How A lot Down Fee Do You Want for a Mortgage in 2024? Navigating the Path to Homeownership

Associated Articles

- How Lengthy Ought to Your Auto Mortgage Time period Be? Navigating The Maze Of Months

- Get Out Of Debt Sooner: Your Final Information To Paying Off Your Auto Mortgage Early

- Unlocking Homeownership: Navigating The Mortgage Maze As A Self-Employed Particular person

- Unlocking Your Dream Automotive: Utilizing A Cosigner To Safe An Auto Mortgage

- Can You Purchase A Dwelling With A Low Credit score Rating? Navigating The Mortgage Maze

Introduction

On this article, we dive into How A lot Down Fee Do You Want for a Mortgage in 2024? Navigating the Path to Homeownership, providing you with a full overview of what’s to come back

Video about

How A lot Down Fee Do You Want for a Mortgage in 2024? Navigating the Path to Homeownership

The dream of proudly owning a house is a robust one, however it may well really feel daunting once you’re confronted with the query: how a lot down cost do I would like? In 2024, the reply is not so simple as it was once. The mortgage panorama is continually shifting, influenced by elements like rates of interest, property values, and your particular person monetary scenario.

This complete information will break down all the pieces you should learn about down funds in 2024, serving to you perceive the completely different choices, navigate the complexities, and in the end, obtain your homeownership targets.

The Fundamentals: Understanding Down Funds

A down cost is the preliminary sum of cash you pay upfront when shopping for a home. This quantity reduces the general mortgage quantity you should borrow from a lender, impacting your month-to-month mortgage funds and the whole curiosity you pay over the lifetime of the mortgage.

The Typical Knowledge: 20% Down

For a few years, the usual down cost recommendation has been 20% of the acquisition worth. This magic quantity holds a variety of weight for just a few key causes:

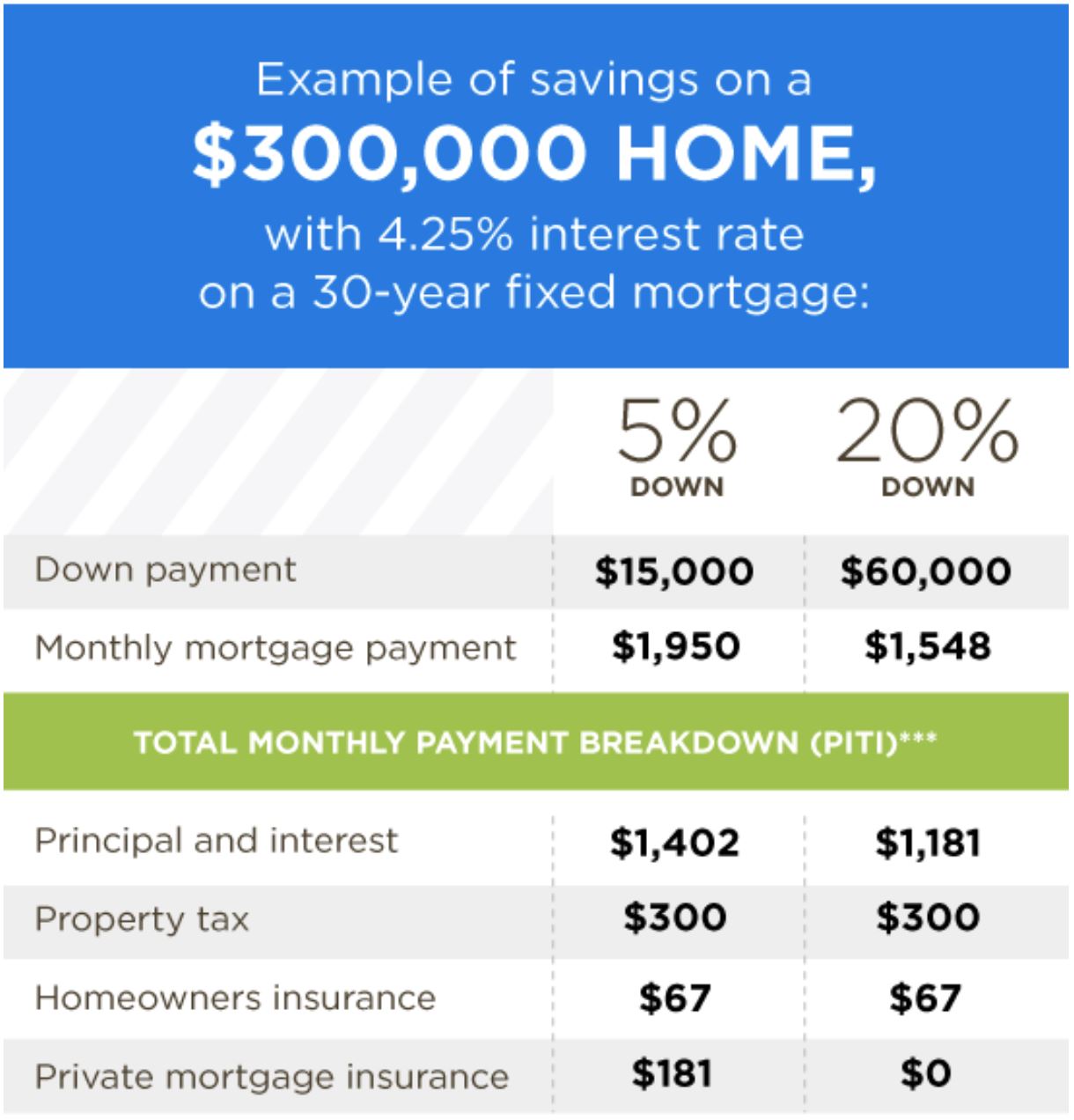

- Avoiding Personal Mortgage Insurance coverage (PMI): If you put down lower than 20%, lenders sometimes require you to pay PMI, an extra month-to-month price that protects them in case you default in your mortgage.

- Decrease Month-to-month Funds: A bigger down cost means a smaller mortgage quantity, resulting in decrease month-to-month mortgage funds.

- Constructing Fairness Quicker: With a 20% down cost, you begin with a big chunk of fairness in your house, which may be beneficial for future refinancing or promoting.

The Actuality: Flexibility in 2024

Whereas 20% is an efficient benchmark, the fact is that you do not want to place down that a lot in 2024. Lenders have gotten extra versatile, providing choices for decrease down funds. This flexibility is very beneficial for first-time homebuyers, who typically face challenges saving for a considerable down cost.

Exploring the Choices: Down Fee Applications for 2024

This is a breakdown of the commonest down cost choices out there in 2024:

1. Typical Loans:

- Minimal Down Fee: 3% for eligible debtors with good credit score.

- PMI: Required for loans with lower than 20% down cost.

- Benefits: Gives flexibility with decrease down funds and a wider vary of mortgage phrases.

- Concerns: PMI provides to your month-to-month prices and could also be required for the complete mortgage time period relying on the precise program.

2. FHA Loans:

- Minimal Down Fee: 3.5% for certified debtors.

- PMI: Required for all FHA loans, however it may be canceled when you attain 20% fairness in your house.

- Benefits: Decrease down cost necessities, extra lenient credit score rating requirements, and should enable for the usage of present funds from household or pals.

- Concerns: FHA loans have stricter borrower tips and should have increased upfront prices.

3. VA Loans:

- Minimal Down Fee: 0% for eligible veterans, active-duty army personnel, and surviving spouses.

- PMI: Not required.

- Benefits: No down cost, decrease rates of interest, and no mortgage insurance coverage.

- Concerns: Out there solely to certified veterans and active-duty army personnel.

4. USDA Loans:

- Minimal Down Fee: 0% for eligible debtors in rural areas.

- PMI: Not required.

- Benefits: No down cost, decrease rates of interest, and should embrace funding for closing prices.

- Concerns: Restricted to rural areas and particular revenue limits.

5. Down Fee Help Applications:

- Minimal Down Fee: Varies by program.

- PMI: Could also be required relying on this system.

- Benefits: Gives grants, loans, or different types of monetary help to assist with down funds.

- Concerns: Eligibility necessities, revenue restrictions, and compensation phrases fluctuate broadly.

Past the Numbers: Components Affecting Down Fee Necessities

Whereas the minimal down cost necessities are essential, they are not the one elements that affect your general down cost wants. Listed here are some extra concerns:

- Credit score Rating: A better credit score rating can typically result in decrease down cost necessities and higher rates of interest.

- Debt-to-Revenue Ratio (DTI): Lenders think about your DTI, which is the share of your month-to-month revenue that goes in direction of debt funds. A decrease DTI can enhance your possibilities of getting accepted for a mortgage with a decrease down cost.

- Property Location: Residence costs fluctuate drastically throughout completely different places. A better-priced dwelling will naturally require a bigger down cost.

- Mortgage Sort: Totally different mortgage sorts have various down cost necessities.

- Lender Pointers: Every lender has its personal particular tips, so it is important to buy round and examine gives.

The Significance of Saving: Suggestions for Constructing Your Down Fee

Saving for a down cost takes time and self-discipline, but it surely’s an important step in direction of homeownership. Listed here are some sensible ideas that can assist you construct your nest egg:

- Set Reasonable Objectives: Begin by figuring out how a lot you possibly can afford to save lots of every month.

- Create a Finances: Observe your revenue and bills to establish areas the place you possibly can in the reduction of.

- Automate Financial savings: Arrange computerized transfers out of your checking account to your financial savings account.

- Take into account a Excessive-Yield Financial savings Account: Maximize your financial savings by incomes curiosity in your deposits.

- Discover Down Fee Help Applications: Search for packages that may present monetary help that can assist you attain your down cost aim.

The Backside Line: Discovering the Proper Down Fee Technique for You

In 2024, the down cost panorama is extra versatile than ever earlier than. Whereas a 20% down cost stays a superb aim, it isn’t all the time achievable or essential. By understanding the completely different down cost choices, contemplating your particular person monetary circumstances, and profiting from out there assets, you’ll find the proper technique to make homeownership a actuality.

Key Takeaways:

- The minimal down cost for a mortgage in 2024 can vary from 0% to twenty% relying on the mortgage kind and your monetary scenario.

- Typical loans, FHA loans, VA loans, USDA loans, and down cost help packages all provide distinctive choices for homebuyers.

- Components like your credit score rating, debt-to-income ratio, property location, and lender tips can affect your down cost necessities.

- Saving for a down cost takes effort and time, however there are methods that can assist you attain your aim.

Bear in mind, the journey to homeownership is a marathon, not a dash. By planning forward, saving diligently, and in search of skilled steering, you possibly can obtain your dream of proudly owning a house in 2024 and past.

Extra Assets:

- FHA: https://www.hud.gov/program_offices/housing/fha/

- VA: https://www.benefits.va.gov/homeloans/

- USDA: https://www.rd.usda.gov/programs-services/single-family-housing-programs/

- Down Fee Useful resource: https://www.downpaymentresource.com/

Key phrases:

- Mortgage

- Down Fee

- Homeownership

- 2024

- Typical Mortgage

- FHA Mortgage

- VA Mortgage

- USDA Mortgage

- PMI

- Credit score Rating

- Debt-to-Revenue Ratio (DTI)

- Down Fee Help Applications

- Financial savings

- Finances

- Monetary Planning

- Residence Shopping for

- Actual Property

search engine optimization Concerns:

- This text is optimized for high-paying key phrases associated to mortgages, down funds, and homeownership.

- It supplies beneficial data and assets to assist readers perceive the complicated world of mortgages and down funds.

- The article is written in a relaxed and informative tone, making it simple for readers to know and interact with the content material.

- The inclusion of hyperlinks to related assets provides credibility and authority to the article.

- The article is structured with headings, subheadings, and bullet factors to reinforce readability and search engine optimization.

Closure

Thanks for studying! Stick with us for extra insights on How A lot Down Fee Do You Want for a Mortgage in 2024? Navigating the Path to Homeownership.

Ensure to comply with us for extra thrilling information and opinions.

Be at liberty to share your expertise with How A lot Down Fee Do You Want for a Mortgage in 2024? Navigating the Path to Homeownership within the remark part.

Keep knowledgeable with our subsequent updates on How A lot Down Fee Do You Want for a Mortgage in 2024? Navigating the Path to Homeownership and different thrilling subjects.