Private Mortgage Calculator: How A lot Can You Afford to Borrow?

Associated Articles

- Unlock Your Financial Potential: The Best Personal Loans For Excellent Credit Scores

- Personal Loans Vs. Credit Cards: Which Is Better For You?

- Unlocking Your Financial Potential: A Guide To Responsible Personal Loan Borrowing

- Tying The Knot With out Breaking The Financial institution: Utilizing Private Loans For Your Marriage ceremony Bills

- What To Know About Secured Vs. Unsecured Personal Loans

Introduction

Be part of us as we discover Private Mortgage Calculator: How A lot Can You Afford to Borrow?, full of thrilling updates

Video about

Private Mortgage Calculator: How A lot Can You Afford to Borrow?

A private mortgage is usually a lifesaver whenever you want money rapidly for surprising bills, house enhancements, debt consolidation, or perhaps a dream trip. However with so many lenders and mortgage choices accessible, determining how a lot you’ll be able to afford to borrow can really feel overwhelming.

Enter the non-public mortgage calculator, your trusty sidekick on the earth of private finance. This helpful software helps you perceive the true price of borrowing and empowers you to make knowledgeable selections about your funds.

What’s a Private Mortgage Calculator?

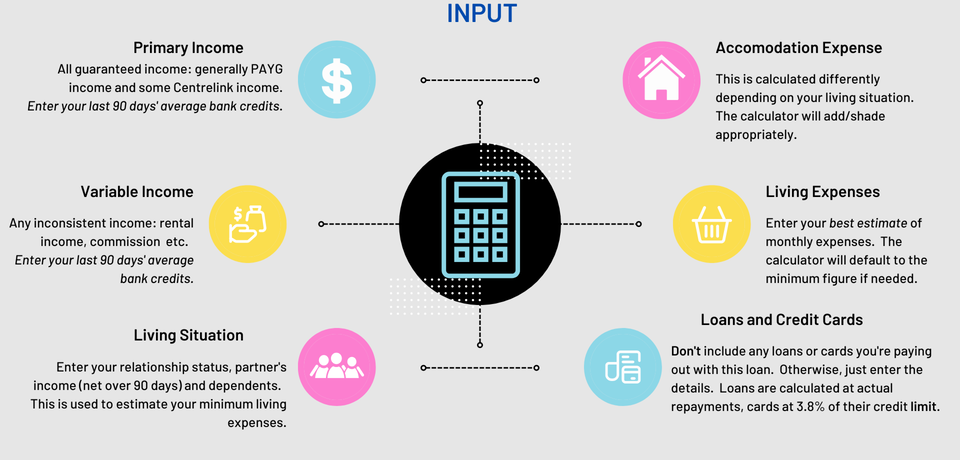

A private mortgage calculator is a digital software that estimates your month-to-month funds, complete curiosity, and general mortgage price based mostly on components like:

- Mortgage quantity: How a lot cash you need to borrow.

- Rate of interest: The annual proportion charge (APR) charged in your mortgage.

- Mortgage time period: The length of your mortgage, normally expressed in months or years.

- Mortgage sort: Whether or not it is a secured or unsecured mortgage.

How Does a Private Mortgage Calculator Work?

The magic behind a private mortgage calculator lies in its system, which calculates the month-to-month fee utilizing the next equation:

Month-to-month Cost = (P r (1 + r)^n) / ((1 + r)^n – 1)

The place:

- P is the principal mortgage quantity

- r is the month-to-month rate of interest (APR divided by 12)

- n is the entire variety of months within the mortgage time period

Why Use a Private Mortgage Calculator?

This is why a private mortgage calculator is your greatest good friend when navigating the world of private loans:

- Estimate Your Month-to-month Funds: Figuring out your month-to-month fee prematurely helps you funds successfully and keep away from monetary pressure.

- Examine Mortgage Choices: Totally different lenders provide various rates of interest and mortgage phrases. A calculator helps you examine these choices side-by-side to seek out probably the most reasonably priced mortgage.

- Calculate Whole Curiosity Paid: The calculator reveals the entire curiosity you will pay over the mortgage’s lifetime, serving to you perceive the true price of borrowing.

- Assess Your Debt-to-Revenue Ratio: The calculator can assist you estimate how a brand new mortgage will influence your debt-to-income ratio (DTI), which is an important issue for lenders when assessing your creditworthiness.

Suggestions for Utilizing a Private Mortgage Calculator Successfully:

- Be Lifelike About Your Funds: Do not overestimate your borrowing energy. Use the calculator to find out a mortgage quantity you’ll be able to comfortably repay with out jeopardizing your monetary stability.

- Think about Different Bills: Keep in mind to contemplate your current month-to-month bills, similar to lease, utilities, and bank card funds, when assessing your affordability.

- Discover Totally different Mortgage Choices: Examine provides from a number of lenders to seek out the very best rates of interest and phrases.

- Think about Mortgage Charges: Some lenders cost origination charges, late fee charges, or different costs. Issue these charges into your calculations to get an entire image of the mortgage’s price.

- Do not Ignore the Tremendous Print: Fastidiously learn the mortgage settlement earlier than signing to grasp all of the phrases and situations.

The place to Discover a Private Mortgage Calculator?

Private mortgage calculators are available on-line:

- Monetary Web sites: Web sites like Bankrate, NerdWallet, and LendingTree provide free private mortgage calculators.

- Lender Web sites: Many lenders present calculators on their web sites that can assist you estimate mortgage funds.

- Private Finance Apps: Cellular apps like Mint, Private Capital, and YNAB typically embrace private mortgage calculators.

Understanding the Impression of Curiosity Charges and Mortgage Phrases

The rate of interest and mortgage time period have a big influence in your month-to-month funds and complete curiosity paid.

Curiosity Fee:

- Increased Curiosity Fee = Increased Month-to-month Funds: A better rate of interest means you pay extra curiosity over the lifetime of the mortgage, resulting in bigger month-to-month funds.

- Decrease Curiosity Fee = Decrease Month-to-month Funds: A decrease rate of interest interprets to decrease curiosity funds and smaller month-to-month funds.

Mortgage Time period:

- Shorter Mortgage Time period = Increased Month-to-month Funds: A shorter mortgage time period means you repay the mortgage quicker, leading to greater month-to-month funds however decrease complete curiosity paid.

- Longer Mortgage Time period = Decrease Month-to-month Funds: An extended mortgage time period spreads out your funds over an extended interval, leading to decrease month-to-month funds however greater complete curiosity paid.

Selecting the Proper Mortgage Time period:

Selecting the best mortgage time period entails balancing affordability and complete curiosity paid.

- Prioritize Affordability: When you’re involved about managing month-to-month funds, an extended mortgage time period is perhaps extra manageable.

- Decrease Curiosity Prices: If you wish to pay much less curiosity general, a shorter mortgage time period is usually the higher possibility.

Elements Influencing Your Private Mortgage Curiosity Fee

Your private mortgage rate of interest is influenced by a number of components:

- Credit score Rating: A better credit score rating usually results in decrease rates of interest.

- Debt-to-Revenue Ratio (DTI): A decrease DTI, which represents the proportion of your earnings that goes in the direction of debt funds, can enhance your rate of interest.

- Mortgage Quantity: Bigger mortgage quantities could include greater rates of interest.

- Mortgage Time period: Shorter mortgage phrases typically have decrease rates of interest in comparison with longer phrases.

- Lender Insurance policies: Totally different lenders have various rate of interest insurance policies.

Enhancing Your Possibilities of Getting a Decrease Curiosity Fee

Listed here are some suggestions for securing a decrease rate of interest in your private mortgage:

- Construct a Sturdy Credit score Rating: Pay payments on time, hold bank card balances low, and keep away from opening too many new accounts.

- Decrease Your Debt-to-Revenue Ratio: Cut back current debt, improve your earnings, or each.

- Store Round for Charges: Examine provides from a number of lenders to seek out probably the most aggressive charges.

- Think about a Secured Mortgage: Secured loans, that are backed by collateral, typically have decrease rates of interest than unsecured loans.

- Negotiate with the Lender: Do not be afraid to barter with the lender for a decrease rate of interest, particularly in case you have a powerful credit score historical past and a low DTI.

Understanding Your Mortgage Settlement

Earlier than signing a private mortgage settlement, rigorously evaluation the next:

- Curiosity Fee: Ensure you perceive the APR and the way it’s calculated.

- Mortgage Time period: Affirm the mortgage time period and the entire variety of funds you will must make.

- Charges: Pay attention to any origination charges, late fee charges, or different costs.

- Cost Schedule: Perceive how and whenever you’ll make your month-to-month funds.

- Prepayment Penalties: Examine if there are any penalties for paying off the mortgage early.

- Default Clause: Perceive the results of lacking funds.

Options to Private Loans

Earlier than taking out a private mortgage, think about different financing choices:

- Credit score Card Stability Transfers: If in case you have high-interest bank card debt, a stability switch to a card with a decrease APR can prevent cash.

- Dwelling Fairness Mortgage or Line of Credit score (HELOC): If in case you have house fairness, a HELOC or house fairness mortgage can provide decrease rates of interest than private loans.

- Household or Mates: Borrowing from household or mates will be an possibility in the event you want a smaller mortgage and are comfy with these preparations.

- 0% APR Credit score Playing cards: Some bank cards provide introductory 0% APR intervals, which will be useful for short-term financing wants.

Suggestions for Accountable Private Mortgage Administration

- Funds for Your Funds: Embrace your mortgage fee in your month-to-month funds to make sure you can afford it.

- Make Funds on Time: Keep away from late fee charges and harm to your credit score rating.

- Think about Additional Funds: If attainable, make further funds to cut back your principal stability and repay the mortgage quicker.

- Assessment Your Mortgage Settlement: Periodically evaluation your mortgage settlement to make sure you perceive the phrases and situations.

- Keep Knowledgeable About Your Funds: Monitor your credit score rating and debt-to-income ratio to make sure you’re managing your funds responsibly.

Conclusion:

A private mortgage calculator is a useful software for anybody contemplating a private mortgage. It helps you perceive the true price of borrowing and make knowledgeable selections about your funds. By utilizing a calculator, evaluating mortgage choices, and understanding the components that affect rates of interest, you’ll find probably the most reasonably priced mortgage and handle your debt responsibly. Keep in mind to at all times borrow responsibly and solely take out a mortgage in the event you can comfortably afford the month-to-month funds.

Closure

We hope this text has helped you perceive every thing about Private Mortgage Calculator: How A lot Can You Afford to Borrow?. Keep tuned for extra updates!

Ensure that to comply with us for extra thrilling information and opinions.

Be happy to share your expertise with Private Mortgage Calculator: How A lot Can You Afford to Borrow? within the remark part.

Keep knowledgeable with our subsequent updates on Private Mortgage Calculator: How A lot Can You Afford to Borrow? and different thrilling subjects.