out Refinance?

1. Debt Consolidation: That is the first motive most householders go for a cash-out refinance. By consolidating a number of money owed into one lower-interest mortgage, you’ll be able to simplify your month-to-month funds and probably cut back your total curiosity burden.

2. Decrease Month-to-month Funds: A decrease rate of interest in your refinance can considerably decrease your month-to-month funds, releasing up money circulation for different monetary objectives.

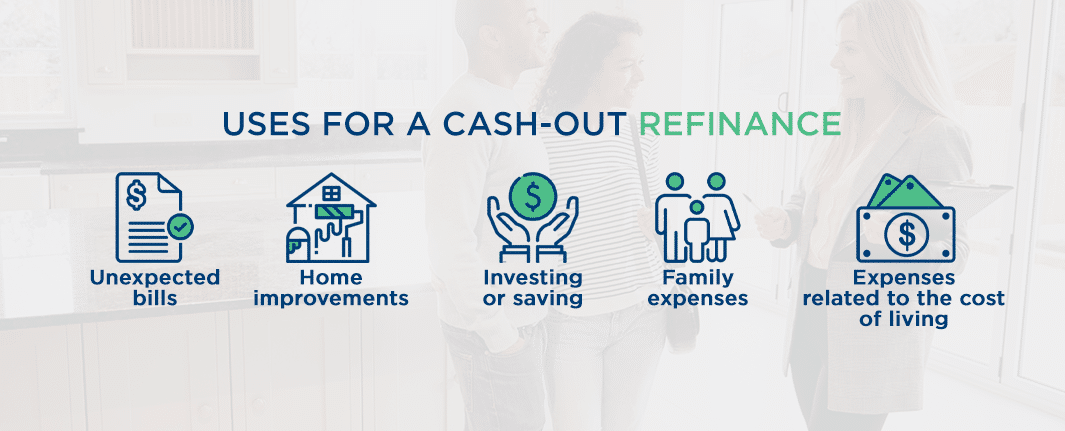

3. Entry to Money for House Enhancements: Have to renovate your kitchen or add a sunroom? Money-out refinancing can present the funds for residence enhancements, rising your house’s worth and delight.

4. Funding for Sudden Bills: Life throws curveballs. A cash-out refinance can present a monetary cushion for surprising bills like medical payments or automobile repairs.

Potential Drawbacks of Money-Out Refinancing

Whereas cash-out refinancing affords quite a few advantages, it is essential to acknowledge the potential drawbacks:

1. Larger Curiosity Charges: When you may decrease your total curiosity burden by consolidating debt, the brand new mortgage’s rate of interest could also be greater than your present price, probably resulting in elevated curiosity funds over the long run.

2. Elevated Mortgage Time period: Extending your mortgage time period can result in greater total curiosity funds, even when your month-to-month cost is decrease.

3. Larger Closing Prices: Refinancing entails closing prices, which might add up, probably offsetting a number of the preliminary financial savings.

4. Danger of Damaging Fairness: If your house’s worth decreases, you could possibly find yourself with damaging fairness, that means you owe greater than your house is price.

5. Influence on Your Credit score Rating: Making use of for a brand new mortgage can briefly decrease your credit score rating, particularly in case you have a number of inquiries inside a brief interval.

Who’s a Money-Out Refinance Proper For?

Not everybody is an appropriate candidate for a cash-out refinance. It is essential to judge your monetary state of affairs and objectives earlier than making a choice.

Money-out refinancing is usually a great choice for:

- Owners with important fairness: You want enough fairness to entry a large money quantity.

- People with high-interest debt: In case your debt has a excessive rate of interest, consolidating it right into a lower-interest mortgage can prevent cash in the long term.

- These with a great credit score rating: A robust credit score rating will aid you qualify for a decrease rate of interest.

- People with a secure earnings: Lenders will assess your capacity to repay the mortgage, so a gentle earnings is important.

Money-out refinancing may not be your best option for:

- Owners with restricted fairness: If you do not have sufficient fairness, you may not have the ability to borrow sufficient to cowl your money owed.

- People with poor credit score: A low credit score rating can result in greater rates of interest and probably make the refinance much less helpful.

- These with unstable earnings: Lenders are much less prone to approve a refinance in case your earnings is unpredictable.

- Individuals with a short-term monetary want: If you happen to want money for a short-term expense, different choices like a private mortgage could be extra appropriate.

Calculating the Potential Financial savings

Earlier than diving right into a cash-out refinance, it is important to calculate the potential financial savings and decide if it is financially advantageous. This entails:

1. Estimating the Quantity of Money You Can Entry: This is determined by your house’s worth, the excellent mortgage stability, and the loan-to-value (LTV) ratio allowed by lenders.

2. Figuring out Your Present Debt Curiosity Charges: Record all of your high-interest money owed, together with bank cards, private loans, and different obligations.

3. Evaluating Curiosity Charges: Analysis present mortgage charges and examine them to your present debt rates of interest.

4. Calculating Month-to-month Cost Financial savings: Subtract the brand new mortgage cost from the sum of your present debt funds.

5. Estimating Complete Curiosity Paid: Calculate the full curiosity you will pay on the brand new mortgage over its time period and examine it to the full curiosity you’d pay in your present money owed.

6. Consider Closing Prices: Do not forget to incorporate closing prices, which might vary from 2% to five% of the mortgage quantity.

The Means of Money-Out Refinancing

As soon as you have determined to pursue a cash-out refinance, here is a common overview of the method:

1. Pre-Approval: Contact a lender and get pre-approved for a refinance. This entails offering details about your earnings, debt, and credit score historical past.

2. Appraisal: The lender will order an appraisal to evaluate your house’s present market worth.

3. Mortgage Software: As soon as the appraisal is full, you will submit a proper mortgage software.

4. Underwriting: The lender will overview your software and monetary paperwork to find out your eligibility and mortgage phrases.

5. Closing: In case your software is accredited, you will attend a closing assembly to signal the mortgage paperwork and obtain the money disbursement.

Ideas for a Profitable Money-Out Refinance

1. Store Round for the Finest Charges: Examine affords from a number of lenders to safe essentially the most favorable rate of interest and phrases.

2. Contemplate a Fastened-Fee Mortgage: Fastened-rate mortgages supply predictable funds and safety in opposition to rising rates of interest.

3. Perceive Your Mortgage Phrases: Rigorously overview the mortgage paperwork and perceive the rate of interest, mortgage time period, and any related charges.

4. Price range for Closing Prices: Consider closing prices when calculating your total prices and financial savings.

5. Use the Money Correctly: Have a plan for the way you will use the money from the refinance. Keep away from pointless spending and prioritize debt consolidation or residence enhancements.

6. Monitor Your Credit score Rating: Regulate your credit score rating, as it will possibly affect your refinancing choices.

Alternate options to Money-Out Refinancing

If a cash-out refinance does not appear to be the appropriate match, take into account these options:

- House Fairness Mortgage: This can be a secured mortgage utilizing your house’s fairness as collateral. It affords a set rate of interest and a set compensation time period.

- House Fairness Line of Credit score (HELOC): This can be a revolving line of credit score secured by your house’s fairness. It lets you borrow cash as wanted, as much as a sure restrict.

- Private Mortgage: That is an unsecured mortgage that does not require collateral. It is sometimes simpler to qualify for than a house fairness mortgage, however rates of interest are sometimes greater.

- Debt Consolidation Mortgage: This can be a mortgage particularly designed to consolidate a number of money owed into one cost. It may assist simplify your funds and probably decrease your month-to-month funds.

Conclusion: Money-Out Refinancing – A Highly effective Software for Monetary Freedom

Money-out refinancing could be a highly effective instrument for consolidating debt, accessing money for residence enhancements, and reaching monetary objectives. Nonetheless, it isn’t a one-size-fits-all answer. Earlier than taking the plunge, fastidiously take into account your monetary state of affairs, potential dangers, and different choices.

By understanding the method, calculating the potential financial savings, and making knowledgeable selections, you’ll be able to harness the ability of cash-out refinancing to take management of your funds and construct a brighter monetary future.

Key phrases: cash-out refinance, debt consolidation, residence fairness, mortgage refinance, rate of interest, mortgage time period, closing prices, credit score rating, monetary freedom, residence enchancment, monetary objectives, debt administration, monetary planning, monetary literacy, residence fairness mortgage, HELOC, private mortgage, debt consolidation mortgage, monetary recommendation, residence shopping for, mortgage, actual property, monetary providers, monetary merchandise, monetary establishments, banking, funding, retirement, financial savings, budgeting, bank card debt, scholar mortgage debt, shopper debt, private finance, cash administration, monetary duty, monetary safety, monetary stability, monetary independence, monetary literacy, monetary schooling, monetary empowerment.

Closure

Thanks for studying! Stick with us for extra insights on Cashing Out: Utilizing a Refinance to Conquer Your Debt.

Don’t overlook to verify again for the most recent information and updates on Cashing Out: Utilizing a Refinance to Conquer Your Debt!

Be at liberty to share your expertise with Cashing Out: Utilizing a Refinance to Conquer Your Debt within the remark part.

Maintain visiting our web site for the most recent traits and evaluations.