Ought to You Get a Private Mortgage or Faucet Into Your 401(okay)? A Complete Information to Making the Proper Selection

Associated Articles

- Unlocking Your Financial Potential: How To Get A Personal Loan With No Credit History

- Prime 5 Private Mortgage Suppliers In The U.S. For 2024

- Is Refinancing A Private Mortgage Value It? A Complete Information To Navigating Your Choices

- Navigating The Maze: A Comprehensive Guide To Personal Loan Approval

- Can You Use A Private Mortgage To Purchase A Automobile? A Complete Information

Introduction

Uncover the newest particulars about Ought to You Get a Private Mortgage or Faucet Into Your 401(okay)? A Complete Information to Making the Proper Selection on this complete information.

Video about

Ought to You Get a Private Mortgage or Faucet Into Your 401(okay)? A Complete Information to Making the Proper Selection

Life throws curveballs. Generally these curveballs come within the type of surprising bills, leaving you scrambling for options. When confronted with a monetary emergency, two frequent choices emerge: taking out a private mortgage or dipping into your 401(okay). However which path is greatest on your distinctive state of affairs?

This complete information will delve into the intricacies of each choices, equipping you with the information to make an knowledgeable resolution that aligns together with your monetary objectives. We’ll discover the professionals and cons of every strategy, contemplating components like rates of interest, tax implications, and the long-term influence in your monetary safety.

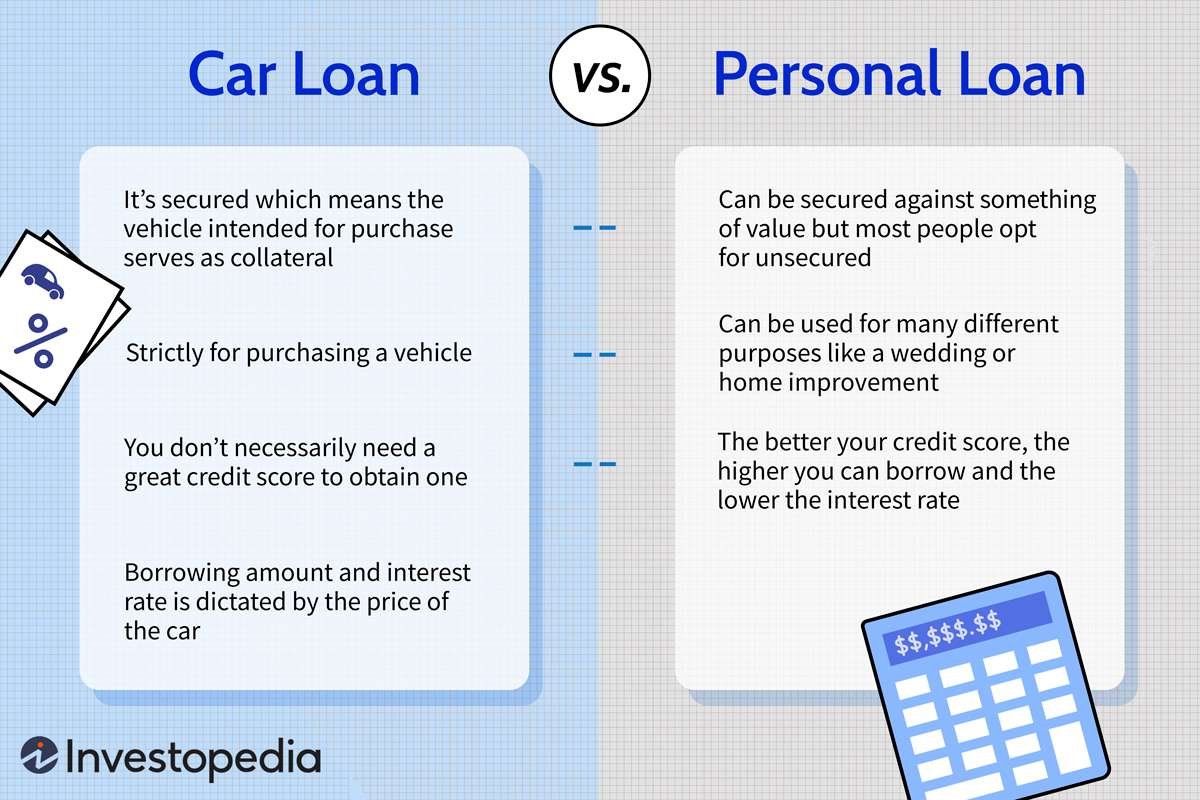

Understanding the Dilemma: Private Loans vs. 401(okay) Loans

The choice between a private mortgage and a 401(okay) mortgage hinges in your particular person circumstances and monetary priorities. Let’s break down the important thing variations:

Private Loans:

- What they’re: Private loans are unsecured loans provided by banks, credit score unions, and on-line lenders. They’re sometimes used for a wide range of functions, together with debt consolidation, residence enchancment, or medical bills.

- Execs:

- Versatile: You need to use the cash for something you want.

- Probably decrease rates of interest: Rates of interest might be aggressive, particularly for debtors with good credit score.

- No influence on retirement financial savings: Your retirement funds stay untouched.

- Cons:

- Greater rates of interest: In comparison with 401(okay) loans, private mortgage rates of interest might be considerably greater.

- Influence on credit score rating: Taking out a private mortgage can have an effect on your credit score rating in case you do not make funds on time.

- Month-to-month funds: You will should make month-to-month funds, which might pressure your finances.

401(okay) Loans:

- What they’re: 401(okay) loans mean you can borrow cash from your personal retirement account. These loans are sometimes provided by your employer and are topic to particular phrases and situations.

- Execs:

- Decrease rates of interest: 401(okay) mortgage rates of interest are normally decrease than private mortgage rates of interest.

- Tax-advantaged: Curiosity you pay on a 401(okay) mortgage is paid to your self, successfully lowering your total tax burden.

- Handy: The mortgage course of is usually less complicated and sooner than making use of for a private mortgage.

- Cons:

- Restricted to retirement funds: You may solely borrow cash out of your 401(okay).

- Potential tax penalties: When you default on the mortgage or withdraw the funds earlier than retirement, it’s possible you’ll face penalties.

- Influence on retirement financial savings: Borrowing out of your 401(okay) can hinder the expansion of your retirement financial savings.

Elements to Contemplate When Making Your Resolution

To make an knowledgeable resolution, take into account these essential components:

1. Curiosity Charges:

- Private Mortgage Curiosity Charges: Rates of interest on private loans range broadly relying in your credit score rating, mortgage quantity, and lender. Charges can vary from 5% to 36% or greater.

- 401(okay) Mortgage Curiosity Charges: 401(okay) mortgage rates of interest are sometimes mounted and decrease than private mortgage charges. The common rate of interest for 401(okay) loans is round 5%.

2. Mortgage Quantity:

- Private Loans: Private loans are sometimes obtainable in quantities starting from just a few thousand {dollars} to tens of hundreds of {dollars}.

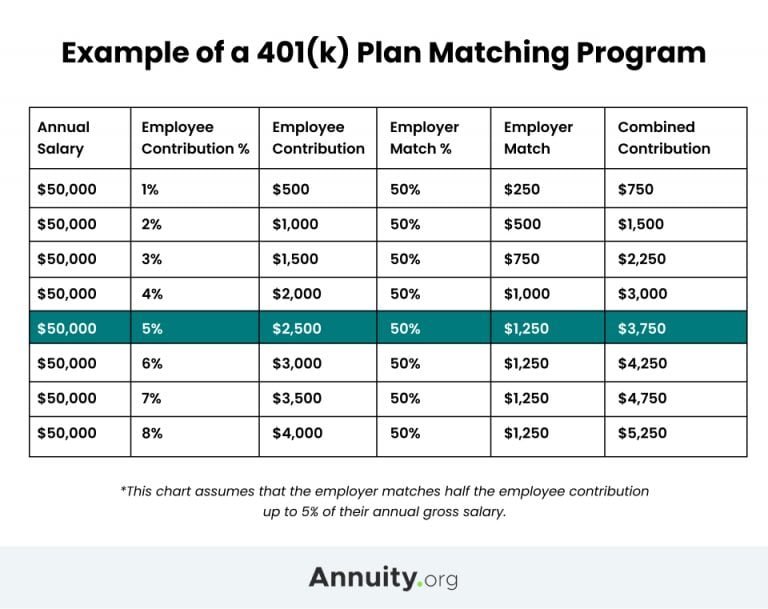

- 401(okay) Loans: 401(okay) mortgage quantities are sometimes capped at a share of your vested account steadiness, normally round 50%.

3. Mortgage Time period:

- Private Loans: Private mortgage phrases range however sometimes vary from one to seven years.

- 401(okay) Loans: 401(okay) mortgage phrases might be shorter, typically starting from one to 5 years.

4. Tax Implications:

- Private Loans: Curiosity paid on private loans is usually not tax-deductible.

- 401(okay) Loans: Curiosity paid on 401(okay) loans is paid to your self and due to this fact doesn’t generate taxable revenue. This generally is a vital benefit, notably for people in greater tax brackets.

5. Influence on Retirement Financial savings:

- Private Loans: Taking out a private mortgage has no direct influence in your retirement financial savings.

- 401(okay) Loans: Borrowing out of your 401(okay) reduces the sum of money obtainable to develop tax-deferred in your retirement account.

6. Credit score Rating:

- Private Loans: Your credit score rating performs a major function in figuring out the rate of interest you qualify for on a private mortgage. The next credit score rating sometimes results in decrease rates of interest.

- 401(okay) Loans: Your credit score rating usually doesn’t influence the rate of interest on a 401(okay) mortgage.

7. Monetary State of affairs:

- Private Loans: Contemplate your present debt load and your capability to make month-to-month funds.

- 401(okay) Loans: Assess the influence of borrowing in your long-term retirement objectives.

When to Select a Private Mortgage:

- Greater credit score rating: You probably have a great credit score rating and may qualify for a decrease rate of interest on a private mortgage, it might be a greater choice than a 401(okay) mortgage.

- Want for flexibility: Private loans provide flexibility when it comes to how you should use the cash.

- Restricted 401(okay) steadiness: In case your 401(okay) steadiness is comparatively small, a private mortgage could also be your solely choice.

When to Select a 401(okay) Mortgage:

- Decrease rate of interest: When you can entry a 401(okay) mortgage with a decrease rate of interest than a private mortgage, it is usually a extra advantageous selection.

- Tax benefits: The tax-advantaged nature of 401(okay) loans generally is a vital profit, particularly for people in greater tax brackets.

- Quick-term want: When you want cash for a brief interval, a 401(okay) mortgage generally is a handy and cost-effective choice.

The Backside Line: Selecting the Proper Path

The choice between a private mortgage and a 401(okay) mortgage shouldn’t be a one-size-fits-all proposition. It is important to fastidiously weigh the professionals and cons of every choice, contemplating your distinctive monetary state of affairs and long-term objectives.

Here is a step-by-step information that will help you make the fitting selection:

- Assess your monetary state of affairs: Decide your present debt load, revenue, and bills.

- Calculate the price of every choice: Think about rates of interest, mortgage phrases, and potential tax implications.

- Contemplate the long-term influence: Consider how every choice will have an effect on your retirement financial savings and total monetary safety.

- Seek the advice of with a monetary advisor: A monetary skilled can present customized steerage and assist you decide that aligns together with your objectives.

Various Options to Contemplate:

If each private loans and 401(okay) loans seem to be undesirable choices, take into account these alternate options:

- Emergency fund: Constructing an emergency fund can present a security internet for surprising bills.

- Bank card money advance: Whereas this feature comes with excessive rates of interest, it may be a short-term resolution.

- Household or pals: If attainable, take into account borrowing cash from household or pals.

- Promoting property: You might promote property like jewellery, electronics, or unused belongings to lift funds.

Conclusion: Making an Knowledgeable Resolution for Your Monetary Future

Selecting between a private mortgage and a 401(okay) mortgage requires cautious consideration. By understanding the professionals and cons of every choice and evaluating your particular person monetary circumstances, you can also make an knowledgeable resolution that aligns together with your monetary objectives and helps you navigate life’s surprising challenges. Bear in mind, your monetary well-being is paramount, so prioritize making selections that help your long-term monetary safety.

web optimization Key phrases:

- Private mortgage

- 401(okay) mortgage

- Retirement financial savings

- Monetary emergency

- Rates of interest

- Tax implications

- Credit score rating

- Mortgage phrases

- Debt consolidation

- Emergency fund

- Monetary advisor

Observe: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. It’s all the time beneficial to seek the advice of with a professional monetary skilled earlier than making any monetary choices.

Closure

We hope this text has helped you perceive the whole lot about Ought to You Get a Private Mortgage or Faucet Into Your 401(okay)? A Complete Information to Making the Proper Selection. Keep tuned for extra updates!

Make sure that to observe us for extra thrilling information and evaluations.

We’d love to listen to your ideas about Ought to You Get a Private Mortgage or Faucet Into Your 401(okay)? A Complete Information to Making the Proper Selection—depart your feedback under!

Hold visiting our web site for the newest traits and evaluations.