Private Mortgage Options: What Are Your Different Choices?

Associated Articles

- How To Choose Between A Personal Loan And A Line Of Credit

- Emergency Private Loans: Your Monetary Lifeline In Occasions Of Want

- Understanding the Influence of Mortgage Curiosity Charges on Month-to-month Budgets

- Co-Signing A Mortgage: A Detailed Information To The Dangers And Rewards

- Can You Use A Private Mortgage To Pay Off Medical Payments? A Complete Information

Introduction

Be part of us as we discover Private Mortgage Options: What Are Your Different Choices?, filled with thrilling updates

Video about

Private Mortgage Options: What Are Your Different Choices?

Life throws curveballs, and generally these curveballs require a little bit additional money. Whether or not it is an surprising automobile restore, a medical emergency, or a house renovation, needing a private mortgage can really feel like a standard prevalence. However earlier than you leap into the primary mortgage supply that pops up, it is essential to know that private loans aren’t your solely possibility. There’s an entire world of economic options on the market, and discovering the proper one on your scenario can prevent important curiosity and stress in the long term.

Understanding the Private Mortgage Panorama

Private loans are a preferred alternative for debtors as a result of they provide a comparatively simple solution to entry funds. They sometimes have fastened rates of interest and reimbursement phrases, making budgeting simpler. However private loans include their very own set of issues:

- Curiosity Charges: Private loans typically carry greater rates of interest in comparison with different types of borrowing, particularly when you’ve got a less-than-perfect credit score rating.

- Charges: Origination charges, late cost charges, and different expenses can add up, rising the general price of the mortgage.

- Credit score Rating Affect: Taking out a private mortgage can have an effect on your credit score rating, particularly in the event you do not handle the mortgage responsibly.

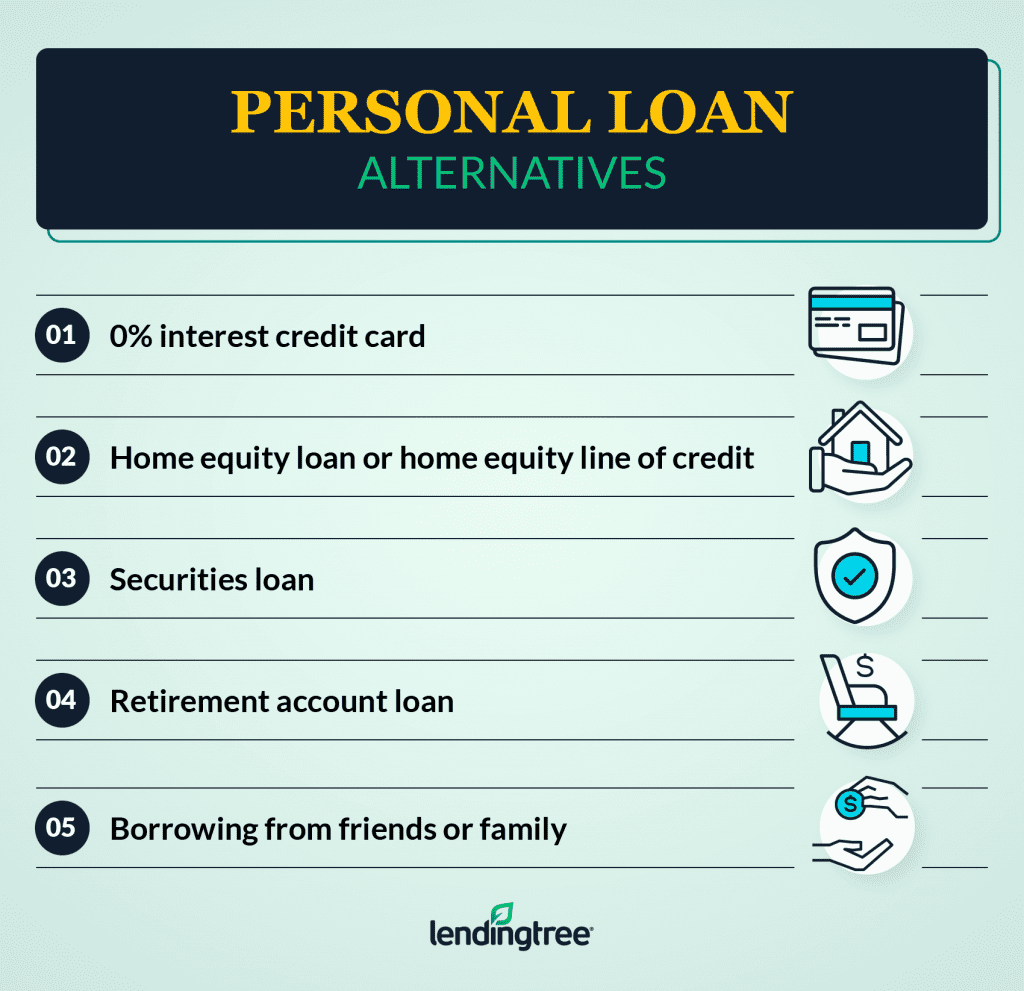

Past the Private Mortgage: Exploring Options

When you’re searching for a extra reasonably priced and versatile solution to finance your wants, contemplate these private mortgage alternate options:

1. Credit score Playing cards

-

Execs:

- Comfort: Bank cards supply prompt entry to funds, permitting you to make purchases instantly.

- Rewards: Many bank cards supply rewards applications like money again, journey miles, or factors that may offset your spending.

- Constructing Credit score: Accountable use of a bank card will help you construct a optimistic credit score historical past.

-

Cons:

- Excessive Curiosity Charges: Bank cards typically have greater rates of interest than private loans, particularly in the event you carry a steadiness.

- Debt Lure: When you do not repay your steadiness in full every month, you possibly can rapidly accumulate curiosity expenses and end up in a cycle of debt.

2. House Fairness Loans and Traces of Credit score (HELOCs)

-

Execs:

- Decrease Curiosity Charges: House fairness loans and HELOCs sometimes have decrease rates of interest than private loans as a result of your house serves as collateral.

- Tax Deductible Curiosity: The curiosity you pay on a house fairness mortgage or HELOC could also be tax deductible, relying in your particular circumstances.

-

Cons:

- Danger of Foreclosures: When you default in your funds, you may lose your house.

- Restricted Entry: You’ll be able to solely borrow towards the fairness you will have in your house, which can restrict the quantity you possibly can entry.

3. Peer-to-Peer (P2P) Lending

-

Execs:

- Probably Decrease Curiosity Charges: P2P lending platforms join debtors with particular person buyers, generally resulting in decrease rates of interest than conventional loans.

- Quicker Approval: P2P loans can typically be authorised sooner than conventional loans.

-

Cons:

- Restricted Availability: Not all P2P lending platforms can be found in each state.

- Credit score Rating Necessities: P2P lenders sometimes have strict credit score rating necessities.

4. Household and Pals

-

Execs:

- Decrease Curiosity Charges or No Curiosity: Household and pals could also be prepared to lend you cash at a decrease rate of interest and even interest-free.

- Flexibility: You’ll be able to work out a reimbursement plan that fits each events.

-

Cons:

- Potential for Pressure: Borrowing cash from family members can put a pressure on relationships, particularly if reimbursement shouldn’t be dealt with correctly.

- Authorized Issues: It is important to place a written settlement in place to keep away from any misunderstandings or authorized points.

5. 0% APR Credit score Playing cards

-

Execs:

- No Curiosity Costs: For a restricted time, you can also make purchases with a 0% APR bank card with out accruing curiosity.

- Handy for Massive Purchases: This is usually a good possibility for financing massive purchases like home equipment or furnishings.

-

Cons:

- Introductory Interval: The 0% APR interval is often restricted, after which you may be charged an ordinary rate of interest.

- Minimal Funds: Be sure you perceive the minimal cost necessities to keep away from accumulating curiosity expenses.

6. Private Traces of Credit score

-

Execs:

- Flexibility: A private line of credit score permits you to borrow solely the quantity you want, as wanted.

- Variable Curiosity Charges: Rates of interest can fluctuate, however you possibly can sometimes lock in a hard and fast fee for a particular interval.

-

Cons:

- Potential for Overspending: Since you will have entry to a revolving line of credit score, it is simple to overspend in the event you’re not cautious.

- Credit score Rating Affect: Utilizing a private line of credit score can have an effect on your credit score rating in the event you do not handle it responsibly.

7. Payday Loans

-

Execs:

- Fast Entry to Money: Payday loans can present quick entry to funds, sometimes inside a day or two.

-

Cons:

- Extraordinarily Excessive Curiosity Charges: Payday loans include exorbitant rates of interest, typically exceeding 400%.

- Debt Cycle: It is easy to get caught in a cycle of borrowing and repaying, resulting in a major quantity of debt.

8. Money Advance Apps

-

Execs:

- Small, Brief-Time period Loans: Money advance apps supply small quantities of cash for a brief interval, sometimes just a few days or even weeks.

- Handy: These apps are simple to make use of and might present fast entry to funds.

-

Cons:

- Excessive Charges: Money advance apps cost excessive charges, typically within the type of curiosity or a share of the mortgage quantity.

- Restricted Entry: The quantity you possibly can borrow is often restricted.

9. Employer-Sponsored Loans

-

Execs:

- Decrease Curiosity Charges: Employer-sponsored loans might supply decrease rates of interest than different choices.

- Handy: Repayments are sometimes deducted immediately out of your paycheck.

-

Cons:

- Restricted Availability: Not all employers supply loans.

- Potential for Job Loss: When you lose your job, you’ll have issue repaying the mortgage.

10. Grants and Monetary Help

-

Execs:

- Free Cash: Grants and monetary help do not should be repaid.

- Large Vary of Choices: There are numerous several types of grants and monetary help applications accessible, relying in your wants.

-

Cons:

- Eligibility Necessities: You need to meet particular eligibility standards to qualify for grants or monetary help.

- Competitors: Many grants and monetary help applications are extremely aggressive.

Selecting the Proper Different for You

With so many choices accessible, selecting the best private mortgage various can really feel overwhelming. This is a step-by-step information that will help you make one of the best determination on your scenario:

- Assess Your Wants: Decide the amount of cash you want and the timeframe for reimbursement.

- Consider Your Monetary State of affairs: Contemplate your revenue, bills, and credit score rating.

- Analysis Your Choices: Discover the totally different alternate options and examine their phrases, charges, and rates of interest.

- Contemplate the Lengthy-Time period Penalties: Take into consideration the potential affect of every possibility in your credit score rating and future monetary stability.

- Search Skilled Recommendation: When you’re uncertain about which possibility is finest for you, seek the advice of with a monetary advisor or credit score counselor.

Suggestions for Managing Your Funds

Irrespective of which private mortgage various you select, it is important to handle your funds responsibly to keep away from falling into debt. Listed here are some ideas:

- Create a Funds: Monitor your revenue and bills to know the place your cash goes.

- Save for Emergencies: Construct an emergency fund to cowl surprising bills.

- Pay Payments on Time: Make all of your funds on time to keep away from late charges and harm to your credit score rating.

- Negotiate Curiosity Charges: If doable, attempt to negotiate a decrease rate of interest in your mortgage or bank card.

- Contemplate Debt Consolidation: If in case you have a number of money owed, consolidating them into one mortgage with a decrease rate of interest will help you get monetary savings.

Conclusion

Private loans usually are not the one solution to entry funds whenever you want them. By exploring the wide selection of alternate options accessible, you’ll find an answer that meets your particular wants and helps you obtain your monetary objectives. Keep in mind to analysis rigorously, examine choices, and make knowledgeable choices to make sure you’re getting the absolute best deal. By taking a proactive method to your funds, you possibly can keep away from the pitfalls of high-interest debt and construct a robust monetary basis for the long run.

Closure

We hope this text has helped you perceive all the pieces about Private Mortgage Options: What Are Your Different Choices?. Keep tuned for extra updates!

Ensure that to comply with us for extra thrilling information and opinions.

We’d love to listen to your ideas about Private Mortgage Options: What Are Your Different Choices?—depart your feedback beneath!

Keep knowledgeable with our subsequent updates on Private Mortgage Options: What Are Your Different Choices? and different thrilling subjects.