Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It?

Associated Articles

- Navigating The Maze: A Complete Information To Submitting A Legal responsibility Insurance coverage Declare

- Navigating The World Of Freelance Insurance coverage: Your Information To The Finest Legal responsibility Protection In 2024

- Do not Let A Mishap Destroy Your Huge Day: Occasion Legal responsibility Insurance coverage Defined

- Maximizing Monetary financial savings with Cheap Nicely being Insurance coverage protection Plans: A Full Info

- Do You Want Legal responsibility Insurance coverage For Your Dwelling-Based mostly Enterprise? Navigating The Dangers And Defending Your Future

Introduction

Uncover the most recent particulars about Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It? on this complete information.

Video about Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It?

Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It?

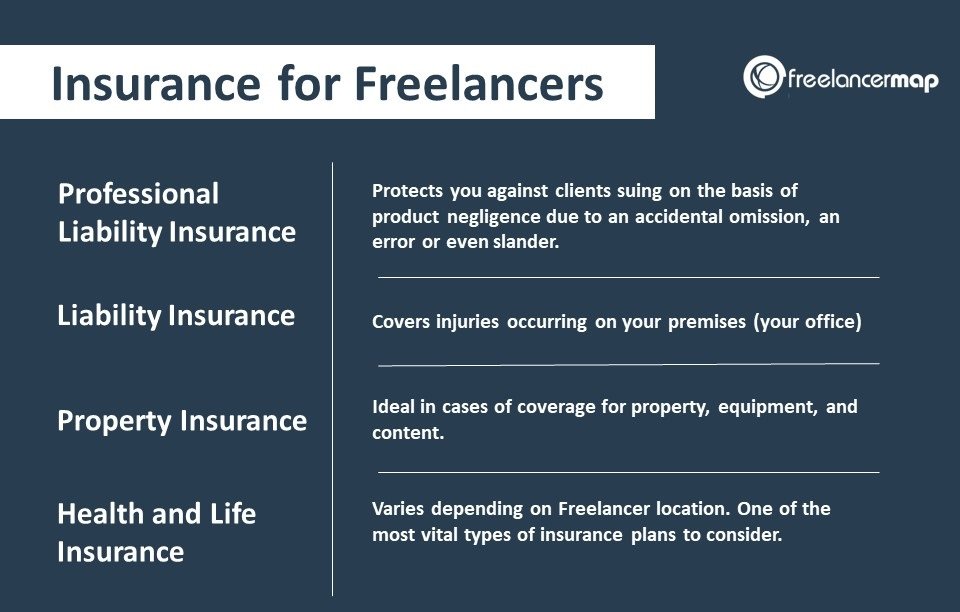

Within the ever-evolving panorama of the gig financial system, freelancing has turn into a well-liked alternative for a lot of looking for versatile work preparations and the liberty to be their very own boss. Nevertheless, this freedom comes with a set of tasks, together with managing dangers and defending your online business. One essential side of safeguarding your freelance profession is skilled legal responsibility insurance coverage, also known as errors and omissions (E&O) insurance coverage.

Whereas some freelancers could take into account it an pointless expense, the truth is that skilled legal responsibility insurance coverage is usually a lifesaver in case of unexpected circumstances. This text delves into the intricacies {of professional} legal responsibility insurance coverage, exploring its advantages and highlighting why it’s important for freelancers throughout numerous industries. We can even focus on the important thing components to think about when selecting the best coverage and supply sensible suggestions for freelancers to reduce their threat publicity.

Understanding Skilled Legal responsibility Insurance coverage: A Defend Towards Claims

Skilled legal responsibility insurance coverage is a sort of insurance coverage coverage that protects professionals from monetary losses arising from claims of negligence, errors, omissions, or breaches of responsibility within the efficiency of their companies. For freelancers, this implies having a security internet in place if a shopper accuses them of offering defective work, lacking deadlines, or inflicting monetary hurt because of their actions or inactions.

Why Freelancers Want Skilled Legal responsibility Insurance coverage

Whereas the choice to buy skilled legal responsibility insurance coverage finally depends upon particular person circumstances and threat tolerance, there are a number of compelling the reason why it’s a clever funding for many freelancers:

1. Defending Your Monetary Stability:

Think about a state of affairs the place a shopper sues you for a big sum of cash because of a mistake in your work. With out skilled legal responsibility insurance coverage, you’d be solely answerable for overlaying authorized charges, settlements, and any potential damages. This might result in monetary damage, jeopardizing your whole enterprise and livelihood.

2. Gaining Shopper Confidence and Belief:

In at present’s aggressive freelance market, shoppers are more and more looking for professionals who display a dedication to high quality and reliability. Having skilled legal responsibility insurance coverage is usually a highly effective sign to potential shoppers that you just take your work severely and are ready to deal with any unexpected points. This may give you a aggressive edge and enable you safe extra profitable initiatives.

3. Peace of Thoughts and Decreased Stress:

Figuring out you may have skilled legal responsibility insurance coverage can considerably cut back stress and nervousness related to the dangers inherent in freelance work. You may deal with delivering high-quality companies with out consistently worrying about potential authorized claims or monetary repercussions.

4. Protection for a Huge Vary of Dangers:

Skilled legal responsibility insurance coverage supplies complete protection for numerous dangers, together with:

- Negligence: Failing to satisfy trade requirements or offering subpar companies.

- Errors and Omissions: Errors, oversights, or missed deadlines in your work.

- Breach of Contract: Failure to satisfy the phrases of a contract with a shopper.

- Copyright Infringement: Utilizing copyrighted supplies with out permission.

- Libel and Slander: Making false or defamatory statements a few shopper or competitor.

- Knowledge Breaches: Unauthorized entry to or disclosure of delicate shopper data.

5. Protection for Authorized Bills:

Skilled legal responsibility insurance coverage not solely covers monetary settlements but in addition pays for authorized bills, similar to:

- Legal professional charges: Hiring authorized illustration to defend you in opposition to a declare.

- Courtroom prices: Submitting charges, knowledgeable witness charges, and different court-related bills.

- Mediation and arbitration: Resolving disputes exterior of court docket.

Key Elements to Take into account When Selecting Skilled Legal responsibility Insurance coverage

Choosing the proper skilled legal responsibility insurance coverage coverage is essential to making sure enough safety in your freelance enterprise. Listed below are some key components to think about:

1. Protection Limits:

The protection restrict refers back to the most sum of money your insurance coverage firm pays out for a single declare. Select a restrict that aligns with the potential monetary dangers related together with your work.

2. Deductible:

The deductible is the quantity you have to pay out of pocket earlier than your insurance coverage protection kicks in. A better deductible typically leads to decrease premiums, nevertheless it additionally means you may must pay extra in case of a declare.

3. Protection Interval:

The protection interval specifies the size of time your coverage is in impact. Make sure the coverage period aligns together with your freelance enterprise wants.

4. Claims Historical past:

Your claims historical past can impression your premium. When you’ve got a historical past of claims, chances are you’ll face larger premiums.

5. Business-Particular Protection:

Some industries, similar to healthcare or monetary companies, have particular necessities for skilled legal responsibility insurance coverage. Ensure that the coverage you select covers the distinctive dangers related together with your discipline.

6. Coverage Exclusions:

It is important to grasp the coverage exclusions, that are particular conditions not lined by the insurance coverage.

7. Premium Prices:

Examine premiums from totally different insurance coverage suppliers to search out the perfect worth in your cash. Take into account components similar to protection limits, deductibles, and coverage phrases.

Minimizing Threat Publicity: Sensible Suggestions for Freelancers

Whereas skilled legal responsibility insurance coverage supplies a security internet, it is important to take proactive steps to reduce your threat publicity and cut back the probability of claims:

1. Preserve Clear Contracts:

All the time have written contracts together with your shoppers outlining the scope of labor, deliverables, cost phrases, and any potential legal responsibility clauses.

2. Talk Successfully:

Set up clear communication channels together with your shoppers and preserve them knowledgeable about venture progress, deadlines, and any potential points.

3. Doc Every part:

Preserve thorough data of your work, together with emails, invoices, venture recordsdata, and communication logs. This documentation might be essential in defending in opposition to claims.

4. Keep Up to date on Business Requirements:

Repeatedly replace your abilities and data to make sure you are offering companies that meet trade greatest practices.

5. Search Skilled Recommendation:

Seek the advice of with a authorized skilled or insurance coverage dealer to grasp your particular dangers and select the proper insurance coverage coverage in your freelance enterprise.

Conclusion: Do not Be Left Unprotected

Skilled legal responsibility insurance coverage is a vital funding for freelancers throughout numerous industries. It supplies a vital security internet in opposition to monetary losses because of negligence, errors, omissions, or breaches of responsibility. By understanding the advantages, components to think about, and threat mitigation methods, freelancers could make knowledgeable selections about their insurance coverage wants and defend their enterprise from unexpected circumstances.

Keep in mind, the price of skilled legal responsibility insurance coverage is a small worth to pay for the peace of thoughts and monetary safety it presents. Do not be left unprotected; put money into skilled legal responsibility insurance coverage at present and safe the way forward for your freelance profession.

Key phrases:

Skilled Legal responsibility Insurance coverage, Errors and Omissions Insurance coverage, E&O Insurance coverage, Freelancers, Gig Economic system, Threat Administration, Monetary Safety, Shopper Confidence, Authorized Bills, Protection Limits, Deductible, Protection Interval, Business-Particular Protection, Coverage Exclusions, Premium Prices, Threat Mitigation, Contracts, Communication, Documentation, Business Requirements, Skilled Recommendation, Freelance Enterprise Insurance coverage, Enterprise Insurance coverage, Insurance coverage for Freelancers.

Closure

We hope this text has helped you perceive every little thing about Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It?. Keep tuned for extra updates!

Don’t neglect to verify again for the most recent information and updates on Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It?!

We’d love to listen to your ideas about Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It?—go away your feedback under!

Keep knowledgeable with our subsequent updates on Skilled Legal responsibility Insurance coverage: Do Freelancers Actually Want It? and different thrilling subjects.