Navigating The Street To Private Loans With Dangerous Credit score: A Complete Information

Navigating the Street to Private Loans with Dangerous Credit score: A Complete Information

Associated Articles

- Navigating The Mortgage Panorama: A Complete Information To Evaluating Private Mortgage Gives

- The Influence Of Federal Reserve Fee Hikes On Private Loans: Navigating The Shifting Panorama

- Demystifying Personal Loans: Understanding APRs And Fees

- Can You Use A Private Mortgage To Pay Off Medical Payments? A Complete Information

- Personal Loan Debt Consolidation: Is It Right For You?

Introduction

On this article, we dive into Navigating the Street to Private Loans with Dangerous Credit score: A Complete Information, supplying you with a full overview of what’s to return

Video about

Navigating the Street to Private Loans with Dangerous Credit score: A Complete Information

Life throws curveballs, and typically these curveballs land you in a state of affairs the place your credit score rating takes a success. Possibly you went by means of a job loss, a medical emergency, or maybe you merely made some monetary missteps previously. Regardless of the motive, having weak credit can really feel like a roadblock, particularly once you want a private mortgage. However do not despair! Whereas securing a private mortgage with weak credit may be difficult, it isn’t inconceivable. This complete information will equip you with the information and methods to navigate this path efficiently.

Understanding the Panorama: Why Dangerous Credit score Makes Getting a Mortgage Powerful

Earlier than diving into methods, let’s perceive why lenders are hesitant to grant private loans to people with weak credit. Here is the lowdown:

- Danger Evaluation: Lenders view credit score scores as a measure of your monetary duty. A low credit score rating indicators a better danger of defaulting on the mortgage, which means they may not get their a reimbursement.

- Profitability: Lenders have to make a revenue. After they understand a better danger, they usually cost increased rates of interest to compensate for potential losses. This could make private loans with weak credit considerably costlier.

- Competitors: Many lenders prioritize debtors with good credit score, as they characterize a decrease danger and probably increased returns.

Decoding Your Credit score Rating: The Numbers That Matter

Your credit score rating is a three-digit quantity that represents your creditworthiness. It is primarily based on data out of your credit score report, which particulars your borrowing historical past and reimbursement patterns. Here is a breakdown of the credit score rating ranges and what they imply:

- Wonderful (740-850): You are a extremely fascinating borrower.

- Good (670-739): You are a dependable borrower with a superb observe file.

- Truthful (580-669): You are a reasonable danger borrower, and lenders could require increased rates of interest.

- Poor (300-579): You are thought of a high-risk borrower, and lenders could also be hesitant to approve your mortgage request.

Discovering Your Path: Methods for Getting Accredited

Now, let’s discover the methods that may assist you safe a private mortgage even with weak credit:

1. Bettering Your Credit score Rating: The Basis for Success

Whereas it may appear daunting, enhancing your credit score rating is the simplest strategy to improve your probabilities of getting authorised and securing a greater rate of interest. Here is how:

- Pay Your Payments On Time: That is the only most vital consider your credit score rating. Arrange reminders, automate funds, or take into account a budgeting app to remain on prime of your payments.

- Maintain Credit score Utilization Low: This refers back to the quantity of credit score you are utilizing in comparison with your accessible credit score restrict. Goal to maintain it beneath 30% to keep away from hurting your rating.

- Keep away from Opening New Accounts: Every time you apply for brand new credit score, a tough inquiry is added to your credit score report, which might briefly decrease your rating.

- Dispute Errors on Your Credit score Report: Errors occur, and incorrect data in your credit score report can negatively affect your rating. Evaluation your credit score report often and problem any inaccuracies.

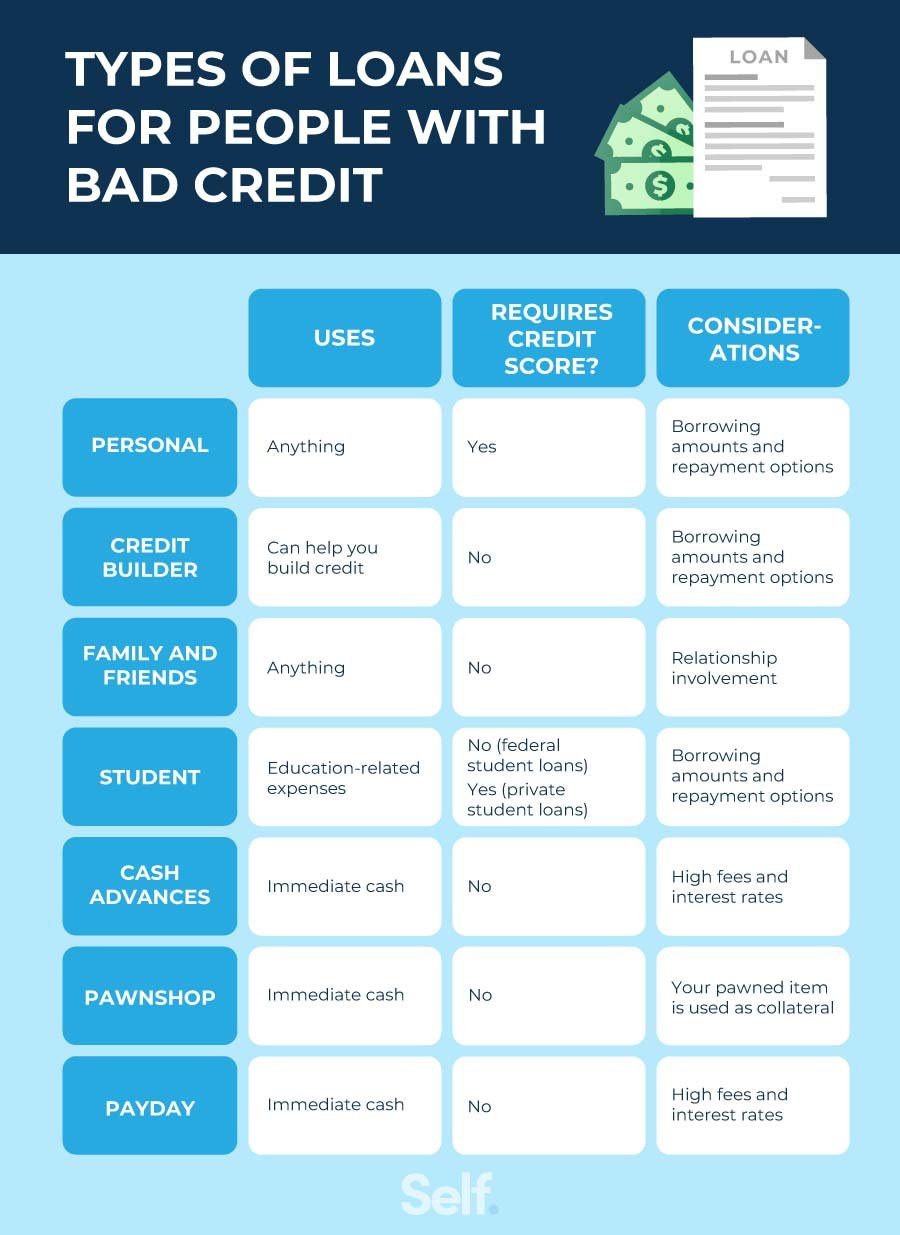

2. Exploring Completely different Lending Choices: Past Conventional Banks

Not all lenders are created equal. Whereas conventional banks may be hesitant to lend to debtors with weak credit, a number of various choices can be found:

- On-line Lenders: These lenders usually have extra versatile lending standards and could also be prepared to think about debtors with decrease credit score scores. Nonetheless, be sure you evaluate rates of interest and phrases fastidiously.

- Credit score Unions: These member-owned monetary establishments usually have extra relaxed lending requirements and should provide extra aggressive charges than conventional banks.

- Peer-to-Peer Lending Platforms: These platforms join debtors with particular person traders who’re prepared to fund loans. They could be a good possibility for these with decrease credit score scores, however the approval course of could take longer.

3. Securing a Co-Signer: Sharing the Duty

If you happen to’re struggling to qualify for a mortgage by yourself, take into account discovering a co-signer with good credit score. A co-signer agrees to be collectively chargeable for repaying the mortgage, which might considerably enhance your probabilities of approval. Nonetheless, it is essential to decide on a co-signer fastidiously and make sure you’re each comfy with the phrases and obligations.

4. Exploring Secured Loans: Utilizing Collateral as a Security Internet

Secured loans require you to offer collateral, resembling a automobile or financial savings account, to safe the mortgage. If you happen to default on the mortgage, the lender can seize the collateral to recuperate their losses. Secured loans usually have decrease rates of interest than unsecured loans, making them a viable possibility for debtors with weak credit.

5. Constructing a Sturdy Mortgage Utility: Making Your Case

When making use of for a private mortgage with weak credit, presenting a powerful software is essential. Here is how you can maximize your probabilities of approval:

- Be Sincere and Clear: Do not attempt to conceal your credit score historical past. Lenders will ultimately uncover any inaccuracies, which might injury your possibilities even additional.

- Exhibit Monetary Stability: Present proof of your revenue, employment historical past, and steady housing state of affairs.

- Clarify Your Credit score Historical past: If you happen to’ve skilled monetary difficulties previously, present a transparent clarification of the state of affairs and the way you’ve got addressed it.

- Supply a Reimbursement Plan: Present the lender that you’ve a plan for repaying the mortgage. This generally is a finances, debt consolidation technique, or different proof of your monetary duty.

6. Navigating the Curiosity Price Panorama: Understanding the Prices

Private loans with weak credit usually include increased rates of interest than these for debtors with good credit score. Here is what that you must know:

- APR (Annual Share Price): This represents the entire price of borrowing, together with curiosity and costs. Examine APRs from totally different lenders to seek out the most effective deal.

- Mortgage Time period: The size of the mortgage can considerably affect the general price. Shorter mortgage phrases usually lead to increased month-to-month funds however decrease total curiosity prices.

- Charges: Pay attention to any origination charges, late cost charges, or different costs related to the mortgage. These can add up over time.

7. Discovering the Proper Lender: Evaluating Choices and Asking the Proper Questions

With so many lending choices accessible, it is important to match totally different lenders and discover the most effective match to your wants. Listed here are some key inquiries to ask:

- What are the eligibility necessities? Make sure you meet the lender’s minimal credit score rating and revenue necessities.

- What’s the APR? Examine APRs from totally different lenders to seek out the bottom price.

- What are the mortgage phrases? Take into account the mortgage time period, reimbursement schedule, and any charges related to the mortgage.

- What’s the mortgage origination course of? Perceive the steps concerned in making use of for the mortgage and the way lengthy it takes to get authorised.

- What are the customer support insurance policies? Select a lender with a superb repute for customer support and responsiveness.

8. Defending Your self: Studying the Tremendous Print and Understanding the Dangers

Earlier than signing on the dotted line, fastidiously evaluation the mortgage settlement and perceive all of the phrases and circumstances. Listed here are some key factors to concentrate to:

- Curiosity Price and Charges: Ensure you perceive the APR, any origination charges, late cost charges, and different costs.

- Reimbursement Schedule: Evaluation the month-to-month cost quantity, the mortgage time period, and the cost due date.

- Prepayment Penalties: Some lenders cost penalties for those who repay the mortgage early. Make sure you perceive any prepayment penalties earlier than signing the settlement.

- Default Clause: Perceive the implications of defaulting on the mortgage, resembling late cost charges, potential injury to your credit score rating, and even authorized motion.

9. Constructing a Sustainable Future: Managing Your Debt and Bettering Your Credit score

Securing a private mortgage with weak credit is simply step one. It is essential to handle your debt responsibly and take steps to enhance your credit score rating over time. Listed here are some methods:

- Create a Finances: Monitor your revenue and bills to determine areas the place you may in the reduction of and release more cash for debt reimbursement.

- Prioritize Debt Reimbursement: Deal with paying down your highest-interest money owed first.

- Take into account Debt Consolidation: A debt consolidation mortgage may also help you mix a number of money owed right into a single mortgage with a decrease rate of interest, making it simpler to handle your repayments.

- Proceed Bettering Your Credit score Rating: By making on-time funds, conserving your credit score utilization low, and avoiding new credit score functions, you may regularly enhance your credit score rating and unlock higher mortgage phrases sooner or later.

Conclusion: A Path to Monetary Freedom

Navigating the world of private loans with weak credit may be difficult, however it’s not insurmountable. By understanding the components that affect lender choices, exploring totally different lending choices, and taking proactive steps to enhance your credit score rating, you may improve your probabilities of securing a mortgage and reaching your monetary targets. Keep in mind, persistence, perseverance, and accountable monetary administration are your allies on this journey. With the fitting method, you may overcome the obstacles of weak credit and construct a brighter monetary future.

Closure

Thanks for studying! Stick with us for extra insights on Navigating the Street to Private Loans with Dangerous Credit score: A Complete Information.

Ensure that to observe us for extra thrilling information and opinions.

We’d love to listen to your ideas about Navigating the Street to Private Loans with Dangerous Credit score: A Complete Information—depart your feedback beneath!

Maintain visiting our web site for the most recent traits and opinions.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…