Private Loans Vs. Credit score Playing cards: Which Is Higher?

Private Loans vs. Credit score Playing cards: Which Is Higher?

Associated Articles

- How To Choose Between A Personal Loan And A Line Of Credit

- Rebuilding Your Monetary Life: How To Get A Private Mortgage After Chapter

- Personal Loans Vs. Credit Cards: Which Is Better For You?

- Personal Loan Repayment Plans: What Are Your Options? Navigating The Path To Financial Freedom

- What To Know About Secured Vs. Unsecured Personal Loans

Introduction

Be a part of us as we discover Private Loans vs. Credit score Playing cards: Which Is Higher?, filled with thrilling updates

Video about

Private Loans vs. Credit score Playing cards: Which Is Higher for You?

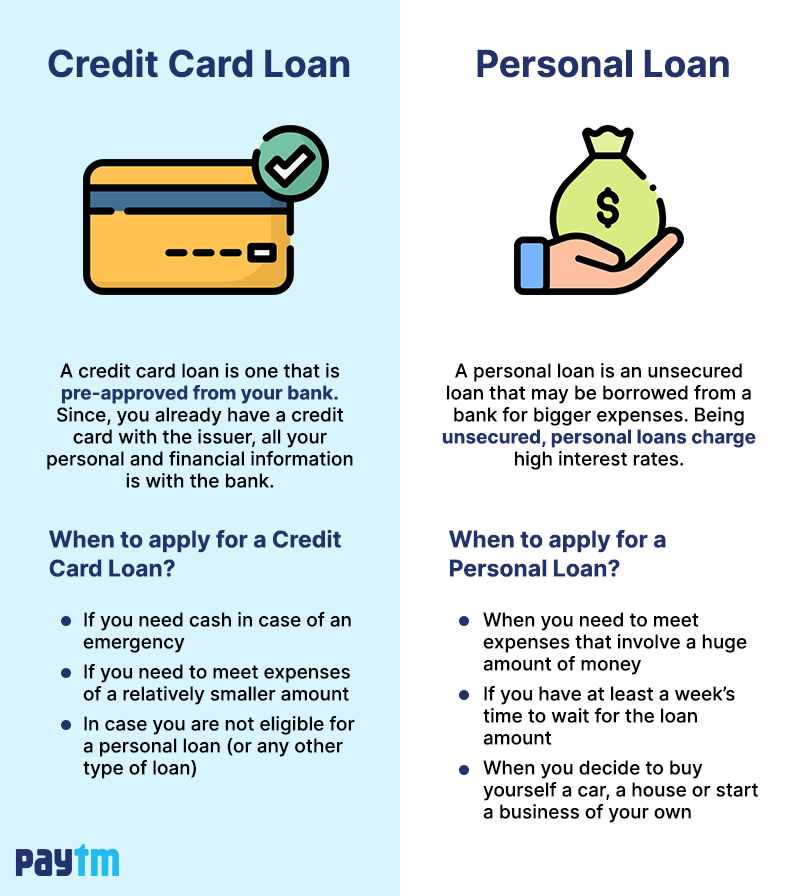

Life throws curveballs. Possibly you must repair your automotive, cowl surprising medical bills, or lastly make that dream residence renovation a actuality. Regardless of the motive, you would possibly end up needing additional money. However with so many choices accessible, how do you select the easiest way to borrow? Two fashionable decisions are private loans and bank cards, every with their very own set of benefits and downsides.

This complete information will break down the important thing variations between private loans and bank cards, serving to you make an knowledgeable resolution on your particular monetary scenario. We’ll discover the professionals and cons of every possibility, delve into rates of interest and charges, and focus on how to decide on the very best match on your wants.

Understanding Private Loans

A private mortgage is a lump sum of cash you borrow from a lender, reminiscent of a financial institution or on-line lender. You repay the mortgage in mounted month-to-month installments over a predetermined interval, sometimes starting from a couple of months to a number of years.

The Professionals of Private Loans:

- Mounted Curiosity Charges: Private loans normally include a hard and fast rate of interest, which means your month-to-month funds stay constant all through the mortgage time period. This predictability makes budgeting simpler.

- Decrease Curiosity Charges: Usually, private loans supply decrease rates of interest than bank cards, particularly for debtors with good credit score. This interprets to decrease general borrowing prices.

- Clear Reimbursement Schedule: With a hard and fast month-to-month fee and a set mortgage time period, you recognize precisely how a lot you will owe and once you’ll be debt-free.

- Consolidation: Private loans can be utilized to consolidate high-interest debt, like bank card balances, into one manageable fee with a decrease rate of interest. This may help you lower your expenses and simplify your funds.

- Bigger Mortgage Quantities: Private loans will be obtained for bigger quantities than bank cards, making them appropriate for important bills like residence renovations or medical payments.

The Cons of Private Loans:

- Stricter Qualification Necessities: Lenders normally have stricter eligibility standards for private loans in comparison with bank cards. You will want a superb credit score rating and a gentle earnings to qualify.

- Origination Charges: Some lenders cost origination charges, that are a share of the mortgage quantity. This payment can add to the general value of borrowing.

- Restricted Flexibility: As soon as you’re taking out a private mortgage, you are locked into a particular compensation schedule. In case your monetary scenario adjustments, it may be troublesome to regulate your funds.

Understanding Credit score Playing cards

A bank card is a revolving line of credit score that lets you borrow cash as much as a sure restrict. You should use your card for purchases, and also you’re sometimes given a grace interval (normally 21-30 days) to repay the stability with out accruing curiosity. Should you do not pay your stability in full by the due date, you will be charged curiosity on the excellent quantity.

The Professionals of Credit score Playing cards:

- Flexibility: Bank cards supply numerous flexibility. You should use them for on a regular basis purchases, journey bills, and emergencies.

- Rewards and Perks: Many bank cards supply rewards packages that may earn you money again, factors, miles, or different advantages.

- Constructing Credit score: Accountable bank card use may help construct your credit score historical past and rating, which is important for future borrowing.

- Emergency Funds: Bank cards can present a security web in case of surprising bills.

- Simpler Approval: Bank cards sometimes have much less stringent approval necessities than private loans, making them extra accessible for people with restricted credit score historical past.

The Cons of Credit score Playing cards:

- Excessive Curiosity Charges: Bank cards typically have a lot greater rates of interest than private loans. Should you do not pay your stability in full every month, the curiosity fees can rapidly accumulate.

- Overspending: Bank cards could make it straightforward to overspend, resulting in debt accumulation.

- Charges: Bank cards can cost numerous charges, reminiscent of annual charges, late fee charges, and over-limit charges.

- Variable Curiosity Charges: Most bank cards have variable rates of interest, which may fluctuate over time, making budgeting tougher.

Selecting the Proper Possibility for You:

So, which is best – a private mortgage or a bank card? The reply is dependent upon your particular person circumstances and monetary targets. Here is a breakdown of conditions the place every possibility is perhaps the higher selection:

When a Private Mortgage Would possibly Be Higher:

- Consolidating Excessive-Curiosity Debt: Should you’re drowning in bank card debt, a private mortgage with a decrease rate of interest may help you consolidate your balances and lower your expenses on curiosity fees.

- Making a Giant Buy: Private loans are perfect for financing important bills like residence renovations, medical payments, or a brand new automotive.

- You Want a Predictable Reimbursement Schedule: With a hard and fast rate of interest and set month-to-month funds, private loans supply a predictable compensation construction that may be useful for budgeting.

When a Credit score Card Would possibly Be Higher:

- Constructing Credit score: Accountable bank card use may help you identify a constructive credit score historical past and enhance your credit score rating.

- On a regular basis Purchases: Bank cards are handy for on a regular basis bills, providing rewards and cashback alternatives.

- Quick-Time period Borrowing: If you must borrow cash for a brief interval and plan to pay it off rapidly, a bank card with a grace interval could be a good possibility.

- Emergency Funds: Bank cards can present a security web in case of surprising bills.

Essential Concerns:

- Your Credit score Rating: Your credit score rating will play a big position in figuring out your eligibility and rates of interest for each private loans and bank cards. A better credit score rating usually interprets to decrease rates of interest and higher mortgage phrases.

- Curiosity Charges and Charges: Fastidiously examine rates of interest and charges related to each choices. Search for lenders who supply aggressive charges and minimal charges.

- Reimbursement Phrases: Contemplate the compensation phrases, such because the mortgage time period and month-to-month funds, and select an possibility that matches your funds and monetary targets.

- Spending Habits: You probably have a historical past of overspending, a bank card won’t be the only option for you. A private mortgage with a hard and fast compensation schedule is perhaps extra manageable.

Suggestions for Utilizing Credit score Playing cards Correctly:

- Pay Your Steadiness in Full Every Month: Goal to repay your bank card stability in full every month to keep away from accruing curiosity fees.

- Set Spending Limits: Set a funds and stick with it. Keep away from utilizing your bank card for impulsive purchases.

- Monitor Your Spending: Observe your bank card spending often to make sure you’re staying inside your funds.

- Keep away from Late Funds: Late funds can injury your credit score rating and enhance your rates of interest.

- Select the Proper Card: Choose a bank card that gives rewards or perks that align together with your spending habits and monetary targets.

Suggestions for Selecting the Proper Private Mortgage:

- Store Round for Charges: Evaluate rates of interest and charges from completely different lenders to search out the very best deal.

- Perceive the Reimbursement Phrases: Evaluation the mortgage phrases, together with the rate of interest, mortgage time period, and month-to-month funds, earlier than committing.

- Contemplate the Origination Charges: Some lenders cost origination charges, which may add to the general value of the mortgage.

- Learn the Advantageous Print: Fastidiously assessment the mortgage settlement earlier than signing to make sure you perceive the phrases and circumstances.

Conclusion:

Each private loans and bank cards will be invaluable monetary instruments, however it’s essential to decide on the choice that most accurately fits your particular person circumstances and monetary targets.

By understanding the professionals and cons of every possibility, evaluating rates of interest and charges, and contemplating your spending habits, you may make an knowledgeable resolution that helps you obtain your monetary aims.

Bear in mind, accountable borrowing is vital to monetary stability. Use each private loans and bank cards correctly, and you will be in your option to a more healthy monetary future.

Closure

We hope this text has helped you perceive all the things about Private Loans vs. Credit score Playing cards: Which Is Higher?. Keep tuned for extra updates!

Don’t neglect to verify again for the most recent information and updates on Private Loans vs. Credit score Playing cards: Which Is Higher?!

Be at liberty to share your expertise with Private Loans vs. Credit score Playing cards: Which Is Higher? within the remark part.

Keep knowledgeable with our subsequent updates on Private Loans vs. Credit score Playing cards: Which Is Higher? and different thrilling subjects.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…