Legal responsibility Insurance coverage for Contractors: Safeguarding Your Enterprise from the Sudden

Associated Articles

- The Final Information To Skilled Legal responsibility Insurance coverage: Defending Your Enterprise And Your Repute

- How to Choose the Right Insurance for Your Home-Based Craft Business

- Understanding The Fundamentals Of Common Legal responsibility Insurance coverage: Your Protect In opposition to The Sudden

- The Significance of Insurance coverage for Defending Your Musical Devices

- The Way forward for Insurance coverage: How AI and Expertise Are Altering the Business

Introduction

Be part of us as we discover Legal responsibility Insurance coverage for Contractors: Safeguarding Your Enterprise from the Sudden, full of thrilling updates

Video about Legal responsibility Insurance coverage for Contractors: Safeguarding Your Enterprise from the Sudden

Legal responsibility Insurance coverage for Contractors: Safeguarding Your Enterprise from the Sudden

The development business is a dynamic and demanding area, full of inherent dangers. From navigating advanced initiatives to managing numerous groups, contractors face a myriad of challenges that may rapidly flip into authorized and monetary complications. That is the place legal responsibility insurance coverage is available in, appearing as an important security web for your small business, defending you from potential lawsuits and monetary burdens.

This complete information will delve into the intricacies of legal responsibility insurance coverage for contractors, offering you with a transparent understanding of the several types of protection, their significance, and the way to decide on the best coverage to your particular wants. We’ll additionally discover the advantages of getting enough insurance coverage, the potential penalties of not being insured, and one of the best practices for making certain you are totally protected.

Understanding the Dangers: Why Contractors Want Legal responsibility Insurance coverage

Contractors function in an setting teeming with potential dangers, each on and off the job web site. A single accident, a minor oversight, or perhaps a dissatisfied shopper can set off a lawsuit, doubtlessly resulting in vital monetary losses and jeopardizing your small business.

Here is a breakdown of the frequent dangers contractors face that necessitate legal responsibility insurance coverage:

- Property Harm: Accidents occur, and your work can generally result in harm to property, whether or not it is the shopper’s constructing, neighboring constructions, and even your personal gear.

- Bodily Harm: Accidents to staff, purchasers, or members of the general public can happen throughout development initiatives, resulting in medical bills, misplaced wages, and potential lawsuits.

- Skilled Negligence: Errors occur, and generally they can lead to monetary losses to your purchasers. In case your negligence causes monetary hurt, you might be held liable.

- Product Legal responsibility: If you happen to manufacture or provide supplies for a undertaking and people supplies trigger hurt or harm, you might be held liable.

- Environmental Harm: Building initiatives can generally result in environmental harm, equivalent to soil contamination or water air pollution, which can lead to pricey cleanup and authorized motion.

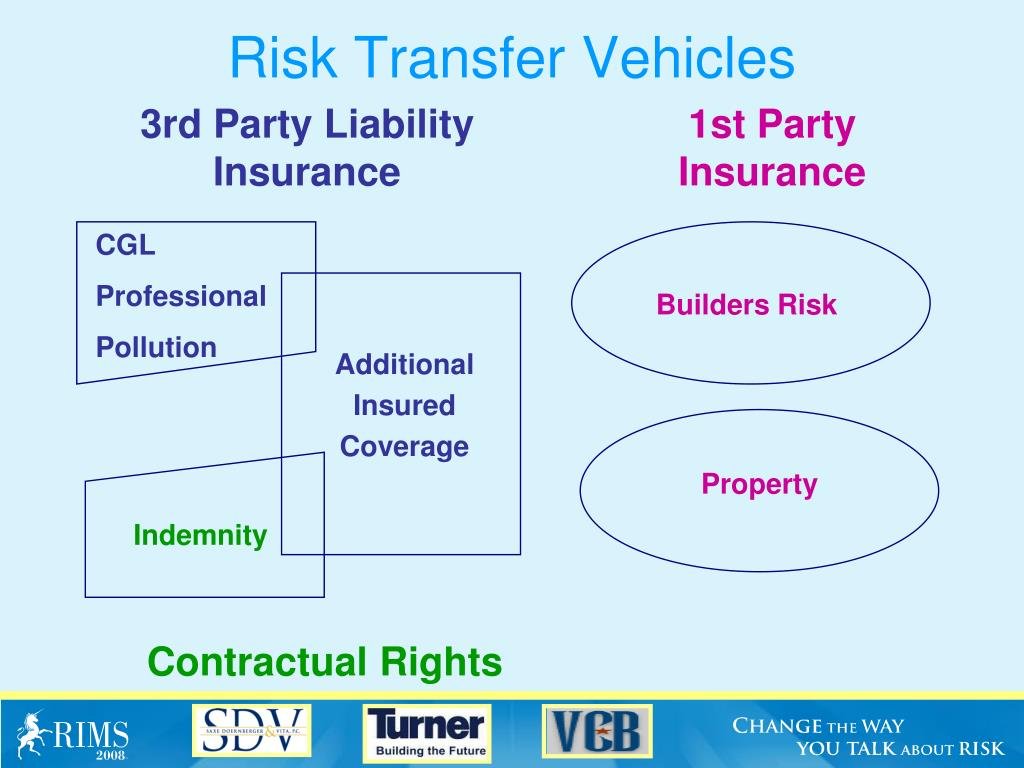

Forms of Legal responsibility Insurance coverage for Contractors

A number of varieties of legal responsibility insurance coverage insurance policies are particularly designed to guard contractors from the dangers outlined above. Here is an in depth take a look at the commonest varieties:

1. Common Legal responsibility Insurance coverage:

That is the cornerstone of legal responsibility insurance coverage for contractors, offering broad safety in opposition to a variety of dangers. It covers claims associated to:

- Bodily Harm: Covers medical bills, misplaced wages, and ache and struggling for accidents brought about to 3rd events in your job web site.

- Property Harm: Covers harm to property belonging to others, together with buildings, gear, and private belongings.

- Private and Promoting Harm: Protects you from claims arising from libel, slander, copyright infringement, or false promoting.

2. Employees’ Compensation Insurance coverage:

This coverage is essential for contractors who make use of staff. It covers medical bills, misplaced wages, and rehabilitation prices for workers injured on the job. It additionally protects you from lawsuits filed by injured staff.

3. Skilled Legal responsibility Insurance coverage (Errors & Omissions):

Such a insurance coverage is designed to guard contractors in opposition to claims arising from skilled negligence, equivalent to design flaws, defective set up, or incorrect recommendation. It’s significantly essential for contractors who present specialised companies or work on advanced initiatives.

4. Business Auto Insurance coverage:

If you happen to use automobiles for your small business, industrial auto insurance coverage is important. It covers harm to your automobiles, accidents to others, and property harm brought on by your automobiles.

5. Umbrella Legal responsibility Insurance coverage:

This coverage gives further protection on prime of your current legal responsibility insurance policies. It acts as a security web, defending you from claims exceeding the boundaries of your different insurance policies.

6. Builders Threat Insurance coverage:

This specialised insurance coverage protects your development initiatives throughout the constructing course of. It covers harm to the constructing itself, supplies, and gear because of hearth, theft, vandalism, or different perils.

Selecting the Proper Legal responsibility Insurance coverage Coverage

The kind and stage of legal responsibility insurance coverage you want will rely upon a number of elements, together with:

- The dimensions and scope of your initiatives: Bigger and extra advanced initiatives would require larger ranges of protection.

- The kind of work you carry out: Specialised contractors might have further protection, equivalent to skilled legal responsibility insurance coverage.

- Your location: State legal guidelines and laws can differ concerning insurance coverage necessities.

- Your monetary state of affairs: You must decide the quantity of protection you possibly can afford.

The Advantages of Having Legal responsibility Insurance coverage

- Monetary Safety: Legal responsibility insurance coverage gives a monetary security web, shielding you from the possibly devastating prices of lawsuits and settlements.

- Peace of Thoughts: Understanding you’ve got enough insurance coverage may give you peace of thoughts and permit you to deal with operating your small business.

- Shopper Confidence: Shoppers usually tend to belief contractors who’re insured, demonstrating your dedication to security and professionalism.

- Enterprise Continuity: Legal responsibility insurance coverage might help you recuperate from a serious incident, stopping monetary destroy and permitting you to proceed working.

The Penalties of Not Having Legal responsibility Insurance coverage

- Monetary Smash: A single lawsuit can wipe out your financial savings and pressure you to shut your small business.

- Authorized Charges: Even for those who win a lawsuit, you may seemingly incur vital authorized charges.

- Status Harm: A lawsuit can harm your status and make it tough to draw new purchasers.

- Private Legal responsibility: If you do not have enough insurance coverage, you might be held personally accountable for damages, placing your private belongings in danger.

Greatest Practices for Legal responsibility Insurance coverage

- Work with a good insurance coverage dealer: A educated dealer might help you discover the best insurance policies and guarantee you’ve got enough protection.

- Assessment your coverage usually: Your insurance coverage wants could change as your small business grows or your initiatives change into extra advanced.

- Preserve correct data: Hold detailed data of your initiatives, contracts, and insurance coverage insurance policies.

- Keep knowledgeable about business traits: Adjustments in laws, security requirements, and authorized precedents can influence your insurance coverage wants.

- Implement security protocols: A powerful security tradition might help stop accidents and cut back your danger of lawsuits.

Conclusion:

Legal responsibility insurance coverage is a necessary funding for contractors, offering essential safety from the monetary and authorized dangers inherent within the development business. By understanding the several types of protection, selecting the best insurance policies, and sustaining greatest practices, you possibly can guarantee your small business is well-protected from the surprising. Investing in legal responsibility insurance coverage is not only a matter of compliance; it is a good enterprise resolution that safeguards your monetary future and lets you deal with constructing a profitable and sustainable enterprise.

Closure

We hope this text has helped you perceive every part about Legal responsibility Insurance coverage for Contractors: Safeguarding Your Enterprise from the Sudden. Keep tuned for extra updates!

Ensure that to observe us for extra thrilling information and opinions.

We’d love to listen to your ideas about Legal responsibility Insurance coverage for Contractors: Safeguarding Your Enterprise from the Sudden—depart your feedback under!

Hold visiting our web site for the newest traits and opinions.