Navigating the Highway to Auto Mortgage Pre-Approval: Do’s and Don’ts for a Easy Journey

Associated Articles

- Unlocking The Secrets and techniques To Your Auto Mortgage Cost: A Complete Information To Correct Calculation

- Unlocking The Finest Auto Mortgage Phrases: A Complete Information To Negotiating Your Manner To Financial savings

- High 10 Ideas For Getting Permitted For An Auto Mortgage In 2024: Drive Away With Confidence

- High 5 On-line Auto Mortgage Lenders To Take into account This Yr: Your Information To Inexpensive Financing

- What Are Auto Mortgage GAP Insurance coverage And Why You Would possibly Want It?

Introduction

Uncover the most recent particulars about Navigating the Highway to Auto Mortgage Pre-Approval: Do’s and Don’ts for a Easy Journey on this complete information.

Video about

Navigating the Highway to Auto Mortgage Pre-Approval: Do’s and Don’ts for a Easy Journey

The thrill of shopping for a brand new automotive is commonly overshadowed by the daunting process of securing financing. Whereas your entire course of can really feel overwhelming, one essential step that may considerably ease the journey is acquiring pre-approval for an auto mortgage. This pre-approval acts as your monetary passport, permitting you to confidently store in your dream automotive figuring out precisely what you possibly can afford.

However like all journey, navigating the trail to auto mortgage pre-approval requires some information and strategic planning. This complete information will equip you with the important do’s and don’ts to make sure a clean and profitable pre-approval course of.

Do’s:

1. Test Your Credit score Rating: Your credit score rating is the inspiration upon which your mortgage approval hinges. Earlier than even stepping foot in a dealership, take the time to test your credit score rating from all three main credit score bureaus: Experian, Equifax, and TransUnion.

- Why it issues: The next credit score rating interprets to raised rates of interest and extra favorable mortgage phrases. A decrease credit score rating might end in larger rates of interest, a smaller mortgage quantity, and even outright rejection.

- The best way to test: You’ll be able to entry your credit score rating by means of free providers like Credit score Karma, Credit score Sesame, or straight from the credit score bureaus themselves.

2. Enhance Your Credit score Rating (If Wanted): In case your credit score rating is not the place you’d prefer it to be, do not despair! There are a number of steps you possibly can take to enhance your credit score rating earlier than making use of for pre-approval.

- Pay your payments on time: Late funds are a significant credit score rating killer. Arrange automated funds or reminders to make sure all of your payments are paid promptly.

- Decrease your credit score utilization: Credit score utilization refers back to the quantity of credit score you are utilizing in comparison with your whole out there credit score. Purpose to maintain this ratio beneath 30% for optimum credit score rating well being.

- Keep away from opening new accounts: Every time you open a brand new credit score account, a tough inquiry is added to your credit score report, which may quickly decrease your rating.

- Dispute errors in your credit score report: Test your credit score report for any inaccuracies and dispute them with the credit score bureaus.

3. Collect Your Monetary Paperwork: Earlier than making use of for pre-approval, collect all the required monetary paperwork. This can streamline the applying course of and forestall delays.

- Important paperwork:

- Proof of revenue: Pay stubs, tax returns, W-2s, or financial institution statements.

- Proof of residence: Utility payments, lease settlement, or mortgage assertion.

- Social Safety quantity: Your Social Safety quantity is required for verification functions.

- Driver’s license: Your driver’s license will likely be used for identification.

4. Store Round for Lenders: Similar to you would not purchase the primary automotive you see, do not accept the primary lender that gives you pre-approval. Examine rates of interest and mortgage phrases from a number of lenders to make sure you’re getting the perfect deal.

- On-line lenders: On-line lenders like LendingTree, SoFi, and LightStream provide aggressive charges and a handy utility course of.

- Credit score unions: Credit score unions typically provide decrease rates of interest and personalised service in comparison with conventional banks.

- Banks: Conventional banks are another choice for auto mortgage pre-approval.

- Dealership financing: Whereas dealerships might provide pre-approval, their charges are sometimes larger than these supplied by impartial lenders.

5. Take into account a Pre-Approval with a Co-Signer: In case you have a decrease credit score rating or restricted credit score historical past, think about making use of for pre-approval with a co-signer. A co-signer with good credit score can assist you safe a mortgage with higher phrases.

- Co-signer tasks: The co-signer is legally obligated to repay the mortgage in the event you default.

- Influence on co-signer’s credit score: The mortgage will seem on the co-signer’s credit score report, probably affecting their credit score rating.

6. Perceive the Pre-Approval Course of: Auto mortgage pre-approval isn’t a assured mortgage approval. It is merely a preliminary evaluation of your creditworthiness. The ultimate mortgage approval will likely be primarily based on the particular automobile you select.

7. Do not Overlook the Nice Print: Earlier than accepting a pre-approval provide, fastidiously overview the phrases and circumstances. Take note of the rate of interest, mortgage time period, and any related charges.

8. Keep Knowledgeable About Your Credit score Rating: As soon as you have been pre-approved, proceed to watch your credit score rating. Any important modifications in your credit score rating might have an effect on the ultimate mortgage approval.

Don’ts:

1. Do not Apply for Pre-Approval With out Checking Your Credit score: Keep away from the frustration of being denied pre-approval by checking your credit score rating earlier than making use of.

2. Do not Apply for Pre-Approval at Each Dealership: Every time you apply for pre-approval, a tough inquiry is added to your credit score report, which may quickly decrease your rating. Restrict your functions to a couple respected lenders.

3. Do not Overlook the Mortgage Time period: An extended mortgage time period might end in decrease month-to-month funds, however it can additionally result in larger total curiosity funds. Select a mortgage time period that matches your monetary state of affairs.

4. Do not Ignore the APR: The Annual Share Fee (APR) displays the full price of borrowing. Examine APRs from totally different lenders to make sure you’re getting the perfect deal.

5. Do not Assume a Pre-Approval is a Assure: Bear in mind, pre-approval isn’t a assured mortgage approval. The ultimate mortgage approval will depend upon the particular automobile you select and the lender’s evaluation of your monetary state of affairs.

6. Do not Delay in Making use of for Pre-Approval: Apply for pre-approval early in your automotive shopping for journey. This gives you time to buy round for the perfect deal and keep away from any last-minute surprises.

7. Do not Be Afraid to Negotiate: Upon getting pre-approval, you’ve gotten leverage to negotiate the perfect worth on the automobile. Use your pre-approval as a bargaining chip to safe a aggressive deal.

8. Do not Neglect About Insurance coverage: Earlier than driving off the lot, guarantee you’ve gotten ample insurance coverage protection. Your lender might require you to have sure varieties of insurance coverage, reminiscent of collision and complete protection.

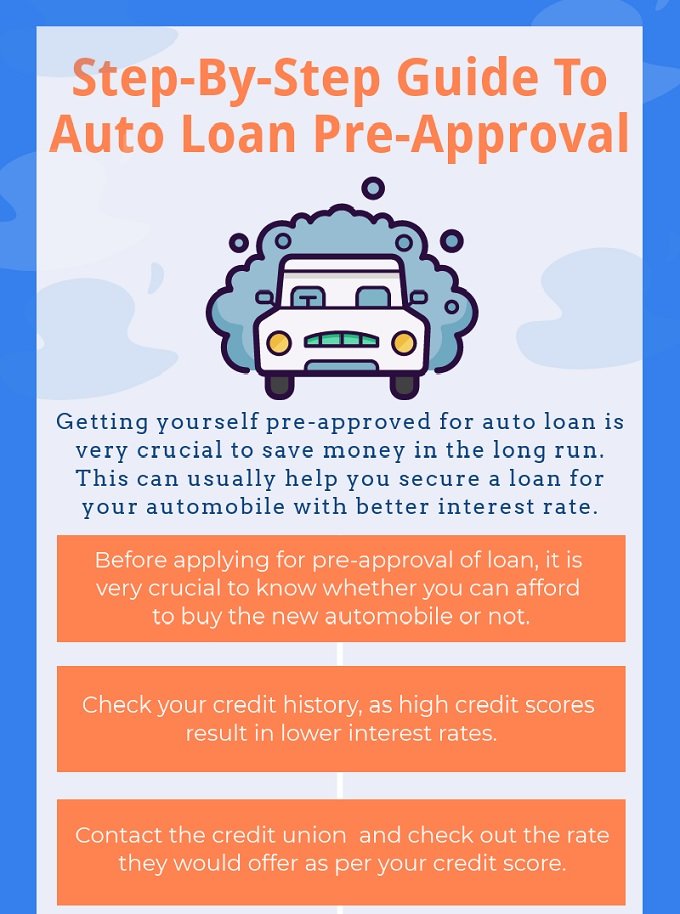

Navigating the Pre-Approval Course of: A Step-by-Step Information

- Test your credit score rating: Get hold of your credit score rating from all three main credit score bureaus.

- Enhance your credit score rating (if wanted): Take steps to enhance your credit score rating earlier than making use of for pre-approval.

- Collect your monetary paperwork: Compile all needed monetary paperwork, together with proof of revenue, residence, and your Social Safety quantity.

- Store round for lenders: Examine rates of interest and mortgage phrases from a number of lenders, together with on-line lenders, credit score unions, and banks.

- Apply for pre-approval: Full the pre-approval utility with the lender(s) of your selection.

- Evaluate the pre-approval provide: Fastidiously overview the phrases and circumstances of the pre-approval provide, together with the rate of interest, mortgage time period, and any related charges.

- Negotiate the automobile worth: Use your pre-approval as leverage to barter the perfect worth on the automobile.

- Finalize the mortgage: As soon as you have chosen a automobile and negotiated a worth, finalize the mortgage along with your chosen lender.

The Advantages of Auto Mortgage Pre-Approval:

- Confidence in your price range: Figuring out how a lot you possibly can borrow permits you to store for vehicles inside your worth vary.

- Quicker automotive shopping for course of: Pre-approval streamlines the financing course of, permitting you to shut the deal shortly.

- Higher rates of interest: Lenders typically provide decrease rates of interest to pre-approved debtors.

- Negotiating energy: Pre-approval provides you leverage to barter a greater worth on the automobile.

Pre-Approval vs. Mortgage Approval: What is the Distinction?

Pre-approval is a preliminary evaluation of your creditworthiness, whereas mortgage approval is the ultimate affirmation that you just qualify for the mortgage. Pre-approval is predicated in your credit score historical past and revenue, whereas mortgage approval is predicated on the particular automobile you select and the lender’s evaluation of your monetary state of affairs.

Ideas for Discovering the Finest Auto Mortgage Deal:

- Store round for lenders: Examine rates of interest and mortgage phrases from a number of lenders.

- Negotiate the rate of interest: Do not be afraid to barter the rate of interest with the lender.

- Take into account a shorter mortgage time period: A shorter mortgage time period will end in decrease total curiosity funds.

- Ask about any related charges: Inquire about any origination charges, utility charges, or different related prices.

Conclusion:

Auto mortgage pre-approval is an important step within the automotive shopping for course of. By following the do’s and don’ts outlined on this information, you possibly can guarantee a clean and profitable pre-approval expertise. Bear in mind, taking the time to analysis and evaluate choices will in the end result in a greater mortgage deal and a extra pleasing automotive shopping for journey.

Key phrases:

- Auto mortgage pre-approval

- Credit score rating

- Rate of interest

- Mortgage time period

- APR

- Pre-approval course of

- Mortgage approval

- Monetary paperwork

- Lender

- Dealership

- Negotiation

- Automobile shopping for

- Credit score historical past

- Revenue

- Co-signer

- Credit score utilization

- Onerous inquiry

- Mortgage charges

- Insurance coverage

- Funds

- Monetary state of affairs

- Purchasing round

- Comparability

- Deal

- Journey

- Expertise

Closure

Thanks for studying! Stick with us for extra insights on Navigating the Highway to Auto Mortgage Pre-Approval: Do’s and Don’ts for a Easy Journey.

Ensure to comply with us for extra thrilling information and critiques.

We’d love to listen to your ideas about Navigating the Highway to Auto Mortgage Pre-Approval: Do’s and Don’ts for a Easy Journey—go away your feedback beneath!

Keep knowledgeable with our subsequent updates on Navigating the Highway to Auto Mortgage Pre-Approval: Do’s and Don’ts for a Easy Journey and different thrilling matters.