Pupil Mortgage Curiosity Charges Are Rising: What This Means for Debtors in 2024

Associated Articles

- How To Navigate The SAVE Plan: A Complete Information For Federal Pupil Mortgage Debtors

- Maximizing Monetary financial savings with Cheap Nicely being Insurance coverage protection Plans: A Full Info

- How to Choose the Right Insurance for Your Home-Based Craft Business

- The Position of Insurance coverage in Defending Your Digital Advertising and marketing Enterprise

- Greatest Life Insurance coverage Insurance policies for Households: A Complete Information

Introduction

Uncover the most recent particulars about Pupil Mortgage Curiosity Charges Are Rising: What This Means for Debtors in 2024 on this complete information.

Video about Pupil Mortgage Curiosity Charges Are Rising: What This Means for Debtors in 2024

Pupil Mortgage Curiosity Charges Are Rising: What This Means for Debtors in 2024

The information is not good for scholar mortgage debtors: rates of interest are on the rise. Which means that the price of your loans is rising, and you will find yourself paying extra over the lifetime of your loans. However do not panic! This text will break down every part it’s good to know concerning the rising rates of interest and what you are able to do to mitigate the influence.

Understanding the Curiosity Charge Hike

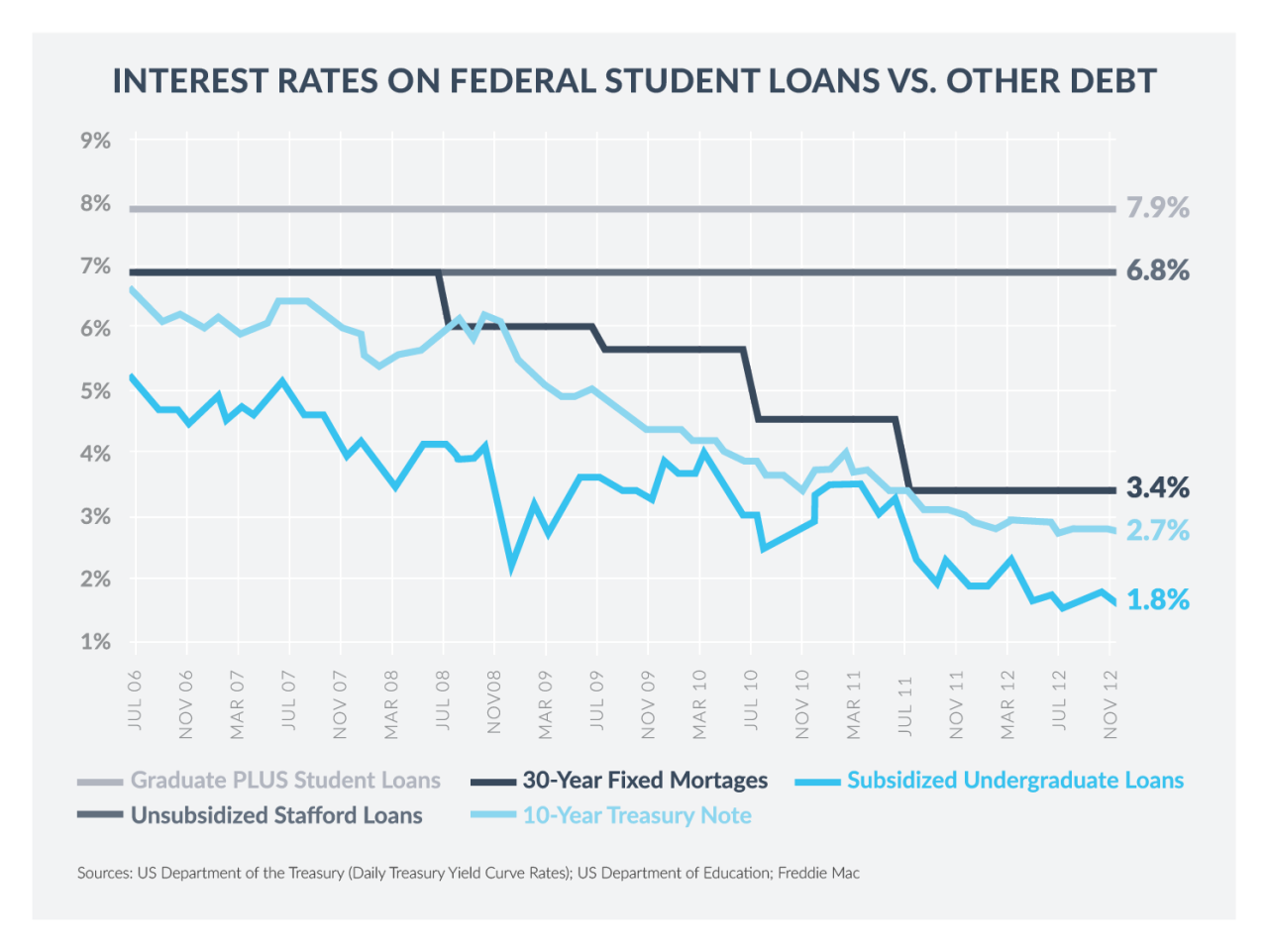

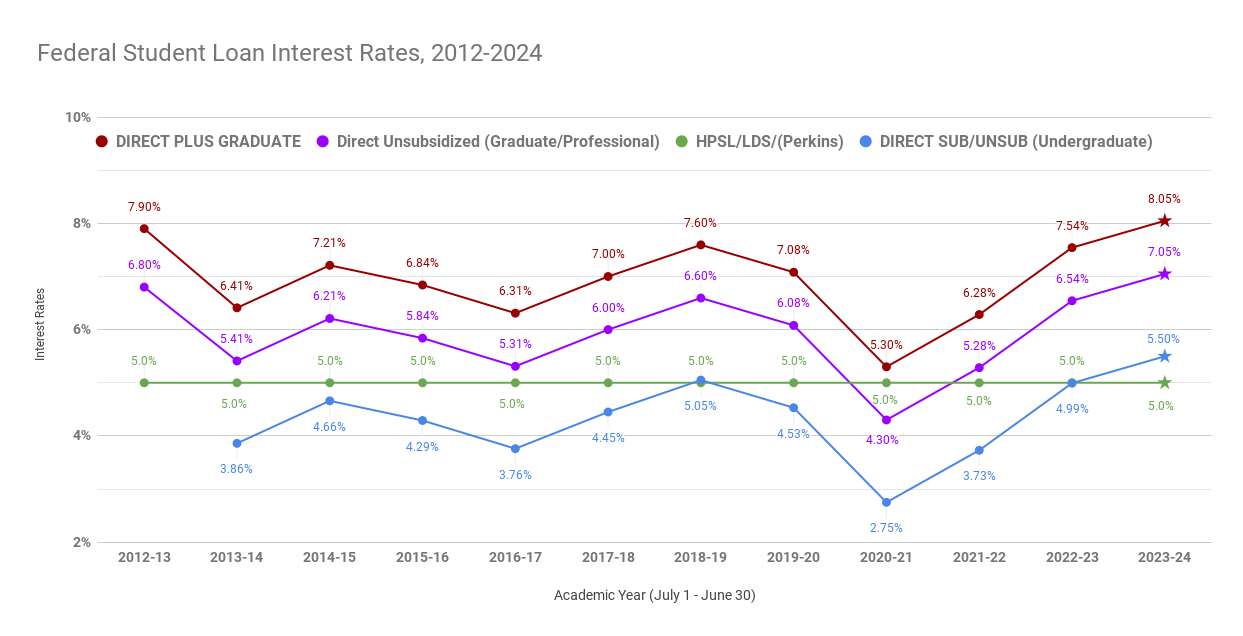

The Federal Reserve has been elevating rates of interest in an effort to fight inflation. This impacts all types of loans, together with scholar loans. The rate of interest on federal scholar loans is tied to the 10-year Treasury observe, which signifies that because the Treasury observe price goes up, so does the rate of interest in your loans.

What Does This Imply for You?

Larger rates of interest imply you may be paying extra every month in your scholar loans. It is because the curiosity is calculated on the excellent mortgage stability, and a better rate of interest means you may be paying extra curiosity on high of the principal quantity.

Let’s take a look at an instance:

Think about you’ve a $10,000 scholar mortgage with a 5% rate of interest. You will pay about $500 in curiosity annually. If the rate of interest rises to 7%, you may be paying about $700 in curiosity annually. That is an additional $200 you may must pay simply due to the rate of interest enhance.

The Affect on Your Mortgage Funds

The influence of rising rates of interest in your month-to-month funds is determined by a number of elements, together with:

- Your mortgage quantity: The bigger your mortgage quantity, the extra you may pay in curiosity.

- Your mortgage time period: An extended mortgage time period means you may pay extra curiosity over time.

- Your rate of interest: A better rate of interest means you may pay extra curiosity every month.

Find out how to Handle the Rising Curiosity Charges

When you cannot management the rate of interest hikes, there are a number of issues you are able to do to handle the influence in your scholar loans:

1. Refinance Your Loans

In case you have personal scholar loans, you could possibly refinance them to a decrease rate of interest. Refinancing means taking out a brand new mortgage to repay your present loans. If yow will discover a lender providing a decrease rate of interest, you can lower your expenses on curiosity over the lifetime of your loans.

2. Make Additional Funds

Even small further funds could make a giant distinction in the long term. Each further greenback you pay goes in the direction of decreasing your principal stability, which implies you may pay much less curiosity general.

3. Think about Revenue-Pushed Compensation Plans

Revenue-driven reimbursement plans (IDRs) regulate your month-to-month funds primarily based in your earnings and household measurement. For those who’re struggling to make your funds, an IDR plan may assist you to handle your debt extra successfully.

4. Discover Mortgage Forgiveness Applications

Some professions, like educating and public service, are eligible for mortgage forgiveness packages. For those who qualify for a forgiveness program, you can have half or your entire scholar mortgage debt forgiven after a sure time period.

5. Keep Knowledgeable

Sustain-to-date on adjustments to scholar mortgage rates of interest and reimbursement plans. The Division of Training and your mortgage servicer will present updates and data.

Suggestions for Managing Your Pupil Mortgage Debt

- Create a Price range: Observe your earnings and bills to see the place your cash goes. It will assist you to establish areas the place you’ll be able to reduce and liberate extra money to pay in the direction of your scholar loans.

- Set Monetary Objectives: Having clear monetary targets will assist you to keep motivated to pay down your scholar mortgage debt.

- Automate Your Funds: Arrange computerized funds to make sure you by no means miss a fee and keep away from late charges.

- Search Skilled Recommendation: For those who’re struggling to handle your scholar mortgage debt, think about looking for assist from a monetary advisor or credit score counselor.

Conclusion

Rising scholar mortgage rates of interest are a major concern for debtors. Understanding the influence of those adjustments and taking proactive steps to handle your debt is essential. By exploring choices like refinancing, making further funds, and contemplating income-driven reimbursement plans, you’ll be able to reduce the monetary burden of your scholar loans. Bear in mind, staying knowledgeable and taking motion is vital to navigating this difficult panorama.

Key phrases:

- Pupil mortgage rates of interest

- Pupil mortgage debt

- Federal scholar loans

- Non-public scholar loans

- Refinancing

- Revenue-driven reimbursement plans

- Mortgage forgiveness

- Monetary planning

- Price range

- Monetary targets

- Automated funds

- Credit score counseling

- Pupil mortgage reimbursement

- Pupil mortgage disaster

- Larger training

- Debt administration

- Monetary literacy

- Pupil mortgage debtors

- Mortgage servicer

- Division of Training

- Treasury observe

- Inflation

- Rate of interest hike

- Monetary hardship

- Mortgage forgiveness packages

- Public service mortgage forgiveness

- Instructor mortgage forgiveness

- Pupil mortgage consolidation

- Pupil mortgage debt aid

- Pupil mortgage forgiveness packages

- Pupil mortgage cancellation

- Pupil mortgage forgiveness eligibility

- Pupil mortgage fee plans

- Pupil mortgage deferment

- Pupil mortgage forbearance

- Pupil mortgage hardship

- Pupil mortgage disaster

- Pupil mortgage reform

- Pupil mortgage advocacy

- Pupil mortgage coverage

- Pupil mortgage laws

- Pupil mortgage information

- Pupil mortgage updates

- Pupil mortgage assets

- Pupil mortgage data

- Pupil mortgage assist

Closure

We hope this text has helped you perceive every part about Pupil Mortgage Curiosity Charges Are Rising: What This Means for Debtors in 2024. Keep tuned for extra updates!

Ensure that to comply with us for extra thrilling information and critiques.

We’d love to listen to your ideas about Pupil Mortgage Curiosity Charges Are Rising: What This Means for Debtors in 2024—depart your feedback under!

Maintain visiting our web site for the most recent tendencies and critiques.