FHA Vs Typical Loans: Professionals And Cons Defined

FHA vs Typical Loans: Professionals and Cons Defined

Associated Articles

- High 5 On-line Auto Mortgage Lenders To Take into account This Yr: Your Information To Inexpensive Financing

- Complete Information to Auto Insurance coverage Quotes: Save Cash and Get the Finest Protection

- Understanding Jumbo Mortgages: Is It Proper For You?

- Get Out Of Debt Sooner: Your Final Information To Paying Off Your Auto Mortgage Early

- Slash Your Automotive Fee: A Information To Decreasing Your Auto Mortgage Prices

Introduction

Welcome to our in-depth have a look at FHA vs Typical Loans: Professionals and Cons Defined

Video about

FHA vs. Typical Loans: Which is Proper for You?

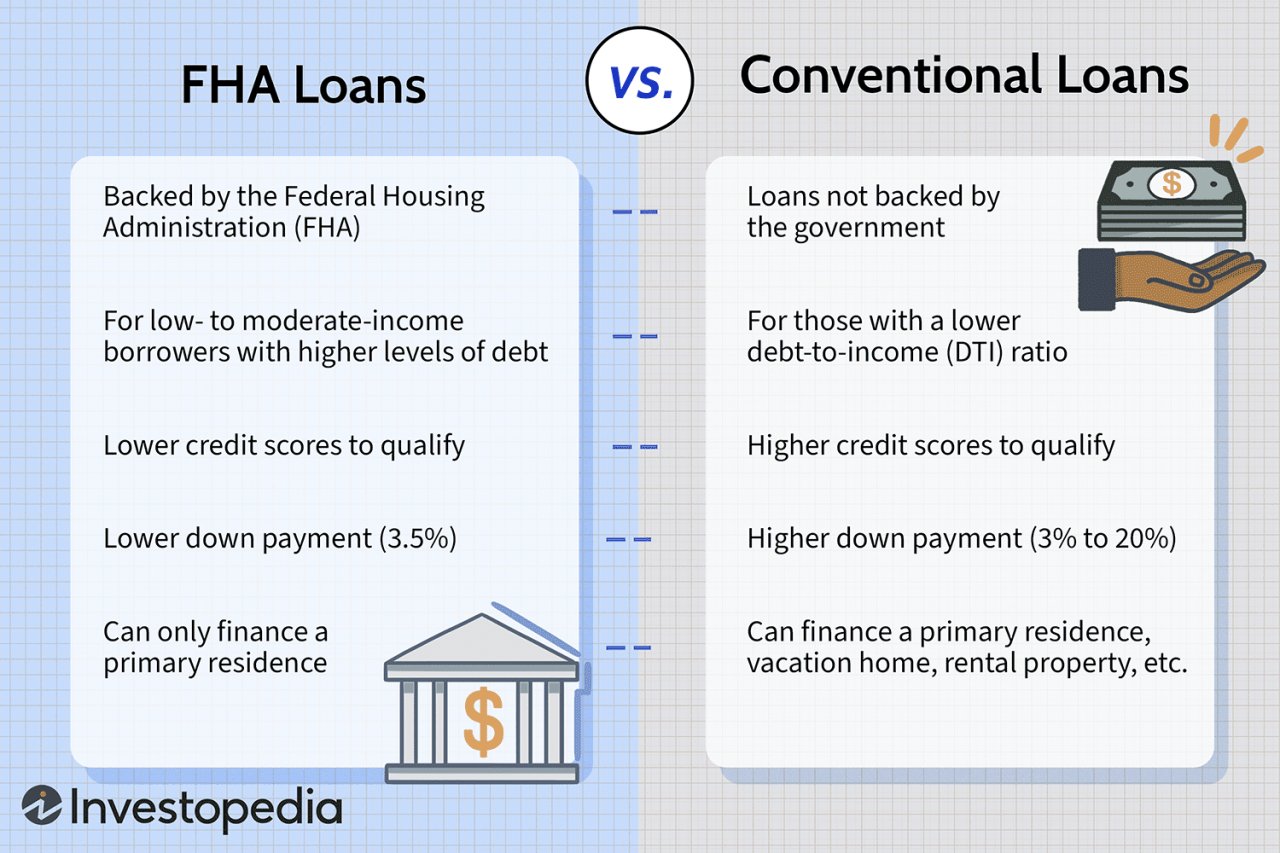

Shopping for a house is a major milestone in life, and securing a mortgage is an important step within the course of. Two widespread mortgage choices stand out: FHA loans and traditional loans. Understanding their variations and weighing the professionals and cons of every may also help you make an knowledgeable choice that aligns together with your monetary state of affairs and objectives.

What’s an FHA Mortgage?

FHA loans, backed by the Federal Housing Administration (FHA), are designed to make homeownership extra accessible to debtors with decrease credit score scores and down funds. These loans provide flexibility and advantages that appeal to first-time homebuyers and people with restricted monetary sources.

What’s a Typical Mortgage?

Typical loans, supplied by personal lenders like banks and mortgage corporations, aren’t backed by the federal government. They sometimes require stronger credit score scores and bigger down funds, however they usually include decrease rates of interest and versatile phrases.

Key Variations: A Head-to-Head Comparability

1. Credit score Rating Necessities:

- FHA Loans: FHA loans are extra forgiving with regards to credit score scores, sometimes requiring a minimal rating of 580 for the most effective charges. Debtors with scores between 500 and 579 should qualify, however they will want a bigger down cost.

- Typical Loans: Typical loans typically require larger credit score scores, sometimes 620 or above for the most effective charges. Some lenders might settle for scores as little as 580, however they will doubtless cost larger rates of interest.

2. Down Fee Necessities:

- FHA Loans: FHA loans provide a decrease down cost requirement, beginning at simply 3.5% of the acquisition worth. This generally is a main benefit for debtors with restricted financial savings.

- Typical Loans: Typical loans sometimes require a better down cost, starting from 3% to twenty% relying on the mortgage kind and lender.

3. Mortgage Limits:

- FHA Loans: FHA loans have mortgage limits that modify by county, reflecting the price of residing in numerous areas. These limits are typically decrease than standard mortgage limits.

- Typical Loans: Typical loans have larger mortgage limits, permitting debtors to finance bigger mortgages.

4. Mortgage Insurance coverage:

- FHA Loans: FHA loans require mortgage insurance coverage premiums (MIP) all through the lifetime of the mortgage. MIP protects the lender in opposition to potential losses if the borrower defaults on the mortgage.

- Typical Loans: Typical loans might require mortgage insurance coverage if the down cost is lower than 20%. Nonetheless, debtors can usually remove mortgage insurance coverage as soon as their loan-to-value ratio (LTV) reaches 80%.

5. Closing Prices:

- FHA Loans: FHA loans sometimes have larger closing prices than standard loans. These prices might embrace origination charges, appraisal charges, and different bills.

- Typical Loans: Typical loans typically have decrease closing prices than FHA loans, however they will nonetheless range relying on the lender and particular mortgage phrases.

6. Eligibility Necessities:

- FHA Loans: FHA loans have much less stringent eligibility necessities than standard loans. They’re extra accessible to debtors with decrease credit score scores, restricted revenue, and up to date credit score challenges.

- Typical Loans: Typical loans have stricter eligibility necessities, sometimes specializing in credit score historical past, debt-to-income ratio, and employment stability.

Professionals and Cons of FHA Loans

Professionals:

- Decrease Down Fee: Probably the most important benefit of FHA loans is the low down cost requirement, usually simply 3.5% of the acquisition worth. This makes homeownership extra attainable for debtors with restricted financial savings.

- Extra Versatile Credit score Rating Necessities: FHA loans are extra forgiving with regards to credit score scores, permitting debtors with decrease scores to qualify for a mortgage.

- Simpler Qualification: FHA loans have much less stringent eligibility necessities, making them accessible to a wider vary of debtors.

- Decrease Month-to-month Funds: With a decrease down cost and probably larger rates of interest, FHA loans can provide decrease month-to-month funds in comparison with standard loans.

Cons:

- Mortgage Insurance coverage Premiums: FHA loans require mortgage insurance coverage premiums (MIP) all through the lifetime of the mortgage, including to the general value of borrowing.

- Greater Curiosity Charges: FHA loans usually include barely larger rates of interest than standard loans, growing the entire value of borrowing over time.

- Mortgage Limits: FHA loans have decrease mortgage limits than standard loans, which might limit the acquisition worth of properties in high-cost areas.

- Stricter Appraisal Necessities: FHA loans have stricter appraisal necessities, which might typically result in delays within the closing course of.

Professionals and Cons of Typical Loans

Professionals:

- Decrease Curiosity Charges: Typical loans sometimes provide decrease rates of interest than FHA loans, leading to decrease month-to-month funds and fewer general curiosity paid over the lifetime of the mortgage.

- No Mortgage Insurance coverage (with 20% Down Fee): Typical loans with a 20% down cost do not require mortgage insurance coverage, saving debtors important prices over the lifetime of the mortgage.

- Greater Mortgage Limits: Typical loans have larger mortgage limits, permitting debtors to finance bigger mortgages and buy dearer properties.

- Extra Versatile Mortgage Choices: Typical loans provide a wider vary of mortgage choices, together with fixed-rate, adjustable-rate, and jumbo loans.

Cons:

- Greater Down Fee: Typical loans typically require a better down cost than FHA loans, usually 3% or extra.

- Stricter Credit score Rating Necessities: Typical loans sometimes require larger credit score scores than FHA loans, making them much less accessible to debtors with decrease credit score histories.

- Doubtlessly Greater Closing Prices: Whereas not at all times the case, standard loans might have larger closing prices than FHA loans, relying on the lender and particular mortgage phrases.

- Mortgage Insurance coverage (with Lower than 20% Down Fee): Typical loans with a down cost lower than 20% sometimes require mortgage insurance coverage, including to the general value of borrowing.

Selecting the Proper Mortgage: Elements to Take into account

The very best mortgage possibility for you relies on your particular person circumstances and monetary objectives. Take into account these elements when deciding between FHA and traditional loans:

- Credit score Rating: You probably have a decrease credit score rating, an FHA mortgage could also be a greater possibility because it has extra versatile credit score rating necessities.

- Down Fee: You probably have a restricted down cost, an FHA mortgage’s decrease down cost requirement could make homeownership extra accessible.

- Mortgage Quantity: In case you’re planning to buy a dearer house, a standard mortgage could also be crucial as a consequence of its larger mortgage limits.

- Curiosity Charges: In case you’re in search of the bottom attainable rates of interest, a standard mortgage could also be a more sensible choice.

- Mortgage Insurance coverage: Take into account the price of mortgage insurance coverage premiums and whether or not you’ll be able to afford to pay them over the lifetime of the mortgage.

- Mortgage Phrases: Evaluate the phrases of each FHA and traditional loans, together with rates of interest, mortgage lengths, and some other related elements.

- Monetary Targets: Take into consideration your long-term monetary objectives and the way a mortgage will match into your general monetary plan.

Suggestions for Enhancing Your Possibilities of Getting Permitted

- Construct Your Credit score Rating: Enhancing your credit score rating could make you extra aggressive for each FHA and traditional loans. Pay your payments on time, preserve your credit score utilization low, and keep away from opening too many new accounts.

- Save for a Down Fee: Intention to avoid wasting for a down cost that meets the necessities of the mortgage kind you are contemplating.

- Get Pre-Permitted for a Mortgage: Getting pre-approved for a mortgage reveals sellers that you are a severe purchaser and may also help you negotiate a greater worth.

- Store Round for Charges: Evaluate rates of interest and phrases from a number of lenders to make sure you’re getting the absolute best deal.

- Evaluation Your Mortgage Paperwork Fastidiously: Earlier than signing any mortgage paperwork, fastidiously evaluation them to grasp the phrases and situations of the mortgage.

Conclusion

Selecting between an FHA mortgage and a standard mortgage is a major choice that requires cautious consideration. By understanding the professionals and cons of every mortgage kind, you may make an knowledgeable selection that aligns together with your monetary state of affairs and objectives. Whether or not you are a first-time homebuyer or an skilled home-owner, evaluating your choices and making the suitable choice can pave the best way for a profitable homeownership journey.

Closure

We hope this text has helped you perceive every part about FHA vs Typical Loans: Professionals and Cons Defined. Keep tuned for extra updates!

Don’t neglect to examine again for the newest information and updates on FHA vs Typical Loans: Professionals and Cons Defined!

We’d love to listen to your ideas about FHA vs Typical Loans: Professionals and Cons Defined—depart your feedback beneath!

Preserve visiting our web site for the newest tendencies and evaluations.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…