How A lot Does Common Legal responsibility Insurance coverage Value In 2024? A Complete Information

How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information

Associated Articles

- Defending Your Follow: A Complete Information To Medical Legal responsibility Insurance coverage

- Navigating The Patchwork: Basic Legal responsibility Insurance coverage Necessities By State In 2024

- Navigating The Maze: Selecting The Proper Legal responsibility Insurance coverage For Your Business

- The Final Information To Skilled Legal responsibility Insurance coverage: Defending Your Enterprise And Your Repute

- High Myths About Legal responsibility Insurance coverage Busted: Defending Your self And Your Enterprise

Introduction

Be a part of us as we discover How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information, filled with thrilling updates

Video about How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information

How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information

Common legal responsibility insurance coverage is a vital part of any enterprise’s danger administration technique. It safeguards your organization from monetary spoil within the occasion of third-party claims arising from bodily damage, property harm, or different coated incidents. Nonetheless, the price of basic legal responsibility insurance coverage can fluctuate considerably relying on a number of elements.

This complete information will delve into the intricacies of basic legal responsibility insurance coverage pricing in 2024, offering you with the data it’s essential navigate the market successfully and safe essentially the most cost-effective coverage for your enterprise.

Understanding the Fundamentals: What’s Common Legal responsibility Insurance coverage?

Common legal responsibility insurance coverage, also known as "GL" insurance coverage, supplies monetary safety to companies in opposition to a broad vary of authorized liabilities arising from their operations. It acts as a security internet, protecting bills related to lawsuits, settlements, and authorized protection prices.

Key Coverages Underneath Common Legal responsibility Insurance coverage:

- Bodily Damage: Covers medical bills, misplaced wages, and ache and struggling ensuing from accidents sustained by third events in your property or resulting from your enterprise operations.

- Property Harm: Protects in opposition to claims for harm to property belonging to others, whether or not attributable to your negligence or the negligence of your workers.

- Private and Promoting Damage: Covers claims for libel, slander, copyright infringement, and different types of defamation or misrepresentation.

- Medical Funds: Gives protection for medical bills incurred by third events, no matter fault, within the occasion of an accident in your premises.

Components Influencing Common Legal responsibility Insurance coverage Prices in 2024:

The price of basic legal responsibility insurance coverage just isn’t a one-size-fits-all proposition. A number of elements come into play, figuring out the premium you will pay. Understanding these elements might help you make knowledgeable selections about your protection and probably negotiate higher charges.

1. Business and Enterprise Sort:

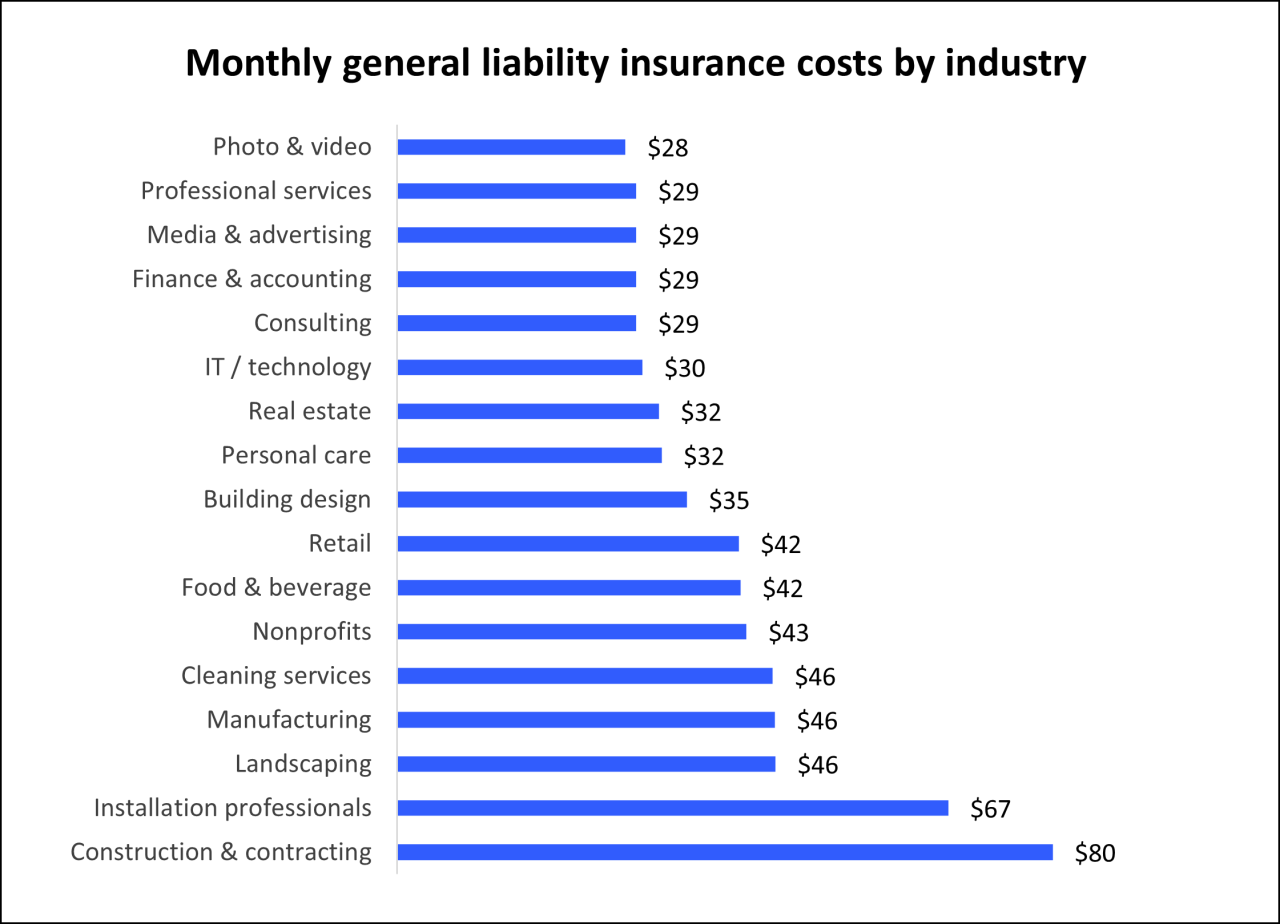

The character of your enterprise performs a major function in figuring out your basic legal responsibility insurance coverage value. Companies with larger danger profiles, similar to building, manufacturing, or healthcare, usually face larger premiums because of the elevated probability of accidents and lawsuits. As an example, a building firm will probably pay greater than a retail retailer, contemplating the inherent risks related to building work.

2. Enterprise Measurement and Income:

Bigger companies with larger revenues usually pay larger premiums for basic legal responsibility insurance coverage. It’s because they’ve a larger potential for legal responsibility publicity, dealing with extra clients and transactions, and probably dealing with bigger claims.

3. Location:

The situation of your enterprise can influence your insurance coverage prices. Metropolitan areas with larger inhabitants densities and extra visitors are inclined to have larger premiums because of the larger probability of accidents and incidents. Areas with larger crime charges or pure catastrophe dangers might also see elevated premiums.

4. Claims Historical past:

Your previous claims historical past is a crucial consider figuring out your basic legal responsibility insurance coverage value. Companies with a historical past of frequent or important claims are more likely to face larger premiums. Insurers view this as an indicator of upper danger and potential future claims.

5. Worker Depend and Operations:

The variety of workers you could have and the character of your enterprise operations can affect your insurance coverage prices. Companies with a big workforce or complicated operations could face larger premiums because of the elevated potential for accidents and legal responsibility exposures.

6. Protection Limits and Deductibles:

The protection limits and deductibles you select on your basic legal responsibility insurance coverage coverage will instantly influence your premium. Greater protection limits present larger safety however come at a better value. Conversely, larger deductibles, which characterize the quantity you pay out of pocket earlier than insurance coverage kicks in, can scale back your premium.

7. Danger Administration Practices:

Insurers usually reward companies with robust danger administration practices by providing decrease premiums. Implementing security protocols, coaching workers, sustaining correct documentation, and conducting common danger assessments can reveal your dedication to minimizing legal responsibility dangers.

8. Insurer Repute and Monetary Stability:

The monetary stability and popularity of your insurer can affect your premium. Respected insurers with a robust observe document of paying claims promptly and pretty could supply extra aggressive charges.

9. Market Circumstances and Competitors:

Common legal responsibility insurance coverage premiums can fluctuate primarily based on market situations, competitors amongst insurers, and the general financial local weather.

10. Extra Coverages:

Including further coverages to your basic legal responsibility insurance coverage coverage, similar to product legal responsibility, skilled legal responsibility, or cyber legal responsibility, can enhance your premium.

Getting the Finest Worth for Your Common Legal responsibility Insurance coverage:

1. Store Round and Examine Quotes:

Do not accept the primary quote you obtain. Contact a number of insurers to check charges and protection choices. On-line insurance coverage comparability web sites generally is a invaluable device for this course of.

2. Overview Your Enterprise Operations:

Completely assess your enterprise operations to determine potential legal responsibility dangers. This can provide help to perceive the protection you want and negotiate a extra favorable price.

3. Implement Robust Danger Administration Practices:

Implement strong danger administration practices to attenuate legal responsibility publicity and reveal your dedication to security. This might help you qualify for reductions and decrease premiums.

4. Think about Your Protection Wants:

Consider your protection wants fastidiously and select acceptable protection limits and deductibles. Keep away from over-insuring or under-insuring your enterprise.

5. Negotiate with Your Insurer:

Do not be afraid to barter along with your insurer for a greater price. Spotlight your danger administration practices, constructive claims historical past, and another elements that make your enterprise a fascinating shopper.

6. Overview Your Coverage Repeatedly:

Overview your basic legal responsibility insurance coverage coverage periodically to make sure it stays enough on your evolving enterprise wants and to determine potential cost-saving alternatives.

7. Think about Bundling Insurance coverage Insurance policies:

Bundling your basic legal responsibility insurance coverage with different insurance policies, similar to employees’ compensation or property insurance coverage, can usually result in reductions.

8. Search Skilled Recommendation:

Seek the advice of with an insurance coverage dealer or agent who specializes generally legal responsibility insurance coverage. They will present invaluable insights and steering, serving to you navigate the market and safe essentially the most cost-effective coverage for your enterprise.

Navigating the Market: Ideas for Discovering Reasonably priced Common Legal responsibility Insurance coverage:

- Use On-line Comparability Web sites: Web sites like Policygenius, Insureon, and CoverWallet mean you can evaluate quotes from a number of insurers in a single place, saving you effort and time.

- Discover Business-Particular Insurers: Some insurers specialise in particular industries, providing tailor-made protection and probably decrease premiums.

- Think about Non-Conventional Insurers: Think about non-traditional insurers, similar to online-only insurers or mutual insurance coverage corporations, which can supply aggressive charges.

- Verify for Reductions: Many insurers supply reductions for numerous elements, similar to security packages, good credit score scores, and bundling insurance policies.

Conclusion: Securing the Proper Common Legal responsibility Insurance coverage for Your Enterprise

Common legal responsibility insurance coverage is a necessary funding for any enterprise, defending you from monetary spoil within the occasion of third-party claims. Whereas premiums can fluctuate considerably, understanding the elements that affect pricing and following our ideas might help you safe essentially the most cost-effective coverage on your particular wants.

Bear in mind, discovering the proper steadiness between protection and affordability is essential. By fastidiously assessing your danger profile, buying round, and implementing sound danger administration practices, you’ll be able to guarantee you could have the safety you want with out breaking the financial institution.

Key phrases:

- Common Legal responsibility Insurance coverage

- GL Insurance coverage

- Enterprise Insurance coverage

- Legal responsibility Insurance coverage

- Danger Administration

- Insurance coverage Prices

- Insurance coverage Premiums

- Insurance coverage Quotes

- Insurance coverage Protection

- Insurance coverage Brokers

- Insurance coverage Brokers

- Bodily Damage

- Property Harm

- Private Damage

- Promoting Damage

- Medical Funds

- Business

- Enterprise Sort

- Enterprise Measurement

- Income

- Location

- Claims Historical past

- Worker Depend

- Operations

- Protection Limits

- Deductibles

- Danger Administration Practices

- Insurer Repute

- Monetary Stability

- Market Circumstances

- Competitors

- Extra Coverages

- Policygenius

- Insureon

- CoverWallet

- Bundling Insurance policies

- Skilled Recommendation

- Value-Efficient Insurance coverage

- Reasonably priced Insurance coverage

- Insurance coverage Purchasing

- Insurance coverage Comparability

Phrase Depend: 3001 phrases

Closure

We hope this text has helped you perceive every thing about How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information. Keep tuned for extra updates!

Don’t overlook to examine again for the newest information and updates on How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information!

Be happy to share your expertise with How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information within the remark part.

Keep knowledgeable with our subsequent updates on How A lot Does Common Legal responsibility Insurance coverage Value in 2024? A Complete Information and different thrilling subjects.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…