Service provider Money Advances: A Lifeline Or A Monetary Entice?

Service provider Money Advances: A Lifeline or a Monetary Entice?

Associated Articles

- High 10 Enterprise Loans For Small Companies: A Complete Information To Funding Your Progress

- Fueling Feminine Ambition: Prime 5 Enterprise Loans For Ladies Entrepreneurs

- Unlocking Alternative: Your Information To Minority-Owned Enterprise Loans

- Unlocking Growth: How Business Loans Can Supercharge Your Cash Flow

- Unlocking Decrease Charges And Higher Phrases: A Complete Information To Refinancing Your Enterprise Mortgage

Introduction

Uncover every thing it is advisable find out about Service provider Money Advances: A Lifeline or a Monetary Entice?

Video about

Service provider Money Advances: A Lifeline or a Monetary Entice?

Operating a enterprise is a rollercoaster experience. One minute you are celebrating a profitable launch, the subsequent you are going through a money movement crunch. When these surprising payments pile up, you may end up contemplating a service provider money advance (MCA). However earlier than you signal on the dotted line, it is essential to grasp the execs and cons of this financing possibility.

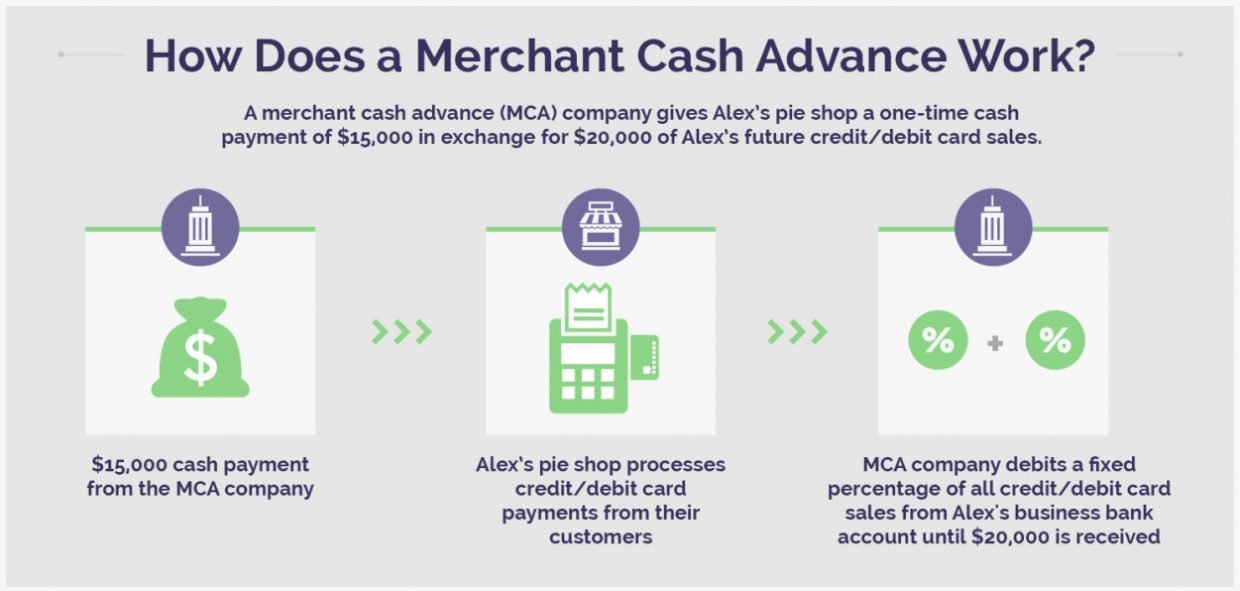

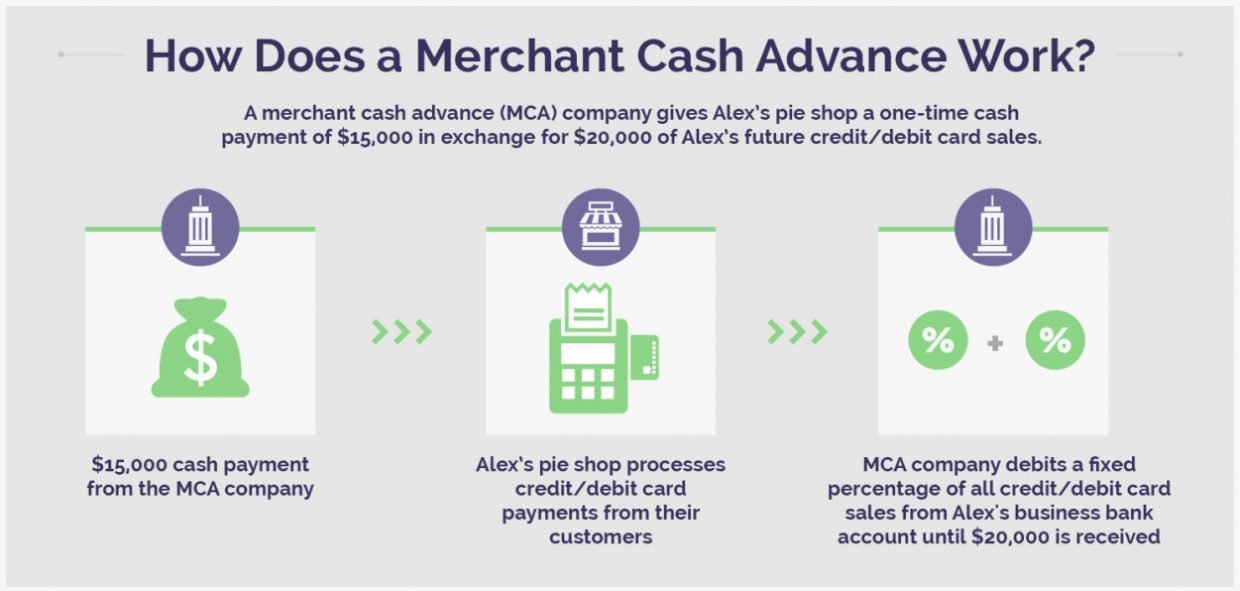

What’s a Service provider Money Advance?

In easy phrases, a service provider money advance is a lump sum of cash offered to companies based mostly on their future bank card gross sales. You primarily promote a portion of your future income to the MCA supplier in trade for quick money. This differs from conventional loans, that are repaid with fastened month-to-month funds.

The Execs of Service provider Money Advances:

1. Velocity and Comfort:

MCA suppliers delight themselves on velocity. In contrast to conventional financial institution loans, which may take weeks and even months to course of, MCAs are usually funded inside a number of days, typically even inside 24 hours. This makes them a priceless possibility for companies going through pressing monetary wants.

2. No Collateral Required:

Many MCAs are unsecured, that means you do not have to place up any belongings as collateral. This can be a main benefit for companies that will not have priceless belongings to pledge or are hesitant to threat shedding them.

3. Versatile Reimbursement:

MCA reimbursement is usually tied to a share of your each day bank card gross sales. This implies your funds fluctuate based mostly on what you are promoting efficiency. If enterprise is sluggish, your funds lower, providing some aid throughout powerful instances.

4. Credit score Rating Flexibility:

Whereas credit score rating helps, MCA suppliers typically think about components past credit score historical past. This makes them a viable possibility for companies with less-than-perfect credit score scores who may wrestle to safe conventional loans.

5. No Fastened Curiosity Charges:

MCAs do not carry conventional rates of interest. As an alternative, they use a issue fee to find out the price of borrowing. This issue fee is utilized to your complete advance, leading to a better total value in comparison with conventional loans.

The Cons of Service provider Money Advances:

1. Excessive Value:

That is maybe the largest disadvantage of MCAs. The issue fee, which may vary from 1.1 to 1.5 and even greater, interprets right into a considerably greater value of borrowing in comparison with conventional loans. This implies you possibly can find yourself paying again considerably greater than the unique advance quantity.

2. Hidden Charges:

Whereas MCA suppliers may promote low issue charges, they typically have hidden charges, akin to origination charges, processing charges, and month-to-month upkeep charges. These charges can add up and additional improve the general value of borrowing.

3. Aggressive Reimbursement:

The each day reimbursement construction of MCAs may be aggressive, particularly should you expertise a dip in gross sales. This could put a pressure in your money movement and probably result in monetary hardship if you cannot sustain with the repayments.

4. Destructive Affect on Credit score Rating:

Whereas MCAs may not instantly impression your credit score rating, the excessive value and aggressive reimbursement phrases can not directly have an effect on your credit score rating should you wrestle to make funds.

5. Lack of Transparency:

Some MCA suppliers lack transparency of their pricing and phrases. It is essential to rigorously overview the contract and perceive all of the related charges earlier than signing.

When are Service provider Money Advances a Good Possibility?

MCAs could be a viable possibility for companies going through short-term money movement points or these needing funds for pressing bills, akin to:

- Seasonal fluctuations in gross sales: If what you are promoting experiences seasonal peaks and dips, an MCA may help bridge the hole throughout sluggish durations.

- Surprising bills: An MCA can cowl surprising repairs, tools upgrades, or emergency bills.

- Stock financing: If it is advisable buy stock rapidly to satisfy demand, an MCA can present the mandatory capital.

When to Keep away from Service provider Money Advances:

Whereas MCAs can provide a fast answer, they aren’t appropriate for each enterprise. Take into account avoiding them if:

- You will have poor credit score: Whereas MCAs are extra versatile than conventional loans, they nonetheless require a sure stage of creditworthiness.

- You will have long-term financing wants: MCAs are designed for short-term wants. For those who require a considerable quantity of capital for a long-term venture, conventional loans are a greater possibility.

- You might be combating money movement: If what you are promoting is already struggling to satisfy its monetary obligations, an MCA with its aggressive reimbursement phrases might additional pressure your money movement.

Options to Service provider Money Advances:

Earlier than choosing an MCA, think about various financing choices:

- Conventional financial institution loans: Whereas they could take longer to course of, financial institution loans provide decrease rates of interest and extra versatile reimbursement phrases.

- Traces of credit score: A line of credit score gives a revolving credit score facility that you would be able to draw upon as wanted, providing flexibility in managing your money movement.

- Small enterprise grants: Authorities businesses and personal organizations provide grants to assist small companies.

- Crowdfunding: Platforms like Kickstarter and Indiegogo mean you can increase funds instantly from buyers.

- Bill factoring: This feature means that you can promote your unpaid invoices to a 3rd social gathering at a reduction for quick money.

Understanding the Dangers:

Earlier than taking out an MCA, it is essential to totally perceive the dangers concerned. It’s best to:

- Evaluate presents from a number of suppliers: Do not accept the primary give you obtain. Store round and examine issue charges, charges, and reimbursement phrases.

- Learn the contract rigorously: Pay shut consideration to the nice print and make sure you perceive all of the charges and phrases earlier than signing.

- Calculate the entire value of borrowing: Do not simply give attention to the preliminary advance quantity. Calculate the entire value of borrowing, together with issue charges and costs, to get a practical image of the true value.

- Assess your skill to repay: Be sure to have a stable plan to repay the advance based mostly in your projected gross sales.

- Take into account the potential impression in your money movement: Issue within the each day repayments and their potential impression in your total money movement.

Conclusion:

Service provider money advances could be a tempting answer for companies going through quick monetary wants. Nevertheless, their excessive value, aggressive reimbursement phrases, and lack of transparency can rapidly flip them right into a monetary lure. Earlier than you think about an MCA, weigh the professionals and cons rigorously, discover various financing choices, and totally perceive the dangers concerned. With cautious planning and a transparent understanding of the phrases, an MCA could be a useful software for short-term money movement wants. However keep in mind, all the time prioritize accountable borrowing and prioritize long-term monetary stability.

Closure

We hope this text has helped you perceive every thing about Service provider Money Advances: A Lifeline or a Monetary Entice?. Keep tuned for extra updates!

Don’t overlook to examine again for the newest information and updates on Service provider Money Advances: A Lifeline or a Monetary Entice?!

We’d love to listen to your ideas about Service provider Money Advances: A Lifeline or a Monetary Entice?—go away your feedback beneath!

Keep knowledgeable with our subsequent updates on Service provider Money Advances: A Lifeline or a Monetary Entice? and different thrilling matters.

Recent Posts

Scaling The Information Mountain: A Information To Information Climber Enterprise Consulting Companies

Scaling the Information Mountain: A Information to Information Climber Enterprise Consulting Companies Associated Articles Data…

Scaling The Information Mountain: A Deep Dive Into Information Climber Know-how

Scaling the Information Mountain: A Deep Dive into Information Climber Know-how Associated Articles Data Climber:…

Information Climbers: Scaling The Peaks Of Information Analytics

Information Climbers: Scaling the Peaks of Information Analytics Associated Articles “Data Climber Vs. Power BI:…

Knowledge Climber: Scaling Your Enterprise With Knowledge Insights

Knowledge Climber: Scaling Your Enterprise with Knowledge Insights Associated Articles Scaling New Heights: Your Guide…

Knowledge Climber: Scaling The Heights Of Enterprise Analytics

Knowledge Climber: Scaling the Heights of Enterprise Analytics Associated Articles Conquering The Data Mountain: Top…

Knowledge Climber: Scaling The Peaks Of Knowledge Science

Knowledge Climber: Scaling the Peaks of Knowledge Science Associated Articles Boosting Your Data Climb: Essential…