Private Mortgage Reimbursement Plans: What Are Your Choices? Navigating The Path To Monetary Freedom

Private Mortgage Reimbursement Plans: What Are Your Choices? Navigating the Path to Monetary Freedom

Associated Articles

- Understanding Fastened Vs. Variable Curiosity Charges On Private Loans

- Unlock Your Financial Potential: The Best Personal Loans For Excellent Credit Scores

- Should You Take Out A Personal Loan For Vacation? A Deep Dive Into The Pros, Cons, And Alternatives

- Personal Loans For Business: Can You Use Them? A Comprehensive Guide

- The Top 10 Personal Loan Apps You Need To Know About: Your Guide To Quick And Easy Cash

Introduction

On this article, we dive into Private Mortgage Reimbursement Plans: What Are Your Choices? Navigating the Path to Monetary Freedom, supplying you with a full overview of what’s to return

Video about

Private Mortgage Reimbursement Plans: What Are Your Choices? Navigating the Path to Monetary Freedom

Taking out a private mortgage is usually a highly effective device for reaching monetary targets, whether or not it is consolidating debt, funding a house renovation, or masking surprising bills. However the true take a look at comes after the preliminary pleasure fades – compensation. The journey from borrower to debt-free can really feel daunting, particularly when confronted with a seemingly insurmountable mortgage quantity. Concern not! Understanding your compensation choices is step one in the direction of navigating this path successfully and reaching monetary freedom.

This complete information will demystify the world of private mortgage compensation plans, equipping you with the data and instruments to decide on one of the best technique to your distinctive state of affairs. We’ll delve into the totally different compensation constructions, discover methods for managing your funds, and uncover the secrets and techniques to reaching sooner debt discount.

Understanding the Fundamentals: The Anatomy of a Private Mortgage Reimbursement Plan

Earlier than diving into the intricacies of compensation plans, let’s set up a stable basis. At its core, a private mortgage compensation plan is a roadmap outlining how you will pay again the borrowed quantity over a predetermined interval. It usually entails:

- Mortgage Quantity: The whole quantity borrowed.

- Curiosity Price: The price of borrowing the cash, expressed as a share.

- Mortgage Time period: The period of the mortgage, often measured in months or years.

- Month-to-month Cost: The fastened quantity you will pay every month in the direction of the mortgage principal and curiosity.

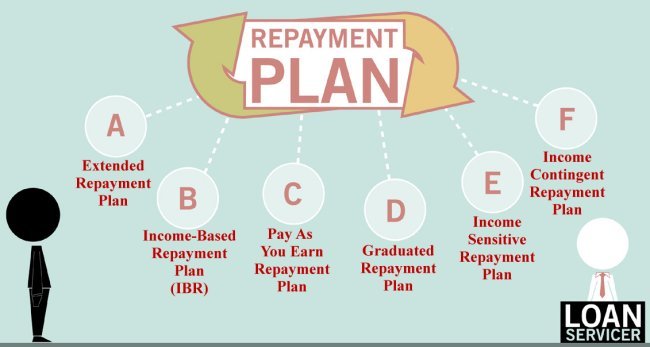

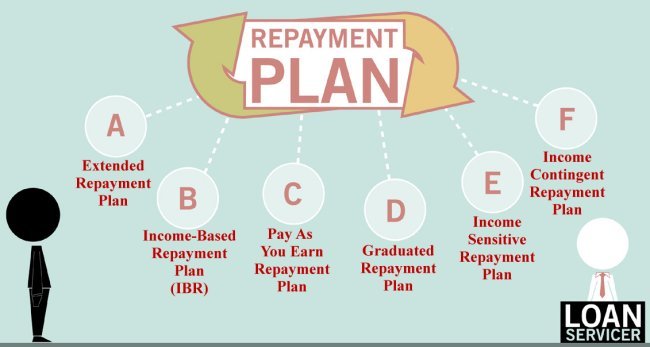

Varieties of Reimbursement Plans: Selecting the Proper Match for Your Wants

The great thing about private loans lies of their flexibility, providing quite a lot of compensation plan constructions to swimsuit totally different monetary conditions and preferences. Let’s discover the most typical varieties:

1. Mounted-Cost Plan:

That is probably the most prevalent sort of compensation plan, providing predictable month-to-month funds all through the mortgage time period. Every cost stays the identical, making certain constant budgeting and monetary planning.

Benefits:

- Predictability: Presents a hard and fast month-to-month cost, simplifying budgeting and monetary planning.

- Stability: Supplies a constant cost construction, minimizing monetary surprises.

- Simplicity: Straightforward to know and monitor.

Disadvantages:

- Doubtlessly longer compensation interval: Might end in an extended compensation time period in comparison with different choices, resulting in increased general curiosity funds.

2. Curiosity-Solely Reimbursement Plan:

This selection lets you make smaller month-to-month funds by solely masking the accrued curiosity on the mortgage. The principal quantity stays untouched till the top of the mortgage time period, while you’ll must make a lump sum cost to repay your entire principal.

Benefits:

- Decrease month-to-month funds: Presents considerably decrease month-to-month funds in comparison with fixed-payment plans.

- Flexibility: Supplies larger flexibility in managing money circulation.

Disadvantages:

- Massive balloon cost: Requires a considerable lump sum cost on the finish of the mortgage time period.

- Greater general curiosity: You may find yourself paying considerably extra curiosity over the mortgage time period.

3. Graduated Cost Plan:

This plan presents step by step growing month-to-month funds over the mortgage time period, beginning with decrease preliminary funds and escalating over time. This construction could be significantly helpful for debtors anticipating their earnings to extend sooner or later.

Benefits:

- Decrease preliminary funds: Makes the mortgage extra manageable through the early phases when earnings could also be decrease.

- Adjusts to earnings progress: Permits funds to align with future earnings will increase.

Disadvantages:

- Rising funds: Requires cautious budgeting and monetary planning as funds improve over time.

- Is probably not appropriate for everybody: Not superb for debtors who anticipate monetary instability or earnings fluctuations.

4. Accelerated Cost Plan:

This plan lets you make further funds in the direction of the principal quantity of your mortgage, lowering the general curiosity paid and shortening the mortgage time period. It is a proactive strategy to debt discount that may prevent vital cash in the long term.

Benefits:

- Sooner debt discount: Considerably reduces the mortgage time period and general curiosity funds.

- Decrease whole curiosity paid: Saves cash on curiosity costs.

Disadvantages:

- Requires disciplined budgeting: Requires a dedication to creating further funds persistently.

- Is probably not appropriate for everybody: Not superb for debtors going through monetary constraints or unpredictable earnings.

5. Skip-a-Cost Choice:

Some lenders supply the flexibleness to skip a cost through the mortgage time period, offering non permanent reduction from month-to-month obligations. This may be significantly helpful in unexpected circumstances like job loss or surprising bills.

Benefits:

- Monetary flexibility: Supplies non permanent reduction from month-to-month funds in occasions of want.

- Lowered monetary burden: Can ease monetary strain throughout difficult durations.

Disadvantages:

- Restricted availability: Not all lenders supply this selection.

- Potential for increased general curiosity: Skipping funds can prolong the mortgage time period, growing general curiosity funds.

Navigating Reimbursement: Methods for Success

Selecting the best compensation plan is simply step one. Listed here are some confirmed methods to navigate the compensation journey successfully and attain your monetary targets:

1. Prioritize On-Time Funds:

Consistency is essential to profitable mortgage compensation. Make each effort to pay your month-to-month installments on time to keep away from late charges and detrimental impacts in your credit score rating.

2. Set Up Automated Funds:

Automating your mortgage funds ensures well timed and hassle-free compensation. Arrange automated debits out of your checking account to your lender, eliminating the chance of forgetting or lacking a cost.

3. Price range Correctly:

Develop an in depth finances that allocates enough funds to your month-to-month mortgage funds. This may assist you to keep on monitor and keep away from falling behind in your obligations.

4. Discover Additional Cost Choices:

Search for alternatives to make further funds in the direction of your mortgage principal. Even small quantities could make a big distinction in lowering your mortgage time period and general curiosity paid.

5. Take into account Debt Consolidation:

In case you have a number of high-interest loans, consolidating them right into a single mortgage with a decrease rate of interest will help you get monetary savings and simplify your compensation course of.

6. Do not Be Afraid to Negotiate:

In the event you’re going through monetary difficulties, do not hesitate to achieve out to your lender and discover choices for modifying your compensation plan. They might be prepared to work with you to discover a resolution that matches your state of affairs.

7. Search Skilled Steering:

In the event you’re struggling to handle your debt or make funds on time, take into account in search of skilled recommendation from a credit score counselor or monetary advisor. They’ll present customized steerage and help that can assist you regain management of your funds.

Unlocking Sooner Debt Discount: Superior Methods

For these in search of to speed up their debt discount journey, listed here are some superior methods to contemplate:

1. The Snowball Technique:

This technique entails specializing in paying off your smallest debt first, whereas making minimal funds on the remainder. As soon as the smallest debt is paid off, you roll the cost quantity onto the following smallest debt, making a snowball impact. This may be psychologically motivating as you see progress and achieve momentum.

2. The Avalanche Technique:

This technique prioritizes paying off money owed with the very best rates of interest first. Whereas it is probably not as psychologically satisfying because the snowball technique, it could actually finally prevent more cash on curiosity costs.

3. Debt Refinancing:

In case you have a mortgage with a excessive rate of interest, take into account refinancing it to a decrease rate of interest. This may considerably cut back your month-to-month funds and speed up your debt discount journey.

4. Debt Settlement:

In sure circumstances, you could possibly negotiate a debt settlement together with your lender, paying a lump sum lower than the unique mortgage quantity. Nevertheless, this selection can negatively influence your credit score rating and must be explored fastidiously.

5. The "Additional Cost" Technique:

This technique entails making an additional cost in the direction of your mortgage principal every month, even when it is only a small quantity. This may considerably cut back the mortgage time period and general curiosity paid.

Conclusion: Embracing Monetary Freedom

Repaying a private mortgage is usually a difficult however finally rewarding journey. By understanding your compensation choices, implementing good methods, and remaining dedicated to your monetary targets, you may navigate this path successfully and obtain monetary freedom. Bear in mind, the hot button is to decide on the plan that most closely fits your particular person circumstances, prioritize on-time funds, and discover alternatives to speed up your debt discount journey. With a transparent plan and a decided mindset, you may conquer your private mortgage and unlock a brighter monetary future.

Closure

Thanks for studying! Stick with us for extra insights on Private Mortgage Reimbursement Plans: What Are Your Choices? Navigating the Path to Monetary Freedom.

Be sure that to observe us for extra thrilling information and opinions.

Be at liberty to share your expertise with Private Mortgage Reimbursement Plans: What Are Your Choices? Navigating the Path to Monetary Freedom within the remark part.

Preserve visiting our web site for the newest developments and opinions.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…