How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information To Saving Large

How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information to Saving Large

Associated Articles

- All the things You Want To Know About Auto Mortgage Reimbursement Phrases: A Complete Information

- Evaluating New Vs. Used Automotive Loans: Which Is Higher?

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

- Complete Information to Auto Insurance coverage Quotes: Save Cash and Get the Finest Protection

- The Shifting Gears: How Rising Curiosity Charges Are Impacting Auto Mortgage Choices

Introduction

Uncover every thing it’s good to learn about How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information to Saving Large

Video about

How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information to Saving Large

Shopping for a automobile is a serious monetary choice, and securing a mortgage is usually a vital step. However do you know that your credit score rating performs an important position in figuring out the rate of interest you will pay? On this complete information, we’ll delve into the intricate relationship between your credit score rating and your auto mortgage rate of interest, revealing how this seemingly summary quantity can considerably impression your general car-buying expertise.

Understanding Your Credit score Rating

Your credit score rating is a three-digit quantity that displays your creditworthiness. It is a numerical illustration of your monetary historical past, based mostly on components like your fee historical past, credit score utilization, credit score combine, and size of credit score historical past. Lenders use this rating to evaluate your threat as a borrower, figuring out how seemingly you might be to repay your money owed on time.

The Influence on Auto Mortgage Curiosity Charges

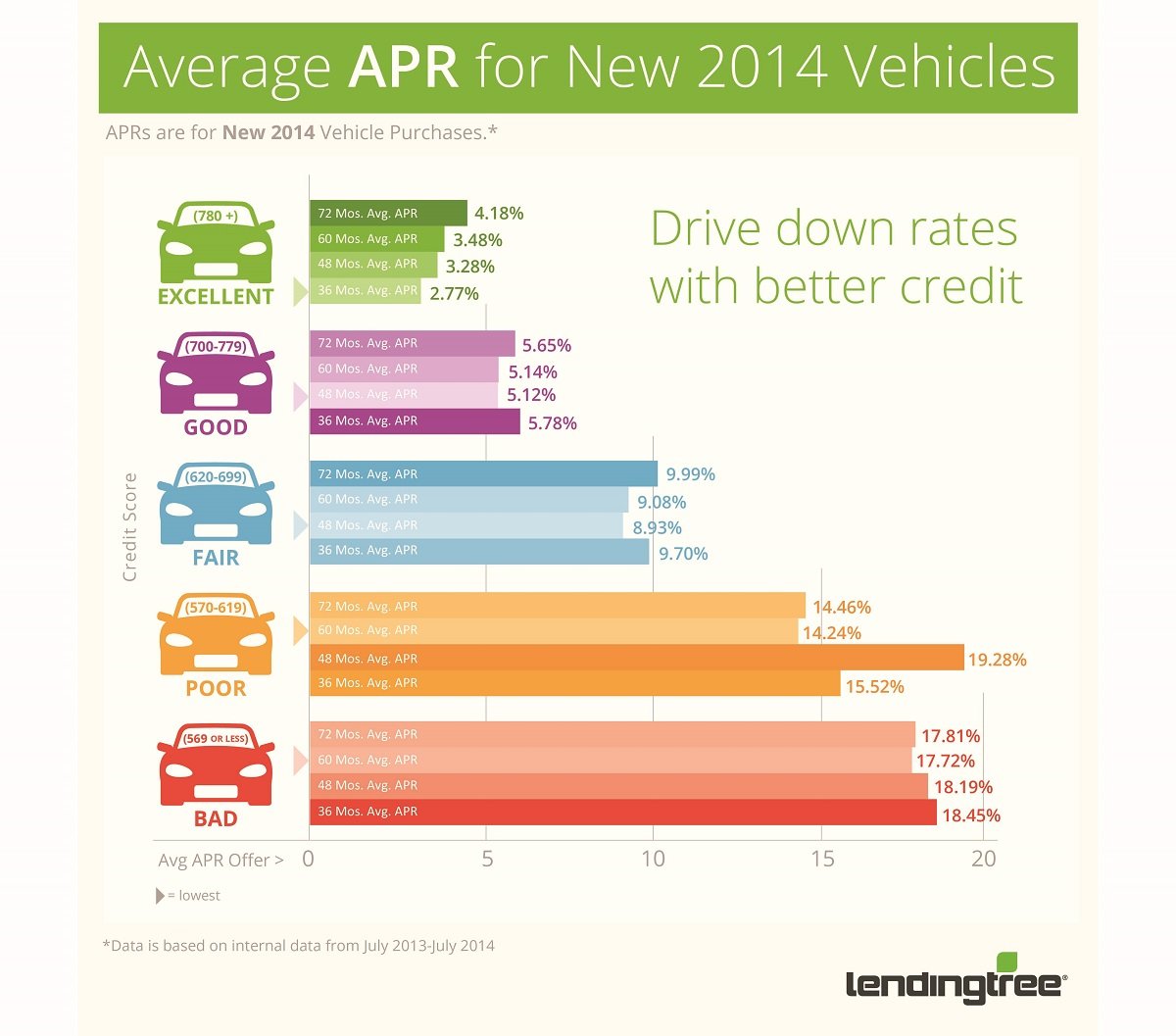

Once you apply for an auto mortgage, lenders use your credit score rating to find out the rate of interest they’re going to give you. The upper your credit score rating, the decrease the rate of interest you will seemingly qualify for. Conversely, a decrease credit score rating will typically lead to the next rate of interest.

Why Does Credit score Rating Matter So A lot?

Consider it this fashion: lenders are within the enterprise of lending cash and anticipating it again, ideally with curiosity. They need to decrease their threat of dropping cash. A excessive credit score rating indicators to lenders that you are a accountable borrower who’s prone to repay your money owed on time. This makes you a much less dangerous borrower, and lenders are prepared to give you a decrease rate of interest as a reward.

However, a low credit score rating suggests the next threat of default. Lenders will compensate for this perceived threat by charging the next rate of interest. This increased rate of interest basically acts as a premium for the lender to tackle the elevated threat related to lending to you.

How A lot Can Your Credit score Rating Have an effect on Your Mortgage?

The impression of your credit score rating in your auto mortgage rate of interest could be vital. Let us take a look at a real-world instance:

- State of affairs 1: You might have a credit score rating of 750 and want to borrow $25,000 for a brand new automobile. You may qualify for an rate of interest of three.5%.

- State of affairs 2: You might have a credit score rating of 600 and want to borrow the identical $25,000. You may face an rate of interest of seven%.

This distinction in rates of interest may appear small at first look, however over the lifetime of the mortgage, it may add as much as 1000’s of {dollars} in additional curiosity expenses. On this instance, the borrower with the decrease credit score rating would find yourself paying over $2,000 extra in curiosity expenses over the lifetime of the mortgage.

The Significance of Constructing and Sustaining Good Credit score

The impression of your credit score rating in your auto mortgage rate of interest highlights the significance of constructing and sustaining good credit score. Listed below are some key methods:

- Pay Your Payments on Time: That is the only most essential consider your credit score rating. Late funds can considerably injury your credit score, resulting in increased rates of interest and making it more durable to get accepted for loans sooner or later.

- Maintain Your Credit score Utilization Low: Credit score utilization refers back to the quantity of credit score you are utilizing in comparison with your complete accessible credit score. Intention to maintain your credit score utilization under 30%.

- Keep away from Opening Too Many New Accounts: Opening too many new credit score accounts in a brief interval can negatively impression your credit score rating.

- Monitor Your Credit score Reviews: Evaluation your credit score reviews often for any errors or inconsistencies. You possibly can receive free credit score reviews from the three main credit score bureaus – Equifax, Experian, and TransUnion – at AnnualCreditReport.com.

- Take into account a Secured Credit score Card: You probably have restricted credit score historical past or a low credit score rating, a secured bank card can assist you construct credit score. You will have to make a safety deposit, which acts as collateral for the cardboard.

- Use Credit score Correctly: Keep away from utilizing bank cards for pointless purchases or for quantities you’ll be able to’t afford to repay.

Learn how to Enhance Your Credit score Rating Earlier than Making use of for an Auto Mortgage

In case you’re planning to purchase a automobile quickly, it is a good suggestion to take steps to enhance your credit score rating earlier than making use of for an auto mortgage. Listed below are some suggestions:

- Pay Down Present Debt: Give attention to lowering your excellent debt, significantly high-interest debt like bank card debt. It will enhance your credit score utilization ratio and exhibit your potential to handle debt successfully.

- Dispute Errors on Your Credit score Report: Test your credit score report for any inaccuracies and dispute them with the credit score bureaus.

- Turn into an Licensed Person: You probably have a trusted good friend or member of the family with good credit score, ask them so as to add you as a certified consumer on their bank card account. This can assist you profit from their constructive credit score historical past.

- Take into account a Credit score Builder Mortgage: These loans are designed that can assist you construct credit score by offering you with a small mortgage that you could repay over time.

Suggestions for Getting the Greatest Auto Mortgage Curiosity Price

- Store Round: Examine rates of interest from a number of lenders earlier than deciding.

- Take into account a Pre-approval: Getting pre-approved for a mortgage earlier than you begin searching for a automobile can provide you a greater concept of your financing choices and put you in a stronger negotiating place.

- Negotiate: Do not be afraid to barter the rate of interest with the lender.

- Take into account a Cosigner: You probably have a low credit score rating, a cosigner with good credit score can assist you qualify for a greater rate of interest.

The Backside Line: Your Credit score Rating Issues

Your credit score rating is a robust consider figuring out your auto mortgage rate of interest. A excessive credit score rating can prevent 1000’s of {dollars} in curiosity expenses over the lifetime of your mortgage. By understanding how your credit score rating impacts your financing choices and taking steps to enhance your credit score, you’ll be able to place your self to safe the absolute best auto mortgage charges. Keep in mind, constructing and sustaining good credit score is a steady course of, and it is a essential step in the direction of reaching your monetary targets.

Closure

We hope this text has helped you perceive every thing about How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information to Saving Large. Keep tuned for extra updates!

Be sure to comply with us for extra thrilling information and critiques.

We’d love to listen to your ideas about How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information to Saving Large—depart your feedback under!

Keep knowledgeable with our subsequent updates on How Your Credit score Rating Impacts Your Auto Mortgage Curiosity Price: A Information to Saving Large and different thrilling subjects.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…