Navigating the House Mortgage Closing Course of: A Complete Information for Patrons

Associated Articles

- Standard Vs. FHA Loans: Which Is Finest?

- The Affect Of Your Credit score Rating On Your House Mortgage: A Complete Information

- Unlocking The Finest Mortgage Phrases: A Complete Information To Negotiation

- Navigating The Path To Homeownership: Your Information To VA Residence Loans

- Refinance Your Dwelling Mortgage: Prime Methods For 2024

Introduction

Be part of us as we discover Navigating the House Mortgage Closing Course of: A Complete Information for Patrons, full of thrilling updates

Video about Navigating the House Mortgage Closing Course of: A Complete Information for Patrons

Navigating the House Mortgage Closing Course of: A Complete Information for Patrons

The house shopping for journey is an thrilling journey, full of anticipation and goals of settling into your good house. Nonetheless, the journey would not finish with discovering the suitable home. The ultimate stage, the closing course of, is an important step that requires cautious consideration and understanding. This complete information will equip you with the information and confidence to navigate this complicated course of easily.

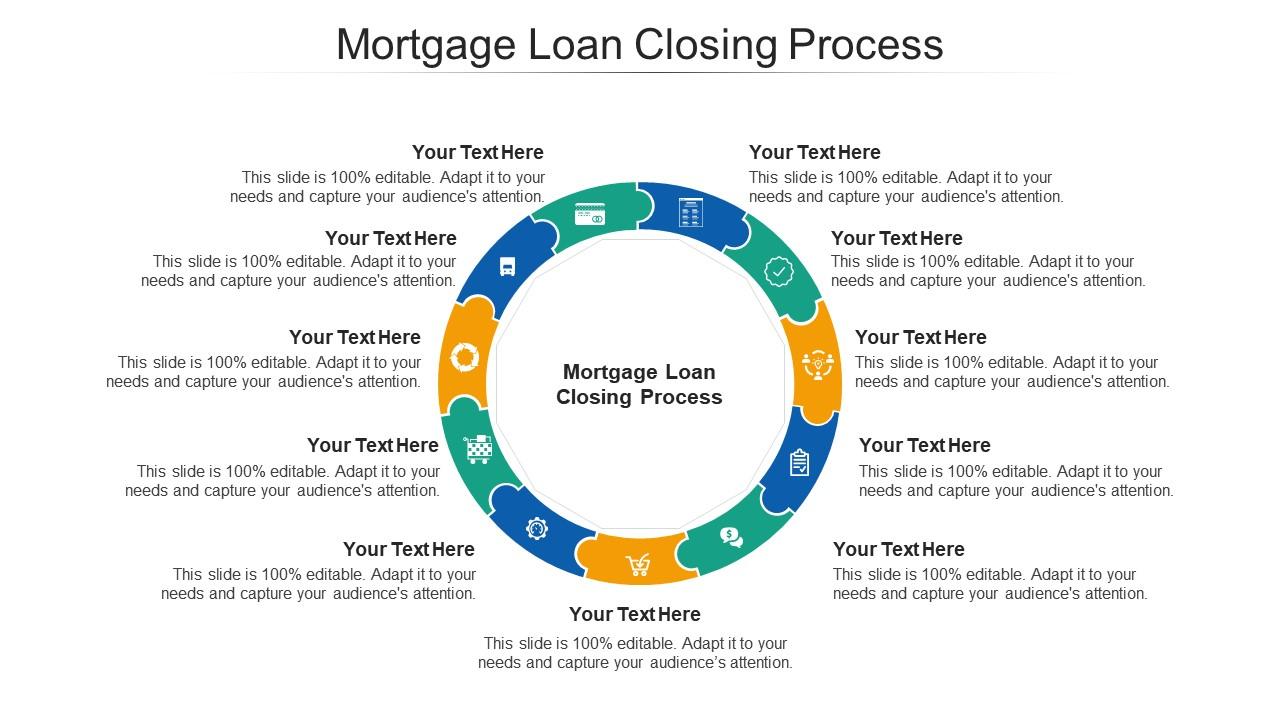

Understanding the Closing Course of: A Step-by-Step Breakdown

The closing course of is the fruits of your property buy journey. It includes a collection of authorized and monetary transactions that finalize the switch of possession from the vendor to you, the client. This is an in depth breakdown of what to anticipate:

1. Mortgage Approval and Closing Underwriting:

As soon as you have secured a pre-approval from a lender, the ultimate underwriting course of begins. This includes a radical assessment of your monetary paperwork, together with:

- Revenue verification: Pay stubs, tax returns, and financial institution statements are reviewed to substantiate your capability to repay the mortgage.

- Credit score historical past: Your credit score rating and historical past are scrutinized to evaluate your creditworthiness.

- Debt-to-income ratio (DTI): Your DTI is calculated primarily based in your month-to-month debt funds and gross earnings, guaranteeing you possibly can handle the mortgage cost.

- Appraisal: An impartial appraiser assesses the property’s market worth to make sure it aligns with the agreed-upon buy worth.

2. Mortgage Paperwork and Disclosures:

As soon as your mortgage is authorized, you may obtain a plethora of paperwork out of your lender, together with:

- Mortgage estimate (LE): This doc offers an in depth breakdown of your mortgage phrases, together with rate of interest, month-to-month funds, and shutting prices.

- Closing Disclosure (CD): The CD summarizes all the ultimate mortgage phrases and prices, together with the mortgage quantity, rate of interest, closing prices, and estimated month-to-month funds. It additionally features a breakdown of the vendor’s prices and any escrow charges.

- Fact in Lending Act (TILA) disclosures: These disclosures present details about the rate of interest, finance prices, and different mortgage phrases.

- Good Religion Estimate (GFE): This estimate offers an preliminary breakdown of the closing prices you possibly can count on to pay.

3. The Closing Assembly:

The closing assembly is the ultimate step within the course of. It is sometimes held at a title firm or legal professional’s workplace. This is what occurs:

- Assessment and signing of paperwork: You will fastidiously assessment and signal all of the mortgage paperwork, together with the mortgage, deed of belief, and shutting disclosures.

- Funds disbursement: The lender disburses the mortgage funds to the vendor, and also you pay any remaining closing prices.

- Property switch: The title firm or legal professional information the switch of possession from the vendor to you.

4. Publish-Closing Actions:

As soon as the closing is full, you may obtain the keys to your new house. Nonetheless, there are nonetheless a couple of post-closing actions to finish:

- Insurance coverage: Guarantee you’ve enough owners insurance coverage protection.

- Utilities: Contact utility corporations to arrange service in your title.

- House inspection: If you have not already, schedule a house inspection to establish any potential points.

Key Concerns for a Easy Closing:

- Keep organized: Preserve all of your paperwork so as and available for the lender and title firm.

- Talk successfully: Preserve your lender and actual property agent knowledgeable of any adjustments in your monetary state of affairs or private circumstances.

- Ask questions: Do not hesitate to ask your lender, actual property agent, or title firm any questions you could have.

- Learn all paperwork fastidiously: Take the time to know the phrases of your mortgage and shutting paperwork earlier than signing something.

- Be ready for sudden delays: The closing course of can typically be delayed on account of unexpected circumstances. Be affected person and keep in communication along with your lender and actual property agent.

Navigating Closing Prices: A Detailed Breakdown

Closing prices are bills incurred throughout the house shopping for course of. They’re sometimes paid on the closing assembly and might range relying in your location, mortgage sort, and the precise phrases of your buy settlement. This is a breakdown of frequent closing prices:

- Mortgage origination charges: This charge is charged by the lender for processing your mortgage software.

- Appraisal charges: The price of hiring an appraiser to evaluate the property’s worth.

- **

Closure

We hope this text has helped you perceive all the pieces about Navigating the House Mortgage Closing Course of: A Complete Information for Patrons. Keep tuned for extra updates!

Don’t neglect to examine again for the most recent information and updates on Navigating the House Mortgage Closing Course of: A Complete Information for Patrons!

We’d love to listen to your ideas about Navigating the House Mortgage Closing Course of: A Complete Information for Patrons—go away your feedback under!

Preserve visiting our web site for the most recent tendencies and opinions.