Navigating The Minefield: Legal responsibility Insurance coverage For Startups – A Complete Information

Navigating the Minefield: Legal responsibility Insurance coverage for Startups – A Complete Information

Associated Articles

- Understanding Errors And Omissions (E&O) Legal responsibility Insurance coverage: A Complete Information

- Legal responsibility Insurance coverage Vs. Full Protection: Which One Do You Want?

- Slash Your Legal responsibility Insurance coverage Premiums: A Complete Information To Saving Cash

- Navigating The Maze: A Complete Information To Submitting A Legal responsibility Insurance coverage Declare

- Legal responsibility Insurance coverage For Contractors: Safeguarding Your Enterprise From The Sudden

Introduction

On this article, we dive into Navigating the Minefield: Legal responsibility Insurance coverage for Startups – A Complete Information, supplying you with a full overview of what’s to come back

Video about Navigating the Minefield: Legal responsibility Insurance coverage for Startups – A Complete Information

Navigating the Minefield: Legal responsibility Insurance coverage for Startups – A Complete Information

Beginning a enterprise is an thrilling journey, stuffed with prospects and challenges. As you deal with constructing your product, creating your model, and securing funding, it is easy to miss one essential facet: legal responsibility insurance coverage. This seemingly summary idea can shortly turn into a really actual and costly drawback if your online business faces a lawsuit or declare.

This complete information will demystify legal responsibility insurance coverage for startups, providing sensible insights and actionable recommendation that can assist you navigate the complexities of this important safety. We’ll cowl:

- The Fundamentals of Legal responsibility Insurance coverage: Understanding the different sorts, their goal, and why they’re crucial in your startup’s success.

- Frequent Sorts of Legal responsibility Insurance coverage for Startups: An in depth breakdown of key insurance coverage insurance policies tailor-made for various enterprise fashions and industries.

- Figuring out Your Particular Wants: Figuring out the precise dangers your startup faces and selecting the best insurance coverage protection accordingly.

- Greatest Practices for Acquiring Legal responsibility Insurance coverage: Suggestions for securing the absolute best protection at aggressive charges, guaranteeing your online business is satisfactorily protected.

- Case Research and Actual-World Examples: Illustrating the significance of legal responsibility insurance coverage by way of real-life eventualities confronted by startups.

- Avoiding Frequent Errors: Understanding potential pitfalls and the way to keep away from them when buying and managing your legal responsibility insurance coverage.

The Significance of Legal responsibility Insurance coverage: A Security Internet for Your Startup

Legal responsibility insurance coverage acts as a security internet in your startup, defending you from monetary spoil within the occasion of a lawsuit or declare. It covers authorized bills, settlements, and judgments arising from incidents that trigger hurt to others, corresponding to:

- Bodily harm: Accidents in your premises, accidents attributable to your merchandise, or negligence resulting in bodily hurt.

- Property harm: Harm to property owned by others attributable to your actions or the actions of your workers.

- Promoting harm: False or deceptive statements in your advertising and marketing supplies, defamation, or copyright infringement.

- Skilled negligence: Errors or omissions in your skilled providers, resulting in monetary loss for purchasers.

Think about this situation: Your startup develops a revolutionary new app. A consumer experiences a technical glitch that causes them to lose vital information, resulting in important monetary losses. They sue your organization for negligence. With out legal responsibility insurance coverage, you would be dealing with a devastating monetary burden, probably jeopardizing your total enterprise.

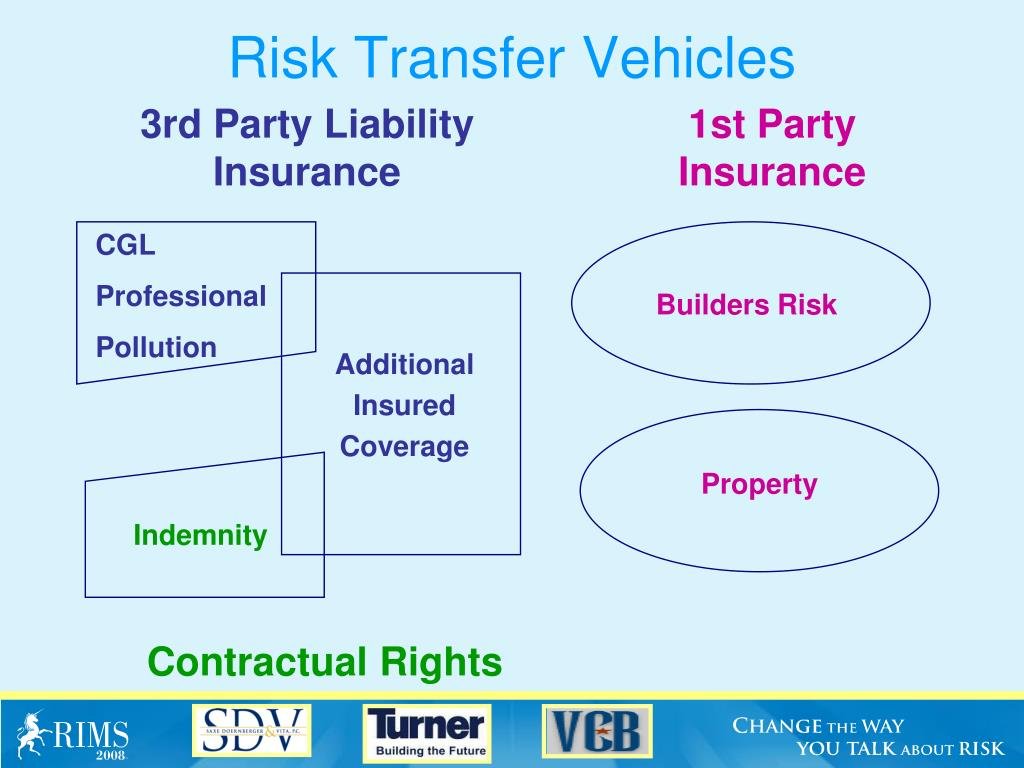

Sorts of Legal responsibility Insurance coverage for Startups: A Detailed Breakdown

The particular forms of legal responsibility insurance coverage you want will rely in your trade, enterprise mannequin, and the potential dangers you face. This is a breakdown of frequent sorts:

1. Normal Legal responsibility Insurance coverage: The cornerstone of legal responsibility insurance coverage for many startups, offering broad protection for a variety of dangers, together with:

- Bodily harm and property harm: Covers claims arising from accidents in your premises or attributable to your services or products.

- Private and promoting harm: Protects towards claims associated to defamation, copyright infringement, or different types of mental property infringement.

- Product legal responsibility: Covers claims associated to faulty merchandise that trigger hurt to shoppers.

- Medical funds: Covers medical bills for people injured in your premises, no matter fault.

2. Product Legal responsibility Insurance coverage: Important for startups promoting bodily merchandise, this insurance coverage covers claims associated to faulty merchandise inflicting harm or property harm. It protects you from lawsuits alleging design flaws, manufacturing errors, or insufficient warnings.

3. Skilled Legal responsibility Insurance coverage (Errors & Omissions): Essential for startups providing skilled providers like consulting, accounting, or authorized recommendation, this insurance coverage covers claims arising from negligent acts, errors, or omissions in your providers. It protects you from lawsuits alleging monetary loss attributable to your skilled negligence.

4. Cyber Legal responsibility Insurance coverage: As cyber threats turn into more and more prevalent, this insurance coverage is significant for startups dealing with delicate information. It covers losses ensuing from information breaches, cyber extortion, and different cyber-related incidents.

5. Administrators and Officers (D&O) Legal responsibility Insurance coverage: This insurance coverage protects the administrators and officers of your organization from private legal responsibility for monetary losses attributable to their selections or actions, offering peace of thoughts and inspiring accountable risk-taking.

6. Staff’ Compensation Insurance coverage: Required by legislation in most states, this insurance coverage protects your workers in case of office accidents or diseases. It covers medical bills, misplaced wages, and incapacity advantages.

7. Business Auto Legal responsibility Insurance coverage: Important for startups with firm autos, this insurance coverage covers harm to different autos or property, in addition to accidents to people attributable to your workers whereas driving firm autos.

Figuring out Your Particular Wants: A Threat Evaluation for Your Startup

Earlier than buying legal responsibility insurance coverage, it is essential to conduct a radical danger evaluation to determine the precise dangers your startup faces. Contemplate elements corresponding to:

- Business: Sure industries have increased inherent dangers than others. For instance, development corporations face a better danger of office accidents than software program growth corporations.

- Enterprise mannequin: The way in which your online business operates can affect your danger profile. An organization promoting bodily merchandise faces totally different dangers than a service-based firm.

- Services and products: The character of your services can decide the forms of legal responsibility dangers you face.

- Location: Geographic location can affect your danger profile attributable to elements like climate circumstances, crime charges, and native rules.

- Staff: The quantity and kind of workers you could have can influence your danger profile.

Greatest Practices for Acquiring Legal responsibility Insurance coverage:

As soon as you’ve got recognized your particular wants, comply with these finest practices to safe the correct protection at aggressive charges:

1. Store Round and Evaluate Quotes: Do not accept the primary quote you obtain. Contact a number of insurance coverage brokers and evaluate quotes from totally different insurance coverage corporations to make sure you’re getting one of the best worth in your cash.

2. Perceive the Coverage Language: Rigorously evaluation the coverage language to make sure you totally perceive the protection you are buying. Ask your insurance coverage dealer to make clear any unclear phrases or circumstances.

3. Contemplate Your Funds and Threat Tolerance: Stability your finances along with your danger tolerance. Whereas complete protection is right, it may be costly. Decide the extent of protection that most closely fits your startup’s monetary state of affairs and danger profile.

4. Select a Respected Insurance coverage Dealer: Accomplice with a good insurance coverage dealer who focuses on serving startups. They’ll information you thru the method, make it easier to perceive your choices, and negotiate one of the best charges.

5. Assessment Your Coverage Recurrently: As your online business grows and evolves, your danger profile could change. Assessment your coverage yearly to make sure it nonetheless adequately covers your wants and make changes as mandatory.

Case Research and Actual-World Examples:

- The Startup That Did not Have Product Legal responsibility Insurance coverage: A younger firm creating progressive kitchen devices confronted a lawsuit after a buyer was injured by a defective product. With out product legal responsibility insurance coverage, the corporate was compelled to accept a big sum, placing a major pressure on their assets and hindering their development.

- The Software program Firm That Confronted a Cyberattack: A startup creating a cloud-based platform skilled a knowledge breach, leading to delicate buyer data being stolen. With out cyber legal responsibility insurance coverage, the corporate confronted hefty prices for information restoration, authorized charges, and regulatory fines.

Avoiding Frequent Errors:

- Underestimating Your Threat: Do not assume your startup is resistant to legal responsibility dangers. Even small companies can face important claims.

- Skipping the Threat Evaluation: Failing to conduct a radical danger evaluation can result in insufficient protection, leaving you susceptible to monetary losses.

- Selecting the Most cost-effective Possibility: Whereas price is vital, do not prioritize worth over protection. Make sure you’re getting sufficient safety, even when it prices somewhat extra.

- Ignoring the Coverage Language: Rigorously evaluation the coverage language to grasp the protection you are buying and any exclusions or limitations.

- Neglecting Common Coverage Evaluations: As your online business grows and modifications, your insurance coverage wants will evolve. Assessment your coverage yearly to make sure it nonetheless meets your necessities.

Conclusion: A Prudent Funding for Your Startup’s Success

Legal responsibility insurance coverage could seem to be an earthly expense, however it’s a vital funding in your startup’s future. By understanding the various kinds of protection, conducting a radical danger evaluation, and following finest practices for acquiring insurance coverage, you may guarantee your online business is satisfactorily shielded from unexpected liabilities. Keep in mind, legal responsibility insurance coverage is not nearly avoiding monetary spoil; it is about peace of thoughts, permitting you to deal with constructing your online business with out the fixed fear of authorized battles and monetary burdens.

Key Takeaways:

- Legal responsibility insurance coverage is crucial for startups to guard towards lawsuits and claims.

- The particular forms of legal responsibility insurance coverage you want will rely in your trade, enterprise mannequin, and danger profile.

- Conduct a radical danger evaluation to determine your particular wants.

- Store round and evaluate quotes from a number of insurance coverage suppliers.

- Perceive the coverage language and select a good insurance coverage dealer.

- Assessment your coverage frequently to make sure it nonetheless meets your necessities.

- Keep away from frequent errors like underestimating your danger, skipping the danger evaluation, or neglecting common coverage critiques.

Investing in legal responsibility insurance coverage is a brilliant transfer for any startup. It is a small worth to pay for the peace of thoughts and monetary safety that you must deal with constructing a profitable enterprise.

Closure

Thanks for studying! Stick with us for extra insights on Navigating the Minefield: Legal responsibility Insurance coverage for Startups – A Complete Information.

Don’t neglect to verify again for the newest information and updates on Navigating the Minefield: Legal responsibility Insurance coverage for Startups – A Complete Information!

We’d love to listen to your ideas about Navigating the Minefield: Legal responsibility Insurance coverage for Startups – A Complete Information—go away your feedback under!

Preserve visiting our web site for the newest developments and critiques.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…