The Affect of Your Credit score Rating on Your House Mortgage: A Complete Information

Associated Articles

- Understanding FHA Dwelling Loans: A Full Information For First-Time And Skilled Homebuyers

- Discovering The Proper Match: Finest House Mortgage Packages For Low-Revenue Households

- Refinance Your Dwelling Mortgage: Prime Methods For 2024

- Standard Vs. FHA Loans: Which Is Finest?

- Unlocking The Door To Homeownership: A Complete Information To Qualifying For A First-Time Homebuyer Mortgage

Introduction

Welcome to our in-depth take a look at The Affect of Your Credit score Rating on Your House Mortgage: A Complete Information

Video about The Affect of Your Credit score Rating on Your House Mortgage: A Complete Information

The Affect of Your Credit score Rating on Your House Mortgage: A Complete Information

Proudly owning a house is commonly thought-about the epitome of the American Dream, an emblem of stability and monetary safety. Nonetheless, the trail to homeownership is paved with monetary hurdles, and some of the vital is your credit score rating. This seemingly easy quantity holds immense energy, influencing every little thing from the rate of interest you qualify for as to whether you even get authorized for a mortgage within the first place.

Understanding the Credit score Rating: Your Monetary Fingerprint

Think about your credit score rating as your monetary fingerprint, a novel identifier that displays your historical past of managing credit score responsibly. It is a three-digit quantity that ranges from 300 to 850, with greater scores indicating higher creditworthiness. Lenders rely closely on this rating to evaluate your danger as a borrower.

The Mechanics of Credit score Scoring: A Look Behind the Curtain

Whereas the precise components used to calculate credit score scores is proprietary, the foremost credit score bureaus, like Experian, Equifax, and TransUnion, think about a number of key elements:

- Cost Historical past (35%): That is probably the most influential issue, accounting for a whopping 35% of your rating. Constant, on-time funds for loans, bank cards, and utilities show your monetary duty. Even a single late cost can considerably impression your rating.

- Quantities Owed (30%): This issue considers the quantity of debt you’ve gotten relative to your out there credit score. A excessive credit score utilization ratio (the proportion of your out there credit score you are utilizing) can negatively have an effect on your rating.

- Size of Credit score Historical past (15%): An extended credit score historical past, particularly if it is constructive, suggests a observe file of accountable credit score administration. New credit score accounts, whereas useful in the long term, can briefly decrease your rating.

- Credit score Combine (10%): Having a mixture of various kinds of credit score, like bank cards, auto loans, and mortgages, demonstrates a diversified credit score portfolio, which might enhance your rating.

- New Credit score (10%): Making use of for brand spanking new credit score can result in laborious inquiries in your credit score report, which might briefly decrease your rating. It is best to keep away from making use of for an excessive amount of credit score in a brief interval.

The Affect of Your Credit score Rating on Your House Mortgage:

Your credit score rating performs a pivotal function in figuring out the phrases of your own home mortgage, influencing a number of key points:

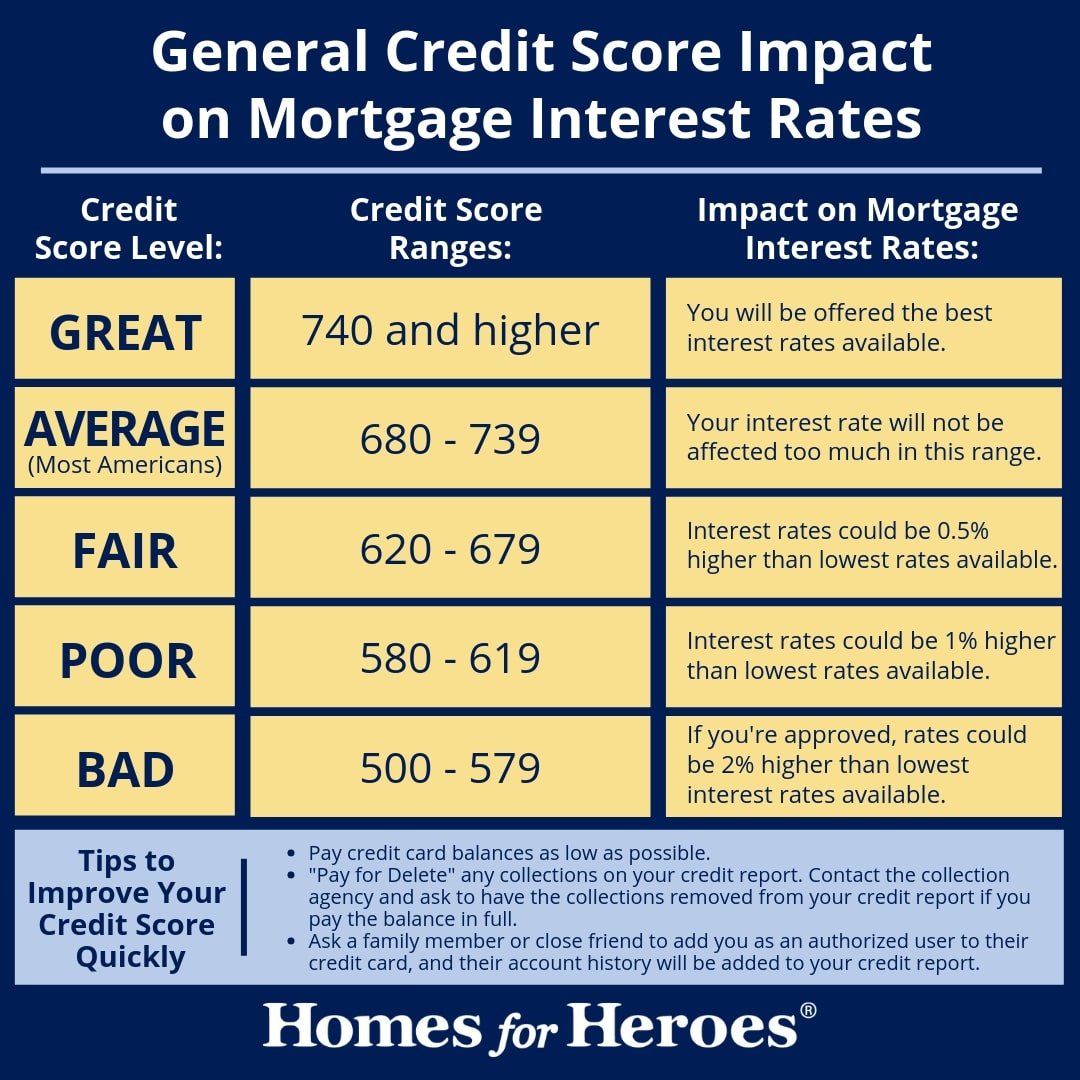

- Mortgage Approval: A low credit score rating generally is a deal-breaker for a lot of lenders. Scores beneath 620 are sometimes thought-about excessive danger, making it tough to safe a mortgage.

- Curiosity Charges: Your credit score rating instantly impacts the rate of interest you qualify for. Debtors with greater credit score scores are deemed much less dangerous, permitting them to safe decrease rates of interest, finally saving them hundreds of {dollars} in curiosity funds over the lifetime of the mortgage.

- Mortgage Choices: Having a superb credit score rating opens doorways to a wider vary of mortgage choices, together with typical loans, FHA loans, and even VA loans, which can provide extra favorable phrases.

- Down Cost Necessities: Whereas circuitously tied to your credit score rating, lenders usually require bigger down funds from debtors with decrease credit score scores to mitigate danger.

- Closing Prices: Increased credit score scores can usually translate to decrease closing prices, as lenders could cost much less for processing and underwriting charges.

Boosting Your Credit score Rating for Homeownership:

In case your credit score rating is not the place you’d prefer it to be, there are steps you’ll be able to take to enhance it earlier than making use of for a mortgage:

- Pay Payments on Time: That is crucial think about bettering your rating. Arrange automated funds or reminders to make sure you by no means miss a due date.

- Cut back Credit score Utilization: Intention to maintain your credit score utilization ratio beneath 30%. Pay down current balances and keep away from maxing out your bank cards.

- Keep away from Opening New Credit score Accounts: Whereas it is good to have a mixture of credit score, opening too many new accounts can negatively impression your rating. Give attention to managing your current accounts responsibly.

- Dispute Errors on Your Credit score Report: Verify your credit score report repeatedly for any inaccuracies and file disputes with the credit score bureaus to right them.

- Contemplate a Secured Credit score Card: If in case you have restricted credit score historical past, a secured bank card may also help construct your credit score. You will want to offer a safety deposit, which acts as collateral.

Navigating the Mortgage Utility Course of with a Good Credit score Rating:

credit score rating is your passport to a clean and profitable mortgage software course of. Here is the way it can profit you:

- Pre-Approval: A robust credit score rating may also help you safe pre-approval for a mortgage, providing you with a aggressive edge in a scorching housing market. Pre-approval demonstrates your monetary readiness to lenders and sellers.

- Sooner Processing: Lenders usually tend to approve your mortgage software rapidly with a superb credit score rating, streamlining the whole course of.

- Negotiating Energy: A robust credit score rating offers you extra leverage when negotiating with sellers, as you’ll be able to current a robust monetary profile.

The Significance of Credit score Monitoring and Common Evaluation:

Your credit score rating is a dynamic quantity that may fluctuate over time. It is essential to observe your credit score report repeatedly and take proactive steps to take care of a wholesome rating. Here is how:

- Verify Your Credit score Report Yearly: You are entitled to a free credit score report from every of the three main credit score bureaus yearly. Evaluation them fastidiously for any errors or suspicious exercise.

- Use Credit score Monitoring Providers: Contemplate subscribing to a credit score monitoring service that alerts you to any modifications in your credit score report, serving to you catch potential issues early.

- Keep Knowledgeable about Credit score Legal guidelines: Hold your self up to date on credit score legal guidelines and laws to guard your rights and keep away from scams.

Past the Numbers: Constructing a Sturdy Monetary Basis

Whereas your credit score rating is a important think about securing a mortgage, it is only one piece of the puzzle. Constructing a robust monetary basis includes greater than only a good credit score rating. It is about growing wholesome monetary habits and making knowledgeable monetary selections.

- Budgeting and Financial savings: Create a sensible funds and persist with it. Make saving a precedence, even when it is only a small quantity every month.

- Debt Administration: Pay down high-interest debt as rapidly as potential. Keep away from accumulating pointless debt.

- Monetary Planning: Seek the advice of with a monetary advisor to develop a customized monetary plan that aligns together with your targets.

Conclusion: Your Credit score Rating, Your Future

Your credit score rating is a robust instrument that may open doorways to monetary alternatives, together with homeownership. By understanding the elements that affect your rating, taking proactive steps to enhance it, and sustaining a wholesome monetary basis, you’ll be able to set your self up for fulfillment within the journey in the direction of homeownership. Keep in mind, a superb credit score rating isn’t just about getting a mortgage; it is about constructing a safe monetary future.

Closure

Thanks for studying! Stick with us for extra insights on The Affect of Your Credit score Rating on Your House Mortgage: A Complete Information.

Ensure that to comply with us for extra thrilling information and evaluations.

We’d love to listen to your ideas about The Affect of Your Credit score Rating on Your House Mortgage: A Complete Information—depart your feedback beneath!

Keep knowledgeable with our subsequent updates on The Affect of Your Credit score Rating on Your House Mortgage: A Complete Information and different thrilling subjects.