Navigating The SBA 7(a) Mortgage: A Complete Information To Qualification

Navigating the SBA 7(a) Mortgage: A Complete Information to Qualification

Associated Articles

- Unlocking Enterprise Funding: Navigating The Mortgage Panorama With Unhealthy Credit score

- Navigating The Path To Funding: How To Qualify For A Business Loan In 2024

- Unlocking Development: Your Information To SBA Loans

- Past The Financial institution: Prime Enterprise Mortgage Options For Startups

- Fueling Feminine Ambition: Prime 5 Enterprise Loans For Ladies Entrepreneurs

Introduction

On this article, we dive into Navigating the SBA 7(a) Mortgage: A Complete Information to Qualification, supplying you with a full overview of what’s to return

Video about

Navigating the SBA 7(a) Mortgage: A Complete Information to Qualification

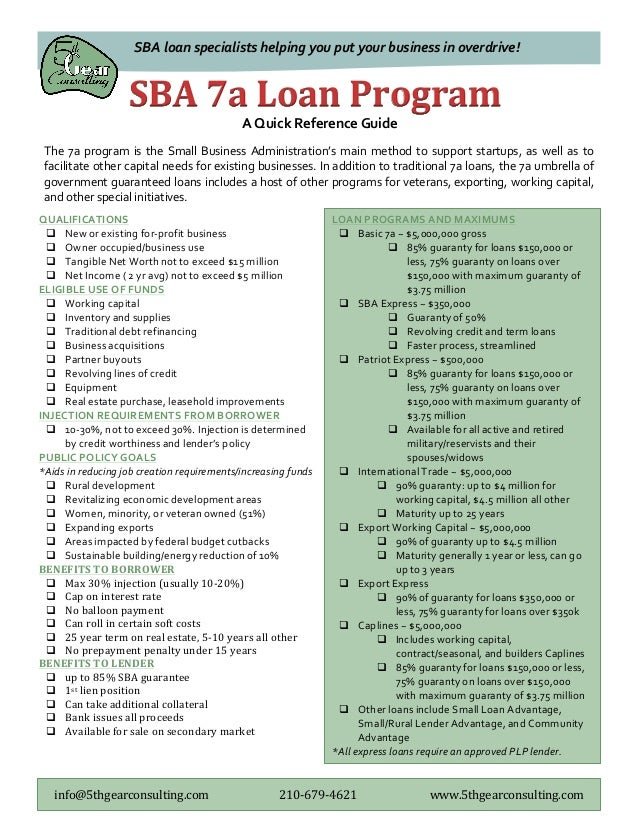

The Small Enterprise Administration (SBA) 7(a) mortgage program is a beacon of hope for a lot of small enterprise house owners looking for funding. With its engaging phrases and authorities backing, it may be a game-changer for companies seeking to develop, improve, or just keep afloat. However qualifying for this coveted mortgage is not a stroll within the park.

This complete information will equip you with the data and understanding wanted to navigate the SBA 7(a) mortgage software course of, growing your possibilities of approval and setting your online business up for fulfillment.

Understanding the SBA 7(a) Mortgage: A Basis for Success

The SBA 7(a) mortgage program is a government-backed mortgage program designed to assist small companies entry capital. It is a versatile software that can be utilized for a variety of functions, together with:

- Working capital: Protecting day-to-day bills, managing money stream, and bridging gaps in funding.

- Gear financing: Buying new or used tools, equipment, or automobiles important for your online business operations.

- Actual property acquisition: Buying land, buildings, or industrial property for your online business wants.

- Enterprise enlargement: Funding development initiatives, opening new places, or increasing product strains.

- Debt refinancing: Consolidating present enterprise debt right into a single, extra manageable mortgage.

The SBA 7(a) Benefit: Why It is a Recreation-Changer for Small Companies

The SBA 7(a) mortgage program stands out from conventional enterprise loans as a consequence of its distinctive advantages:

- Decrease rates of interest: SBA loans typically include decrease rates of interest than standard loans, making them extra inexpensive and serving to you get monetary savings over the mortgage time period.

- Longer compensation phrases: You possibly can take pleasure in longer compensation durations, sometimes as much as 25 years, permitting for extra manageable month-to-month funds and easing monetary strain.

- Versatile mortgage quantities: SBA 7(a) loans can be found in a variety of quantities, catering to companies of all sizes and funding wants.

- Authorities assure: The SBA ensures a portion of the mortgage, lowering the danger for lenders and making it simpler for companies to safe financing.

- Much less stringent credit score necessities: Whereas credit score historical past continues to be necessary, the SBA considers components past credit score rating, permitting companies with less-than-perfect credit score an opportunity to qualify.

The Qualification Journey: Unlocking the Doorways to SBA 7(a) Funding

Qualifying for an SBA 7(a) mortgage entails a multi-faceted course of, requiring you to display your online business’s viability and creditworthiness. Here is a breakdown of the important thing eligibility standards:

1. Enterprise Eligibility:

- For-profit: What you are promoting have to be a for-profit entity working in america.

- Authorized construction: You have to be a legally structured enterprise, similar to a sole proprietorship, partnership, company, or restricted legal responsibility firm (LLC).

- Good standing: What you are promoting have to be in good standing with all related state and federal companies, together with the IRS.

- Acceptable industries: Most industries are eligible for SBA 7(a) loans, with some exceptions, similar to lending, playing, and sure sorts of actual property improvement.

- No ineligible actions: What you are promoting should not be engaged in any actions thought of ineligible for SBA financing, similar to speculative ventures or unlawful actions.

2. Proprietor Eligibility:

- U.S. citizenship or residency: You have to be a U.S. citizen or everlasting resident.

- Good credit score historical past: Your private credit score rating performs a big function within the qualification course of. Whereas a excessive rating is most popular, the SBA considers different components past credit score rating, similar to your fee historical past and credit score utilization.

- No previous defaults: You should have no excellent defaults on earlier SBA loans or different government-backed loans.

- No felony historical past: You will need to not have any vital felony convictions that might hinder your capability to handle a enterprise.

- Ample expertise: The SBA sometimes prefers enterprise house owners with prior expertise of their trade, demonstrating their understanding of the market and operational capabilities.

3. Monetary Eligibility:

- Robust monetary efficiency: What you are promoting should display a historical past of worthwhile operations or a transparent path to profitability.

- Sufficient money stream: You want to have ample money stream to cowl your working bills and debt obligations.

- Affordable debt-to-equity ratio: The SBA prefers companies with a wholesome debt-to-equity ratio, indicating a balanced monetary construction.

- Collateral availability: Relying on the mortgage quantity and function, the SBA could require collateral, similar to actual property, tools, or stock, to safe the mortgage.

- Monetary projections: You will want to offer detailed monetary projections outlining your online business’s future income, bills, and money stream.

4. The SBA’s Position: Guiding and Guaranteeing

The SBA would not immediately lend cash to companies. As an alternative, it really works with authorized lenders, similar to banks and credit score unions, to offer ensures on loans. This assure reduces the lender’s danger, making them extra more likely to approve loans to small companies.

The Utility Course of: A Step-by-Step Information

As soon as you have established your eligibility, you may have to navigate the applying course of. Here is a breakdown of the important thing steps:

1. Select a Lender:

- Analysis and examine: Store round and examine gives from totally different SBA-approved lenders.

- Think about your wants: Select a lender that focuses on your trade or has expertise with SBA loans.

- Search for aggressive charges and phrases: Examine rates of interest, charges, and compensation phrases to seek out the very best deal.

2. Collect Required Paperwork:

- Marketing strategy: A complete marketing strategy outlining your online business’s mission, targets, market evaluation, monetary projections, and administration group.

- Monetary statements: Current stability sheets, revenue statements, and money stream statements reflecting your online business’s monetary well being.

- Tax returns: Current federal revenue tax returns for your online business and private tax returns.

- Private monetary info: Credit score stories, financial institution statements, and different paperwork demonstrating your private monetary state of affairs.

- Collateral info: If relevant, present particulars about any property you are providing as collateral.

3. Submit Your Utility:

- Full the applying: Fill out the SBA mortgage software kind, offering correct and detailed details about your online business.

- Present supporting documentation: Submit all required paperwork to your chosen lender.

- Assessment and signal: Fastidiously evaluate the mortgage paperwork earlier than signing, making certain you perceive the phrases and circumstances.

4. Underwriting and Approval:

- Mortgage evaluate: The lender will evaluate your software and supporting paperwork, conducting an evaluation of your creditworthiness and monetary stability.

- SBA evaluate: The SBA will evaluate your software, specializing in the enterprise’s viability, mortgage function, and compliance with program tips.

- Approval or denial: You will obtain a call from the lender, both approving or denying your mortgage software.

5. Mortgage Disbursement and Reimbursement:

- Funding: As soon as your mortgage is authorized, the lender will disburse the funds in response to the agreed-upon phrases.

- Reimbursement schedule: You will be required to make common funds in response to the mortgage settlement, together with principal and curiosity.

- Monitoring and compliance: The SBA could monitor your online business’s efficiency to make sure you’re utilizing the mortgage funds appropriately and assembly your compensation obligations.

Frequent Pitfalls to Keep away from:

Whereas the SBA 7(a) mortgage program gives vital benefits, it is essential to concentrate on potential pitfalls that may hinder your software course of:

- Incomplete or inaccurate software: Failing to offer full and correct info can result in delays or rejection.

- Poor credit score historical past: A low credit score rating or a historical past of missed funds can elevate purple flags for lenders.

- Weak monetary efficiency: A historical past of losses or inadequate money stream could make it tough to qualify for a mortgage.

- Lack of a marketing strategy: A well-written marketing strategy is essential for demonstrating your online business’s viability and future development potential.

- Unrealistic monetary projections: Overly optimistic projections can elevate considerations concerning the feasibility of your marketing strategy.

- Lack of collateral: If required, failing to offer ample collateral can jeopardize your mortgage approval.

Maximizing Your Possibilities of Success:

To extend your possibilities of securing an SBA 7(a) mortgage, take into account these methods:

- Put together totally: Collect all required paperwork, together with your marketing strategy, monetary statements, and private monetary info.

- Work with a certified lender: Select a lender with expertise in SBA loans and a observe document of success in serving to small companies.

- Construct a robust credit score historical past: Enhance your credit score rating by paying payments on time, lowering debt, and sustaining a wholesome credit score utilization ratio.

- Exhibit a transparent path to profitability: Present detailed monetary projections and a compelling narrative about your online business’s future development potential.

- Search skilled recommendation: Seek the advice of with a enterprise advisor, accountant, or lawyer to make sure you perceive this system necessities and navigate the applying course of successfully.

Conclusion: Embracing the Energy of SBA 7(a) Funding

The SBA 7(a) mortgage program is a useful useful resource for small companies looking for funding. By understanding the qualification standards, navigating the applying course of, and avoiding frequent pitfalls, you’ll be able to enhance your possibilities of securing this coveted mortgage and setting your online business up for fulfillment.

Keep in mind, acquiring an SBA 7(a) mortgage is just not a assured final result. Nonetheless, with thorough preparation, cautious planning, and a dedication to constructing a robust enterprise basis, you’ll be able to unlock the facility of this program and gas your online business’s development and prosperity.

Closure

We hope this text has helped you perceive every thing about Navigating the SBA 7(a) Mortgage: A Complete Information to Qualification. Keep tuned for extra updates!

Ensure that to comply with us for extra thrilling information and evaluations.

Be at liberty to share your expertise with Navigating the SBA 7(a) Mortgage: A Complete Information to Qualification within the remark part.

Keep knowledgeable with our subsequent updates on Navigating the SBA 7(a) Mortgage: A Complete Information to Qualification and different thrilling subjects.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…