Is Umbrella Insurance coverage Definitely worth the Additional Price? A Complete Information to Defending Your Property

Associated Articles

- What Does Legal responsibility Insurance coverage Cowl? A Detailed Breakdown For Peace Of Thoughts

- Maximizing Monetary financial savings with Cheap Nicely being Insurance coverage protection Plans: A Full Info

- Navigating The Labyrinth: Exploring Product Legal responsibility Insurance coverage For E-Commerce Companies

- Understanding The Fundamentals Of Common Legal responsibility Insurance coverage: Your Protect In opposition to The Sudden

- Navigating The Maze: Prime Rated Common Legal responsibility Insurance coverage Firms In 2024

Introduction

Welcome to our in-depth take a look at Is Umbrella Insurance coverage Definitely worth the Additional Price? A Complete Information to Defending Your Property

Video about Is Umbrella Insurance coverage Definitely worth the Additional Price? A Complete Information to Defending Your Property

Is Umbrella Insurance coverage Definitely worth the Additional Price? A Complete Information to Defending Your Property

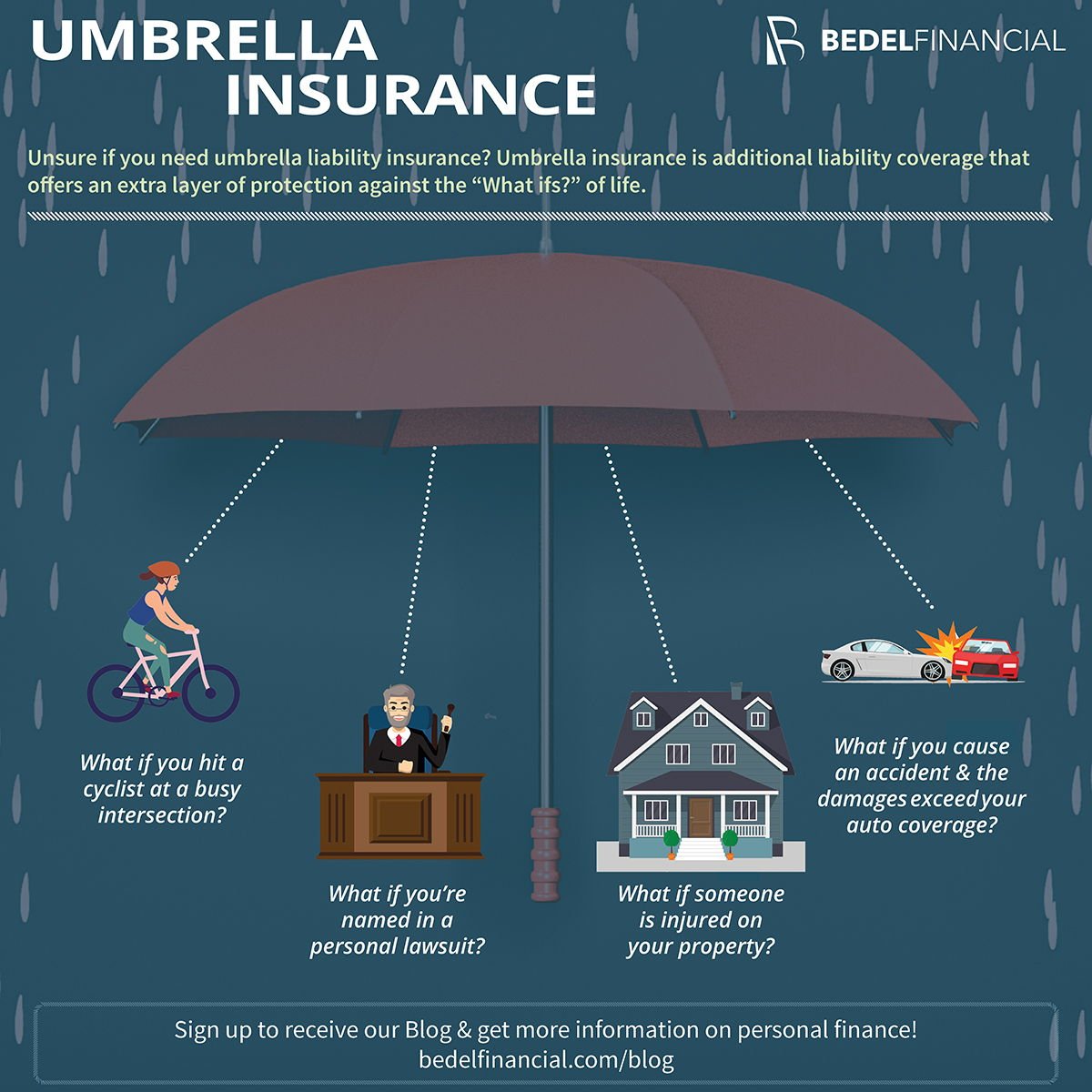

In a world of accelerating authorized dangers and potential legal responsibility, the query of whether or not umbrella insurance coverage is value the additional value is extra related than ever. This kind of insurance coverage acts as a security internet, extending protection past your present insurance policies and providing an important layer of safety in your property. However with the added value comes the query of whether or not it’s really essential. This complete information will delve into the intricacies of umbrella insurance coverage, exploring its advantages, potential drawbacks, and in the end, serving to you determine if it is the fitting alternative in your particular circumstances.

Understanding the Fundamentals: What’s Umbrella Insurance coverage?

Think about a situation the place you are concerned in an accident, and the damages exceed the bounds of your auto or house owner’s insurance coverage. That is the place umbrella insurance coverage steps in. It acts as an additional layer of protection, extending your legal responsibility safety past your present insurance policies. Consider it as a security internet, defending your property in case of a major monetary disaster.

Key Options and Advantages:

- Enhanced Legal responsibility Protection: Umbrella insurance coverage considerably will increase your legal responsibility protection limits, sometimes starting from $1 million to $10 million or extra. This implies you are coated for a wider vary of potential claims, together with these arising from accidents, accidents, property harm, and even defamation.

- Protection Prices: Along with masking damages, umbrella insurance policies usually embrace authorized protection prices, offering monetary help for legal professionals and different authorized bills incurred in defending towards a lawsuit.

- Broader Protection: Not like customary insurance policies, umbrella insurance coverage usually covers a wider vary of conditions, together with:

- Private Damage: Covers claims for bodily accidents, emotional misery, and wrongful loss of life.

- Property Injury: Protects towards claims for harm to property attributable to your negligence.

- Libel and Slander: Presents safety towards claims of defamation, together with false statements made in writing or verbally.

- Negligence: Covers conditions the place you are discovered accountable for inflicting hurt to a different individual or their property.

- Peace of Thoughts: Figuring out you may have further monetary safety can present peace of thoughts, particularly if in case you have substantial property to guard.

Who Wants Umbrella Insurance coverage?

Whereas umbrella insurance coverage might be helpful for anybody, it is significantly precious for people and households with:

- Important Property: If you happen to personal a house, precious possessions, investments, or have a excessive internet value, umbrella insurance coverage can safeguard your property within the occasion of a considerable declare.

- Excessive-Danger Actions: Participating in actions like proudly owning a ship, driving a motorbike, or internet hosting massive events will increase your threat of legal responsibility.

- Skilled Legal responsibility: Professionals like medical doctors, legal professionals, and monetary advisors could also be significantly susceptible to malpractice claims.

- Teen Drivers: Having a teenage driver will increase your threat of accidents and potential legal responsibility.

- Enterprise House owners: Even if in case you have enterprise legal responsibility insurance coverage, umbrella insurance coverage can present further safety in your private property.

Price Issues: How A lot Does Umbrella Insurance coverage Price?

The price of umbrella insurance coverage varies relying on a number of components, together with:

- Protection Limits: The upper your protection limits, the dearer the coverage.

- Underlying Insurance policies: The protection limits of your present auto and house owner’s insurance coverage insurance policies can affect the price.

- Location: Your state’s legal guidelines and the prevalence of lawsuits in your space can influence pricing.

- Danger Elements: Your private threat components, similar to driving file, age, and occupation, can have an effect on the premium.

Estimating the Price:

Typically, umbrella insurance coverage premiums are comparatively inexpensive, usually costing as little as $150 to $300 per yr for a $1 million coverage. Nevertheless, premiums can improve considerably for greater protection limits and people with greater threat profiles.

Potential Drawbacks:

Whereas umbrella insurance coverage presents important advantages, it is important to think about potential drawbacks:

- Extra Price: It is an additional expense, and that you must weigh the price towards the potential advantages.

- Restricted Protection: Umbrella insurance coverage solely covers occasions that exceed the bounds of your underlying insurance policies.

- Exclusions: Sure conditions, like intentional acts or business-related liabilities, might not be coated.

- Underinsurance: In case your underlying insurance policies have insufficient protection limits, your umbrella insurance coverage might not present enough safety.

Selecting the Proper Protection:

When deciding whether or not umbrella insurance coverage is best for you, contemplate these components:

- Your Property: Assess the worth of your property, together with your property, investments, and different precious possessions.

- Your Danger Profile: Contemplate your life-style, hobbies, and potential exposures to legal responsibility.

- Your Finances: Decide how a lot you are keen to spend on further insurance coverage protection.

- Your Present Insurance policies: Evaluation the protection limits and exclusions of your auto and house owner’s insurance coverage insurance policies.

Suggestions for Getting the Greatest Worth:

- Store Round: Examine quotes from a number of insurance coverage suppliers to seek out the most effective charges.

- Contemplate Bundling: Bundling your umbrella insurance coverage along with your different insurance policies can usually end in reductions.

- Improve Your Deductible: Selecting the next deductible can decrease your premium.

- Evaluation Your Coverage: Rigorously overview your coverage to grasp its protection limits, exclusions, and different phrases.

Conclusion: Making the Proper Resolution

In the end, the choice of whether or not to buy umbrella insurance coverage is a private one. Whereas it presents precious safety, it is important to weigh the price towards the potential advantages and your particular person circumstances. If in case you have important property to guard, a high-risk life-style, or are involved about potential legal responsibility, umbrella insurance coverage could also be a worthwhile funding. Nevertheless, if in case you have restricted property and a low threat profile, it might not be essential.

Key Takeaways:

- Umbrella insurance coverage offers an additional layer of legal responsibility safety past your present insurance policies.

- It is significantly precious for people with important property, high-risk actions, or skilled legal responsibility.

- The price of umbrella insurance coverage varies relying on components like protection limits, location, and threat profile.

- Whereas it presents advantages, potential drawbacks embrace further value, restricted protection, and exclusions.

- Contemplate your property, threat profile, funds, and present insurance policies when making your determination.

By rigorously evaluating your wants and researching your choices, you may decide whether or not umbrella insurance coverage is the fitting alternative for you and your loved ones.

Closure

We hope this text has helped you perceive every part about Is Umbrella Insurance coverage Definitely worth the Additional Price? A Complete Information to Defending Your Property. Keep tuned for extra updates!

Be certain to observe us for extra thrilling information and opinions.

Be at liberty to share your expertise with Is Umbrella Insurance coverage Definitely worth the Additional Price? A Complete Information to Defending Your Property within the remark part.

Keep knowledgeable with our subsequent updates on Is Umbrella Insurance coverage Definitely worth the Additional Price? A Complete Information to Defending Your Property and different thrilling subjects.