Decoding The Mortgage-to-Worth Ratio: How It Impacts Your Mortgage Phrases

Decoding the Mortgage-to-Worth Ratio: How It Impacts Your Mortgage Phrases

Associated Articles

- Understanding FHA Dwelling Loans: A Full Information For First-Time And Skilled Homebuyers

- Denied! What To Do When Your House Mortgage Software Will get Rejected

- The Balloon Mortgage: A Dangerous Trip With Potential Rewards

- How To Select Between Mounted-Fee And Adjustable-Fee Mortgages

- Standard Vs. FHA Loans: Which Is Finest?

Introduction

Be a part of us as we discover Decoding the Mortgage-to-Worth Ratio: How It Impacts Your Mortgage Phrases, full of thrilling updates

Video about Decoding the Mortgage-to-Worth Ratio: How It Impacts Your Mortgage Phrases

Decoding the Mortgage-to-Worth Ratio: How It Impacts Your Mortgage Phrases

Shopping for a house is likely one of the most important monetary choices you may ever make. Whereas the joy of discovering your dream property is exhilarating, the method will be daunting, particularly when navigating the complexities of mortgage financing. One key issue that considerably influences your mortgage phrases is the Mortgage-to-Worth (LTV) ratio. Understanding this ratio is essential to securing the very best mortgage and making knowledgeable monetary choices.

This complete information will demystify the LTV ratio, explaining the way it works, its impression in your mortgage phrases, and how one can leverage it to your benefit.

What’s the Mortgage-to-Worth Ratio?

The Mortgage-to-Worth (LTV) ratio is a straightforward however highly effective metric utilized by lenders to evaluate the chance related to a mortgage mortgage. It represents the share of the property’s worth that you just’re borrowing from the lender.

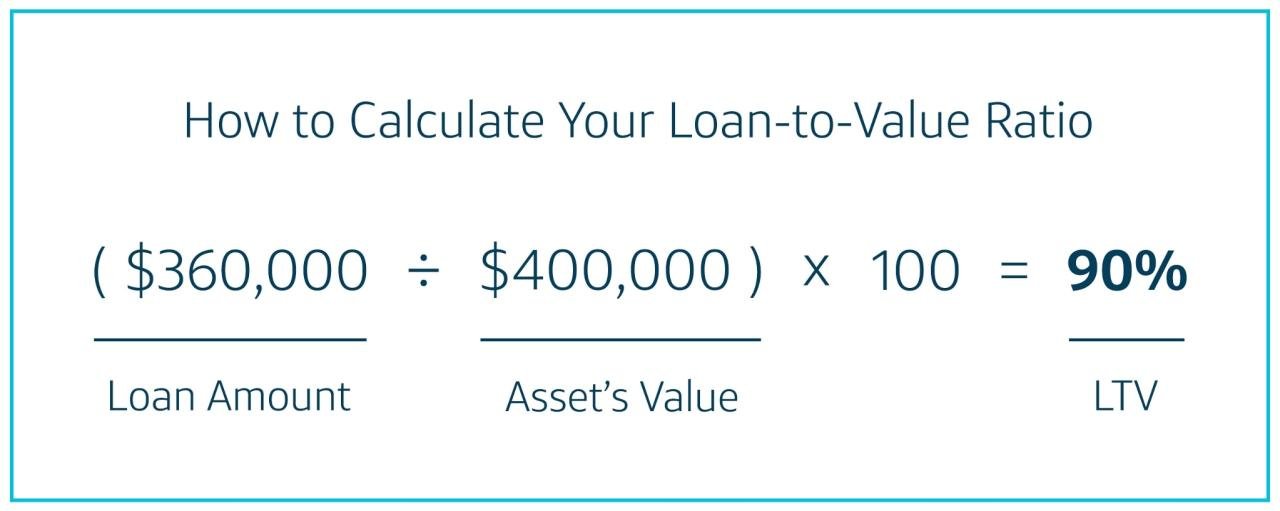

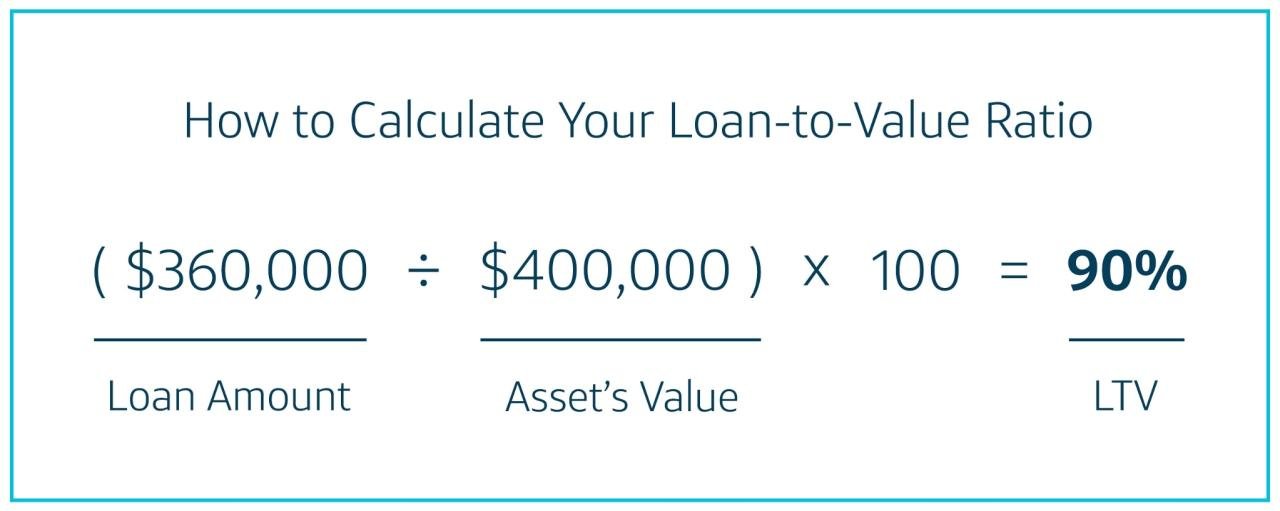

Calculating the LTV Ratio

The formulation for calculating the LTV ratio is simple:

LTV = Mortgage Quantity / Property Worth

For instance, in case you’re borrowing $200,000 to buy a $250,000 house, your LTV ratio can be 80% ( $200,000 / $250,000 = 0.80).

Why Does LTV Matter?

The LTV ratio is a vital issue for lenders as a result of it straight displays the quantity of fairness you could have within the property. Increased LTV ratios point out a bigger mortgage quantity relative to the property’s worth, making the mortgage riskier for the lender. Conversely, decrease LTV ratios counsel you could have extra fairness, lowering the lender’s danger.

Affect of LTV on Mortgage Phrases

The LTV ratio performs a big position in shaping your mortgage phrases, influencing a number of key points:

- Curiosity Charges: Lenders usually provide decrease rates of interest to debtors with decrease LTV ratios. It is because a decrease LTV signifies a decrease danger for the lender. Conversely, debtors with increased LTV ratios could face increased rates of interest as a result of elevated danger.

- Down Fee: The LTV ratio straight influences the required down fee. A better LTV ratio requires a smaller down fee, whereas a decrease LTV ratio necessitates a bigger down fee.

- Mortgage-to-Worth Ratio and Down Fee:

- 80% LTV: This usually requires a 20% down fee.

- 90% LTV: This necessitates a ten% down fee.

- 95% LTV: This requires a 5% down fee.

- Mortgage Insurance coverage: For standard loans, debtors with LTV ratios above 80% are usually required to buy non-public mortgage insurance coverage (PMI). PMI protects the lender in case of a default and is normally paid month-to-month as a part of your mortgage fee.

- Mortgage Availability: Lenders could also be extra more likely to approve loans with decrease LTV ratios, as they understand them as much less dangerous.

- Closing Prices: Closing prices can fluctuate relying on the LTV ratio, as some prices are calculated based mostly on the mortgage quantity.

Methods to Enhance Your LTV Ratio

Whereas your LTV ratio is primarily decided by your down fee and the property’s worth, there are methods you may make use of to enhance it over time:

- Enhance Your Down Fee: A bigger down fee will mechanically decrease your LTV ratio, making your mortgage extra enticing to lenders.

- Appreciation of Property Worth: If the worth of your own home appreciates over time, your LTV ratio will naturally lower.

- Make Further Principal Funds: Paying additional in direction of your principal quantity may also help cut back your mortgage stability and decrease your LTV ratio.

- Refinance Your Mortgage: Refinancing your mortgage can doubtlessly decrease your LTV ratio in case you can safe a decrease rate of interest or cut back your mortgage quantity.

- House Fairness Mortgage or Line of Credit score: Taking out a house fairness mortgage or line of credit score can present further funds, but it surely additionally will increase your general debt and doubtlessly your LTV ratio.

Navigating the LTV Ratio: Key Issues

- Understanding Your Monetary Scenario: Assess your monetary state of affairs actually and decide how a lot of a down fee you may afford.

- Store Round for Lenders: Evaluate presents from a number of lenders to search out the perfect rates of interest and phrases based mostly in your LTV ratio.

- Contemplate the Lengthy-Time period Prices: Whereas a decrease LTV ratio could result in decrease rates of interest initially, it additionally requires a bigger down fee. Weigh the long-term prices and advantages of various LTV ratios.

- Seek the advice of a Monetary Advisor: A monetary advisor can present personalised steering on managing your LTV ratio and making knowledgeable mortgage choices.

The Backside Line:

The Mortgage-to-Worth (LTV) ratio is a strong software that may affect your mortgage phrases considerably. Understanding its impression and the way it works may also help you safe the very best mortgage and make knowledgeable monetary choices. By strategically managing your LTV ratio, you may doubtlessly unlock decrease rates of interest, lowered closing prices, and elevated mortgage availability, finally setting your self up for long-term monetary success in your homeownership journey.

Key phrases:

Mortgage-to-Worth Ratio (LTV), Mortgage Phrases, Curiosity Charges, Down Fee, Mortgage Insurance coverage, PMI, House Fairness, Mortgage Approval, Refinancing, Monetary Advisor, Homeownership, Actual Property, Property Worth, Mortgage Mortgage, Debt, Fairness, Monetary Selections, Monetary Planning, Monetary Literacy, Mortgage Calculator, Mortgage Charges, Mortgage Pre-Approval, House Shopping for Information, Actual Property Market, Housing Market, Homeownership Prices, Monetary Duty.

website positioning Optimization:

This text is optimized for website positioning by incorporating related key phrases all through the content material, together with each high-volume and long-tail key phrases. It additionally features a clear and concise construction, making it straightforward for engines like google to know the content material. The article can be written in a conversational tone, making it partaking and informative for readers.

Further Content material:

- LTV Ratio Calculator: Embrace an interactive LTV ratio calculator in your web site to permit customers to calculate their LTV ratio and discover totally different situations.

- Mortgage Comparability Device: Present a software that enables customers to match mortgage presents from totally different lenders based mostly on their LTV ratio and different elements.

- Weblog Posts: Create weblog posts on particular subjects associated to LTV ratios, equivalent to "The best way to Enhance Your LTV Ratio," "LTV Ratio and Refinancing," or "The Affect of LTV on Closing Prices."

- Infographics: Develop visually interesting infographics that specify the LTV ratio and its impression on mortgage phrases.

- Video Tutorials: Create quick video tutorials that present step-by-step steering on understanding and managing LTV ratios.

By incorporating these methods, you may create a complete and informative useful resource that draws a wider viewers and helps customers make knowledgeable choices about their mortgage financing.

Closure

Thanks for studying! Stick with us for extra insights on Decoding the Mortgage-to-Worth Ratio: How It Impacts Your Mortgage Phrases.

Be sure to observe us for extra thrilling information and evaluations.

We’d love to listen to your ideas about Decoding the Mortgage-to-Worth Ratio: How It Impacts Your Mortgage Phrases—go away your feedback beneath!

Preserve visiting our web site for the most recent tendencies and evaluations.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…