Shielding Your Enterprise: A Complete Information to Stopping Insurance coverage Fraud

Associated Articles

- Maximizing Monetary financial savings with Cheap Nicely being Insurance coverage protection Plans: A Full Info

- Skilled Legal responsibility Insurance coverage: Defending Your Enterprise From The Sudden

- Navigating The Maze: How To Select The Proper Enterprise Insurance coverage Coverage

- The Impression Of Enterprise Insurance coverage On Threat Administration: A Complete Information

- Does Your Enterprise Want Key Individual Insurance coverage? A Complete Information

Introduction

Uncover the most recent particulars about Shielding Your Enterprise: A Complete Information to Stopping Insurance coverage Fraud on this complete information.

Video about

Shielding Your Enterprise: A Complete Information to Stopping Insurance coverage Fraud

Insurance coverage fraud is a pervasive drawback, costing companies and people billions of {dollars} yearly. It is not only a matter of dishonest claims; it additionally drives up premiums for everybody. As a enterprise proprietor, safeguarding your organization from this menace is essential. This complete information will equip you with the information and techniques to stop insurance coverage fraud, shield your backside line, and foster a tradition of integrity inside your group.

Understanding the Panorama: Kinds of Insurance coverage Fraud

Earlier than delving into prevention methods, it is important to know the various kinds of insurance coverage fraud that companies face:

1. Arduous Fraud: This entails deliberate and intentional acts to deceive insurers for monetary acquire. Examples embody:

- Staged Accidents: Fabricating accidents to file false claims for accidents or property injury.

- Pretend Accidents: Exaggerating or inventing accidents to inflate declare quantities.

- Ghost Staff: Creating fictitious staff to inflate payroll and declare larger staff’ compensation premiums.

- Arson: Deliberately setting fireplace to property to gather insurance coverage payouts.

- Property Flipping: Buying undervalued property, inflating its worth on insurance coverage insurance policies, after which deliberately damaging it to say a payout.

2. Tender Fraud: This entails exaggerating present claims or misrepresenting info to acquire a bigger payout. Examples embody:

- Inflated Medical Payments: Including pointless procedures or remedies to extend medical declare quantities.

- Exaggerated Loss: Claiming extra injury or stolen items than truly occurred.

- A number of Claims: Submitting a number of claims for a similar incident or damage.

- Claiming Non-Coated Losses: Making an attempt to say protection for losses not included within the coverage.

3. Inside Fraud: This entails staff or insiders throughout the group committing fraud. Examples embody:

- Declare Padding: Inflating declare quantities by including fictitious bills or providers.

- False Reporting: Submitting false claims for private acquire or to cowl up negligence.

- Misappropriation of Funds: Stealing or misusing insurance coverage funds for private use.

- Collusion with Outdoors Events: Working with exterior people to defraud the insurer.

4. Organized Fraud: This entails coordinated efforts by legal organizations to defraud insurers by means of large-scale schemes. Examples embody:

- Insurance coverage Scams: Working pretend companies or staging accidents to file fraudulent claims.

- Identification Theft: Utilizing stolen identities to file fraudulent claims.

- Cybercrime: Hacking into insurance coverage programs to govern claims or steal delicate knowledge.

Stopping Insurance coverage Fraud: A Multi-Layered Method

Stopping insurance coverage fraud requires a multi-layered strategy that addresses each inner and exterior vulnerabilities. Here is a complete information to implementing efficient prevention methods:

1. Constructing a Tradition of Integrity

- Moral Management: Begin with sturdy moral management that units the tone for all the group. Leaders ought to clearly talk the corporate’s dedication to moral conduct and compliance with all legal guidelines and laws.

- Code of Conduct: Implement a complete code of conduct that explicitly outlines moral expectations for all staff, together with clear insurance policies in opposition to fraud and reporting procedures for suspected wrongdoing.

- Coaching and Schooling: Repeatedly prepare staff on fraud prevention and detection, emphasizing the significance of moral conduct, recognizing fraud purple flags, and reporting suspicious exercise.

- Worker Consciousness Packages: Conduct ongoing consciousness campaigns to teach staff concerning the forms of fraud, their potential penalties, and the corporate’s dedication to stopping it.

2. Strengthening Inside Controls

- Segregation of Duties: Be certain that no single particular person has management over all points of a transaction or course of. This helps forestall collusion and fraud.

- Common Audits: Conduct common inner audits of monetary information, insurance coverage insurance policies, and claims processes to determine any inconsistencies or potential fraud.

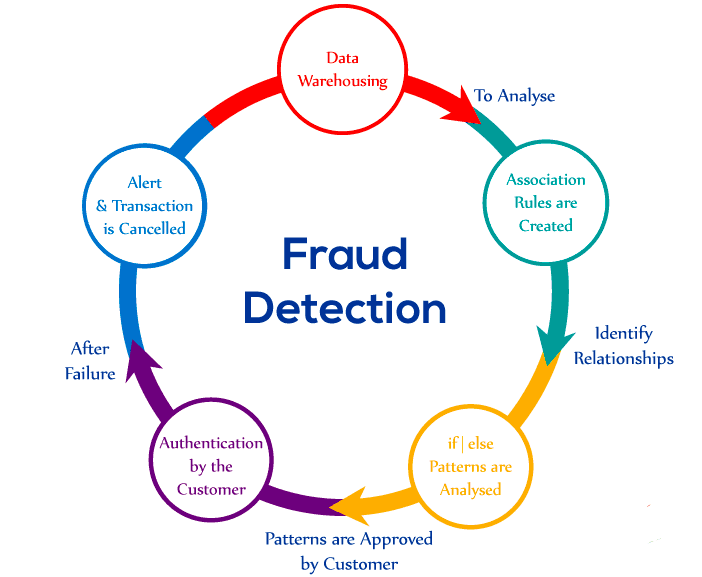

- Automated Controls: Make the most of know-how to automate key processes and generate alerts for suspicious exercise. This could embody fraud detection software program, knowledge analytics instruments, and automatic declare processing programs.

- Background Checks: Carry out thorough background checks on all new staff, particularly these concerned in dealing with delicate monetary info or claims processing.

- Inside Reporting Mechanisms: Set up a confidential and nameless reporting system for workers to report suspected fraud with out concern of retaliation.

3. Enhancing Claims Administration

- Clear and Concise Insurance policies: Preserve clear and complete insurance coverage insurance policies which might be simply understood by staff and prospects. This helps decrease confusion and potential for misinterpretation.

- Thorough Declare Investigation: Implement a radical declare investigation course of that features verifying info, conducting interviews, and reviewing supporting documentation.

- Fraud Detection Instruments: Make the most of specialised fraud detection instruments and software program to investigate declare knowledge, determine patterns, and flag suspicious claims for additional investigation.

- Collaboration with Legislation Enforcement: Develop sturdy relationships with native regulation enforcement businesses and insurance coverage fraud investigators to share info and collaborate on investigations.

4. Leveraging Know-how

- Knowledge Analytics: Use knowledge analytics to determine traits, anomalies, and potential fraud patterns in claims knowledge.

- Machine Studying: Implement machine studying algorithms to automate fraud detection and determine high-risk claims for additional overview.

- Cybersecurity Measures: Implement strong cybersecurity measures to guard delicate knowledge and stop unauthorized entry to insurance coverage programs.

- Digital Signatures and Digital Verification: Use digital signatures and digital verification programs to make sure the authenticity of paperwork and stop forgery.

5. Exterior Collaboration

- Trade Associations: Be a part of trade associations and take part in networking occasions to share finest practices and find out about rising fraud traits.

- Insurance coverage Carriers: Preserve open communication together with your insurance coverage carriers and supply them with common updates in your fraud prevention efforts.

- Fraud Prevention Consultants: Contemplate hiring exterior fraud prevention consultants to conduct assessments, present coaching, and implement personalized options.

6. Staying Forward of the Curve

- Staying Knowledgeable: Keep knowledgeable concerning the newest fraud traits and rising applied sciences by subscribing to trade publications, attending conferences, and collaborating in on-line boards.

- Steady Enchancment: Repeatedly consider your fraud prevention program and make vital changes to remain forward of evolving threats.

- Proactive Measures: Take a proactive strategy to fraud prevention by implementing preventative measures earlier than an incident happens.

Case Research: Actual-World Examples of Insurance coverage Fraud Prevention

Case Research 1: Knowledge Analytics Detects Ghost Staff

A big retail firm carried out an information analytics platform to investigate its payroll knowledge. The platform recognized anomalies in worker information, together with people with uncommon work patterns, inconsistent pay charges, and lacking identification info. Additional investigation revealed a scheme involving fictitious staff created to inflate payroll and declare larger staff’ compensation premiums. The corporate was capable of get better important monetary losses and stop future fraud.

Case Research 2: Machine Studying Identifies Inflated Claims

A healthcare supplier carried out a machine studying mannequin to investigate affected person information and determine potential fraud in medical billing. The mannequin flagged claims with uncommon billing patterns, inconsistencies in affected person historical past, and abnormally excessive expenses for sure procedures. This led to the identification of a community of docs who had been submitting inflated claims for pointless providers.

Case Research 3: Inside Reporting System Uncovers Worker Fraud

A producing firm established a confidential inner reporting system for workers to report suspected fraud. An worker observed suspicious exercise within the firm’s stock administration system and reported it by means of the system. Investigation revealed {that a} warehouse supervisor was stealing stock and promoting it on the black market. The worker’s report allowed the corporate to get better stolen items and stop additional losses.

Conclusion: A Dedication to Integrity

Stopping insurance coverage fraud requires a multi-pronged strategy that encompasses a tradition of integrity, sturdy inner controls, efficient claims administration, leveraging know-how, collaboration with exterior companions, and a dedication to steady enchancment. By implementing these methods, companies can considerably scale back their threat of turning into victims of fraud and shield their monetary well-being. Keep in mind, insurance coverage fraud isn’t just a monetary crime; it undermines belief, erodes public confidence, and in the end harms everybody. By taking a proactive stance and making a tradition of moral conduct, companies can play a significant function in combating this pervasive drawback.

Closure

We hope this text has helped you perceive the whole lot about Shielding Your Enterprise: A Complete Information to Stopping Insurance coverage Fraud. Keep tuned for extra updates!

Be sure to observe us for extra thrilling information and opinions.

We’d love to listen to your ideas about Shielding Your Enterprise: A Complete Information to Stopping Insurance coverage Fraud—depart your feedback under!

Hold visiting our web site for the most recent traits and opinions.