Pupil Mortgage Debt: The Hidden Hurdle to Homeownership

Associated Articles

- The Affect Of Your Credit score Rating On Your House Mortgage: A Complete Information

- Discovering Your Dream Residence With out Breaking The Financial institution: The Finest States For Low-Price Residence Loans

- How Curiosity Charges Have an effect on Your Month-to-month Mortgage Cost: A Complete Information

- Unlocking The Energy Of A 30-Yr Mounted-Price Mortgage: Is It The Proper Key For Your Homeownership Journey?

- Ditch The PMI: A Complete Information To Avoiding Mortgage Insurance coverage

Introduction

Uncover every little thing you have to find out about Pupil Mortgage Debt: The Hidden Hurdle to Homeownership

Video about Pupil Mortgage Debt: The Hidden Hurdle to Homeownership

Pupil Mortgage Debt: The Hidden Hurdle to Homeownership

The dream of proudly owning a house is a strong one, however for a lot of, the trail to attaining it’s paved with monetary hurdles. One of many largest obstacles? Pupil mortgage debt. This seemingly separate monetary obligation can have a major impression on your own home mortgage software, doubtlessly delaying your goals of homeownership.

This text will delve into the complicated relationship between pupil mortgage debt and residential mortgage purposes, exploring the way it impacts your probabilities of getting permitted and the methods you possibly can make use of to beat these challenges.

Understanding the Influence of Pupil Mortgage Debt

Pupil loans, whereas a mandatory funding in your future, can considerably impression your capacity to safe a house mortgage. Here is how:

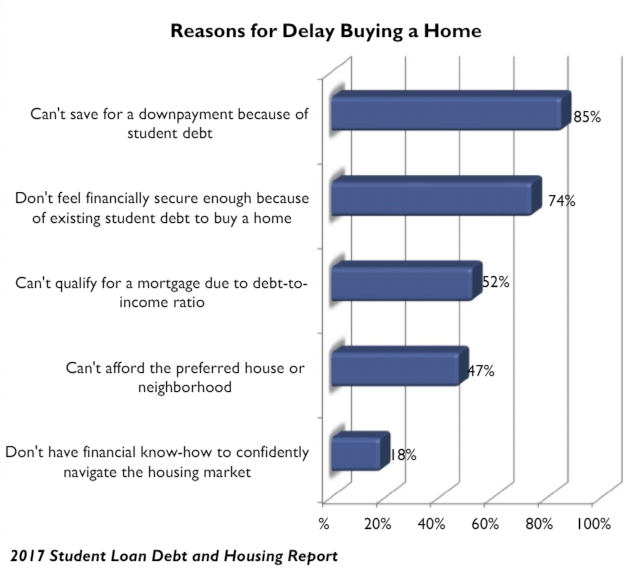

1. Debt-to-Earnings Ratio (DTI): Lenders use DTI to evaluate your capacity to handle month-to-month funds. DTI is calculated by dividing your whole month-to-month debt funds (together with pupil loans) by your gross month-to-month earnings. A excessive DTI, typically pushed by pupil mortgage funds, could make you seem much less financially secure, resulting in the next rate of interest and even mortgage rejection.

2. Credit score Rating: Pupil mortgage funds, particularly in the event you’re struggling to maintain up, can negatively impression your credit score rating. A low credit score rating could make you a riskier borrower, leading to larger rates of interest and even mortgage denial.

3. Mortgage-to-Worth (LTV) Ratio: Lenders typically require the next down cost for debtors with important pupil mortgage debt. It is because the upper DTI makes you a much less enticing borrower, resulting in the next LTV ratio and doubtlessly requiring a bigger down cost.

4. Mortgage Eligibility: Some lenders may need particular insurance policies relating to pupil mortgage debt, setting limits on the quantity of pupil mortgage debt you possibly can have relative to your earnings. This could make it difficult to qualify for a house mortgage, even when your credit score rating and DTI are inside acceptable ranges.

Navigating the Pupil Mortgage Debt Problem

Whereas pupil mortgage debt can pose a major problem, it isn’t an insurmountable impediment. By understanding the components that lenders think about and using good methods, you possibly can improve your probabilities of securing a house mortgage.

1. Handle Your Pupil Mortgage Funds:

- Keep Present: Make your pupil mortgage funds on time to keep away from late charges and unfavorable impacts in your credit score rating.

- Consolidate Your Loans: Consolidating your pupil loans can simplify your funds and doubtlessly decrease your month-to-month funds.

- Refinance Your Loans: Refinancing your pupil loans might help you safe a decrease rate of interest, lowering your month-to-month funds and doubtlessly bettering your DTI.

- Think about Earnings-Pushed Reimbursement Plans: Earnings-driven reimbursement plans regulate your month-to-month funds primarily based in your earnings, making them extra manageable.

2. Enhance Your Credit score Rating:

- Monitor Your Credit score Report: Commonly verify your credit score report for errors and guarantee all info is correct.

- Pay Payments On Time: Make all of your invoice funds on time, together with bank card funds, to take care of a optimistic cost historical past.

- Cut back Credit score Utilization: Hold your credit score utilization ratio low (ideally beneath 30%) by avoiding maxing out your bank cards.

- Grow to be an Licensed Consumer: When you’ve got a member of the family or pal with a superb credit score rating, ask them so as to add you as a certified consumer on their bank card.

3. Save for a Bigger Down Fee:

- Finances Strategically: Create an in depth price range and prioritize saving for a bigger down cost.

- Discover Down Fee Help Applications: A number of authorities and non-profit organizations supply down cost help applications to assist first-time homebuyers.

- Think about Vendor Financing: In some circumstances, you may have the ability to negotiate vendor financing, permitting you to make a smaller down cost.

4. Store Round for Lenders:

- Examine Curiosity Charges: Completely different lenders supply various rates of interest and mortgage phrases. Store round to seek out essentially the most aggressive charges.

- Think about Non-Conventional Lenders: Some lenders specialise in working with debtors who’ve pupil mortgage debt.

5. Search Skilled Steering:

- Seek the advice of a Monetary Advisor: A monetary advisor might help you develop a personalised monetary plan that considers your pupil mortgage debt and homeownership objectives.

- Discuss to a Mortgage Mortgage Officer: A mortgage mortgage officer can information you thru the house mortgage course of, offering useful insights and recommendation.

Methods for Homeownership with Pupil Mortgage Debt

1. Lease to Personal: This feature means that you can lease a property with the choice to buy it later. It may be a superb various for debtors with important pupil mortgage debt, because it provides them time to enhance their monetary state of affairs earlier than committing to a mortgage.

2. Repair and Flip: This technique includes buying a property, renovating it, after which promoting it for a revenue. Whereas this requires important upfront capital and experience, it may be a viable possibility for debtors with pupil mortgage debt who’re keen to tackle the dangers concerned.

3. Co-ownership: Sharing possession of a property with a associate can cut back the monetary burden and make it simpler to qualify for a mortgage.

4. Dwell in a Smaller Residence: Selecting a smaller house might help you handle your month-to-month mortgage funds and liberate more money circulation to pay down your pupil mortgage debt.

5. Think about a Lease-Again Settlement: In the event you’re promoting your present house, think about a rent-back settlement with the client. This lets you proceed residing in your house when you save for a down cost on a brand new property.

The Backside Line:

Pupil mortgage debt can considerably impression your own home mortgage software, however it’s not an insurmountable impediment. By understanding the components that lenders think about, managing your pupil mortgage funds, bettering your credit score rating, and exploring various homeownership methods, you possibly can improve your probabilities of attaining your dream of proudly owning a house. Bear in mind, in search of skilled steering from a monetary advisor or mortgage mortgage officer may be invaluable in navigating this course of.

Closure

Thanks for studying! Stick with us for extra insights on Pupil Mortgage Debt: The Hidden Hurdle to Homeownership.

Don’t neglect to verify again for the newest information and updates on Pupil Mortgage Debt: The Hidden Hurdle to Homeownership!

We’d love to listen to your ideas about Pupil Mortgage Debt: The Hidden Hurdle to Homeownership—depart your feedback beneath!

Hold visiting our web site for the newest developments and critiques.