Standard vs. FHA Loans: Which is Finest?

Associated Articles

- Dwelling Mortgage Pre-Approval: Your Ticket To A Easy Homebuying Journey

- Unlocking The Door To Homeownership: A Complete Information To Qualifying For A First-Time Homebuyer Mortgage

- Refinance Your Dwelling Mortgage: Prime Methods For 2024

- Discovering The Proper Match: Finest House Mortgage Packages For Low-Revenue Households

- Understanding the Tax Advantages of Utilizing Loans for Dwelling Enhancements

Introduction

On this article, we dive into Standard vs. FHA Loans: Which is Finest?, providing you with a full overview of what’s to come back

Video about Standard vs. FHA Loans: Which is Finest?

Standard vs. FHA Loans: Which is Finest for You?

Shopping for a house is a big monetary resolution, and choosing the proper mortgage is essential. Two fashionable choices are typical loans and FHA loans, every with its personal set of benefits and drawbacks. Understanding the variations between these loans may also help you make an knowledgeable resolution that aligns along with your monetary scenario and objectives.

What are Standard Loans?

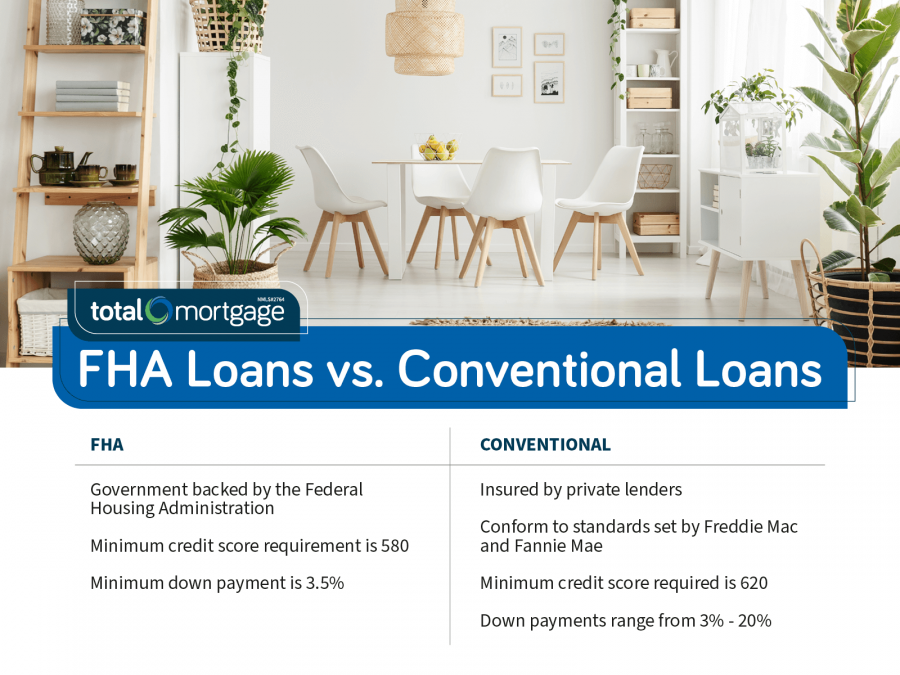

Standard loans are mortgages that are not insured or assured by the federal government. They’re provided by personal lenders, resembling banks and mortgage firms, and cling to particular underwriting tips established by Fannie Mae and Freddie Mac, the 2 largest mortgage traders in the USA.

Key Options of Standard Loans:

- Decrease Curiosity Charges: Typically, typical loans provide decrease rates of interest in comparison with FHA loans, which interprets to decrease month-to-month funds and fewer general curiosity paid over the lifetime of the mortgage.

- Larger Down Cost Necessities: Standard loans sometimes require a bigger down fee, normally 5% to twenty%, relying on the mortgage sort and your credit score rating.

- Stricter Credit score Rating Necessities: Lenders usually have stricter credit score rating necessities for typical loans, sometimes requiring a rating of a minimum of 620.

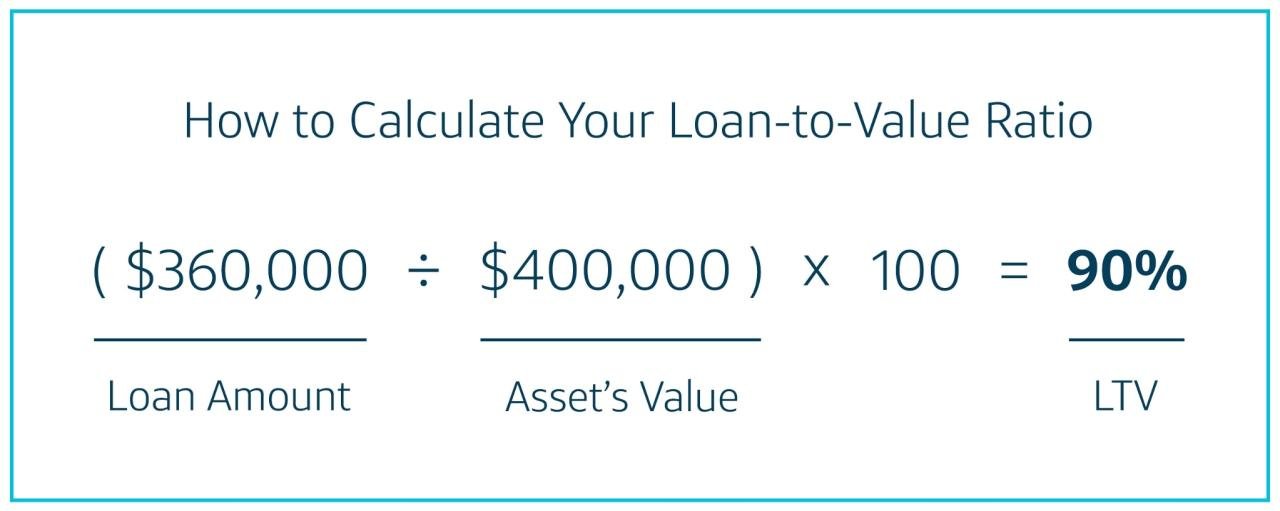

- Non-public Mortgage Insurance coverage (PMI): If you happen to put down lower than 20% on a traditional mortgage, you will probably be required to pay Non-public Mortgage Insurance coverage (PMI), which protects the lender in case of default. PMI could be canceled as soon as your loan-to-value ratio (LTV) reaches 80%.

- Mortgage Limits: There are most mortgage quantities for typical loans, which differ by county and are adjusted yearly.

What are FHA Loans?

FHA loans are government-insured mortgages provided by accepted lenders and backed by the Federal Housing Administration (FHA). These loans are designed to make homeownership extra accessible to debtors with decrease credit score scores and smaller down funds.

Key Options of FHA Loans:

- Decrease Down Cost Necessities: FHA loans require a minimal down fee of simply 3.5%, making them enticing to first-time homebuyers and people with restricted financial savings.

- Extra Lenient Credit score Rating Necessities: FHA loans have much less stringent credit score rating necessities in comparison with typical loans, sometimes accepting scores as little as 580.

- Mortgage Insurance coverage Premium (MIP): FHA loans require mortgage insurance coverage premiums (MIP), that are paid upfront and month-to-month. The upfront MIP is 1.75% of the mortgage quantity, and the month-to-month MIP is usually 0.85% of the mortgage quantity. MIP is paid for the lifetime of the mortgage except you refinance into a traditional mortgage.

- Decrease Closing Prices: FHA loans usually have decrease closing prices in comparison with typical loans.

- Versatile Qualifying Tips: FHA loans have extra versatile qualifying tips, making them appropriate for debtors with less-than-perfect credit score or restricted earnings.

Selecting the Proper Mortgage for You:

One of the best mortgage for you depends upon your particular person circumstances and monetary objectives. This is a breakdown of things to think about:

1. Down Cost:

- Standard Loans: When you have a big down fee, a traditional mortgage may be a greater choice attributable to decrease rates of interest and the potential to keep away from PMI.

- FHA Loans: When you have a smaller down fee or restricted financial savings, an FHA mortgage could make homeownership extra attainable.

2. Credit score Rating:

- Standard Loans: When you have a great credit score rating (620 or above), you will probably qualify for a traditional mortgage with higher rates of interest.

- FHA Loans: When you have a decrease credit score rating, an FHA mortgage may be the best choice, as they’ve extra lenient credit score rating necessities.

3. Mortgage Quantity:

- Standard Loans: Standard loans have greater mortgage limits, which could be useful if you happen to’re trying to buy a dearer property.

- FHA Loans: FHA loans have decrease mortgage limits, making them extra appropriate for smaller or extra reasonably priced properties.

4. Mortgage Time period:

- Standard Loans: Each typical and FHA loans provide quite a lot of mortgage phrases, starting from 15 to 30 years.

- FHA Loans: FHA loans provide a 30-year fixed-rate mortgage, which is the commonest choice.

5. Mortgage Insurance coverage:

- Standard Loans: PMI could be a vital expense, however it may be canceled as soon as your LTV reaches 80%.

- FHA Loans: MIP is required for the lifetime of the mortgage, which may add to your month-to-month funds.

6. Closing Prices:

- Standard Loans: Standard loans sometimes have greater closing prices.

- FHA Loans: FHA loans usually have decrease closing prices.

7. Mortgage Flexibility:

- Standard Loans: Standard loans provide extra flexibility by way of mortgage phrases and options, resembling adjustable-rate mortgages (ARMs) and interest-only loans.

- FHA Loans: FHA loans primarily provide fixed-rate mortgages, which give stability and predictability.

Benefits and Disadvantages of Standard Loans:

Benefits:

- Decrease rates of interest: This may end up in decrease month-to-month funds and fewer general curiosity paid over the lifetime of the mortgage.

- Potential for decrease closing prices: Relying on the lender and your particular circumstances, you might be able to negotiate decrease closing prices with a traditional mortgage.

- Extra mortgage choices: Standard loans provide a wider vary of mortgage phrases and options, together with ARMs and interest-only loans.

- Potential for quicker approval: Standard loans could also be processed quicker than FHA loans, as they don’t seem to be topic to the identical authorities rules.

Disadvantages:

- Larger down fee necessities: This could be a barrier for first-time homebuyers or these with restricted financial savings.

- Stricter credit score rating necessities: Debtors with decrease credit score scores might not qualify for a traditional mortgage.

- PMI requirement: If you happen to put down lower than 20%, you will have to pay PMI, which may add to your month-to-month bills.

- Mortgage limits: There are most mortgage quantities for typical loans, which is probably not enough for dearer properties.

Benefits and Disadvantages of FHA Loans:

Benefits:

- Decrease down fee necessities: This makes homeownership extra accessible to debtors with restricted financial savings.

- Extra lenient credit score rating necessities: Debtors with decrease credit score scores have a greater likelihood of qualifying for an FHA mortgage.

- Decrease closing prices: FHA loans usually have decrease closing prices in comparison with typical loans.

- Versatile qualifying tips: This may be useful for debtors with less-than-perfect credit score or restricted earnings.

Disadvantages:

- Larger rates of interest: FHA loans sometimes have greater rates of interest in comparison with typical loans.

- Mortgage insurance coverage premium (MIP): MIP is required for the lifetime of the mortgage, which may add to your month-to-month bills.

- Mortgage limits: FHA loans have decrease mortgage limits, making them much less appropriate for dearer properties.

- Potential for longer approval occasions: FHA loans might take longer to course of as a result of authorities involvement.

Selecting the Proper Mortgage: A Case Examine

Let’s take into account two hypothetical situations as an example how the selection between a traditional mortgage and an FHA mortgage can differ relying on particular person circumstances:

State of affairs 1: First-Time Homebuyer with Restricted Financial savings

Sarah is a first-time homebuyer with a credit score rating of 600 and a down fee of three.5%. She’s trying to buy a modest house in a mid-sized metropolis.

On this situation, an FHA mortgage could be a more sensible choice for Sarah. The decrease down fee requirement and extra lenient credit score rating necessities make it simpler for her to qualify for a mortgage. Though FHA loans have greater rates of interest and require MIP, some great benefits of a decrease down fee and simpler qualification outweigh these drawbacks for Sarah.

State of affairs 2: Skilled Homebuyer with Glorious Credit score

John is an skilled homebuyer with a credit score rating of 750 and a down fee of 20%. He is trying to buy a bigger house in a fascinating neighborhood.

On this situation, a traditional mortgage could be a more sensible choice for John. His wonderful credit score rating and substantial down fee make him a main candidate for a traditional mortgage, which gives decrease rates of interest and the potential to keep away from PMI. The upper mortgage limits of typical loans additionally make them appropriate for John’s want to buy a bigger house.

Conclusion:

In the end, the perfect mortgage for you depends upon your particular person monetary scenario, credit score rating, down fee quantity, and desired mortgage quantity. Rigorously take into account the benefits and drawbacks of every mortgage sort and seek the advice of with a professional mortgage lender to find out which choice greatest aligns along with your objectives and monetary circumstances.

Key phrases:

- Standard loans

- FHA loans

- Mortgage loans

- Dwelling shopping for

- Down fee

- Credit score rating

- Rates of interest

- Non-public mortgage insurance coverage (PMI)

- Mortgage insurance coverage premium (MIP)

- Mortgage limits

- Closing prices

- Mortgage flexibility

- First-time homebuyer

- Skilled homebuyer

- Monetary objectives

- Mortgage lender

- Homeownership

- Monetary resolution

- Actual property

- Housing market

- Monetary planning

- Funds

- Debt

- Credit score historical past

- Mortgage utility

- Mortgage approval

- Mortgage phrases

- Fastened-rate mortgage

- Adjustable-rate mortgage (ARM)

- Curiosity-only mortgage

- Mortgage pre-approval

- Mortgage pre-qualification

- Mortgage calculator

- Dwelling affordability

- Dwelling fairness

- Property worth

- Mortgage-to-value ratio (LTV)

- Refinancing

- Dwelling enchancment

- Debt consolidation

- Monetary literacy

- Housing affordability

- Actual property market

- Homeownership prices

- Mortgage charges

- Mortgage developments

- Housing market outlook

- Dwelling shopping for suggestions

- Monetary recommendation

- Actual property professionals

- Dwelling inspection

- Closing course of

- Dwelling insurance coverage

- Property taxes

- Dwelling upkeep

- Dwelling fairness line of credit score (HELOC)

- Reverse mortgage

- Homeownership advantages

- Monetary safety

- Funding

- Retirement planning

- Property planning

- Monetary freedom

- Monetary objectives

- Monetary success

- Monetary literacy

- Monetary schooling

- Monetary well-being

- Monetary stability

- Monetary independence

- Monetary planning

- Monetary administration

- Monetary advisors

- Monetary consultants

- Monetary sources

- Monetary information

- Monetary markets

- Monetary merchandise

- Monetary providers

- Monetary expertise

- Monetary innovation

- Monetary disruption

- Monetary inclusion

- Monetary empowerment

- Monetary literacy

- Monetary schooling

- Monetary well-being

- Monetary stability

- Monetary independence

- Monetary planning

- Monetary administration

- Monetary advisors

- Monetary consultants

- Monetary sources

- Monetary information

- Monetary markets

- Monetary merchandise

- Monetary providers

- Monetary expertise

- Monetary innovation

- Monetary disruption

- Monetary inclusion

- Monetary empowerment

- Monetary literacy

- Monetary schooling

- Monetary well-being

- Monetary stability

- Monetary independence

- Monetary planning

- Monetary administration

- Monetary advisors

- Monetary consultants

- Monetary sources

- Monetary information

- Monetary markets

- Monetary merchandise

- Monetary providers

- Monetary expertise

- Monetary innovation

- Monetary disruption

- Monetary inclusion

- Monetary empowerment

- Monetary literacy

- Monetary schooling

- Monetary well-being

- Monetary stability

- Monetary independence

- Monetary planning

- Monetary administration

- Monetary advisors

- Monetary consultants

- Monetary sources

- Monetary information

- Monetary markets

- Monetary merchandise

- Monetary providers

- Monetary expertise

- Monetary innovation

- Monetary disruption

- Monetary inclusion

- Monetary empowerment

Closure

We hope this text has helped you perceive every little thing about Standard vs. FHA Loans: Which is Finest?. Keep tuned for extra updates!

Don’t neglect to examine again for the newest information and updates on Standard vs. FHA Loans: Which is Finest?!

Be happy to share your expertise with Standard vs. FHA Loans: Which is Finest? within the remark part.

Preserve visiting our web site for the newest developments and evaluations.