Evaluating New Vs. Used Automotive Loans: Which Is Higher?

Evaluating New vs. Used Automotive Loans: Which is Higher?

Associated Articles

- Complete Information to Auto Insurance coverage Quotes: Save Cash and Get the Finest Protection

- Auto Loans For First-Time Consumers: Your Information To Getting On The Street

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

- High 10 Ideas For Getting Permitted For An Auto Mortgage In 2024: Drive Away With Confidence

- Greatest Auto Loans With Low Credit score: A Complete Information To Discovering The Excellent Trip

Introduction

Uncover the most recent particulars about Evaluating New vs. Used Automotive Loans: Which is Higher? on this complete information.

Video about

New vs. Used Automotive Loans: Which is Higher for You?

Shopping for a automobile is a big funding, and selecting between a brand new and used automobile mortgage is an important determination. Each choices have their execs and cons, and the only option will depend on your particular person monetary scenario, driving wants, and danger tolerance. This complete information will assist you to navigate the complexities of latest and used automobile loans, empowering you to make an knowledgeable determination that aligns together with your targets.

New Automotive Loans: The Attract of the Model New

New automobiles provide the most recent expertise, security options, and magnificence, interesting to these looking for a contemporary begin and a way of possession. Nevertheless, the value tag for a brand new automobile may be considerably increased than a comparable used mannequin, resulting in bigger mortgage quantities and probably longer compensation phrases.

Professionals of New Automotive Loans:

- Guarantee: New automobiles include a producer’s guarantee, providing peace of thoughts understanding that any defects or malfunctions might be lined for a selected interval.

- Newest Options: New automobiles boast the most recent technological developments, together with superior security options, infotainment programs, and driver help applied sciences.

- Customization: You’ll be able to personalize your new automobile with particular colours, trims, and choices, making a car that completely fits your preferences.

- Reliability: New automobiles are usually extra dependable than used automobiles, as they have not amassed put on and tear.

- Depreciation: Whereas all automobiles depreciate, new automobiles expertise probably the most vital depreciation within the first few years. Nevertheless, this preliminary depreciation is usually offset by the guarantee and the worth of the most recent options.

Cons of New Automotive Loans:

- Larger Value: New automobiles are considerably dearer than used automobiles, resulting in bigger mortgage quantities and probably increased month-to-month funds.

- Larger Curiosity Charges: Mortgage suppliers usually provide decrease rates of interest on used automobile loans in comparison with new automobile loans, because of the decrease danger related to used automobiles.

- Depreciation: New automobiles depreciate quickly within the first few years, that means their worth decreases shortly.

- Insurance coverage Prices: Insurance coverage premiums for brand spanking new automobiles are usually increased than for used automobiles.

Used Automotive Loans: Worth for Cash

Used automobiles provide a extra inexpensive choice for these looking for a dependable car with out breaking the financial institution. The cheaper price tag interprets to smaller mortgage quantities and probably decrease month-to-month funds, making them a extra budget-friendly alternative.

Professionals of Used Automotive Loans:

- Decrease Value: Used automobiles are considerably cheaper than new automobiles, permitting for smaller mortgage quantities and probably decrease month-to-month funds.

- Decrease Curiosity Charges: Mortgage suppliers usually provide decrease rates of interest on used automobile loans in comparison with new automobile loans, because of the decrease danger related to used automobiles.

- Slower Depreciation: Used automobiles have already skilled probably the most vital depreciation, so their worth declines extra slowly in comparison with new automobiles.

- Potential for Negotiation: You will have extra room to barter the value of a used automobile in comparison with a brand new automobile.

Cons of Used Automotive Loans:

- No Guarantee: Used automobiles usually include a restricted guarantee, if any, which may go away you chargeable for restore prices.

- Unknown Historical past: You might not know the complete historical past of a used automobile, together with its upkeep file and former accidents.

- Potential for Repairs: Used automobiles have already amassed put on and tear, rising the chance of needing repairs sooner or later.

- Restricted Options: Used automobiles might not have the most recent expertise or security options present in new automobiles.

Components to Think about When Selecting Between New and Used Automotive Loans:

- Finances: Think about your total monetary scenario and the way a lot you’ll be able to afford to spend on a automobile mortgage.

- Driving Wants: Take into consideration your every day commute, household measurement, and life-style to find out the kind of car that most closely fits your wants.

- Threat Tolerance: Are you comfy taking up the chance of potential repairs with a used automobile, or do you favor the peace of thoughts of a brand new automobile guarantee?

- Analysis: Totally analysis totally different automobile fashions, evaluate costs, and discover mortgage choices from numerous lenders.

- Credit score Rating: Your credit score rating will influence your mortgage rate of interest, so be sure to have a superb credit score rating earlier than making use of for a automobile mortgage.

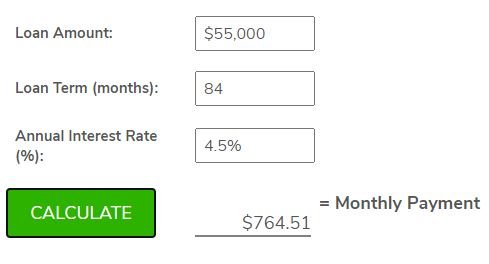

- Mortgage Time period: Think about the size of your mortgage time period, as longer phrases can lead to decrease month-to-month funds however increased total curiosity prices.

- Down Fee: A bigger down cost can scale back your mortgage quantity and probably decrease your month-to-month funds.

Navigating the Mortgage Utility Course of:

As soon as you’ve got selected a automobile, whether or not new or used, it is time to safe financing. Here is a step-by-step information to navigate the mortgage software course of:

- Pre-Approval: Getting pre-approved for a automobile mortgage earlier than you begin purchasing can provide you a transparent understanding of your borrowing energy and assist you to negotiate a greater worth.

- Evaluate Mortgage Gives: Store round for mortgage provides from totally different lenders, evaluating rates of interest, phrases, and charges.

- Negotiate the Mortgage Phrases: Do not be afraid to barter the rate of interest and different mortgage phrases with the lender.

- Overview the Mortgage Settlement: Fastidiously learn the mortgage settlement earlier than signing it, ensuring you perceive all of the phrases and situations.

Ideas for Saving Cash on Automotive Loans:

- Enhance Your Credit score Rating: A better credit score rating can qualify you for decrease rates of interest, saving you cash in the long term.

- Store Round for Mortgage Gives: Evaluate mortgage provides from a number of lenders to search out the very best charges and phrases.

- Negotiate the Curiosity Charge: Do not be afraid to barter the rate of interest with the lender.

- Think about a Shorter Mortgage Time period: A shorter mortgage time period can lead to increased month-to-month funds however decrease total curiosity prices.

- Make Further Funds: Making additional funds in your mortgage will help you pay it off sooner and save on curiosity fees.

Conclusion: The Proper Selection for You

In the end, the choice of whether or not to decide on a brand new or used automobile mortgage will depend on your particular person circumstances and priorities. New automobiles provide the most recent options and a guaranty, whereas used automobiles present a extra inexpensive choice with probably decrease rates of interest. By fastidiously contemplating your funds, driving wants, and danger tolerance, you may make an knowledgeable determination that results in a satisfying and financially sound automobile possession expertise.

Bear in mind, it is not simply in regards to the preliminary buy worth; take into account the long-term prices of possession, together with upkeep, repairs, and insurance coverage. By taking the time to analysis and evaluate choices, yow will discover the very best automobile mortgage on your particular wants and benefit from the freedom of the open highway.

Closure

We hope this text has helped you perceive every thing about Evaluating New vs. Used Automotive Loans: Which is Higher?. Keep tuned for extra updates!

Make certain to comply with us for extra thrilling information and opinions.

We’d love to listen to your ideas about Evaluating New vs. Used Automotive Loans: Which is Higher?—go away your feedback beneath!

Hold visiting our web site for the most recent tendencies and opinions.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…