Get Out of Debt Sooner: Your Final Information to Paying Off Your Auto Mortgage Early

Associated Articles

- High 10 Ideas For Getting Permitted For An Auto Mortgage In 2024: Drive Away With Confidence

- Auto Loans For First-Time Consumers: Your Information To Getting On The Street

- Evaluating New Vs. Used Automotive Loans: Which Is Higher?

- The Shifting Gears: How Rising Curiosity Charges Are Impacting Auto Mortgage Choices

- Cracking The Code: How To Qualify For 0% APR Auto Loans In 2024

Introduction

On this article, we dive into Get Out of Debt Sooner: Your Final Information to Paying Off Your Auto Mortgage Early, supplying you with a full overview of what’s to come back

Video about

Get Out of Debt Sooner: Your Final Information to Paying Off Your Auto Mortgage Early

Feeling the load of your auto mortgage? You are not alone! Many individuals battle with the month-to-month funds, particularly in at the moment’s economic system. However what if you happen to might escape that monetary burden prior to anticipated?

This complete information will stroll you thru the perfect methods to repay your auto mortgage early, empowering you to regain management of your funds and obtain monetary freedom.

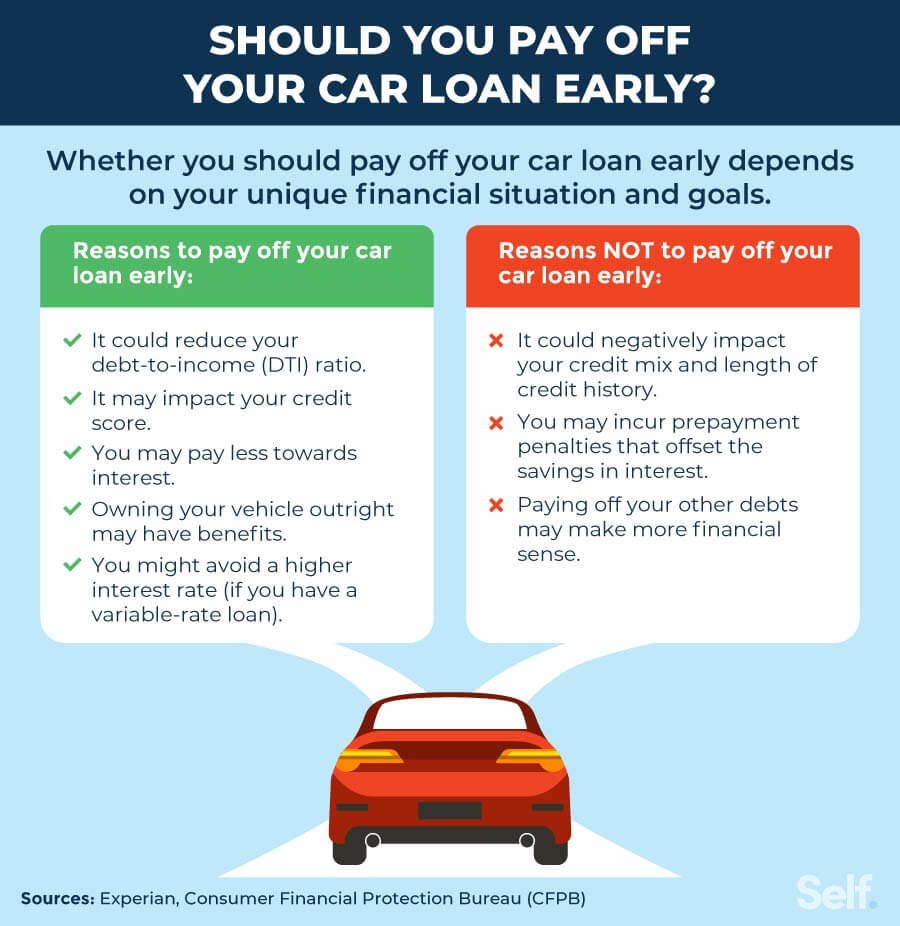

Why Pay Off Your Auto Mortgage Early?

Earlier than diving into the methods, let’s perceive the compelling the explanation why paying off your auto mortgage early is a brilliant monetary transfer:

- Save on Curiosity: Auto loans include curiosity, a hidden price that eats away at your hard-earned cash. By paying off the mortgage early, you considerably cut back the entire curiosity you pay, saving you tons of, even hundreds, of {dollars} over the lifetime of the mortgage.

- Increase Your Credit score Rating: A decrease debt-to-credit ratio (DTI) improves your credit score rating, opening doorways to raised rates of interest on future loans and bank cards.

- Free Up Your Finances: Month-to-month funds are a significant expense, and paying off your auto mortgage frees up invaluable money move. You should utilize this more money for financial savings, investments, or different monetary targets.

- Scale back Monetary Stress: Carrying a big auto mortgage can create monetary stress. By paying it off early, you get rid of that burden and luxuriate in peace of thoughts.

Understanding Your Auto Mortgage

Earlier than you may strategize, it’s worthwhile to perceive the fundamentals of your auto mortgage:

- Mortgage Quantity: That is the principal quantity you borrowed.

- Curiosity Price: That is the share charged on the excellent mortgage stability.

- Mortgage Time period: That is the length of your mortgage, often in months or years.

- Month-to-month Fee: That is the mounted quantity you pay every month.

Key Methods to Pay Off Your Auto Mortgage Early

Now, let’s discover the best methods to repay your auto mortgage early:

1. The Energy of Additional Funds:

Essentially the most simple technique to speed up your mortgage payoff is by making additional funds. Even small further quantities could make a big distinction over time.

- Bi-Weekly Funds: As a substitute of creating one month-to-month cost, break up it into two bi-weekly funds. This successfully makes you make 26 funds a yr as an alternative of 12, leading to sooner mortgage compensation.

- One-Time Lump Sum: If you happen to obtain a bonus, tax refund, or surprising windfall, use a portion of it to make a considerable additional cost.

- Computerized Funds: Arrange automated funds out of your checking account to make sure constant additional funds.

2. The Snowball Technique:

This standard debt-reduction technique focuses on paying off your smallest debt first, then utilizing the freed-up money move to deal with the subsequent largest debt, and so forth.

- Prioritize Smallest Balances: Establish your smallest auto mortgage (when you’ve got a number of) and make additional funds to pay it off rapidly.

- Achieve Momentum: As you repay every mortgage, the freed-up funds are then utilized to the subsequent largest mortgage, making a snowball impact.

- Motivation and Success: The snowball methodology gives early wins, boosting motivation and confidence as you see progress.

3. The Avalanche Technique:

This technique prioritizes paying off debt with the very best rate of interest first. Whereas it might not supply the identical instant gratification because the snowball methodology, it saves you probably the most cash on curiosity in the long term.

- Give attention to Highest Curiosity Charges: Establish the auto mortgage with the very best rate of interest and allocate additional funds in the direction of it.

- Decrease Curiosity Prices: Paying off high-interest money owed first helps cut back the entire curiosity you pay over the lifetime of your loans.

- Lengthy-Time period Financial savings: Though it might take longer to repay the smallest loans, the avalanche methodology in the end ends in important monetary financial savings.

4. Refinance Your Mortgage:

Refinancing your auto mortgage is usually a highly effective instrument to speed up your payoff, particularly if you happen to’ve improved your credit score rating since taking out the unique mortgage.

- Store for Decrease Charges: Contact lenders and examine rates of interest and phrases. Search for loans with shorter phrases, as this may typically end in greater month-to-month funds however sooner compensation.

- Think about a Money-Out Refinance: When you have fairness in your car, you would possibly take into account a cash-out refinance. This lets you borrow towards your fairness to consolidate debt or obtain different monetary targets. Nonetheless, be cautious as this will result in greater general debt and curiosity prices.

- Watch out for Charges: Be conscious of refinancing charges, which may offset the financial savings from a decrease rate of interest.

5. Negotiate with Your Lender:

Do not be afraid to barter together with your lender. You would possibly have the ability to safe a decrease rate of interest or a shorter mortgage time period, which may considerably affect your payoff timeline.

- Construct a Sturdy Case: Analysis common rates of interest and mortgage phrases on your car sort. Be ready to current your case for a decrease rate of interest or shorter time period.

- Leverage Your Creditworthiness: A robust credit score rating can provide you negotiating leverage.

- Be Persistent: Do not be discouraged in case your preliminary request is denied. Proceed to barter and discover choices.

6. Promote Your Automobile and Improve:

If you happen to’re prepared to make a big change, take into account promoting your present car and upgrading to a more moderen, extra fuel-efficient mannequin. This technique will help you:

- Scale back Month-to-month Funds: Newer autos usually have decrease mortgage funds attributable to improved gasoline effectivity and probably decrease rates of interest.

- Generate Fairness: By promoting your present car, you would possibly have the ability to generate some fairness, which can be utilized to pay down your mortgage or make a bigger down cost on a brand new car.

- Decrease Upkeep Prices: Newer autos typically require much less upkeep, saving you cash in the long term.

7. The Energy of Budgeting:

A strong price range is important for any debt discount technique. It helps you monitor your revenue and bills, establish areas to chop again, and allocate funds successfully.

- Monitor Your Bills: Use a budgeting app or spreadsheet to watch your revenue and spending.

- Establish Pointless Bills: Search for areas the place you may cut back spending, reminiscent of eating out, leisure, or subscriptions.

- Prioritize Debt Reimbursement: Allocate a good portion of your price range to additional auto mortgage funds.

8. Aspect Hustles and Additional Revenue:

Think about taking up a facet hustle or discovering methods to generate additional revenue. This could present further funds to speed up your mortgage payoff.

- Freelancing: Make the most of your abilities and expertise to seek out freelance gigs in your space of experience.

- Ridesharing: Drive for ride-sharing providers like Uber or Lyft to earn additional money.

- On-line Surveys: Take part in on-line surveys and market analysis research for a small revenue stream.

9. Search Skilled Recommendation:

If you happen to’re struggling to handle your auto mortgage or want customized steerage, take into account in search of recommendation from a monetary advisor or credit score counselor. They will present tailor-made methods and assist that will help you obtain your monetary targets.

10. Keep Motivated and Monitor Your Progress:

The journey to paying off your auto mortgage could be difficult. Keep motivated by monitoring your progress and celebrating milestones.

- Visualize Your Purpose: Create a visible reminder of your purpose, reminiscent of a debt-free countdown calendar.

- Reward Your self: Have a good time your progress with small rewards, reminiscent of a dinner out or a film night time.

- Keep Targeted: Bear in mind your long-term monetary targets and the advantages of paying off your auto mortgage early.

Widespread Errors to Keep away from:

- Ignoring the Curiosity: Do not simply deal with the principal quantity; be sure that to know the rate of interest and its affect in your complete mortgage price.

- Skipping Funds: Missed funds can result in late charges and harm your credit score rating.

- Overspending: Keep away from impulsive purchases and follow your price range to make sure you have sufficient funds for additional funds.

- Ignoring Your Credit score Rating: A very good credit score rating is important for securing favorable mortgage phrases and refinancing alternatives.

- Not Searching for Assist: Do not hesitate to hunt skilled steerage if you happen to’re struggling to handle your debt.

Conclusion: Your Path to Monetary Freedom

Paying off your auto mortgage early is a rewarding expertise that may considerably enhance your monetary well-being. By implementing the methods outlined on this information, you may take management of your funds, cut back your debt burden, and pave the way in which for a brighter monetary future.

Bear in mind, the secret’s to be constant, keep motivated, and select the methods that finest suit your particular person circumstances. With dedication and a well-defined plan, you may obtain your purpose of changing into debt-free and benefit from the freedom that comes with it.

Closure

We hope this text has helped you perceive all the pieces about Get Out of Debt Sooner: Your Final Information to Paying Off Your Auto Mortgage Early. Keep tuned for extra updates!

Don’t overlook to examine again for the most recent information and updates on Get Out of Debt Sooner: Your Final Information to Paying Off Your Auto Mortgage Early!

We’d love to listen to your ideas about Get Out of Debt Sooner: Your Final Information to Paying Off Your Auto Mortgage Early—depart your feedback beneath!

Hold visiting our web site for the most recent developments and evaluations.