Is It Higher to Get a Private Mortgage or Use a Credit score Card? Navigating the Monetary Maze

Associated Articles

- Personal Loan Repayment Plans: What Are Your Options? Navigating The Path To Financial Freedom

- How Do Personal Loans Affect Your Credit Score? A Comprehensive Guide

- Can You Get A Private Mortgage For Funding Functions? Navigating The Dangers And Rewards

- The Impression Of Private Loans On Your Mortgage Utility: A Complete Information

- Unmasking The Myths: Your Guide To Personal Loans

Introduction

Uncover the newest particulars about Is It Higher to Get a Private Mortgage or Use a Credit score Card? Navigating the Monetary Maze on this complete information.

Video about

Is It Higher to Get a Private Mortgage or Use a Credit score Card? Navigating the Monetary Maze

Within the whirlwind of contemporary life, surprising bills can pop up like undesirable houseguests. Whether or not it is a automobile restore, a medical invoice, or a house renovation, the necessity for fast money can depart you scrambling. However when confronted with this monetary dilemma, two widespread choices emerge: private loans and bank cards. Each provide a lifeline, however choosing the proper one can considerably affect your monetary well-being.

This complete information delves into the intricacies of private loans and bank cards, evaluating their options, prices, and suitability for various conditions. By the top, you may be outfitted to make an knowledgeable determination that aligns along with your distinctive monetary wants and objectives.

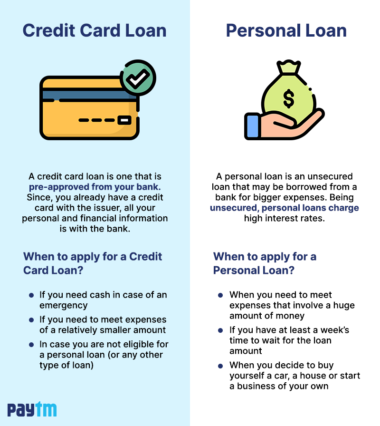

Understanding the Fundamentals: Private Loans vs. Credit score Playing cards

Private Loans:

- What they’re: A lump sum of cash borrowed from a lender, sometimes a financial institution or on-line monetary establishment.

- How they work: You repay the mortgage in fastened month-to-month installments over a predetermined interval, with curiosity calculated on the excellent steadiness.

- Key options:

- Mounted rates of interest: Rates of interest often stay fixed all through the mortgage time period.

- Mounted month-to-month funds: Your fee quantity stays the identical every month, making budgeting simpler.

- Set compensation interval: The mortgage time period is outlined upfront, providing you with a transparent timeline for compensation.

- Potential for decrease rates of interest: Private loans typically have decrease rates of interest than bank cards, particularly for debtors with good credit score.

Credit score Playing cards:

- What they’re: A revolving line of credit score that permits you to borrow cash for purchases as much as a specified restrict.

- How they work: You should use your bank card to make purchases, and also you’re sometimes given a grace interval (often 21-30 days) to repay the steadiness with out curiosity. When you do not pay the steadiness in full inside the grace interval, curiosity prices begin accruing.

- Key options:

- Variable rates of interest: Rates of interest can fluctuate primarily based on market circumstances and your creditworthiness.

- Minimal month-to-month funds: You solely must pay a minimal quantity every month, however this may result in larger curiosity prices and longer compensation phrases.

- Rewards and perks: Many bank cards provide rewards packages, money again, journey factors, or different perks.

- Potential for overspending: The comfort of bank cards can result in overspending for those who’re not cautious.

When to Select a Private Mortgage:

- Massive, one-time bills: Private loans are perfect for vital purchases like a automobile, house renovation, or medical payments.

- Predictable compensation: The fastened month-to-month funds make it simpler to finances and make sure you keep on observe.

- Decrease rates of interest: You probably have good credit score, a private mortgage can provide decrease rates of interest than a bank card, saving you cash on curiosity prices.

- Debt consolidation: Consolidating a number of high-interest money owed right into a single private mortgage with a decrease rate of interest will help you lower your expenses and simplify your compensation course of.

When to Select a Credit score Card:

- Small, recurring bills: Bank cards are handy for on a regular basis purchases like groceries, gasoline, and eating.

- Flexibility: You should use a bank card for a wide range of purchases and solely pay the steadiness if you’re prepared.

- Rewards and perks: Many bank cards provide rewards packages, money again, journey factors, or different perks that may add worth to your spending.

- Constructing credit score: Accountable use of a bank card will help you construct a constructive credit score historical past, which is important for future monetary alternatives like mortgages and loans.

Essential Issues: Price, Curiosity Charges, and Credit score Rating Influence

Curiosity Charges:

- Private loans: Rates of interest on private loans range relying in your credit score rating, mortgage quantity, and the lender. Typically, debtors with glorious credit score can safe decrease rates of interest.

- Bank cards: Bank card rates of interest are sometimes larger than private mortgage charges and may fluctuate primarily based in your credit score rating and market circumstances.

Charges:

- Private loans: Some lenders could cost origination charges, that are a proportion of the mortgage quantity, or different charges for processing the mortgage.

- Bank cards: Bank cards could cost annual charges, late fee charges, over-limit charges, or steadiness switch charges.

Credit score Rating Influence:

- Private loans: A excessive credit score rating is important for acquiring a private mortgage with a good rate of interest.

- Bank cards: Your credit score rating impacts each your eligibility for a bank card and the rate of interest you may obtain.

Selecting the Proper Possibility: A Step-by-Step Method

- Assess your monetary state of affairs: Consider your earnings, bills, and current debt obligations.

- Decide your wants: Determine the aim of the mortgage or bank card and the quantity you require.

- Examine choices: Analysis totally different private mortgage suppliers and bank card issuers to check rates of interest, charges, and phrases.

- Take into account your credit score rating: The next credit score rating offers you entry to decrease rates of interest and extra favorable mortgage phrases.

- Learn the wonderful print: Fastidiously overview the mortgage settlement or bank card phrases and circumstances earlier than making a call.

Suggestions for Accountable Borrowing:

- Borrow solely what you want: Keep away from borrowing greater than you’ll be able to afford to repay.

- Set a finances and follow it: Create a sensible finances that features your mortgage or bank card funds.

- Make greater than the minimal fee: Paying greater than the minimal fee will provide help to repay your debt sooner and cut back curiosity prices.

- Monitor your credit score rating: Preserve observe of your credit score rating and be sure you’re utilizing your credit score responsibly.

Conclusion: Making the Knowledgeable Alternative

The choice between a private mortgage and a bank card will not be one-size-fits-all. Understanding the nuances of every choice, contemplating your particular person monetary state of affairs, and following accountable borrowing practices will provide help to make the only option on your wants. Keep in mind, borrowing must be a software for attaining your monetary objectives, not a burden that weighs you down.

Past the Fundamentals: Exploring the Nuances

Private Loans: A Deeper Dive

- Forms of private loans: There are a number of varieties of private loans, together with secured loans, unsecured loans, and peer-to-peer loans. Every sort has its personal set of phrases and circumstances.

- Mortgage phrases and circumstances: Pay shut consideration to the rate of interest, mortgage time period, origination charges, and different charges related to the mortgage.

- Mortgage prepayment: Some lenders help you prepay your mortgage with out penalty, which may prevent cash on curiosity prices.

- Mortgage consolidation: Consolidating a number of high-interest money owed right into a single private mortgage with a decrease rate of interest will help you lower your expenses and simplify your compensation course of.

Credit score Playing cards: Uncovering the Particulars

- Bank card rewards packages: Many bank cards provide rewards packages that may earn you money again, journey factors, or different perks.

- Bank card rates of interest: Bank card rates of interest can range considerably, so it is essential to buy round and evaluate gives.

- Bank card charges: Bank cards could cost annual charges, late fee charges, over-limit charges, or steadiness switch charges.

- Bank card steadiness switch: Transferring a high-interest steadiness from one other bank card to a card with a decrease rate of interest can prevent cash on curiosity prices.

The Significance of Constructing Credit score:

A very good credit score rating is important for acquiring favorable phrases on loans, bank cards, and different monetary merchandise. Constructing credit score takes time and accountable monetary conduct. Listed here are some ideas for enhancing your credit score rating:

- Pay your payments on time: Late funds can considerably harm your credit score rating.

- Preserve your credit score utilization low: Your credit score utilization ratio is the quantity of credit score you are utilizing in comparison with your out there credit score. Intention to maintain your credit score utilization ratio beneath 30%.

- Do not open too many new accounts: Every time you apply for a brand new bank card or mortgage, a tough inquiry is positioned in your credit score report, which may briefly decrease your rating.

- Monitor your credit score report: Evaluation your credit score report often for any errors or inaccuracies.

Different Financing Choices:

- Residence fairness loans: You probably have fairness in your house, you’ll be able to borrow towards it by taking out a house fairness mortgage or line of credit score.

- Peer-to-peer lending: Peer-to-peer lending platforms join debtors with traders, permitting you to entry loans immediately from people.

- Household or mates: You probably have a detailed relationship with somebody who’s keen to lend you cash, you might be able to get hold of a private mortgage with a decrease rate of interest.

Navigating the Monetary Panorama: A Complete Information

- Monetary literacy: Understanding the fundamentals of private finance, together with budgeting, saving, investing, and debt administration, is essential for making knowledgeable monetary choices.

- Monetary planning: Working with a monetary advisor will help you develop a complete monetary plan that aligns along with your objectives and danger tolerance.

- Monetary sources: There are quite a few on-line and offline sources out there that will help you study private finance, together with web sites, books, articles, and monetary establishments.

In Conclusion: Empowering Your self with Monetary Data

The journey to monetary freedom begins with data. By understanding the intricacies of private loans, bank cards, and different financing choices, you may make knowledgeable choices that align along with your monetary objectives. Keep in mind, accountable borrowing is a key ingredient in constructing a stable monetary basis. Embrace the facility of data and take management of your monetary future.

Closure

We hope this text has helped you perceive all the things about Is It Higher to Get a Private Mortgage or Use a Credit score Card? Navigating the Monetary Maze. Keep tuned for extra updates!

Don’t overlook to examine again for the newest information and updates on Is It Higher to Get a Private Mortgage or Use a Credit score Card? Navigating the Monetary Maze!

We’d love to listen to your ideas about Is It Higher to Get a Private Mortgage or Use a Credit score Card? Navigating the Monetary Maze—depart your feedback beneath!

Keep knowledgeable with our subsequent updates on Is It Higher to Get a Private Mortgage or Use a Credit score Card? Navigating the Monetary Maze and different thrilling subjects.