Rebuilding Your Monetary Life: How To Get A Private Mortgage After Chapter

Rebuilding Your Monetary Life: Methods to Get a Private Mortgage After Chapter

Associated Articles

- Unlocking Financial Freedom: Your Guide To No-Origination-Fee Personal Loans

- Navigating The Mortgage Panorama: A Complete Information To Evaluating Private Mortgage Gives

- Co-Signing A Mortgage: A Detailed Information To The Dangers And Rewards

- Unlock Your Financial Potential: The Best Personal Loans For Excellent Credit Scores

- Personal Loans Vs. Credit Cards: Which Is Better For You?

Introduction

Be part of us as we discover Rebuilding Your Monetary Life: Methods to Get a Private Mortgage After Chapter, filled with thrilling updates

Video about

Rebuilding Your Monetary Life: Methods to Get a Private Mortgage After Chapter

Chapter can really feel like a monetary earthquake, leaving you with shattered credit score and a way of hopelessness. However it does not should be the top of the street. You’ll be able to rebuild your monetary life, and getting a private mortgage could be a essential step in that course of.

This complete information will stroll you thru the intricacies of acquiring a private mortgage after chapter, empowering you to navigate this difficult terrain with confidence. We’ll cowl all the pieces from understanding the impression of chapter in your credit score to exploring completely different mortgage choices and maximizing your probabilities of approval.

Understanding the Influence of Chapter on Your Credit score

Chapter is a severe authorized course of that considerably impacts your credit score rating. It stays in your credit score report for 10 years for Chapter 7 chapter and 7 years for Chapter 13 chapter. This unfavorable mark makes it troublesome to safe loans, bank cards, and even hire an residence.

The Influence of Chapter on Your Credit score Rating:

- Important Drop: Your credit score rating will plummet after chapter. It’s because lenders view chapter as an indication of monetary instability and a better threat of defaulting on future loans.

- Restricted Entry to Credit score: Many lenders shall be hesitant to increase credit score to somebody with a latest chapter on their report. You could face greater rates of interest and stricter mortgage phrases.

- Influence on On a regular basis Life: Past mortgage functions, your chapter submitting can have an effect on your potential to hire an residence, safe a job, and even get insurance coverage.

Constructing Again Your Credit score After Chapter

Whereas the trail to restoration could appear daunting, it is essential to keep in mind that rebuilding your credit score is feasible. Listed here are some methods that can assist you regain your monetary footing:

- Pay Your Payments on Time: Consistency is vital. Make all of your funds on time, even when it is simply the minimal quantity. This demonstrates to lenders that you’re accountable along with your funds.

- Use Secured Credit score Playing cards: Secured bank cards require a safety deposit, which mitigates the chance for the lender. This could be a good start line for rebuilding your credit score historical past.

- Develop into an Licensed Consumer: Ask a member of the family or good friend with good credit score so as to add you as a certified person on their bank card account. This can assist increase your credit score rating, however you’ll want to perceive the duties concerned.

- Monitor Your Credit score Report: Often test your credit score report for errors and guarantee all info is correct. You’ll be able to entry your credit score report at no cost from the three main credit score bureaus: Experian, Equifax, and TransUnion.

- Contemplate Credit score Counseling: A credit score counselor can present helpful steerage on managing your funds, creating a finances, and exploring choices for debt consolidation or compensation.

Understanding Private Mortgage Choices After Chapter

As soon as you have begun rebuilding your credit score, you can begin exploring private mortgage choices. Listed here are some key elements to contemplate:

- Mortgage Sort: Private loans are available in numerous kinds, together with unsecured loans, secured loans, and installment loans. Every sort has its personal eligibility standards and rates of interest.

- Mortgage Quantity: Decide how a lot cash you have to borrow. Contemplate the aim of the mortgage and guarantee it is a manageable quantity.

- Curiosity Price: The rate of interest on a private mortgage will rely in your credit score rating, mortgage quantity, and lender. Store round for the very best charges and phrases.

- Mortgage Time period: The mortgage time period is the period of the mortgage. Shorter phrases sometimes have greater month-to-month funds however decrease general curiosity prices.

Forms of Private Loans for Put up-Chapter Debtors:

- Secured Private Loans: These loans require collateral, resembling a automobile or financial savings account, to safe the mortgage. They sometimes have decrease rates of interest than unsecured loans however include the chance of shedding your collateral should you default.

- Unsecured Private Loans: These loans are usually not backed by collateral. They often have greater rates of interest than secured loans because of the elevated threat for the lender.

- Installment Loans: These loans contain mounted month-to-month funds over a set interval. They’re a typical choice for private loans and supply a predictable compensation construction.

Discovering a Lender Keen to Work With You:

Discovering a lender keen to approve your mortgage after chapter might be difficult. Nonetheless, there are alternatives obtainable:

- On-line Lenders: On-line lenders typically have extra versatile eligibility standards and could also be keen to contemplate debtors with less-than-perfect credit score.

- Credit score Unions: Credit score unions are recognized for his or her group focus and will supply extra favorable phrases to debtors with a historical past of monetary hardship.

- Banks: Some banks supply private loans to debtors with a latest chapter, however they could have stricter necessities and better rates of interest.

Suggestions for Growing Your Probabilities of Approval:

- Enhance Your Credit score Rating: The upper your credit score rating, the higher your probabilities of approval and the decrease your rate of interest. Observe the methods talked about earlier to rebuild your credit score.

- Store Round for Charges: Evaluate rates of interest and mortgage phrases from a number of lenders to search out the very best deal.

- Present Robust Documentation: Be ready to supply documentation, resembling proof of earnings, employment historical past, and financial institution statements, to help your mortgage software.

- Be Clear About Your Chapter: Do not attempt to disguise your chapter historical past. Be sincere with lenders about your previous monetary state of affairs and show your dedication to rebuilding your credit score.

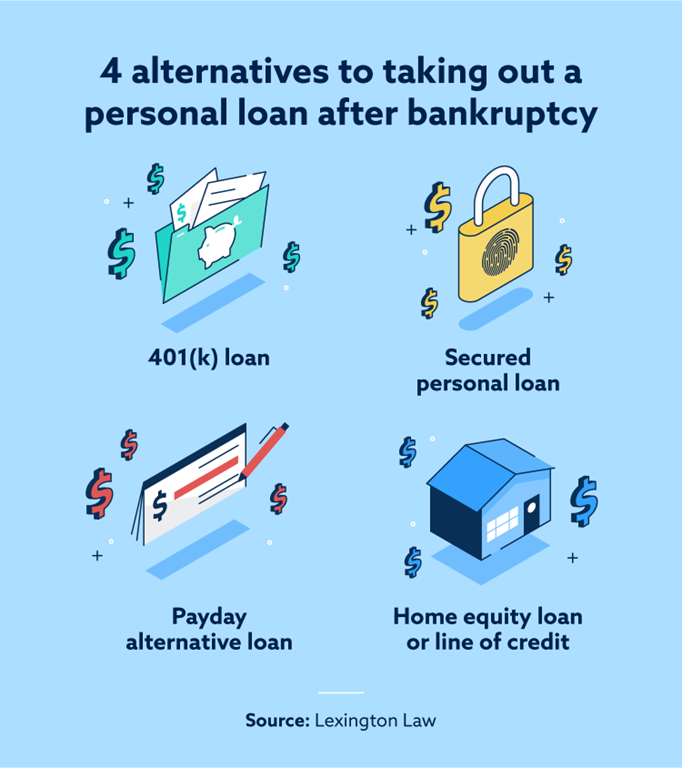

Options to Private Loans:

For those who’re struggling to safe a private mortgage, take into account these options:

- Debt Consolidation Loans: These loans can assist you mix a number of money owed into one mortgage with a decrease rate of interest.

- House Fairness Loans: For those who personal a house, you possibly can faucet into your fairness to safe a mortgage. Nonetheless, pay attention to the dangers related to residence fairness loans.

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper join debtors with particular person buyers. These platforms could also be extra versatile with credit score necessities.

- Credit score Builder Loans: These loans are designed to assist folks rebuild their credit score. They sometimes contain a small mortgage quantity and stuck month-to-month funds.

Navigating the Put up-Chapter Mortgage Course of:

As soon as you have discovered a lender and been pre-approved for a mortgage, you will want to finish the appliance course of. This is a step-by-step information:

- Collect Your Paperwork: Put together the mandatory documentation, together with proof of earnings, employment historical past, financial institution statements, and some other required info.

- Full the Software: Fill out the mortgage software precisely and completely. Be ready to reply questions on your monetary historical past, together with your chapter submitting.

- Present Credit score Authorization: The lender might want to entry your credit score report back to confirm your creditworthiness.

- Overview the Mortgage Settlement: Fastidiously learn the mortgage settlement earlier than signing. Perceive the phrases, rate of interest, and compensation schedule.

- Obtain Your Mortgage Funds: As soon as the mortgage is authorized, you will obtain the funds in your account.

Managing Your Mortgage After Chapter:

As soon as you have secured a private mortgage, it is essential to handle it responsibly:

- Make Your Funds on Time: At all times make your funds on time to keep away from late charges and injury to your credit score rating.

- Create a Funds: Develop a practical finances that features your mortgage funds and different bills.

- Monitor Your Progress: Monitor your mortgage stability and monitor your progress towards compensation.

- Search Assist If Wanted: For those who’re struggling to make your funds, contact your lender to debate choices like a cost plan or forbearance.

Conclusion: A Contemporary Begin with Monetary Duty

Chapter could be a troublesome expertise, nevertheless it does not should outline your future. By rebuilding your credit score and exploring mortgage choices, you possibly can take management of your funds and safe a recent begin.

Bear in mind, persistence and perseverance are key. Deal with accountable monetary administration, and you will be in your method to attaining your monetary objectives. This text has supplied a complete overview of the private mortgage panorama for post-bankruptcy debtors. By understanding the challenges and alternatives, you possibly can navigate this journey with confidence and emerge stronger than ever.

Closure

Thanks for studying! Stick with us for extra insights on Rebuilding Your Monetary Life: Methods to Get a Private Mortgage After Chapter.

Be sure to observe us for extra thrilling information and evaluations.

Be happy to share your expertise with Rebuilding Your Monetary Life: Methods to Get a Private Mortgage After Chapter within the remark part.

Keep knowledgeable with our subsequent updates on Rebuilding Your Monetary Life: Methods to Get a Private Mortgage After Chapter and different thrilling subjects.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…