Discovering the Proper Match: Finest House Mortgage Packages for Low-Revenue Households

Associated Articles

- Understanding the Tax Advantages of Utilizing Loans for Dwelling Enhancements

- Unlocking The Door To Homeownership: A Complete Information To Qualifying For A First-Time Homebuyer Mortgage

Introduction

On this article, we dive into Discovering the Proper Match: Finest House Mortgage Packages for Low-Revenue Households, providing you with a full overview of what’s to return

Video about Discovering the Proper Match: Finest House Mortgage Packages for Low-Revenue Households

Discovering the Proper Match: Finest House Mortgage Packages for Low-Revenue Households

The dream of homeownership is inside attain for a lot of, however for low-income households, navigating the advanced world of mortgages can really feel daunting. Fortunately, varied government-backed and personal mortgage applications are designed to assist make homeownership a actuality for these with restricted monetary assets.

This complete information will discover the most effective dwelling mortgage applications for low-income households, offering insights into eligibility necessities, advantages, and potential pitfalls to be careful for. By understanding these applications, you may empower your self to make knowledgeable choices and embark on the thrilling journey in direction of homeownership.

Understanding the Challenges of Low-Revenue Homebuyers

Low-income households typically face distinctive challenges when pursuing homeownership:

- Restricted Financial savings: Constructing a considerable down fee could be a important hurdle, as saving cash may be difficult with restricted earnings.

- Credit score Rating Constraints: A decrease credit score rating can restrict entry to conventional mortgage loans, typically leading to larger rates of interest.

- Monetary Instability: Job insecurity, fluctuating earnings, or surprising bills could make it tough to qualify for a mortgage and handle month-to-month mortgage funds.

Authorities-Backed Packages: Your Path to Homeownership

Happily, government-backed applications present essential assist for low-income households searching for to buy a house:

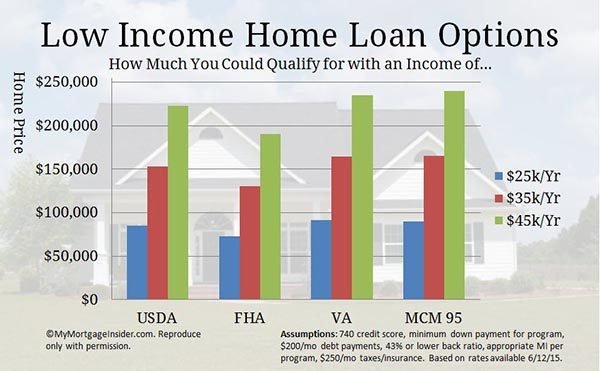

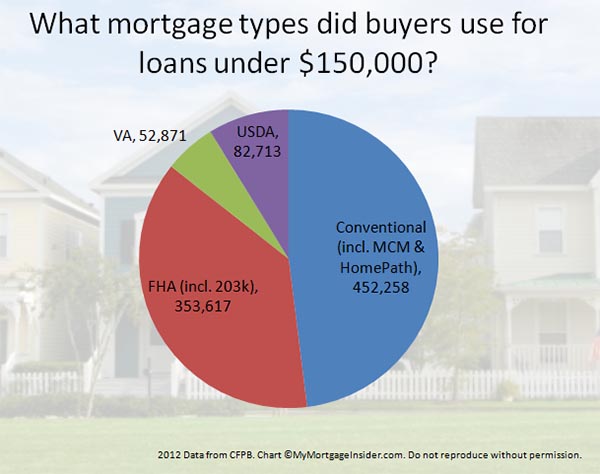

1. FHA Loans (Federal Housing Administration)

- Key Options: FHA loans are insured by the Federal Housing Administration, permitting lenders to supply extra favorable phrases to debtors with decrease credit score scores and down funds.

- Advantages:

- Decrease Down Fee: FHA loans require a minimal down fee of three.5%, making homeownership extra accessible.

- Versatile Credit score Necessities: FHA loans are extra lenient with credit score scores, opening doorways for these with decrease scores.

- Decrease Closing Prices: FHA loans typically have decrease closing prices in comparison with typical loans.

- Eligibility:

- Credit score Rating: A minimal credit score rating of 580 is mostly required for a 3.5% down fee.

- Debt-to-Revenue Ratio (DTI): FHA loans permit for the next DTI than typical loans, making it simpler for debtors with current debt to qualify.

- Revenue Limits: There are not any particular earnings limits for FHA loans, however the mortgage quantity is capped based mostly on the world’s median dwelling worth.

- Potential Pitfalls:

- Mortgage Insurance coverage Premium: FHA loans require mortgage insurance coverage premiums (MIP) for the lifetime of the mortgage, which may add to the general price.

- Stricter Appraisal Necessities: FHA loans have stricter appraisal necessities, which may generally result in delays or issues.

2. USDA Loans (United States Division of Agriculture)

- Key Options: USDA loans are designed to advertise homeownership in rural areas, providing reasonably priced financing choices to eligible debtors.

- Advantages:

- Zero Down Fee: USDA loans typically require no down fee, making homeownership a actuality for these with restricted financial savings.

- Low Curiosity Charges: USDA loans typically have decrease rates of interest in comparison with different mortgage choices.

- No Mortgage Insurance coverage: USDA loans don’t require mortgage insurance coverage, saving debtors important prices.

- Eligibility:

- Location: USDA loans can be found in eligible rural areas throughout the nation.

- Revenue Limits: There are earnings limits based mostly on the placement and household measurement.

- Credit score Rating: A minimal credit score rating of 640 is usually required.

- Potential Pitfalls:

- Restricted Availability: USDA loans are solely obtainable in particular rural areas.

- Property Restrictions: USDA loans have restrictions on the kind of property that may be bought, resembling measurement and age.

3. VA Loans (Division of Veterans Affairs)

- Key Options: VA loans are solely obtainable to eligible veterans, active-duty navy personnel, and surviving spouses.

- Advantages:

- No Down Fee: VA loans sometimes require no down fee, making homeownership extra accessible.

- Aggressive Curiosity Charges: VA loans typically have aggressive rates of interest in comparison with different mortgage choices.

- No Mortgage Insurance coverage: VA loans don’t require mortgage insurance coverage, saving debtors important prices.

- Eligibility:

- Navy Service: Debtors should meet particular navy service necessities.

- Credit score Rating: A minimal credit score rating of 620 is mostly required.

- Debt-to-Revenue Ratio (DTI): VA loans permit for the next DTI than typical loans.

- Potential Pitfalls:

- Funding Charge: VA loans sometimes require a funding payment, which may add to the general price.

- Property Restrictions: VA loans have restrictions on the kind of property that may be bought, resembling age and situation.

4. State and Native Packages

Many states and native communities provide applications particularly tailor-made to help low-income households with homeownership:

- Down Fee Help: These applications present grants or loans to assist cowl the down fee, lowering the monetary burden on debtors.

- First-Time Homebuyer Packages: These applications provide varied advantages, resembling decreased rates of interest, closing price help, or counseling companies.

- Mortgage Credit score Certificates (MCCs): MCCs present a tax credit score for a portion of the mortgage curiosity paid, leading to important tax financial savings.

Personal Mortgage Choices: Exploring Various Routes

Whereas government-backed applications provide invaluable assist, personal lenders additionally provide mortgage choices for low-income households:

1. Group Growth Monetary Establishments (CDFIs)

- Key Options: CDFIs are non-profit organizations that present monetary companies to underserved communities, together with low-income households.

- Advantages:

- Versatile Mortgage Phrases: CDFIs typically provide extra versatile mortgage phrases, together with decrease rates of interest and longer compensation durations.

- Monetary Counseling: Many CDFIs present monetary counseling companies to assist debtors perceive their choices and navigate the homebuying course of.

- Eligibility:

- Revenue Limits: CDFIs sometimes have earnings limits for debtors.

- Credit score Rating: CDFIs are extra lenient with credit score scores than conventional lenders.

- Potential Pitfalls:

- Restricted Availability: CDFIs might have restricted assets and might not be obtainable in all areas.

- Greater Curiosity Charges: Whereas CDFIs typically provide decrease rates of interest than conventional lenders, they could nonetheless be larger than government-backed mortgage applications.

2. Homebuyer Schooling Packages

- Key Options: Homebuyer teaching programs present coaching and assets to assist people perceive the homebuying course of and put together for homeownership.

- Advantages:

- Monetary Literacy: These applications educate important monetary ideas, resembling budgeting, credit score administration, and saving.

- Mortgage Understanding: Homebuyer teaching programs present insights into completely different mortgage choices, closing prices, and different points of homeownership.

- Entry to Sources: These applications join members with assets resembling lenders, actual property brokers, and residential inspectors.

- Eligibility:

- Typically Open to All: Homebuyer teaching programs are sometimes open to all people, no matter earnings stage.

- Potential Pitfalls:

- Restricted Scope: Homebuyer teaching programs might not present direct monetary help, however reasonably concentrate on training and steering.

Navigating the Course of: Key Ideas for Success

- Enhance Your Credit score Rating: The next credit score rating can considerably enhance your mortgage choices and rates of interest.

- Save for a Down Fee: Even with low down fee applications, having some financial savings demonstrates your monetary accountability.

- Store Round for Lenders: Evaluate charges and phrases from completely different lenders to seek out the most effective deal.

- Search Monetary Counseling: A monetary counselor can present steering and assist all through the homebuying course of.

- Perceive Your Funds: Calculate your month-to-month bills and guarantee you may comfortably afford the mortgage funds.

- Get Pre-Accepted for a Mortgage: Pre-approval demonstrates your monetary readiness and helps you perceive your borrowing energy.

- Be Ready for Closing Prices: Closing prices can add up, so issue them into your finances.

Conclusion: Constructing a Basis for the Future

Proudly owning a house is a major milestone, providing stability, satisfaction, and a basis for the longer term. For low-income households, government-backed applications and personal mortgage choices present very important assist, making homeownership a tangible aim. By understanding the assorted applications, rigorously assessing your monetary scenario, and searching for steering from professionals, you may navigate the homebuying course of with confidence and construct a brighter future for your self and your loved ones.

Closure

Thanks for studying! Stick with us for extra insights on Discovering the Proper Match: Finest House Mortgage Packages for Low-Revenue Households.

Ensure that to observe us for extra thrilling information and critiques.

Be happy to share your expertise with Discovering the Proper Match: Finest House Mortgage Packages for Low-Revenue Households within the remark part.

Preserve visiting our web site for the most recent developments and critiques.