Curiosity-Solely Mortgages: A Detailed Take a look at the Execs and Cons

Associated Articles

- Unlocking Financial savings: Your Information To Auto Mortgage Refinancing In 2024

- What Are Auto Mortgage GAP Insurance coverage And Why You Would possibly Want It?

- Secured Vs. Unsecured Auto Loans: Professionals And Cons

- Auto Mortgage Vs. Lease: Which Is Higher For You?

- What Occurs If You Miss An Auto Mortgage Fee? A Information To Avoiding Late Charges And Defending Your Credit score

Introduction

Uncover the most recent particulars about Curiosity-Solely Mortgages: A Detailed Take a look at the Execs and Cons on this complete information.

Video about

Curiosity-Solely Mortgages: A Detailed Take a look at the Execs and Cons

Introduction:

Within the advanced world of house financing, understanding the nuances of various mortgage sorts is essential. One such possibility, gaining growing consideration, is the interest-only mortgage. This text delves deep into the intricacies of this mortgage sort, exploring its potential advantages and downsides that will help you make an knowledgeable determination.

What’s an Curiosity-Solely Mortgage?

An interest-only mortgage, because the identify suggests, lets you pay solely the curiosity in your mortgage every month, with out paying down the principal. Because of this your month-to-month funds will probably be decrease than these of a conventional mortgage, however you’ll not be constructing fairness in your house as shortly.

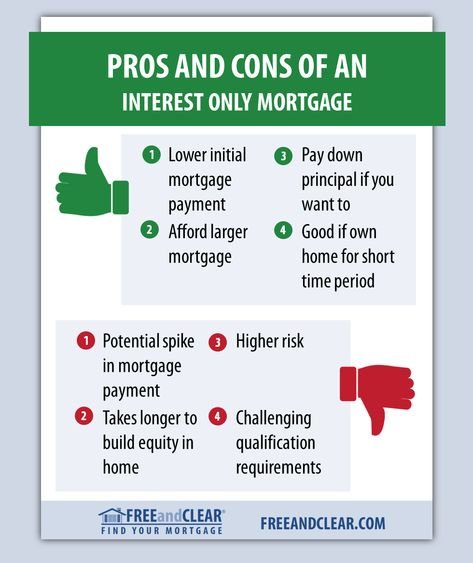

Execs of Curiosity-Solely Mortgages:

1. Decrease Month-to-month Funds:

Essentially the most vital benefit of an interest-only mortgage is the decrease month-to-month funds. This is usually a appreciable monetary reduction, releasing up extra cash move for different monetary targets like investments, financial savings, or paying off different money owed.

2. Potential for Greater Buy Energy:

With decrease month-to-month funds, you possibly can doubtlessly qualify for a bigger mortgage quantity. This lets you buy a dearer house, providing you with entry to bigger and extra fascinating properties.

3. Flexibility:

Curiosity-only mortgages supply flexibility by way of reimbursement. You’ll be able to select to pay down the principal at any time, or you possibly can proceed to pay solely the curiosity till the tip of the mortgage time period. This flexibility might be advantageous for many who anticipate a change of their monetary scenario or have a short-term plan for homeownership.

4. Tax Advantages:

Curiosity paid on a mortgage is usually tax-deductible, offering potential tax financial savings for householders. This profit applies to each interest-only and conventional mortgages.

5. Potential for Funding Development:

The freed-up money move from decrease month-to-month funds might be directed in the direction of investments, doubtlessly resulting in greater returns than merely paying down the principal.

Cons of Curiosity-Solely Mortgages:

1. No Fairness Construct-Up:

The largest downside of an interest-only mortgage is the dearth of fairness build-up. Since you’re solely paying the curiosity, you aren’t lowering the principal stability, leaving you weak to unfavourable fairness if the worth of your house declines.

2. Balloon Fee at Maturity:

On the finish of the mortgage time period, you can be required to make a big lump-sum fee, often called a balloon fee, to cowl the remaining principal stability. This is usually a vital monetary burden, particularly in case you have not been in a position to save sufficient to cowl it.

3. Threat of Destructive Fairness:

If the worth of your house decreases beneath the quantity you owe on the mortgage, you should have unfavourable fairness. This is usually a main downside if it is advisable to promote your house, as it’s possible you’ll not have the ability to recoup your funding.

4. Greater Curiosity Charges:

Curiosity-only mortgages typically include greater rates of interest than conventional mortgages, as lenders understand them as riskier. This could considerably improve the entire quantity of curiosity you pay over the lifetime of the mortgage.

5. Restricted Availability:

Curiosity-only mortgages will not be as broadly accessible as conventional mortgages. They’re usually provided by non-public lenders and will have stricter lending standards.

6. Potential for Monetary Pressure:

If you’re unable to make the balloon fee on the finish of the mortgage time period, it’s possible you’ll face foreclosures. This might result in vital monetary misery and injury your credit score rating.

Who Ought to Take into account an Curiosity-Solely Mortgage?

Curiosity-only mortgages could also be appropriate for sure debtors, but it surely’s essential to fastidiously consider your monetary scenario and long-term targets earlier than making a call. Listed here are some situations the place an interest-only mortgage is likely to be thought-about:

- Quick-Time period Homeownership: In case you plan to promote your house inside a couple of years, an interest-only mortgage could also be an excellent possibility. You’ll be able to get pleasure from decrease funds for a shorter interval and keep away from the balloon fee.

- Excessive-Revenue Earners: You probably have a excessive revenue and are assured in your capability to make the balloon fee on the finish of the mortgage time period, an interest-only mortgage is likely to be an acceptable possibility.

- Traders: Actual property traders typically use interest-only mortgages to accumulate properties and generate rental revenue. They can cowl the balloon fee with rental proceeds.

Alternate options to Curiosity-Solely Mortgages:

If you’re not comfy with the dangers related to an interest-only mortgage, there are a number of alternate options you possibly can contemplate:

- Conventional Mortgages: Conventional mortgages contain paying each principal and curiosity every month, permitting you to construct fairness in your house over time.

- Mounted-Fee Mortgages: Mounted-rate mortgages supply predictable month-to-month funds and safety from fluctuating rates of interest.

- Adjustable-Fee Mortgages (ARMs): ARMs supply decrease preliminary rates of interest, however the charges can alter over time. This is usually a good possibility for debtors who anticipate a short-term homeownership interval.

Conclusion:

Curiosity-only mortgages can supply decrease month-to-month funds and elevated buying energy, however in addition they include vital dangers. It is important to fastidiously weigh the professionals and cons earlier than making a call. If you’re contemplating an interest-only mortgage, it is essential to seek the advice of with a certified mortgage skilled to know the complexities and guarantee it aligns together with your monetary targets and threat tolerance. Bear in mind, knowledgeable decision-making is vital to attaining your homeownership goals.

Key phrases:

Curiosity-only mortgage, mortgage, house mortgage, financing, actual property, fairness, balloon fee, unfavourable fairness, rates of interest, tax advantages, funding, monetary targets, threat tolerance, mortgage skilled, homeownership, affordability, affordability calculator, mortgage calculator, shopping for a house, actual property market, monetary planning, monetary literacy, credit score rating, debt, debt administration, monetary stability, monetary safety, funding technique, retirement planning.

Closure

We hope this text has helped you perceive every thing about Curiosity-Solely Mortgages: A Detailed Take a look at the Execs and Cons. Keep tuned for extra updates!

Make certain to observe us for extra thrilling information and critiques.

We’d love to listen to your ideas about Curiosity-Solely Mortgages: A Detailed Take a look at the Execs and Cons—depart your feedback beneath!

Hold visiting our web site for the most recent tendencies and critiques.