Knowledge Climber for Finance: Streamlining Expense and Income Monitoring

Associated Articles

- AI Automation In Data Climber: Reducing Manual Errors And Boosting Efficiency

- How AI Integration In Data Climber Enhances Predictive Analysis: A Deep Dive

- Climbing The Data Ladder: How Data Climber Can Transform Your Manufacturing Business

- Scaling The Heights Of Data: Investing In Data Climber: ROI Benefits And Implementation Costs

- The Future Of Data Climbers In Renewable Energy Projects: Scaling New Heights

Introduction

On this article, we dive into Knowledge Climber for Finance: Streamlining Expense and Income Monitoring, supplying you with a full overview of what’s to come back

Video about

Knowledge Climber for Finance: Streamlining Expense and Income Monitoring

Within the ever-evolving panorama of contemporary finance, companies are continuously searching for methods to optimize their operations, achieve deeper insights into their monetary efficiency, and make data-driven choices. This quest for effectivity and transparency has led to the emergence of highly effective instruments like "Knowledge Climber" – a revolutionary platform designed to streamline expense and income monitoring, providing a complete answer for companies of all sizes.

The Want for a Knowledge-Pushed Method:

Conventional strategies of expense and income monitoring usually depend on handbook processes, spreadsheets, and disparate techniques. This fragmented method can result in numerous challenges, together with:

- Inaccurate Knowledge: Handbook knowledge entry is vulnerable to errors, resulting in inaccurate monetary stories and hindering knowledgeable decision-making.

- Lack of Actual-Time Visibility: Counting on outdated knowledge makes it obscure present monetary efficiency and determine potential points.

- Time-Consuming Processes: Manually amassing, processing, and analyzing knowledge may be time-consuming, diverting assets from different crucial duties.

- Restricted Insights: Conventional strategies provide restricted insights into spending patterns, income streams, and different key monetary metrics.

Knowledge Climber: A Sport Changer for Finance:

Knowledge Climber emerges as a strong answer to those challenges, providing a centralized platform that automates expense and income monitoring, offering real-time insights, and empowering companies to make data-driven choices. Here is a deeper dive into its key options and advantages:

1. Automated Expense Monitoring:

Knowledge Climber revolutionizes expense monitoring by automating the method, eliminating handbook knowledge entry and related errors. It seamlessly integrates with numerous monetary techniques, together with financial institution accounts, bank cards, and accounting software program, mechanically extracting transaction knowledge. This integration eliminates the necessity for handbook reconciliation, saving worthwhile time and decreasing the danger of human error.

2. Complete Income Monitoring:

Past bills, Knowledge Climber provides sturdy income monitoring capabilities. It permits companies to observe numerous income streams, monitor gross sales efficiency, and analyze buyer habits. The platform can combine with CRM techniques, e-commerce platforms, and point-of-sale techniques, offering a unified view of income technology throughout completely different channels.

3. Actual-Time Insights and Reporting:

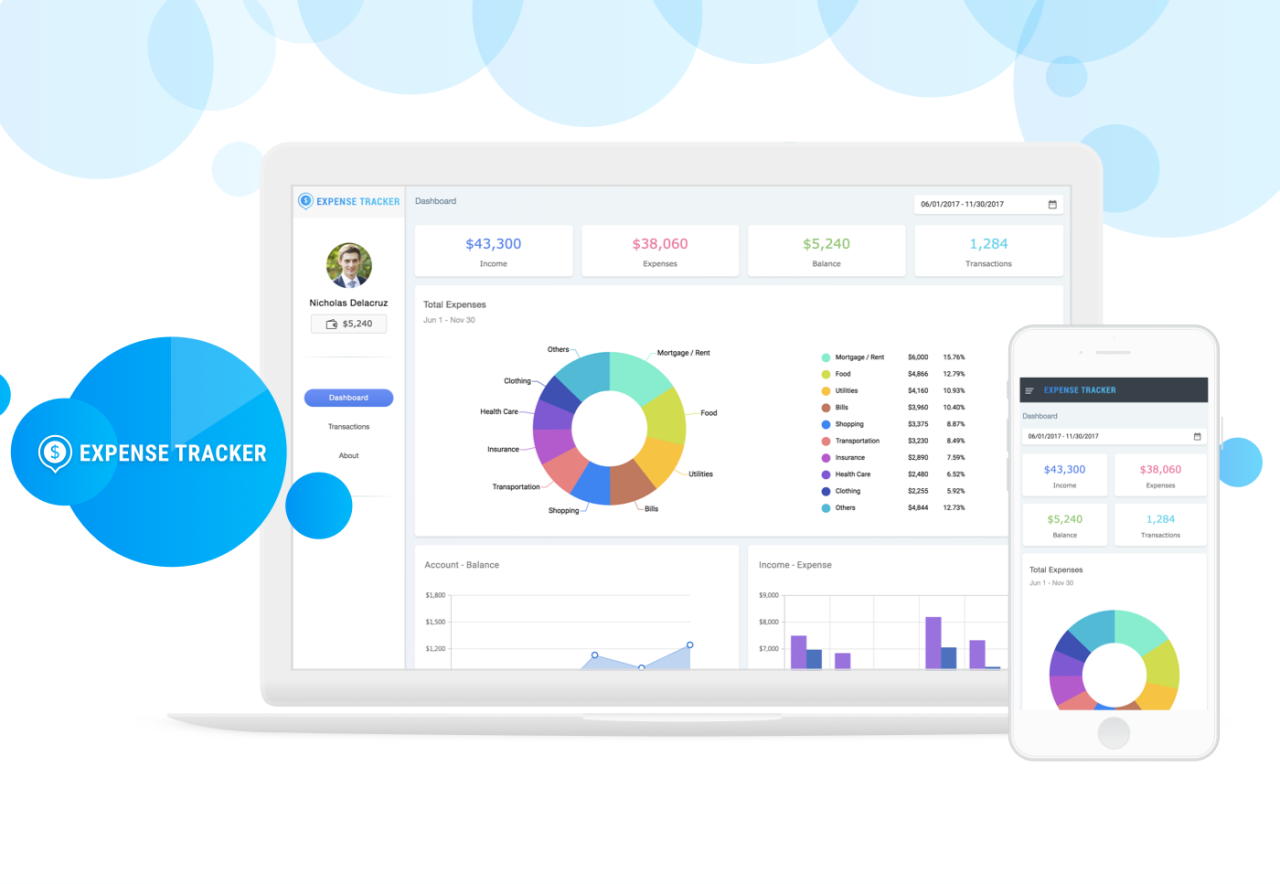

Knowledge Climber offers real-time entry to monetary knowledge, providing a dynamic and up-to-date view of bills, income, and different key metrics. This real-time visibility empowers companies to trace efficiency, determine developments, and make knowledgeable choices rapidly. The platform additionally generates customizable stories and dashboards, enabling customers to visualise monetary knowledge in significant methods and achieve actionable insights.

4. Enhanced Collaboration and Transparency:

Knowledge Climber fosters seamless collaboration inside finance groups and throughout departments. Customers can share stories, insights, and monetary knowledge with colleagues, selling transparency and facilitating knowledgeable decision-making. The platform additionally provides safe entry management, guaranteeing knowledge privateness and compliance with regulatory necessities.

5. Improved Budgeting and Forecasting:

By offering a transparent image of historic bills and income, Knowledge Climber empowers companies to develop extra correct budgets and forecasts. The platform’s knowledge evaluation capabilities allow customers to determine spending patterns, forecast future bills, and optimize useful resource allocation.

6. Streamlined Audit and Compliance:

Knowledge Climber simplifies audit and compliance processes by offering organized and readily accessible monetary knowledge. The platform’s audit path characteristic ensures traceability of transactions, facilitating compliance with related rules and enhancing transparency.

7. Integration with Current Programs:

Knowledge Climber seamlessly integrates with numerous present monetary techniques, together with accounting software program, CRM platforms, and cost gateways. This integration streamlines workflows, eliminates knowledge silos, and ensures a unified view of economic knowledge.

8. Consumer-Pleasant Interface:

Knowledge Climber boasts a user-friendly interface, making it accessible to customers with various ranges of technical experience. The platform’s intuitive design, clear navigation, and complete assist assets guarantee a clean and environment friendly person expertise.

The Advantages of Knowledge Climber for Finance:

The implementation of Knowledge Climber brings a mess of advantages to companies, considerably impacting their monetary operations and total efficiency:

- Elevated Effectivity: Automation of expense and income monitoring frees up worthwhile time for finance groups, permitting them to deal with strategic initiatives and evaluation.

- Improved Accuracy: Knowledge Climber eliminates handbook knowledge entry, decreasing the danger of errors and guaranteeing correct monetary reporting.

- Enhanced Visibility: Actual-time entry to monetary knowledge offers a transparent image of efficiency, enabling companies to determine developments and make well timed choices.

- Knowledge-Pushed Resolution-Making: Knowledge Climber empowers companies to make knowledgeable choices based mostly on correct, real-time knowledge, main to raised useful resource allocation, price optimization, and improved profitability.

- Enhanced Collaboration: The platform facilitates collaboration amongst finance groups and throughout departments, selling transparency and shared understanding of economic knowledge.

- Improved Compliance: Knowledge Climber simplifies audit and compliance processes, guaranteeing traceability of transactions and compliance with related rules.

- Lowered Prices: By streamlining processes and automating duties, Knowledge Climber reduces administrative prices related to expense and income monitoring.

- Elevated Productiveness: Knowledge Climber empowers finance groups to work extra effectively, liberating up time for strategic initiatives and value-adding actions.

Implementation and Adoption:

Implementing Knowledge Climber is a simple course of, requiring minimal technical experience. The platform provides complete onboarding help, together with coaching assets and devoted buyer help. The implementation usually entails:

- Knowledge Integration: Connecting Knowledge Climber with present monetary techniques, corresponding to financial institution accounts, bank cards, accounting software program, and CRM platforms.

- Consumer Configuration: Defining person roles, permissions, and entry ranges to make sure knowledge safety and compliance.

- Knowledge Migration: Importing historic knowledge into the platform for a complete view of economic efficiency.

- Coaching and Assist: Offering customers with complete coaching on the platform’s options and functionalities.

Case Research and Actual-World Examples:

Knowledge Climber has confirmed its worth in numerous industries and enterprise sizes. Listed below are some real-world examples highlighting its influence:

- Small Enterprise: A small retail enterprise utilizing Knowledge Climber to trace bills and income from a number of gross sales channels, together with on-line and in-store purchases. The platform offered real-time insights into gross sales developments, enabling the enterprise to optimize stock administration and alter advertising methods for elevated profitability.

- Mid-Sized Manufacturing Firm: A producing firm utilizing Knowledge Climber to automate expense monitoring for its international operations. The platform streamlined expense reporting, lowered errors, and offered a unified view of spending throughout completely different departments and places.

- Massive Enterprise: A big monetary companies firm utilizing Knowledge Climber to trace income from numerous funding services and products. The platform enabled the corporate to research buyer habits, determine progress alternatives, and optimize pricing methods.

The Way forward for Knowledge Climber:

Knowledge Climber is consistently evolving, incorporating new options and functionalities to reinforce its capabilities and handle the ever-changing wants of companies. Future developments embrace:

- Superior Analytics and Machine Studying: Incorporating machine studying algorithms to supply predictive analytics, determine spending anomalies, and provide proactive suggestions for price optimization.

- Integration with Rising Applied sciences: Seamless integration with blockchain know-how, synthetic intelligence (AI), and different rising applied sciences to additional automate processes, improve safety, and unlock new insights.

- Personalised Consumer Experiences: Tailoring the platform’s interface and options to fulfill the particular wants of particular person customers and departments.

Conclusion:

Knowledge Climber is a recreation changer for finance, empowering companies to streamline expense and income monitoring, achieve deeper insights into their monetary efficiency, and make data-driven choices. Its automated processes, real-time visibility, complete reporting, and seamless integration with present techniques make it an indispensable instrument for companies of all sizes. Because the monetary panorama continues to evolve, Knowledge Climber is poised to play an more and more crucial position in serving to companies navigate complexity, obtain monetary effectivity, and drive sustainable progress.

Additional Exploration:

- Knowledge Climber Web site: Go to the official Knowledge Climber web site for complete details about the platform’s options, advantages, and pricing.

- Trade Publications: Discover trade publications and articles that debate the influence of data-driven finance and the position of expense and income monitoring instruments.

- Finance Professionals: Community with finance professionals and trade consultants to assemble insights and greatest practices for leveraging knowledge analytics in monetary administration.

- On-line Boards and Communities: Have interaction in on-line boards and communities devoted to finance and know-how to debate developments, challenges, and options associated to data-driven monetary operations.

By embracing Knowledge Climber and embracing a data-driven method to finance, companies can unlock new ranges of effectivity, transparency, and profitability, paving the best way for a brighter monetary future.

Closure

We hope this text has helped you perceive all the things about Knowledge Climber for Finance: Streamlining Expense and Income Monitoring. Keep tuned for extra updates!

Don’t overlook to examine again for the newest information and updates on Knowledge Climber for Finance: Streamlining Expense and Income Monitoring!

Be at liberty to share your expertise with Knowledge Climber for Finance: Streamlining Expense and Income Monitoring within the remark part.

Preserve visiting our web site for the newest developments and critiques.