Does Legal responsibility Insurance coverage Cowl Authorized Charges? Unraveling the Complexities

Associated Articles

- Do You Want Legal responsibility Insurance coverage For Your Dwelling-Based mostly Enterprise? Navigating The Dangers And Defending Your Future

- Navigating The Patchwork: Basic Legal responsibility Insurance coverage Necessities By State In 2024

- How to Choose the Right Insurance for Your Home-Based Craft Business

- The Position of Insurance coverage in Defending Your Digital Advertising and marketing Enterprise

- Understanding The Fundamentals Of Common Legal responsibility Insurance coverage: Your Protect In opposition to The Sudden

Introduction

Welcome to our in-depth have a look at Does Legal responsibility Insurance coverage Cowl Authorized Charges? Unraveling the Complexities

Video about Does Legal responsibility Insurance coverage Cowl Authorized Charges? Unraveling the Complexities

Does Legal responsibility Insurance coverage Cowl Authorized Charges? Unraveling the Complexities

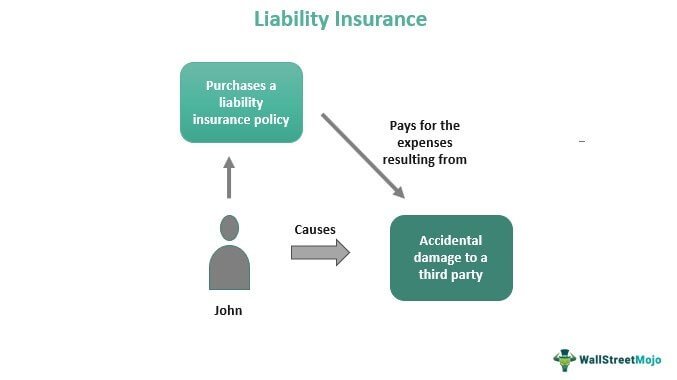

Legal responsibility insurance coverage is a vital element of danger administration for people and companies alike. It supplies monetary safety in opposition to potential lawsuits arising from negligence or different wrongful acts. Nevertheless, a typical query arises: does legal responsibility insurance coverage cowl authorized charges? The reply, like many issues on this planet of insurance coverage, shouldn’t be a easy sure or no.

This text will delve deep into the advanced world of authorized charges and legal responsibility insurance coverage, exploring the varied eventualities the place protection applies and when it would not. We’ll look at various kinds of legal responsibility insurance coverage, analyze particular conditions, and supply sensible ideas for navigating the authorized panorama with confidence.

Understanding the Fundamentals: Legal responsibility Insurance coverage and Authorized Charges

Earlier than we dive into the complexities, let’s first perceive the basics. Legal responsibility insurance coverage, in essence, acts as a protect in opposition to monetary losses stemming from authorized claims. When a coated incident happens, the insurance coverage firm steps in to:

- Pay damages: This covers the prices of accidents, property injury, or different monetary losses suffered by the claimant.

- Present authorized protection: This contains the price of hiring legal professionals to defend the insured in opposition to the declare.

Now, the query of authorized charges arises. Does legal responsibility insurance coverage cowl the price of authorized illustration for the insured? The reply is typically sure, however with essential caveats.

Sorts of Legal responsibility Insurance coverage and Authorized Charge Protection

.png/690aeaf3-b1a6-df76-ef4a-aa219024e6e4?imagePreview=1)

To know the nuances of authorized price protection, we have to perceive the various kinds of legal responsibility insurance coverage:

- Basic Legal responsibility Insurance coverage: It is a broad coverage overlaying a variety of potential liabilities, together with bodily damage, property injury, and private damage. Most normal legal responsibility insurance policies embrace authorized protection prices as a part of their protection. This implies your insurer can pay for the authorized illustration required to struggle the declare in opposition to you.

- Skilled Legal responsibility Insurance coverage (Errors and Omissions): This coverage particularly protects professionals like medical doctors, legal professionals, accountants, and consultants in opposition to claims arising from skilled negligence or errors. E&O insurance policies sometimes embrace authorized protection prices as a part of the protection.

- Product Legal responsibility Insurance coverage: This coverage covers companies that manufacture, distribute, or promote merchandise in opposition to claims associated to product defects. Product legal responsibility insurance policies often embrace authorized protection prices as a part of their protection.

- Auto Legal responsibility Insurance coverage: This coverage covers drivers in opposition to claims arising from automobile accidents. Auto legal responsibility insurance policies sometimes embrace authorized protection prices as a part of the protection.

Essential Issues: Protection Limits and Exclusions

Whereas legal responsibility insurance coverage typically covers authorized protection prices, there are essential issues to remember:

- Coverage Limits: Each legal responsibility insurance coverage coverage has a selected restrict for authorized protection prices. This implies there is a most quantity the insurer can pay for authorized charges. As soon as this restrict is reached, the insured could also be chargeable for overlaying any further authorized bills.

- Exclusions: All legal responsibility insurance coverage insurance policies have particular exclusions, that are conditions or occasions not coated by the coverage. It is essential to assessment your coverage fastidiously to grasp what’s and is not coated. For example, some insurance policies could exclude authorized charges associated to claims arising from intentional acts, legal exercise, or sure varieties of enterprise operations.

- Responsibility to Defend: Most legal responsibility insurance coverage insurance policies embrace a "obligation to defend" clause. This implies the insurer is obligated to defend the insured in opposition to any coated declare, even when the declare is finally discovered to be baseless or with out benefit. This obligation to defend applies no matter whether or not the declare is probably going to achieve success.

Particular Situations: When Authorized Charges Might or Might Not Be Coated

For example the complexities of authorized price protection, let’s look at just a few particular eventualities:

Situation 1: A Slip and Fall Accident

A buyer slips and falls in your retailer, injuring themselves. You have got normal legal responsibility insurance coverage.

- Protection: Your normal legal responsibility insurance coverage coverage will seemingly cowl the authorized protection prices related to this declare. The insurer can pay for the lawyer to symbolize you in courtroom.

- Essential Issues: The coverage limits and exclusions will apply. If the authorized charges exceed the coverage restrict, it’s possible you’ll be chargeable for the distinction. The coverage may also exclude protection for claims arising from particular circumstances, reminiscent of intentional negligence.

Situation 2: Medical Malpractice Declare

A affected person claims that a health care provider’s negligence brought about an damage. The physician has skilled legal responsibility insurance coverage.

- Protection: The physician’s skilled legal responsibility (E&O) coverage will seemingly cowl the authorized protection prices related to this declare. The insurer can pay for the lawyer to symbolize the physician in courtroom.

- Essential Issues: The coverage limits and exclusions will apply. The coverage may exclude protection for claims arising from sure medical procedures, intentional misconduct, or particular varieties of negligence.

Situation 3: Faulty Product Declare

A shopper claims {that a} product manufactured by an organization brought about them damage. The corporate has product legal responsibility insurance coverage.

- Protection: The product legal responsibility insurance coverage coverage will seemingly cowl the authorized protection prices related to this declare. The insurer can pay for the lawyer to symbolize the corporate in courtroom.

- Essential Issues: The coverage limits and exclusions will apply. The coverage may exclude protection for claims arising from particular product sorts, intentional design flaws, or sure varieties of manufacturing defects.

Situation 4: Automotive Accident with a Declare of Negligence

A driver is concerned in a automobile accident and is accused of negligence. The motive force has auto legal responsibility insurance coverage.

- Protection: The auto legal responsibility insurance coverage coverage will seemingly cowl the authorized protection prices related to this declare. The insurer can pay for the lawyer to symbolize the driving force in courtroom.

- Essential Issues: The coverage limits and exclusions will apply. The coverage may exclude protection for claims arising from particular varieties of accidents, driving underneath the affect, or intentional acts.

Suggestions for Navigating Authorized Charges and Legal responsibility Insurance coverage

Understanding the intricacies of authorized price protection and legal responsibility insurance coverage is important for navigating authorized challenges with confidence. Listed here are some sensible ideas:

- Learn Your Coverage Fastidiously: Take the time to fastidiously assessment your legal responsibility insurance coverage coverage. Pay shut consideration to the protection limits, exclusions, and the obligation to defend clause.

- Seek the advice of with an Insurance coverage Skilled: In case you have any questions on your coverage or particular eventualities, seek the advice of with an insurance coverage skilled. They will present knowledgeable steerage and assist you to perceive your protection.

- Maintain Detailed Data: Keep correct information of all related paperwork, together with your insurance coverage coverage, correspondence along with your insurer, and any authorized paperwork associated to a declare.

- Search Authorized Recommendation: In case you are going through a authorized declare, it is important to seek the advice of with an skilled legal professional. A lawyer can advise you in your rights and obligations and information you thru the authorized course of.

Conclusion: Navigating the Complexities with Confidence

Legal responsibility insurance coverage performs an important function in defending people and companies from monetary damage within the face of authorized claims. Whereas authorized protection prices are typically coated, it is necessary to grasp the constraints, exclusions, and particular eventualities that will affect protection. By fastidiously reviewing your coverage, consulting with professionals, and looking for authorized recommendation when vital, you’ll be able to navigate the complexities of authorized charges and legal responsibility insurance coverage with confidence. Keep in mind, data is energy, and understanding your protection is essential to making sure satisfactory safety within the occasion of a authorized declare.

Closure

We hope this text has helped you perceive all the pieces about Does Legal responsibility Insurance coverage Cowl Authorized Charges? Unraveling the Complexities. Keep tuned for extra updates!

Be certain that to observe us for extra thrilling information and critiques.

Be at liberty to share your expertise with Does Legal responsibility Insurance coverage Cowl Authorized Charges? Unraveling the Complexities within the remark part.

Keep knowledgeable with our subsequent updates on Does Legal responsibility Insurance coverage Cowl Authorized Charges? Unraveling the Complexities and different thrilling subjects.