Private Loans vs. Auto Loans: What is the Distinction?

Associated Articles

- High 10 Private Mortgage Suppliers In 2024: Your Information To Discovering The Greatest Match

- Top Personal Loans For Home Repairs: Financing Your Dream Home, One Fix At A Time

- Tying The Knot With out Breaking The Financial institution: Utilizing Private Loans For Your Marriage ceremony Bills

- How To Choose Between A Personal Loan And A Line Of Credit

- Should You Get A Personal Loan Or Tap Into Your 401(k)? A Comprehensive Guide To Making The Right Choice

Introduction

On this article, we dive into Private Loans vs. Auto Loans: What is the Distinction?, providing you with a full overview of what’s to come back

Video about

Private Loans vs. Auto Loans: What is the Distinction? A Complete Information to Selecting the Proper Mortgage for You

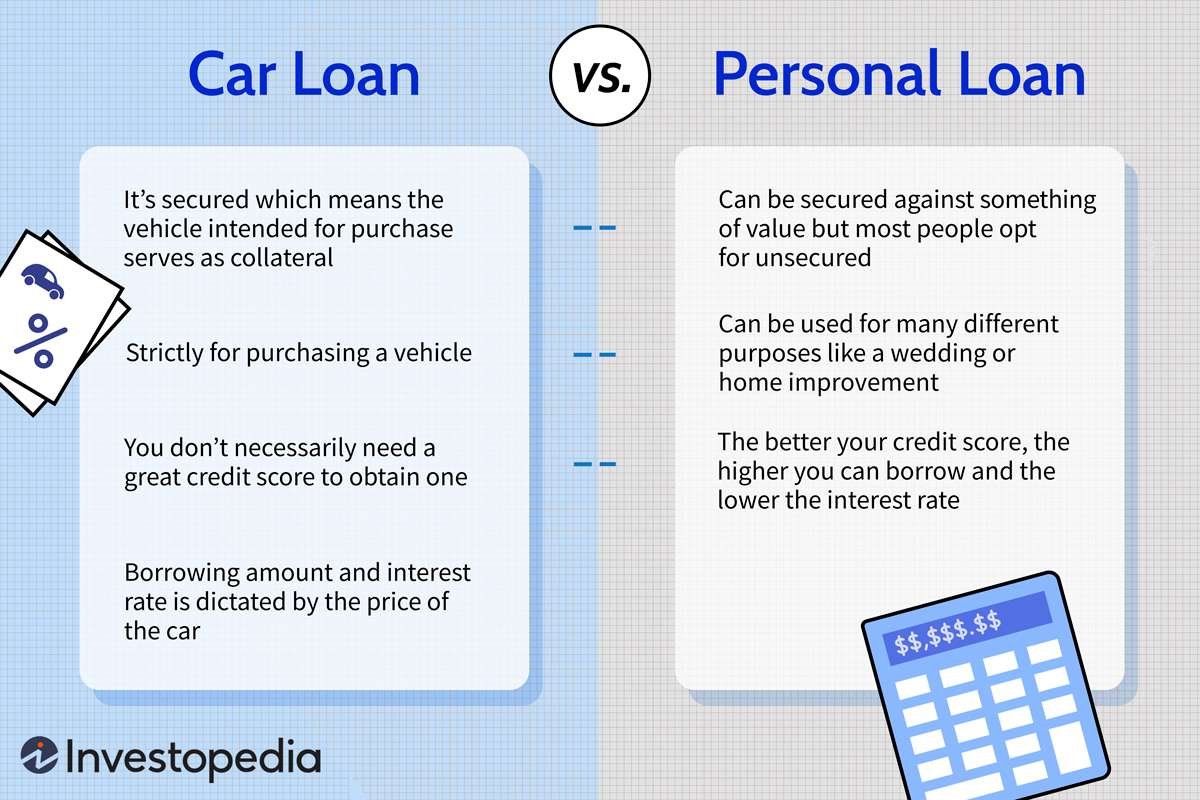

With regards to financing large purchases, navigating the world of loans can really feel like a maze. Two frequent mortgage sorts usually confuse debtors: private loans and auto loans. Whereas each are designed that can assist you purchase one thing you want or need, they differ considerably of their objective, phrases, and general suitability. This complete information will break down the variations between private loans and auto loans, serving to you make an knowledgeable choice about which mortgage is best for you.

Understanding the Fundamentals: What’s a Private Mortgage?

A private mortgage is a flexible monetary software that lets you borrow a lump sum of cash for quite a lot of functions. This flexibility is the hallmark of non-public loans. You should use them for:

- Consolidation of debt: Mix a number of high-interest money owed into one manageable fee with a decrease rate of interest.

- Dwelling enhancements: Renovate your kitchen, improve your rest room, or add a brand new room to your own home.

- Medical bills: Cowl sudden medical payments or procedures not coated by insurance coverage.

- Main purchases: Finance a dream trip, purchase a brand new equipment, or cowl a major life occasion.

- Sudden bills: Deal with sudden emergencies like automotive repairs or roof harm.

Key Options of Private Loans:

- Versatile Use: You should use a private mortgage for nearly any objective, providing you with management over your funds.

- Mounted Curiosity Charges: Private loans usually include fastened rates of interest, guaranteeing predictable month-to-month funds.

- Variable Mortgage Phrases: Select a mortgage time period that matches your price range and compensation objectives, sometimes starting from 1 to 7 years.

- No Collateral Required: Private loans are unsecured, which means you do not have to pledge any belongings as collateral.

- Aggressive Curiosity Charges: Private mortgage rates of interest can differ relying in your credit score rating, mortgage quantity, and lender.

- On-line Utility Course of: Many lenders provide handy on-line purposes, making it simpler to use and get permitted.

Delving Deeper: Exploring the World of Auto Loans

Auto loans, because the title suggests, are particularly designed to finance the acquisition of a automobile. They can help you unfold the price of a brand new or used automotive over a set time period, making it extra manageable.

Key Options of Auto Loans:

- Particular Objective: Auto loans are strictly meant for automobile purchases, limiting their use to cars.

- Decrease Curiosity Charges: Auto loans sometimes provide decrease rates of interest in comparison with private loans, reflecting the decrease danger for lenders.

- Longer Mortgage Phrases: Auto mortgage phrases usually lengthen for 3 to 7 years, generally even longer, permitting for decrease month-to-month funds.

- Collateral Required: The automobile you buy serves as collateral for the mortgage, which means the lender can repossess the automotive should you default on funds.

- Particular Financing Choices: Dealerships usually provide particular financing choices, reminiscent of zero-percent financing or cash-back incentives.

Selecting the Proper Mortgage: When to Use a Private Mortgage

Private loans are a flexible financing resolution that can be utilized for a variety of wants. Listed below are some eventualities the place a private mortgage could be the higher selection:

- Consolidating Excessive-Curiosity Debt: You probably have a number of bank cards with excessive rates of interest, a private mortgage will help you consolidate your debt into one lower-interest fee, saving you cash on curiosity expenses.

- Dwelling Enhancements: Private loans can present the required funds for dwelling renovations, upgrades, or repairs, permitting you to extend your house’s worth or enhance your dwelling house.

- Medical Bills: Sudden medical payments will be financially devastating. A private mortgage will help you cowl these bills with out depleting your financial savings or taking over extra debt.

- Main Purchases: Planning a giant journey, shopping for new furnishings, or masking a serious life occasion? A private mortgage can present the monetary flexibility to make these purchases with out breaking the financial institution.

- Sudden Bills: Life throws curveballs. A private mortgage will help you deal with sudden emergencies like automotive repairs, roof harm, or unexpected medical wants.

Selecting the Proper Mortgage: When to Use an Auto Mortgage

Auto loans are particularly tailor-made for automobile purchases, providing a number of benefits for financing your subsequent automotive. Here is when an auto mortgage could be the higher choice:

- Buying a New or Used Automobile: Auto loans are the usual technique to finance automotive purchases, whether or not you are shopping for a brand-new mannequin or a pre-owned automobile.

- Decrease Curiosity Charges: Auto loans usually include decrease rates of interest than private loans, making them a more cost effective technique to finance a automotive.

- Longer Mortgage Phrases: Longer mortgage phrases imply decrease month-to-month funds, which will be helpful should you’re on a decent price range.

- Particular Financing Choices: Dealerships usually provide particular financing choices, reminiscent of zero-percent financing or cash-back incentives, that may make automotive possession extra inexpensive.

The Execs and Cons: Weighing Your Choices

Earlier than you decide to both a private mortgage or an auto mortgage, it is important to think about the professionals and cons of every choice.

Private Loans:

Execs:

- Versatile Use: Use the mortgage for any objective, providing you with larger monetary freedom.

- Mounted Curiosity Charges: Predictable month-to-month funds, eliminating rate of interest fluctuations.

- Variable Mortgage Phrases: Select a mortgage time period that matches your price range and compensation objectives.

- No Collateral Required: No danger of dropping belongings should you default on funds.

- Aggressive Curiosity Charges: Rates of interest will be aggressive, particularly with good credit score.

- On-line Utility Course of: Handy on-line purposes for fast and straightforward approval.

Cons:

- Greater Curiosity Charges: Private mortgage rates of interest will be greater than auto mortgage charges.

- Shorter Mortgage Phrases: Shorter mortgage phrases can result in greater month-to-month funds.

- Potential for Debt Consolidation: Whereas a private mortgage can consolidate debt, it could additionally result in extra debt if not managed rigorously.

Auto Loans:

Execs:

- Decrease Curiosity Charges: Sometimes provide decrease rates of interest than private loans, saving you cash on curiosity expenses.

- Longer Mortgage Phrases: Longer phrases may end up in decrease month-to-month funds, making automotive possession extra manageable.

- Particular Financing Choices: Dealerships usually provide incentives like zero-percent financing or cash-back presents.

- Collateral Safety: The automotive serves as collateral, offering some monetary safety for the lender.

Cons:

- Particular Objective: Restricted to automobile purchases, limiting your monetary flexibility.

- Collateral Threat: Defaulting on funds might result in repossession of your automotive.

- Probably Excessive Down Cost: Auto loans usually require a major down fee, particularly for newer autos.

- Hidden Charges: Dealerships might cost extra charges past the rate of interest, growing the general price of the mortgage.

Past the Fundamentals: Elements to Think about

When deciding between a private mortgage and an auto mortgage, contemplate these extra elements:

- Your Credit score Rating: Your credit score rating performs a major position in figuring out the rate of interest you qualify for. The next credit score rating usually results in decrease rates of interest.

- Your Monetary State of affairs: Assess your present revenue, bills, and debt ranges to find out how a lot you may comfortably afford to repay every month.

- The Mortgage Quantity: The quantity you could borrow will affect the mortgage phrases and rate of interest you qualify for.

- The Mortgage Time period: Select a mortgage time period that aligns together with your compensation objectives and monetary scenario.

- The Lender: Examine rates of interest, charges, and mortgage phrases from a number of lenders to search out one of the best deal.

- The Automobile’s Worth: When contemplating an auto mortgage, analysis the automobile’s market worth to make sure you’re not overpaying.

Making the Proper Alternative: A Step-by-Step Information

Here is a step-by-step information that can assist you make an knowledgeable choice about which mortgage is best for you:

- Outline Your Want: Clearly determine the aim of the mortgage. Are you seeking to finance a automotive, consolidate debt, or cowl a serious buy?

- Analysis Mortgage Choices: Examine rates of interest, charges, and mortgage phrases from a number of lenders for each private loans and auto loans.

- Consider Your Credit score Rating: Test your credit score rating and perceive the way it impacts your mortgage eligibility and rate of interest.

- Assess Your Monetary State of affairs: Decide how a lot you may comfortably afford to repay every month primarily based in your revenue, bills, and debt ranges.

- Think about the Mortgage Time period: Select a mortgage time period that aligns together with your compensation objectives and monetary scenario.

- Examine Mortgage Presents: Examine the general price of every mortgage, together with rates of interest, charges, and mortgage phrases.

- Make an Knowledgeable Determination: Choose the mortgage choice that greatest meets your monetary wants and objectives.

Conclusion: Discovering the Excellent Match for Your Wants

Selecting between a private mortgage and an auto mortgage requires cautious consideration of your monetary scenario, the aim of the mortgage, and your particular person wants. By understanding the important thing variations between these mortgage sorts and following the steps outlined above, you can also make an knowledgeable choice that may enable you obtain your monetary objectives.

Keep in mind:

- Store round for one of the best charges: Do not accept the primary give you obtain. Examine rates of interest and mortgage phrases from a number of lenders.

- Learn the nice print: Completely evaluate the mortgage settlement earlier than signing to make sure you perceive the phrases and circumstances.

- Handle your debt responsibly: Make well timed funds to keep away from late charges and preserve a superb credit score rating.

By making knowledgeable choices and managing your loans responsibly, you may leverage the facility of borrowing to attain your monetary objectives and construct a brighter future.

Closure

We hope this text has helped you perceive all the pieces about Private Loans vs. Auto Loans: What is the Distinction?. Keep tuned for extra updates!

Don’t neglect to examine again for the most recent information and updates on Private Loans vs. Auto Loans: What is the Distinction?!

We’d love to listen to your ideas about Private Loans vs. Auto Loans: What is the Distinction?—depart your feedback beneath!

Preserve visiting our web site for the most recent tendencies and evaluations.