Navigating the Mortgage Panorama: Securing a Private Mortgage with Unhealthy Credit score

Associated Articles

- Unlocking Your Monetary Potential: A Complete Information To Private Mortgage Eligibility For Self-Employed People

- High 10 Private Mortgage Suppliers In 2024: Your Information To Discovering The Greatest Match

- Refinancing Private Loans: Your Information To Decrease Funds And Financial savings

- The Mortgage Shark Lurks On-line: Unmasking Private Mortgage Scams And Defending Your Funds

- Personal Loan Repayment Plans: What Are Your Options? Navigating The Path To Financial Freedom

Introduction

Be part of us as we discover Navigating the Mortgage Panorama: Securing a Private Mortgage with Unhealthy Credit score, filled with thrilling updates

Video about

Navigating the Mortgage Panorama: Securing a Private Mortgage with Unhealthy Credit score

Let’s face it, life throws curveballs. Typically, these curveballs land squarely in your credit score rating, leaving you with a "adverse credit" label that may really feel like a monetary roadblock. However do not despair! Whereas securing a private mortgage with adverse credit may appear daunting, it isn’t inconceivable. With the proper information and technique, you’ll be able to navigate the mortgage panorama and discover a lender keen to work with you.

This complete information will equip you with the instruments and insights to efficiently apply for a private mortgage even with less-than-perfect credit score. We’ll cowl the whole lot from understanding your credit score rating and exploring accessible choices to constructing a robust software and negotiating favorable phrases.

1. Understanding Your Credit score Rating: The Basis of Your Mortgage Journey

Your credit score rating is a numerical illustration of your creditworthiness, reflecting your historical past of borrowing and reimbursement. Lenders use this rating to evaluate your threat as a borrower. A adverse credit rating usually falls beneath 630, indicating a historical past of missed funds, defaults, or excessive credit score utilization.

Understanding the Credit score Rating System:

- FICO Rating: Probably the most broadly used credit score scoring mannequin, FICO scores vary from 300 to 850.

- VantageScore: One other in style credit score scoring mannequin, VantageScores vary from 300 to 850.

Elements Affecting Your Credit score Rating:

- Cost Historical past (35%): That is essentially the most vital issue, reflecting your on-time funds on all credit score accounts.

- Quantities Owed (30%): This consists of your credit score utilization ratio (the proportion of your accessible credit score you are utilizing).

- Size of Credit score Historical past (15%): An extended credit score historical past usually signifies stability and accountable borrowing.

- New Credit score (10%): Opening new credit score accounts can briefly decrease your rating, particularly in the event you apply for a number of loans inside a brief interval.

- Credit score Combine (10%): Having a mixture of credit score accounts, comparable to bank cards, installment loans, and mortgages, demonstrates accountable credit score administration.

2. Exploring Your Mortgage Choices: Discovering the Proper Path for Your Wants

When you perceive your credit score rating, it is time to discover the mortgage choices accessible to you. Whereas conventional banks and credit score unions is perhaps much less receptive to debtors with adverse credit, a number of different lenders focus on offering loans to people with less-than-perfect credit score.

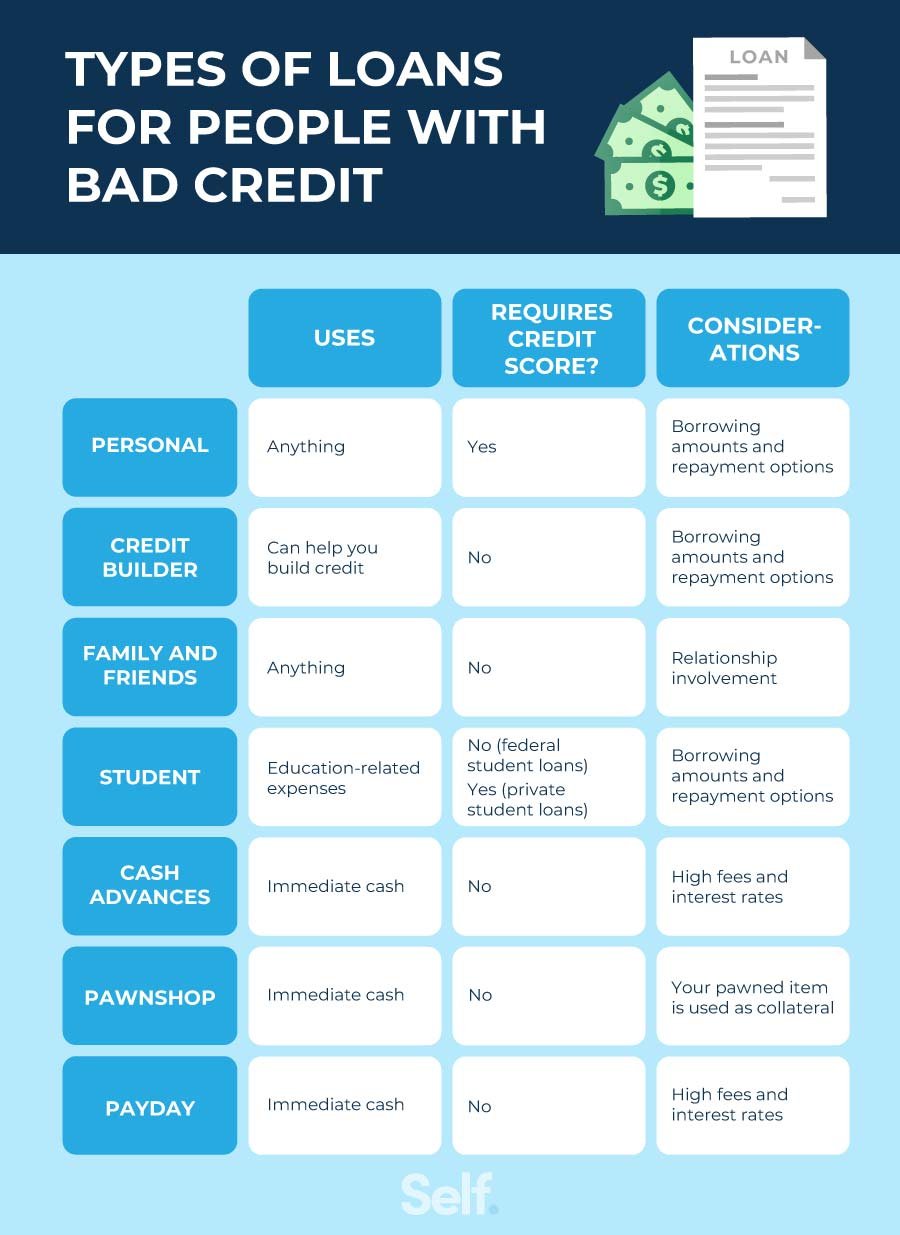

This is a breakdown of the widespread mortgage choices for debtors with adverse credit:

a) On-line Lenders:

- Professionals: On-line lenders usually have extra versatile lending standards and sooner approval instances.

- Cons: They usually cost larger rates of interest and charges.

- Key Examples: LendingClub, Prosper, Upstart, Avant.

b) Credit score Unions:

- Professionals: Credit score unions usually supply extra aggressive charges and personalised service, particularly for members.

- Cons: They could have stricter eligibility necessities than on-line lenders.

- Key Concerns: Search for credit score unions that supply applications particularly designed for debtors with adverse credit.

c) Peer-to-Peer (P2P) Lending:

- Professionals: P2P platforms join debtors with particular person traders, probably providing decrease rates of interest.

- Cons: P2P loans might have larger charges and require an extended approval course of.

- Key Examples: LendingClub, Prosper.

d) Secured Loans:

- Professionals: Secured loans usually have decrease rates of interest as a result of they’re backed by collateral, comparable to a automotive or financial savings account.

- Cons: Should you default on a secured mortgage, you threat shedding your collateral.

- Key Concerns: Contemplate secured loans in case you have worthwhile property to make use of as collateral.

e) Payday Loans (Keep away from These):

- Professionals: Payday loans supply fast money, however they arrive with exorbitant rates of interest and charges.

- Cons: They will entice debtors in a cycle of debt and needs to be averted in any respect prices.

- Key Concerns: At all times discover different choices earlier than resorting to payday loans.

3. Constructing a Sturdy Utility: Presenting Your Greatest Monetary Self

When making use of for a private mortgage with adverse credit, it is essential to current a robust software that highlights your monetary accountability and dedication to reimbursement. This is a step-by-step information to constructing a successful software:

a) Verify Your Credit score Report:

- Receive a free copy of your credit score report: You’ll be able to entry your free credit score report from AnnualCreditReport.com annually.

- Evaluation your credit score report for inaccuracies: Dispute any errors to enhance your rating.

- Perceive the components affecting your credit score rating: Establish areas the place you’ll be able to enhance.

b) Enhance Your Credit score Rating (If Attainable):

- Pay your payments on time: That is the best solution to enhance your credit score rating.

- Decrease your credit score utilization ratio: Goal to maintain your credit score utilization beneath 30%.

- Keep away from opening new credit score accounts: Opening too many accounts can negatively influence your rating.

- Contemplate a secured bank card: This may help construct your credit score historical past in case you have restricted credit score.

c) Collect Required Paperwork:

- Proof of earnings: Pay stubs, tax returns, or financial institution statements.

- Proof of residency: Utility payments or financial institution statements.

- Authorities-issued ID: Driver’s license or passport.

- Checking account info: For direct deposit and cost processing.

d) Store Round and Examine Charges:

- Use on-line mortgage comparability instruments: These instruments will let you examine provides from completely different lenders.

- Contact a number of lenders: Get quotes from numerous lenders to safe the very best rate of interest and phrases.

- Do not accept the primary supply: Take your time and discover all accessible choices.

e) Present Clear and Concise Info:

- Be truthful and correct: Present full and correct info in your software.

- Clarify any credit score challenges: Be clear about any previous monetary difficulties and exhibit your dedication to monetary accountability.

- Spotlight constructive monetary habits: Emphasize your secure earnings, accountable spending, and dedication to repaying your money owed.

4. Negotiating Favorable Mortgage Phrases: Securing the Greatest Deal

As soon as you have been pre-approved for a mortgage, it is time to negotiate the phrases to safe essentially the most favorable deal. Listed below are some ideas for negotiating:

a) Perceive the Mortgage Phrases:

- Rate of interest: That is the price of borrowing cash, expressed as a share.

- Mortgage time period: That is the size of time you need to repay the mortgage.

- Origination charge: A charge charged by the lender for processing your mortgage.

- Prepayment penalty: A charge charged for paying off the mortgage early.

b) Discover Different Mortgage Choices:

- Contemplate a cosigner: A cosigner with good credit score may help you qualify for a decrease rate of interest.

- Discover secured loans: If in case you have property to make use of as collateral, chances are you’ll qualify for a decrease rate of interest.

- Negotiate with the lender: Be ready to debate your monetary state of affairs and exhibit your dedication to reimbursement.

c) Be Ready to Stroll Away:

- Do not accept unfavorable phrases: If the lender is not keen to barter, you’ll be able to all the time stroll away and discover different choices.

- Examine provides from a number of lenders: This provides you leverage to barter higher phrases.

5. Sustaining Monetary Duty: Constructing a Stronger Future

Securing a private mortgage with adverse credit is simply step one. To construct a stronger monetary future, it is important to take care of monetary accountability:

- Make your mortgage funds on time: That is essential for bettering your credit score rating and avoiding late charges.

- Create a funds and keep on with it: This helps you handle your funds successfully and keep away from overspending.

- Pay down your money owed: Concentrate on paying down your money owed as shortly as doable to enhance your credit score rating and scale back your curiosity funds.

- Monitor your credit score rating: Usually test your credit score report for errors and observe your progress.

- Search skilled monetary recommendation: A monetary advisor may help you develop a personalised monetary plan and handle your funds successfully.

Conclusion: Constructing a Brighter Monetary Future

Securing a private mortgage with adverse credit will be difficult, but it surely’s not inconceivable. By understanding your credit score rating, exploring accessible mortgage choices, constructing a robust software, and negotiating favorable phrases, you’ll be able to improve your probabilities of success. Bear in mind, sustaining monetary accountability is essential for constructing a brighter monetary future.

Listed below are some extra ideas for navigating the mortgage panorama with adverse credit:

- Be affected person and protracted: The method of securing a mortgage with adverse credit can take time, so do not get discouraged in the event you’re rejected initially.

- Do not quit in your monetary targets: Even with adverse credit, you’ll be able to nonetheless obtain your monetary targets.

- Search assist from household and pals: Speak to your family members about your monetary state of affairs and ask for his or her assist.

- Contemplate credit score counseling: A credit score counselor may help you develop a plan to enhance your credit score rating and handle your funds successfully.

Bear in mind, your credit score rating is just not a mirrored image of your price. It is merely a snapshot of your monetary historical past. By taking proactive steps to enhance your credit score and handle your funds responsibly, you’ll be able to construct a stronger monetary future and unlock new alternatives.

Closure

We hope this text has helped you perceive the whole lot about Navigating the Mortgage Panorama: Securing a Private Mortgage with Unhealthy Credit score. Keep tuned for extra updates!

Don’t neglect to test again for the most recent information and updates on Navigating the Mortgage Panorama: Securing a Private Mortgage with Unhealthy Credit score!

We’d love to listen to your ideas about Navigating the Mortgage Panorama: Securing a Private Mortgage with Unhealthy Credit score—go away your feedback beneath!

Keep knowledgeable with our subsequent updates on Navigating the Mortgage Panorama: Securing a Private Mortgage with Unhealthy Credit score and different thrilling subjects.