Fueling Feminine Ambition: Prime 5 Enterprise Loans For Ladies Entrepreneurs

Fueling Feminine Ambition: Prime 5 Enterprise Loans for Ladies Entrepreneurs

Associated Articles

- Navigating The Path To Funding: How To Qualify For A Business Loan In 2024

- Best Online Business Loans: 2024 Edition – Your Guide To Funding Growth

- Securing The Funding You Need: Your Guide To Qualifying For A Business Loan In 2024

- Fueling Your Startup’s Development: The Greatest Enterprise Mortgage Suppliers For Aspiring Entrepreneurs

- Unlocking Progress: High 10 Enterprise Loans For Small Companies In 2023

Introduction

On this article, we dive into Fueling Feminine Ambition: Prime 5 Enterprise Loans for Ladies Entrepreneurs, supplying you with a full overview of what’s to return

Video about

Fueling Feminine Ambition: Prime 5 Enterprise Loans for Ladies Entrepreneurs

Beginning and rising a enterprise is not any straightforward feat, however for ladies entrepreneurs, the journey typically comes with an added layer of challenges. From navigating gender bias to securing funding, girls enterprise house owners face distinctive hurdles. However the excellent news is, assets and help are more and more out there to assist them thrive.

Probably the most essential facets of enterprise success is entry to capital. Whether or not you are launching your first enterprise or increasing an present one, a enterprise mortgage can present the monetary basis you want to obtain your objectives.

This text will delve into the highest 5 enterprise loans designed to empower girls entrepreneurs, equipping you with the information to decide on the fitting financing choice on your particular wants.

Understanding Your Funding Wants

Earlier than diving into the mortgage choices, it is essential to grasp your particular monetary necessities. Ask your self:

- What’s what you are promoting objective? Are you launching a brand new firm, increasing your operations, buying tools, or managing money stream?

- How a lot funding do you want? Be practical about your monetary wants and keep away from overborrowing.

- What’s your compensation timeline? Contemplate your money stream projections and select a mortgage time period that aligns together with your marketing strategy.

- What’s your credit score rating? A robust credit score rating will open doorways to higher mortgage phrases and rates of interest.

Prime 5 Enterprise Loans for Ladies Entrepreneurs

1. SBA Loans:

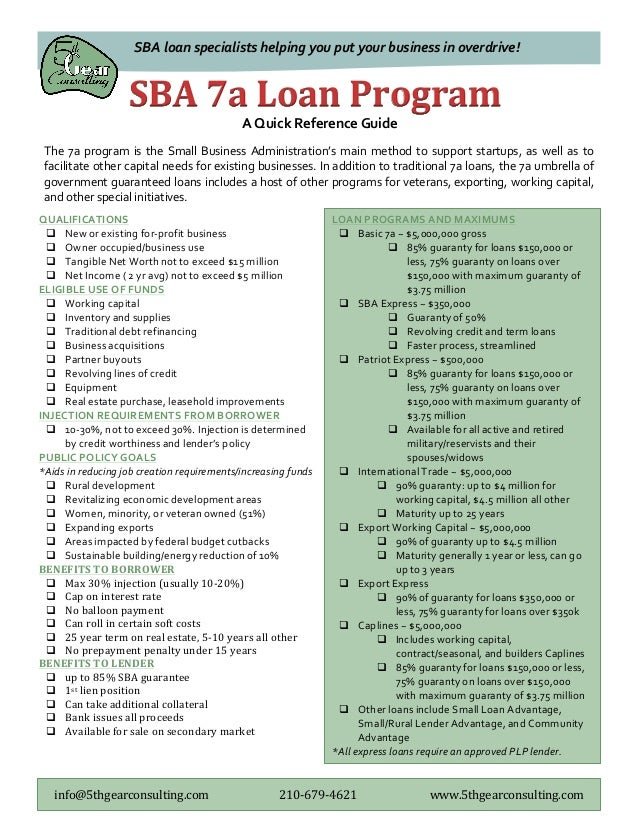

The Small Enterprise Administration (SBA) presents a spread of mortgage packages particularly designed to help small companies, together with these owned by girls. These packages are recognized for his or her favorable phrases, together with decrease rates of interest and longer compensation intervals.

Here is why SBA loans are enticing for ladies entrepreneurs:

- Decrease Curiosity Charges: SBA loans typically include decrease rates of interest than typical loans, making them extra reasonably priced.

- Longer Compensation Phrases: SBA loans supply longer compensation phrases, supplying you with extra flexibility to handle your money stream.

- Versatile Eligibility Necessities: SBA loans have extra versatile eligibility necessities than conventional financial institution loans, making them accessible to a wider vary of companies.

- Authorities Assure: The SBA ensures a portion of the mortgage, lowering the chance for lenders and doubtlessly making it simpler to safe financing.

Standard SBA mortgage packages for ladies entrepreneurs embody:

- 7(a) Mortgage Program: The preferred SBA mortgage program, providing as much as $5 million in funding for a wide range of enterprise functions.

- 504 Mortgage Program: Gives financing for mounted belongings like land, buildings, and tools.

- Microloan Program: Presents small loans of as much as $50,000 to assist startups and small companies get off the bottom.

2. Ladies-Owned Enterprise Loans:

Many monetary establishments supply specialised mortgage packages tailor-made particularly to women-owned companies. These packages typically include further help and assets, together with mentorship, networking alternatives, and enterprise improvement help.

Here is why women-owned enterprise loans are value exploring:

- Devoted Assist: These packages present entry to assets and mentorship particularly designed to help girls entrepreneurs.

- Aggressive Curiosity Charges: Many lenders supply aggressive rates of interest and versatile compensation phrases for women-owned companies.

- Simplified Software Course of: Some packages streamline the appliance course of, making it simpler to safe funding.

Standard lenders providing women-owned enterprise loans embody:

- Financial institution of America: Presents a wide range of mortgage packages and assets for ladies entrepreneurs.

- Citibank: Gives entry to enterprise loans, strains of credit score, and different monetary merchandise particularly for women-owned companies.

- Wells Fargo: Presents a spread of mortgage packages and assets, together with mentorship and enterprise improvement help.

3. On-line Enterprise Loans:

On-line lenders are revolutionizing the best way companies entry funding. These platforms supply a quick and handy strategy to safe loans, typically with minimal paperwork and fast approval occasions.

Here is why on-line enterprise loans are a well-liked selection for ladies entrepreneurs:

- Quick Approval Occasions: On-line lenders can typically approve loans inside days, offering quick entry to capital.

- Simplified Software Course of: The applying course of is often streamlined and may be accomplished on-line, eliminating the necessity for in-person conferences.

- Versatile Mortgage Choices: On-line lenders supply a wide range of mortgage choices, together with short-term loans, strains of credit score, and time period loans, catering to numerous enterprise wants.

Standard on-line lenders for ladies entrepreneurs embody:

- Lendio: A web based market that connects debtors with a number of lenders, providing a variety of mortgage choices.

- Kabbage: Gives on-line enterprise loans, strains of credit score, and different monetary merchandise to small companies.

- OnDeck: Presents on-line enterprise loans and contours of credit score, with quick funding and versatile compensation phrases.

4. Crowdfunding:

Crowdfunding has emerged as a robust different funding supply for ladies entrepreneurs. This method permits you to increase capital from numerous people, sometimes by on-line platforms.

Here is why crowdfunding is a sexy choice:

- Entry to Numerous Buyers: Crowdfunding permits you to faucet into a large pool of potential traders, together with people, angel traders, and enterprise capitalists.

- Group Constructing: Crowdfunding may also help construct pleasure and generate buzz round what you are promoting, making a group of supporters.

- Flexibility: Crowdfunding platforms supply totally different fashions, permitting you to decide on the method that most closely fits what you are promoting and fundraising objectives.

Standard crowdfunding platforms for ladies entrepreneurs embody:

- Kickstarter: A preferred platform for inventive initiatives, together with companies that supply distinctive services or products.

- Indiegogo: Presents a broader vary of crowdfunding fashions, together with fairness crowdfunding and rewards-based crowdfunding.

- Fundable: A platform particularly designed for companies, providing a spread of funding choices and assets.

5. Grants:

Grants are free cash offered by authorities companies, foundations, and different organizations to help particular initiatives or companies. Whereas securing grants may be aggressive, they could be a invaluable supply of funding for ladies entrepreneurs.

Here is why grants are value exploring:

- Free Funding: Grants are non-repayable, that means you do not have to pay them again.

- Focused Assist: Many grants are particularly designed to help girls entrepreneurs, minority-owned companies, or companies in particular industries.

- Potential for Lengthy-Time period Affect: Grants can present funding for analysis, improvement, or different initiatives that may have an enduring impression on what you are promoting.

Standard grant packages for ladies entrepreneurs embody:

- Ladies’s Enterprise Heart (WBC) Grants: WBCs supply grants and different assets to assist girls entrepreneurs begin and develop their companies.

- Small Enterprise Innovation Analysis (SBIR) Program: Gives grants to small companies for analysis and improvement initiatives.

- State and Native Grants: Many state and native governments supply grants to help small companies of their communities.

Navigating the Software Course of

Securing any kind of enterprise mortgage or grant requires cautious planning and preparation. Listed below are some key steps to navigate the appliance course of:

- Develop a Sturdy Enterprise Plan: A well-written marketing strategy is important for securing funding. It ought to define what you are promoting objectives, goal market, monetary projections, and administration staff.

- Construct a Sturdy Credit score Rating: Lenders and grant suppliers typically prioritize candidates with good credit score historical past. Take steps to enhance your credit score rating earlier than making use of for funding.

- Collect Required Documentation: Be ready to supply monetary statements, tax returns, and different documentation to help your software.

- Community and Search Mentorship: Join with different girls entrepreneurs, enterprise mentors, and trade professionals to achieve insights and help.

- Do not Be Afraid to Ask for Assist: Search steering from enterprise advisors, accountants, or monetary professionals that can assist you navigate the appliance course of and make knowledgeable selections.

Conclusion:

Entry to capital is an important ingredient for ladies entrepreneurs to succeed. By understanding the totally different mortgage choices out there and taking the time to analysis and put together, you may empower your self to safe the funding you want to obtain what you are promoting objectives.

Keep in mind, the journey of entrepreneurship is commonly paved with challenges, however with the fitting assets and help, you may overcome obstacles and construct a thriving enterprise.

Closure

We hope this text has helped you perceive every part about Fueling Feminine Ambition: Prime 5 Enterprise Loans for Ladies Entrepreneurs. Keep tuned for extra updates!

Be certain that to comply with us for extra thrilling information and opinions.

We’d love to listen to your ideas about Fueling Feminine Ambition: Prime 5 Enterprise Loans for Ladies Entrepreneurs—depart your feedback beneath!

Preserve visiting our web site for the most recent tendencies and opinions.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…