Leveraging Your Residence Mortgage for Funding Property: A Information to Sensible Monetary Strikes

Associated Articles

- Refinance Your Dwelling Mortgage: Prime Methods For 2024

- Refinance Your FHA Mortgage: Unlock Decrease Charges And Save Cash

- Every little thing You Want To Know About Adjustable-Fee Mortgages (ARMs): Your Information To Navigating The Shifting Curiosity Panorama

- Unlocking Your House’s Potential: Prime Causes To Refinance Your Mortgage

- Discovering The Proper Match: Finest House Mortgage Packages For Low-Revenue Households

Introduction

On this article, we dive into Leveraging Your Residence Mortgage for Funding Property: A Information to Sensible Monetary Strikes, providing you with a full overview of what’s to come back

Video about Leveraging Your Residence Mortgage for Funding Property: A Information to Sensible Monetary Strikes

Leveraging Your Residence Mortgage for Funding Property: A Information to Sensible Monetary Strikes

Proudly owning a house is a cornerstone of the American Dream, however for a lot of, it is just the start. The need to construct wealth, diversify investments, and obtain monetary freedom typically leads people to discover the world of actual property funding. And what higher option to get began than by leveraging your current house mortgage?

This text delves into the intricacies of utilizing your private home mortgage to buy an funding property, masking every little thing from eligibility standards and financing choices to potential advantages and dangers. We’ll equip you with the information and insights to make knowledgeable choices and navigate the thrilling but complicated world of actual property investing.

Understanding the Fundamentals: Residence Loans and Funding Properties

Earlier than we dive into the specifics, let’s make clear some important terminology:

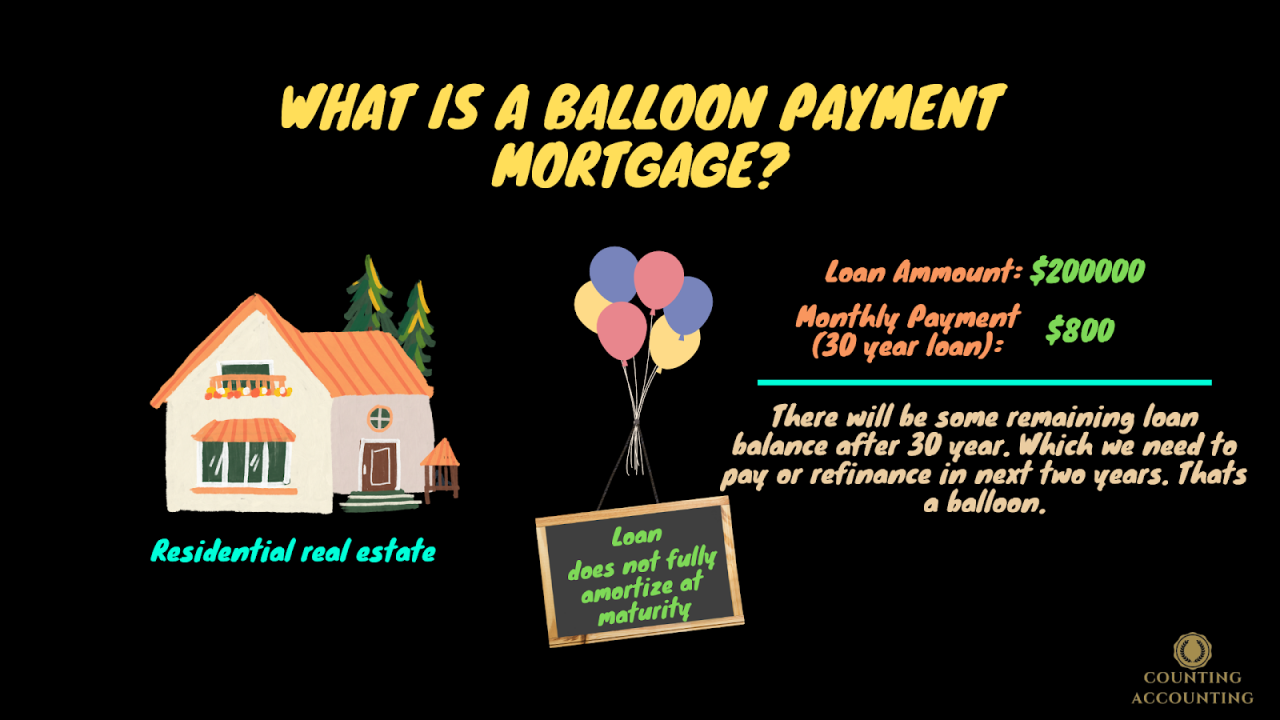

- Residence Mortgage: A mortgage mortgage secured by your major residence, usually used for buying, refinancing, or house enchancment tasks.

- Funding Property: A property acquired for the aim of producing rental revenue, appreciation, or each. It may be a single-family house, multi-family unit, industrial constructing, and even land.

- Leveraging: Utilizing current belongings or sources to amass new belongings or alternatives. On this context, leveraging your private home mortgage means utilizing its fairness to finance an funding property.

The Attraction of Utilizing a Residence Mortgage for Funding

Why would anybody select to make use of their house mortgage to purchase an funding property? The reply lies within the potential advantages:

- Decrease Curiosity Charges: Residence loans typically include decrease rates of interest than conventional funding property loans. This interprets to decrease month-to-month funds and doubtlessly increased returns in your funding.

- Entry to Fairness: Your property’s fairness represents the portion of its worth you’ve got paid off. Tapping into this fairness permits you to leverage your current funding to amass a brand new property while not having a big down fee.

- Tax Benefits: Rental revenue from an funding property will be offset by sure bills, together with mortgage curiosity funds. This may result in vital tax financial savings.

- Diversification: Actual property investments can diversify your portfolio, decreasing your total danger publicity. By including an funding property to your combine, you possibly can doubtlessly mitigate the influence of market fluctuations.

The Potential Dangers: A Actuality Examine

Whereas utilizing a house mortgage for funding presents engaging benefits, it is essential to acknowledge the potential dangers:

- Elevated Debt: Taking over further debt can pressure your funds, particularly in case your funding property does not carry out as anticipated.

- Detrimental Money Movement: Rental revenue might not cowl all bills, together with mortgage funds, property taxes, upkeep, and insurance coverage. This may result in monetary losses and stress.

- Market Volatility: Actual property values can fluctuate, doubtlessly lowering your funding’s price.

- Property Administration Challenges: Managing a rental property will be time-consuming and demanding, requiring information of tenant legal guidelines, upkeep, and monetary administration.

Eligibility Standards: Who Can Leverage Their Residence Mortgage?

Not everyone seems to be eligible to make use of their house mortgage for funding property purchases. Lenders usually have particular standards:

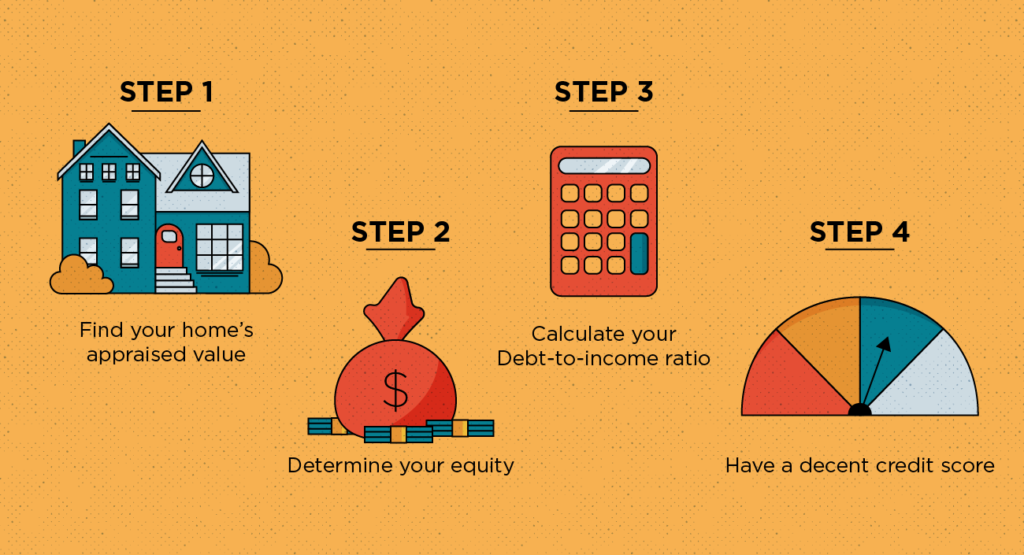

- Credit score Rating: You will want a powerful credit score rating, typically above 620, to qualify for favorable mortgage phrases.

- Debt-to-Revenue Ratio (DTI): Your DTI, calculated by dividing your month-to-month debt funds by your gross month-to-month revenue, must be inside acceptable limits.

- Mortgage-to-Worth (LTV) Ratio: The LTV ratio, calculated by dividing the mortgage quantity by the property’s worth, determines the required down fee. Lenders might have completely different LTV necessities for funding properties.

- Occupancy Necessities: Some lenders might require you to occupy your major residence for a sure interval earlier than permitting you to make use of its fairness for funding.

Financing Choices: Selecting the Proper Path

A number of financing choices exist for utilizing your private home mortgage to buy an funding property:

- Money-Out Refinance: This includes refinancing your current house mortgage for a bigger quantity, permitting you to entry the distinction in money. Nevertheless, it could possibly enhance your month-to-month funds and total debt.

- Residence Fairness Line of Credit score (HELOC): A HELOC supplies a revolving line of credit score secured by your private home’s fairness. You possibly can borrow as wanted, however rates of interest are usually variable.

- Residence Fairness Mortgage: A house fairness mortgage supplies a lump sum of money primarily based on your private home’s fairness, with fastened rates of interest. It is much like a second mortgage.

- Funding Property Mortgage: A conventional mortgage particularly designed for funding properties. Whereas rates of interest could also be increased than house loans, these loans supply flexibility by way of down fee necessities and occupancy guidelines.

Navigating the Course of: Step-by-Step Information

This is a step-by-step information that can assist you navigate the method of utilizing your private home mortgage for funding:

- Assess Your Funds: Calculate your private home’s fairness, analyze your credit score rating, and evaluation your DTI. Decide your price range and the quantity you possibly can comfortably borrow.

- Analysis Funding Alternatives: Establish potential funding properties that align along with your monetary objectives, danger tolerance, and market information. Take into account location, rental demand, and potential appreciation.

- Discover Financing Choices: Evaluate rates of interest, mortgage phrases, and costs for various financing choices, together with cash-out refinance, HELOC, house fairness mortgage, and funding property loans.

- Get Pre-Permitted: Get hold of pre-approval from a lender to grasp your borrowing energy and streamline the acquisition course of.

- Make an Provide: As soon as you’ve got discovered an acceptable property, submit a suggestion and negotiate the acquisition value.

- Safe Financing: As soon as your supply is accepted, work along with your lender to finalize the mortgage phrases and full the mandatory paperwork.

- Shut the Deal: Attend the closing assembly and signal the ultimate paperwork to finish the property buy.

Ideas for Success: Maximizing Your Funding

To maximise your possibilities of success when utilizing a house mortgage for funding, take into account the following pointers:

- Select the Proper Property: Totally analysis the market and choose a property with sturdy rental demand, potential for appreciation, and minimal upkeep wants.

- Display screen Tenants Fastidiously: Conduct thorough background checks, confirm references, and set up clear lease agreements to mitigate potential dangers.

- Handle Your Funds Properly: Monitor bills, keep correct information, and develop a price range to make sure your funding stays worthwhile.

- Search Skilled Recommendation: Seek the advice of with an actual property agent, property supervisor, accountant, and lawyer to achieve skilled steering and reduce potential pitfalls.

Conclusion: A Highly effective Instrument for Constructing Wealth

Utilizing a house mortgage to purchase an funding property generally is a highly effective device for constructing wealth and diversifying your portfolio. Nevertheless, it is not with out its dangers. By fastidiously contemplating your monetary scenario, understanding the potential advantages and downsides, and following the steps outlined on this information, you possibly can enhance your possibilities of success and unlock the potential of actual property funding.

Bear in mind, accountable monetary planning and a well-defined funding technique are essential for reaching your objectives and maximizing your returns.

Key phrases:

- Residence Mortgage

- Funding Property

- Actual Property Funding

- Fairness

- Leverage

- Money-Out Refinance

- HELOC

- Residence Fairness Mortgage

- Funding Property Mortgage

- Rental Revenue

- Appreciation

- Diversification

- Danger

- Monetary Planning

- Monetary Freedom

- Property Administration

- Tenant Screening

- Lease Settlement

- Budgeting

- Monetary Planning

- Actual Property Market

- Market Evaluation

- Property Valuation

- Funding Technique

- ROI (Return on Funding)

- Property Administration

- Property Upkeep

- Tax Benefits

- Mortgage Curiosity Deduction

- Capital Features

- Depreciation

- Monetary Planning

- Monetary Targets

- Monetary Safety

- Monetary Literacy

- Wealth Constructing

- Monetary Independence

- Passive Revenue

- Actual Property Investing Ideas

- Actual Property Investing Methods

- Actual Property Market Developments

- Actual Property Investing Assets

- Actual Property Investing Schooling

- Actual Property Investing Books

- Actual Property Investing Podcasts

- Actual Property Investing Communities

Closure

Thanks for studying! Stick with us for extra insights on Leveraging Your Residence Mortgage for Funding Property: A Information to Sensible Monetary Strikes.

Be certain that to observe us for extra thrilling information and critiques.

Be at liberty to share your expertise with Leveraging Your Residence Mortgage for Funding Property: A Information to Sensible Monetary Strikes within the remark part.

Keep knowledgeable with our subsequent updates on Leveraging Your Residence Mortgage for Funding Property: A Information to Sensible Monetary Strikes and different thrilling matters.